With just 5% of small businesses receiving a loan from the Paycheck Protection Program (PPP), the first round didn’t reach its target. The PPP was designed to help small businesses, but disclosure of some of the applicants has revealed multi-million/billion-dollar companies have applied and received tens of millions of dollars.

This, in great part, is why the $349 billion emergency funding ran out of funds in just 13 days. And according to a new survey from LendingTree, small business owners are expressing their frustration.

One of the respondents in the survey:

“I’ve kept my employees on payroll even though we closed because it is the right thing to do. Unemployment in our state is only $275 per month. They can’t live on that. Now, I’m in limbo waiting for the PPP money. I have no idea when, or if, it comes through. We’ll be ruined if I kept them on and the money doesn’t come through.”

The concern of this business owner was the intended goal of the PPP. Simply put, the PPP was to provide forgivable loans to help small business owners keep employees on their payroll during the COVID-19 outbreak.

Paycheck Protections Program Statistics

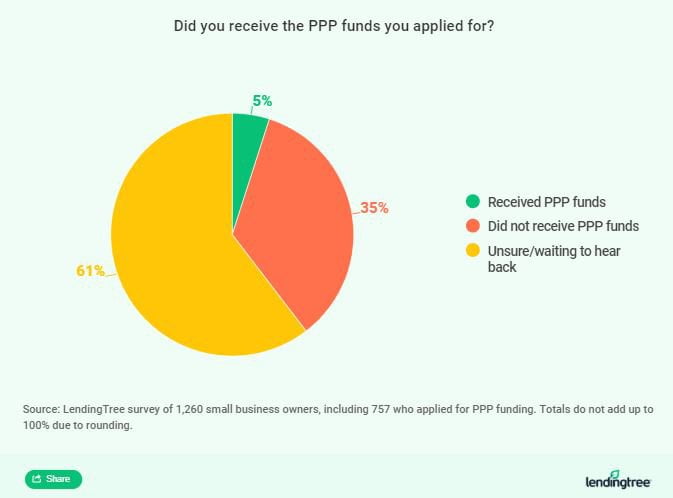

This survey was carried out by LendingTree with the participation of 1,260 small business owners. Of these, 757 business owners say they applied for the PPP loan.

One of the more startling findings from the survey is only 5% of the small business owners have received funding so far. This is despite the fact 6 in 10 applicants completed their applications within the first five days.

Simplifying the Application Process

Even though the funds for the PPP program was funneled through the SBA, banks accepted the applications and issued the loans. According to LendingTree, “Some large banks were late to begin accepting applications and many prioritized customers with existing banking relationships.” This is because they didn’t have time to review the guidelines.

For over half (57%) of small business owners, inconsistent communication and lack of clarity about documents from banks was an issue. To make matters worse, one in 10 applicants had a hard time gathering all of the required documents.

The respondents say they are going to use the funds for rent or mortgage (59%), utilities (50%), interest on pre-existing loans (29%), and benefits (18%).

When it comes to the actual amount of the loan, it was an average of $49,335.40. More than two thirds or 68% said they got the amount they applied for, 15% got more and 18% received less. This amount is going to allow 56% of recipients to reopen or continue operations for 90 days. However, 27% insist it is definitely not enough to keep their business going.

Laying Off Employees

A whopping 58% of small businesses say they have laid off employees because of coronavirus-related issues. But the remaining 42% are facing similar challenges too. Of these, 11% say they expect to lay off employees in the near future and 55% say it is a possibility.

So, more layoffs are on the way. And some industries are going to be hit harder than others.

Likely to lay off staff:

- Accommodation and food services: 82%

- Administrative and support, and waste management: 75%

- Mining, quarrying and oil and gas extraction: 75%

- Arts, entertainment and recreation: 68%

- Manufacturing: 65%

- Management of companies and enterprises: 20%

- Information: 22%

- Real estate and rental and leasing: 31%

- Wholesale trade: 35%

- Finance and insurance: 36%

The good news is Congress is in the process of passing another round of funding. And let’s hope this time actual small businesses will get the money they need to pay their employees and keep their company running.

But more importantly, the process has to be simplified so small businesses can apply quickly and get the loan they need. Because small businesses are cutting their workforce in big numbers.

Image: Depositphotos.com