Chart of the Week: Most companies see customer retention as a priority but B2B companies are better at prioritizing it

When it comes to subscription businesses, the key to growth has historically been getting new subscribers. Not only is customer acquisition a fairly expensive undertaking, as the market becomes flooded with more choice, but it is also far too easy for your new subscribers to simply click a button to cancel and take their business elsewhere.

This is why many businesses are putting the focus on customer retention instead. Not only is working to keep existing customers a lower-cost option, but it can also result in the creation of brand advocates, better relationships and even a better product.

In fact, according to Brightback’s 2019 State of Customer Retention Survey, 97% of B2C, B2B and hybrid subscription companies say that retention of existing customers is currently a priority. Here are some of the key findings from this year’s survey.

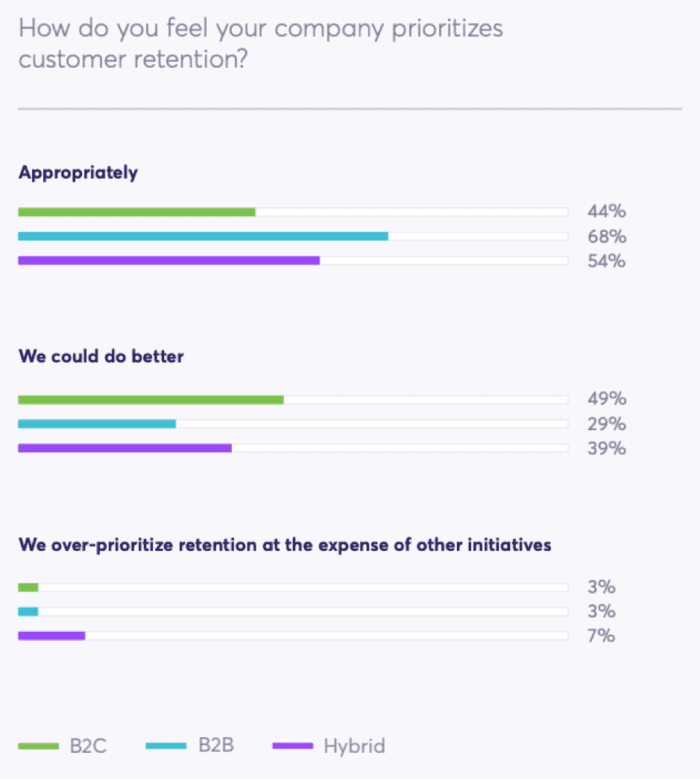

B2B brands are on top of retention

B2B brands seem to be performing best in terms of prioritizing retention, with 68% of respondents saying their company prioritizes the strategy appropriately. On top of these, just 29% of B2B respondents said their companies could be better when it comes to customer retention, meaning B2B as a sector seems to be on top form.

In comparison, B2C companies seem aware that there is more they can do to improve their retention strategies and put existing customers first. Under half (44%) of B2C respondents said retention is prioritized by their companies appropriately with 49% admitting that they could definitely do better.

Hybrid companies are in the middle, with over half (54%) saying retention s appropriately prioritized and 39% saying they can do better.

