The fifth-generation mobile standard known as 5G will not only

bring significant benefits like much faster data speeds and

increased connectivity, it will also be the first all-inclusive

cellular network able to accommodate three distinct types of use

cases, ranging from very basic to the cutting edge. Many of these

use cases operated historically on different networks, creating

challenges in achieving economies of scale, according to a recent

IHS Markit webinar on 5G.

The comprehensive, wide-ranging nature of 5G is also why its

implementation presents specific hurdles on network infrastructure

and end-device design not encountered with the predecessor 4G LTE

technology.

The “one network” feature is of critical importance in 5G, which

IHS Markit defines as coinciding with the commercial rollout of

networks and devices compliant with Release 15 of NR Phase 1

specifications from the 3GPP, the standards body that develops

protocols for mobile telephony.

Some key characteristics of 5G Release 15 include a

non-standalone mode of operation utilizing LTE core and LTE as an

anchor carrier; specific component carrier bandwidths as they

relate to the 6-gigahertz (GHz) dividing line of spectrum for

optimal 5G use; and support for mobile features like carrier

aggregation and beamforming.

The ability of 5G to support three divergent types of use cases

within a single network architecture is remarkable because the use

cases at times involve contradictory technical requirements. The

use cases range from immersive mobile broadband VR experiences with

zero delay; to low-bandwidth applications of dense Internet of

Things (IoT) nodes; to leading-edge, mission-critical use cases

like remote vehicle operation or industrial manufacturing.

Exploring 5G use cases

The three types of use cases in 5G are enhanced mobile broadband

(eMBB) and fixed wireless access (FWA), Massive IoT, and

mission-critical applications.

In the first use case, 5G can improve the data experience of

those on the move with eMBB while also enabling capacity peak data

rates for the home through FWA. Mostly consumer driven involving

smartphones and laptops, both eMBB and FWA can be used for smart

home applications, mobile viewing of ultra-high-definition (UHD)

content, augmented and virtual reality, and cloud-based

experiences.

The second use case for 5G involves the phenomenon of Massive

IoT, characterized by deep and dense coverage of up to 1 million

connections within a square kilometer; support of connected devices

with long battery life of 10 years or more; and transmission of low

rates of data that are not delay sensitive via machine-type

communications (MTC). Massive IoT applications include sensors that

support smart buildings, smart agriculture, smart cities, and

transport and logistics.

In the third use case, 5G will be indispensable to

mission-critical applications involving ultra-reliable low-latency

communications (URLLC), where no delays can be tolerated and where

high security standards are required. A network failure in

mission-critical apps could lead to catastrophic consequences. Use

cases include autonomous cars, digital health and remote medical

surgery, robots and drones, and industrial automation.

Overall, the three types of use cases involve varying

requirements, depending on their function and technical

specifications, adding to the difficulty and complexity of

deploying 5G. Home and mobile broadband, for instance, call for

higher performance, while low-power consumption and cost are the

foremost issues in IoT applications. For mission-critical apps,

meanwhile, low latency and safeguarding security are the most

important considerations.

For this year, any 5G network rollouts will largely focus on the

eMBB element of 5G, which in many ways is an extension of the

capabilities that already exist in 4G LTE and LTE Advanced.

Meanwhile, the wider range of 5G capabilities, including URLLC and

Massive IoT, won’t be available just yet but will unfold instead in

a phased approach that could take a few years.

5G market prospects

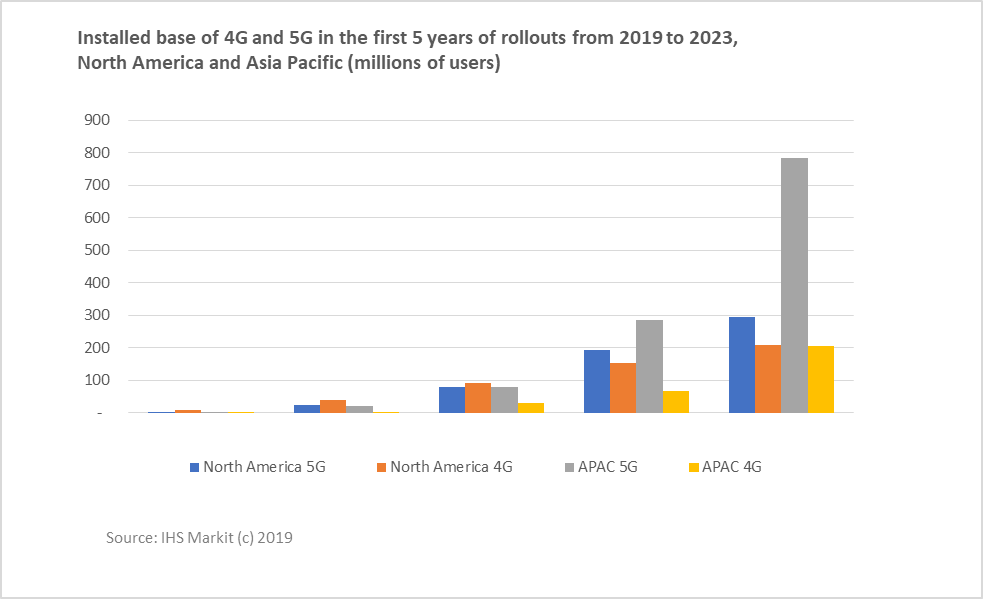

The projected installed base of 5G in its first five years of

launch will be much larger than that of 4G over the same time. By

2023 or Year 5, subscribers to 5G will reach 1.3 billion, up

substantially from a low starting base in 2019, the first year of

5G rollouts.

