Don’t let money stop you from pursuing your dreams.

If you want to start your own business but don’t have the funding, you can still get it off the ground in a number of ways.

As an entrepreneur myself, I admire anyone who wants to create a company.

It’s not easy.

In fact, only half of small businesses in the United States will survive through their fifth year of operation.

Furthermore, just 30% of those businesses make it through ten years.

Based on this information, it’s clear that failure is more frequent than success when it comes to startup companies.

So I commend you for wanting to pursue this path.

While running a startup may be difficult, it’s also extremely rewarding.

You’ll learn a lot along the way. There are plenty of things I wish I knew before starting my first company.

But getting your startup off the ground is the first step.

Like with most aspects of business, you’ll need some money to do this.

If you’ve never been through this process before, it may seem intimidating.

Not sure where to start?

There’s no one right answer.

In fact, you can get money from multiple sources.

I’ve outlined 9 ways for you to get your startup funded.

I’ll let you decide which ones are best for your startup company.

1. Create a detailed business plan

Before you do anything else, you need to have a clear understanding of how you plan to operate your business.

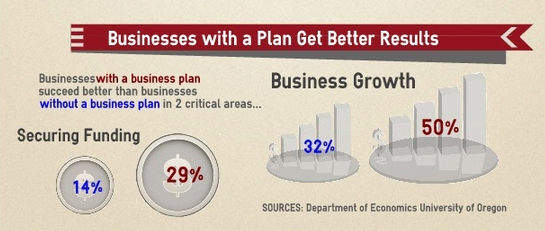

A business plan will increase your chances of securing funds:

Companies that have a business plan also have higher growth rates.

Here’s why.

First of all, it’ll be hard for you to raise money from anyone without a business plan.

Different types of investors, which we’ll discuss shortly, will need to see financial projections before they even consider giving you a dime.

This plan will also set you up for success.

Once you get into the daily grind of your business operations, you’ll always have your plan as a reference to remind you how to proceed.

You may forget some ideas a year or two down the road if you don’t have everything in writing.

Your business plan should have a clear description of your business.

Who are you?

What do you do?

It should also include a market analysis.

This will discuss information and research about your competitors as well as your target market.

You’ll also want to outline the organizational structure of your company.

Have clearly defined roles for managers and other positions within your organization.

Arguably the most important part of a business plan is the financials.

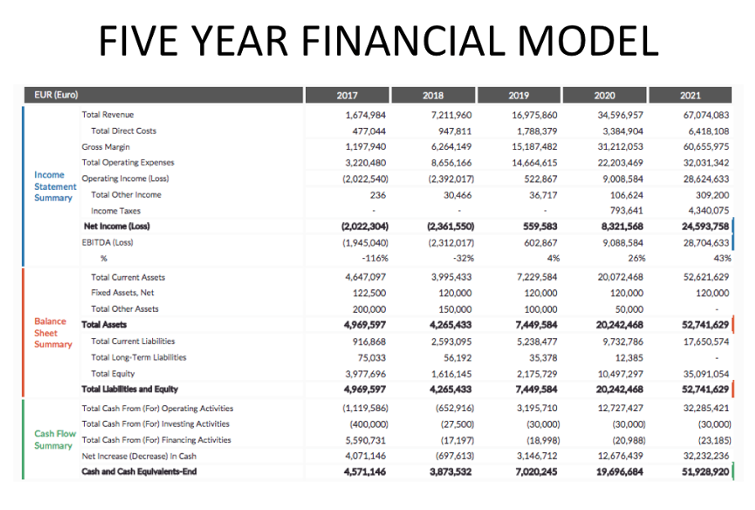

Do your best to include financial projections for the next three to five years:

Make sure your projections are realistic.

As you can see from the example above, this company doesn’t project profitability until the third year of operation.

That’s okay.

You don’t need to turn a profit on your first day or even your first year.

Just try your best to accurately predict your finances.

This section of the business plan will help you secure funding from other sources on our list as well.

2. Visit your local bank

Go to the banks you use for your personal banking needs.

I recommend starting there because you already have a relationship with those companies.

Set up an appointment with a loan officer.

Show up to your meeting prepared.

Dress professionally. Bring your business plan.

Explain to the loan officer how much money you need and what it will be used for.

Depending on your situation, you may qualify for loans for certain aspects of your business, such as equipment.

If the bank denies your small business loan application, you could also try to get a personal line of credit from that institution.

You can use that line of credit to fund your initial business expenses.

Don’t quit after your first appointment.

You could try other banks and financial institutions if your first stop is unsuccessful.