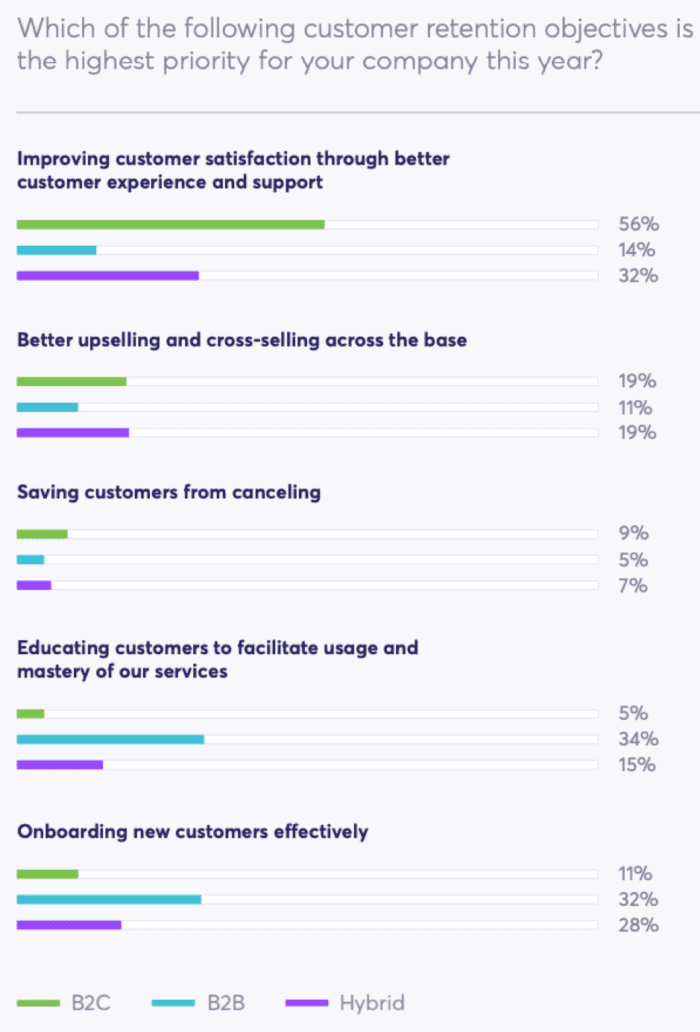

Customer experience and education are the main retention strategies

The survey found that B2C and B2B companies both approach customer retention in slightly different ways. While 56% of B2C respondents say that “improving customer satisfaction through better customer experience and support” is a high priority this year, just 14% of B2B respondents stay the same. Hybrid companies agree with B2C on this priority.

In comparison, B2B companies put more store in education, with 34% saying that “educating customers to facilitate usage and mastery of our services” is a big priority for the next year. Just 5% of B2C companies say the same.

This focus on education over customer service is likely due to the fact that B2B relationships can end up lasting years, meaning that providing education on how to make the most of products or services is likely to lead into customer satisfaction. When it comes to B2C industries, the broader market means that customer service can make all the difference between a company and its competitors.