The two largest markets will be North America and Asia Pacific.

However, beginning on the fourth year in 2022, Asia Pacific will

surpass North America in 5G rollouts, as shown in the graphic

below, thanks to massive deployment of 5G technology in China and

India. The so-called “golden year” will be 2023, when 5G will be

present in most handsets.

Average revenue per user (ARPU) will also be markedly higher in 5G,

forecast to reach $50-70 a month in the US and Australia. In

comparison, blended ARPU for voice and data was relatively flat in

the first few years of 4G LTE use.

The early years of 5G will see eMBB leading in deployment.

However, operators are likely to come up with customized 5G pricing

plans, depending on the requirements of each use case. Examples of

use cases that lend to customization include the real-time

streaming of games and the viewing of high-definition or

ultra-high-definition content.

Network architecture

The deployment of eMBB in the initial stages of 5G entails using

the same core that runs 4G LTE. At the same time, the end-to-end

architecture of 5G is being designed—a tough undertaking

because critical-type communications are involved, and every access

point added to the 5G network must be secure.

The 5G “one network” capability also presents challenges of its

own. The vision of one network handling and managing several

networks is appealing in its elegant simplicity, but the steps

needed to achieve such a vision are complex and manifold, requiring

extensive time and resources to develop and implement.

The inherent service-based concept is the fundamental difference

between the new 3GPP 5G system architecture and that of previous

generations. This means that 5G architecture is designed entirely

to address all services related to its three principal use cases

with utmost software-based agility. The approach is a departure

from that seen in traditional network architecture, which is built

with specific network elements or nodes that are mostly

proprietary.

Instead, the 5G architecture elements are defined as network

functions that offer their services via interfaces of a common

framework to any network functions that are permitted to make use

of these provided services. The starting point is the network

repository functions (NRF), which allow every network function to

discover the services offered by other network functions. This

architecture model features modularity, reusability, and the

self-containment of network functions while also using the latest

virtualization and software technologies.

5G device readiness

Devices capable of utilizing 5G will be ready for use almost as

soon as the technology becomes available, signaling the advanced

state of readiness of the market. Unlike 4G, which had only three

smartphones during the first year of launch, 5G can boast of at

least 20 smartphone designs available for release to the market

this year.

In North America, the first 5G device is Motorola’s 5G Moto Mod,

which connects to the Motorola Z3. The Z3 smartphone is an

unassuming 4G handset, but it was selected as the first 5G offering

by Motorola because it can be customized with “mods.” By connecting

to the 5G Mod, the Moto Z3/5G is, in effect, a conventional 4G LTE

device able to access 5G’s so-called millimeter wave (mmWave)

capability—the band of spectrum where implementations of 5G

will produce the most dramatic results.

The Motorola device notwithstanding, the first true integrated

5G solution is Samsung’s Galaxy S10, available in Europe and Asia.

In Europe, meanwhile, UK operator EE launched at the end of May its

5G network and the OnePlus 7Pro 5G.

With speeds theoretically as high as 5 gigabits or more per

second, mmWave technology delivers extremely fast data rates,

compared to just 100-200 megabits per second for existing 4G LTE

services. On the downside, mmWave coverage and range are

constrained to distances of approximately one city block, and the

tiny wavelength of mmWave makes the wireless signals hard to pick

up but easy to block with obstacles. These characteristics make it

challenging to build a radio frequency (RF) front to discern clear

signals out of the low-propagation mmWave.

The 5G Mod and other mmWave smartphones, including the Samsung

Galaxy S10 5G for Verizon, address this issue by integrating three

or four separate millimeter-antenna modules that are strategically

placed throughout the device to create spatial diversity, improve

reception, and mitigate interference. This compares to just one

antenna in most smartphone designs.

But such a solution drives up costs considerably, as each module

includes its own RF path, complete with a phase antenna array,

power amplifiers, power-management chip, and RF transceiver. At

$18.80 apiece for each module, the four modules in the 5G Mod add

up to a total of $75.20—three times the cost of the RF

subsystem in 4G smartphones.

The modem and RF front end are competitive spaces in 5G device

readiness, with various players pitching their own 5G offerings on

the market. The players include Qualcomm, which was first-to-market

with its Snapdragon x50 modem; Samsung and its Exynos 5100, used in

Samsung’s own Galaxy line of smartphones; Intel and the XM M8160,

which can be found in computers as well as in Tesla’s Model 3 car;

MediaTek’s M70, a system-on-chip solution from the Taiwanese maker

that won’t be available until next year; Qualcomm and the x55, its

second-generation modem; and UNISoC with its IVY510, a low-cost

solution from the Taiwanese maker formerly known as Spreadtrum,

whose modem is aimed primarily at the Chinese market.

A seventh player is China’s HiSilicon and its Belong 5000.

HiSilicon is fully owned by Huawei, and its modem is a captive

solution for use in the Huawei Mate 20X, like how the Samsung

Exynos 5100 is used solely for Samsung’s Galaxy smartphones. Given

the geopolitical issues affecting Huawei, however, the Huawei

phones with 5G modems may not be available for use outside China

for some time.

IHS Markit Technology Expert

With contributions from

Francis Sideco, Bill

Morelli,

Elias Aravantinos, Stéphane

Téral, and Wayne

Lam

Posted 13 June 2019