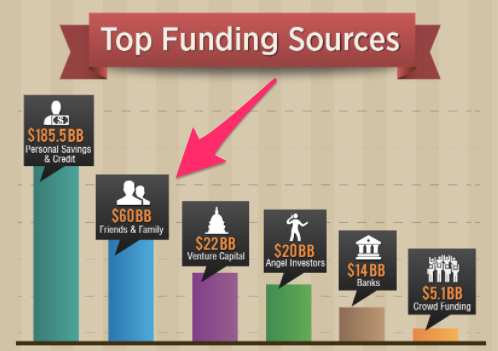

3. Seek help from friends and family

In the United States, friends and family are second on the list for top startup funding sources.

These are the people who love you and trust you.

Most importantly, they believe in you and your potential.

Don’t be afraid to ask your loved ones for a loan.

Plus, unlike with a bank, you’ll likely be able to get some money from your friends and family without having to pay any interest.

Who knows, if you’re lucky, you might even get funds as a gift.

So talk to your parents, siblings, grandparents, or even your rich uncle.

Just know there are some risks associated with this approach as well.

You definitely don’t want to take a loan your friends gave you in good faith and lose it.

That could put both of you in a very uncomfortable situation.

With that said, I’ve talked to some entrepreneurs who said this had the opposite effect on them.

Loans from their family contributed to their success because they had extra motivation to not lose the investment.

They didn’t want to let their loved ones down.

4. Venture capitalists (VCs)

You can also secure funds from venture capitalists.

VC firms invest in the early stages of your company in exchange for an equity share.

If you decide to take this route, be prepared to give away a portion of your business.

That’s not always a bad thing.

If VCs have some skin in the game, they may be able to provide you with other resources that can contribute to the success of the company.

But just understand that smart VCs will only structure these deals if they are in their favor.

They don’t want to make a return on their investment in 30 years.

VCs want to make their money back, plus some, as soon as possible.

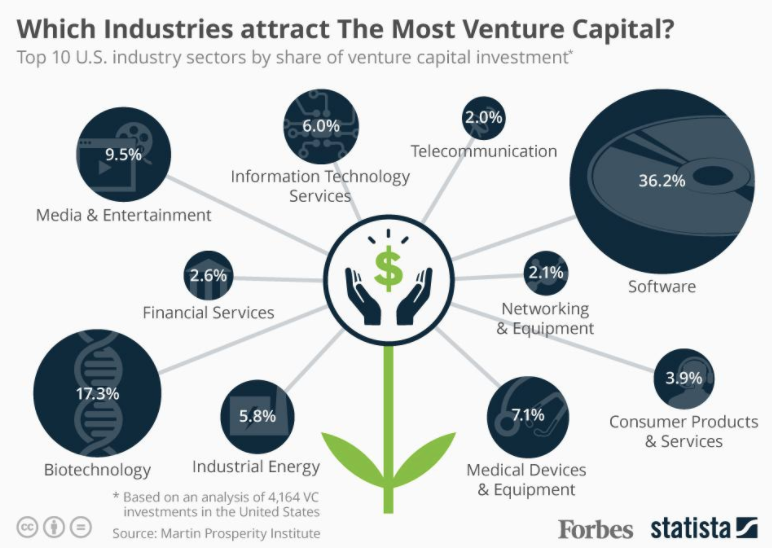

The likelihood of you receiving VC funding largely depends on your industry.

As you can see from this data, venture capital firms are typically drawn to startups within software and technology sectors.

So if your startup company is a local pizza shop, you probably won’t have luck with VCs.

5. Angel investors

Although these terms are often used interchangeably, angel investors differ from VCs.

While angel investors can take an equity share of your startup in exchange for their investment, their funding can also be exchanged for convertible debt.

It’s not uncommon for these investors to be entrepreneurs or former entrepreneurs themselves.

Although money is their motivation, they are more likely to be genuinely interested in your business as well as the growth and development of particular industries.

If you find the right angel investor, you may benefit from their expert advice and management skills.

It’s more common for angel investors to supply funding to businesses when they are still in the early stages, whereas VCs typically look to get involved a little bit later.

Unlike a VC firm that has a committee and advisors working together, an angel investor may make a decision on their own.

They may simply like your plan, trust your goals, and believe that your business will be successful.

That’s why it’s important for you to be able to articulate your business plan well.

A short meeting over coffee or lunch with an angel investor might be all it takes to get them on board to fund your startup.

6. Crowdfunding

Take advantage of the resources available to you online.

You can use crowdfunding websites to raise capital.

While most people think of Kickstarter when it comes to these platforms, there are some alternative websites you can consider as well.

