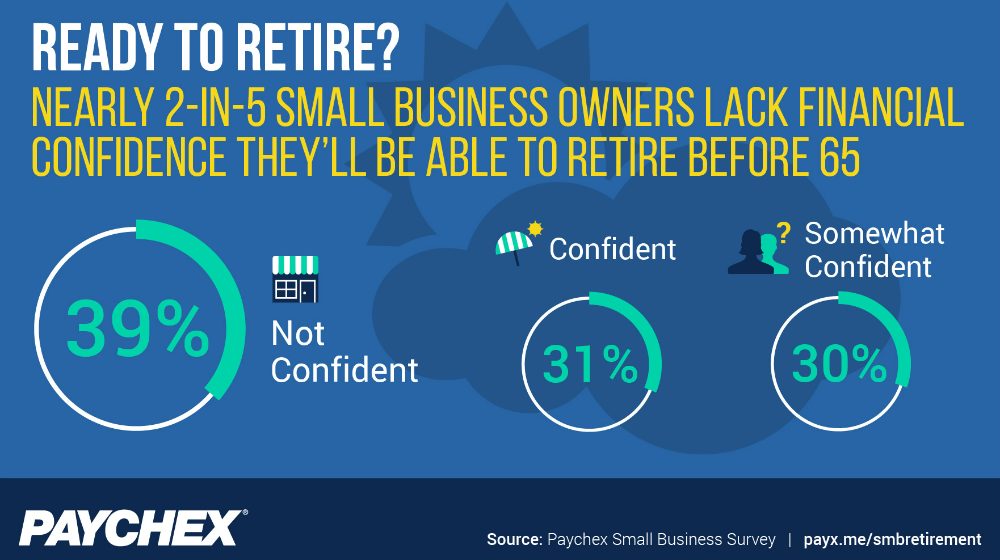

Small business owners are generally apprehensive about their own retirement, believing they are not financially prepared. This was the finding of a recent Paychex Small Business Survey, focused on small business owners and their employees’ feelings on their retirement.

Small Business Owners are Worried About Retirement

The majority of respondents said that simply being able to save more would increase their confidence about retirement. Fifteen percent of small business owners said that nothing would make them more confident about retirement, while eight percent believe better retirement tools would help them understand retirement expenses, such as healthcare costs.

The survey highlights the so-called ‘looming retirement crisis’ in the U.S., the tendency for small business owners and employees to be unprepared for their retirement. It shows the importance of sufficiently saving and preparing for becoming financially secure in retirement.

Some small business owners may plan on selling their businesses to fund their retirement. However, in a statement about the survey, Paychex urges caution, stating:

“Some small business owners may figure that they will sell their business as a way to fund their retirement, or not retire at all. In both scenarios, there’s no guarantee that these solutions will be feasible in the future. A backup plan in the form of retirement savings can be a more secure option.”

The survey also found that many business owners would appreciate greater fiscal guidance when it comes to retirement. 10 percent of the respondents said they would like assistance in converting lump-sum accounts to projected monthly income. Another 10 percent said they want greater guidance on investments and appropriate savings rates.

With the poll finding that nearly 2 in 5 small business owners lack financial confidence that they’ll be able to retire before 65, the data clearly shows concern in the small business community over this issue.

Image: Paychex