Here are a few popular choices for startup companies:

All of these sites operate in more or less the same way.

Some put you in a pool of professional investors, while others let you raise money from anyone.

If your project is promoted properly, you can raise a ton of money.

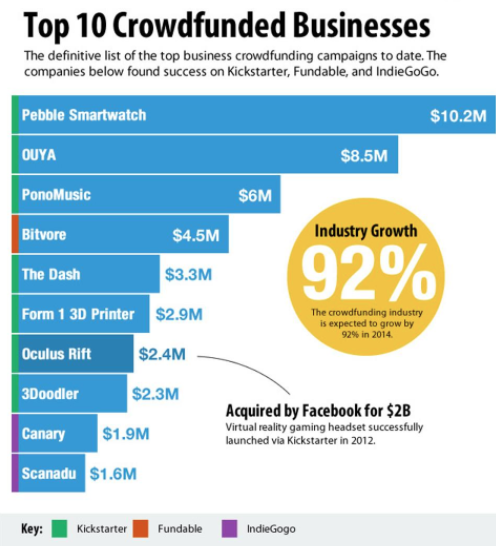

Here’s an example to show you what I’m talking about.

In 2012, a company called Oculus Rift launched a campaign on Kickstarter with a goal of $250,000.

The company aimed to produce virtual reality headsets.

They ended up raising $2.4 million dollars, which was nearly ten times their goal.

It’s safe to say that funding was successful.

The money led to rapid success and growth of the company.

Just two years later, Facebook bought Oculus for $2 billion.

It just goes to show crowdfunding isn’t just for college students or small side projects.

There’s real money to be found out there.

You just need to look for it.

Here’s a look at some of the other top crowdfunded startups in terms of capital raised:

But just because you secure millions in funding doesn’t mean your company will automatically be successful.

Pebble Watches raised over $10 million in 2012, which largely exceeded their $100,000 goal.

But a highly competitive space made it difficult for this company to stand the test of time.

In 2016, Pebble announced they were ceasing daily operations. They stopped producing watches and honoring warranties.

The company folded.

7. Dip into your personal savings

You could also consider funding the startup company on your own.

If you’ve got money saved up for a down payment on a house or some other big purchase, you could use it to launch your business instead.

It’s risky because you won’t have any money to fall back on if your business is unsuccessful.

But if you’re willing to bet on yourself, there are plenty of positive factors to this route.

First of all, you won’t have to give up any equity in your company.

You get to keep all the profits instead of sharing them with investors.

You also won’t have to pay any interest on a line of credit or bank loan.

If you pay for everything yourself, you won’t be letting down friends or family members who may have loaned you money.

This isn’t an option for everyone.

But if you have an extra $20,000 in the bank, consider using it if your startup costs are low.

8. Look for a strategic partner

I’m sure you’ve heard the saying, “Two heads are better than one.”

Getting a strategic partner for your startup company can help accelerate the development of your business.

In fact, over 80% of companies say partnerships are essential to their growth.

Your partner has a bank account as well.

Between the two of you, you might have enough money saved to get your startup off the ground.

If not, it’s another person to help you secure funding through the other methods I’ve outlined in this post.

Partners also reduce your liability. You won’t be on the hook for as much if things go south.

On a flip side, you’ll only get half the profits.

You may get even less if you give away equity to other investors.

Make sure you find someone you can trust.

While your strategic partner may be able to bring new ideas and solutions to the table, there can also be conflicts and disagreements.

9. Try to minimize initial business costs

Reevaluate your startup costs.

You may not need to raise as much money as you initially thought.

Make the money you already have last as long as possible.

Instead of paying for an office, you could work from your home or a shared office space.

Pay for goods and services as you go instead of paying upfront for large quantities of products.

Use cost-effective materials.

Think outside the box.

And while this may not work for every startup, you can also barter.

Instead of paying for certain products or services, offer your own services in return.

This may be successful if you’re working with other startup companies in a similar to yours situation.

Just do your best to keep costs as low as possible.

Conclusion

Starting a new business is exciting.

But it’s not cheap.

Not everyone has enough money to get their startup company off the ground.

If you can’t fund your business on your own, try getting a loan or line of credit from your local bank.

You could always ask your friends and family for help.

Venture capitalists, angel investors, strategic partners, and crowdfunding platforms are also great options to consider.

It’s important that you always start with a strong business plan.

Come up with realistic financial projections.

This will make it easier for you to get money from investors.

You also need to keep all your costs as low as possible to make your funds last until you can get a steady income stream.

Follow these tips, and you’ll be on the right path toward raising money for your company.

Good luck!

What strategies are you using to secure funding for your startup company?