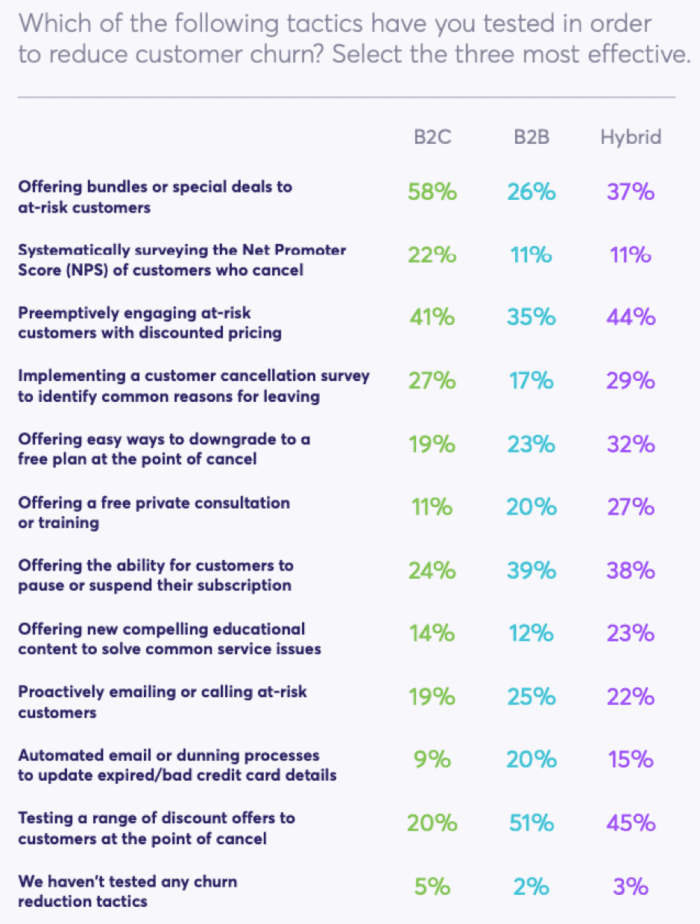

Discounts and deals are a popular retention method

Even if a company is delivering great customer service or an educational approach, there are going to be some customers who wish to cancel. This is where strategies to reduce customer churn come in handy as they can help you target at-risk customers and provide a reason for them to stay subscribed.

Discounts and special offers seem to be the most popular retention strategies across the board. While 58% of B2C companies offer ‘bundles or special deals to at-risk customers’, 51% of B2B companies test ‘a range of discount offers to customers at the point of cancel’. Hybrid companies follow suit with 45% testing offers at the point of cancel and 37% offering special deals to at-risk customers.

However, another popular option among 44% of hybrid companies is “pre-emptively engaging at-risk customers with discount pricing”, which seems to be a good option across the board.

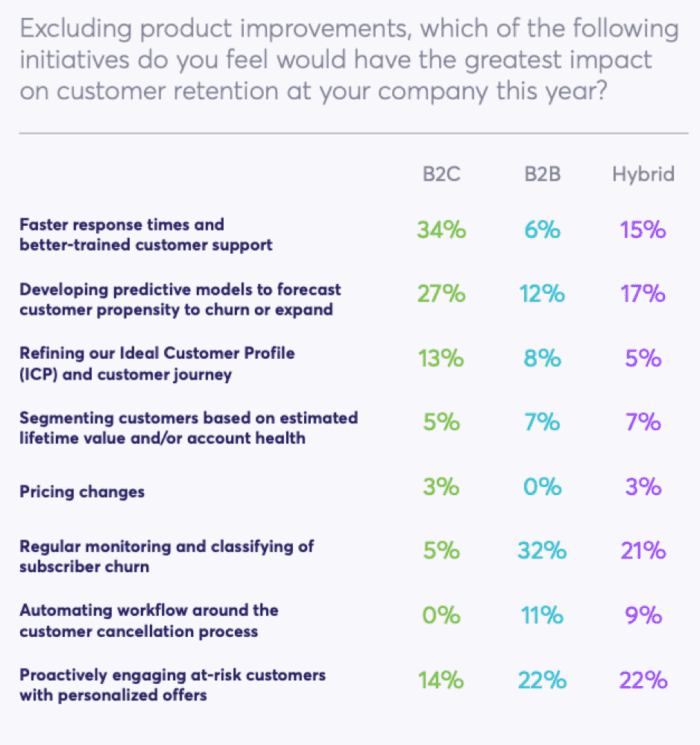

Understanding when and why to engage is key to retention

Personalizing customers’ experiences and engaging with them regularly are big parts of retention. However, many companies are not able to measure exactly what it is customers need or want from them, let alone deliver the best possible experience.

This is perhaps why 32% of B2B and 21% of hybrid companies are looking to “regularly monitor and classify subscriber churn” in order to better understand exactly why customers cancel. Understanding this would better enable them to send the right communication at the right time and create key educational material. However, only 5% of B2C companies said this is an initiative that would have an impact.

Consistent with other findings from the survey, 34% of B2C organizations say that “faster response times and better-trained customer support” will have the greatest effect on customer retention. While customer service can set companies apart, not having the right data to base communications on can mean that the service delivered is not what customers need in order to stay.

Despite the fact that discounts and offers are the most popular forms of a retention strategy, pricing changes came bottom of the list of activities that could impact customer retention. No B2B customers said this would make a difference while only 3% of both hybrid and B2C companies said it would.

A lack of retention is stalling growth

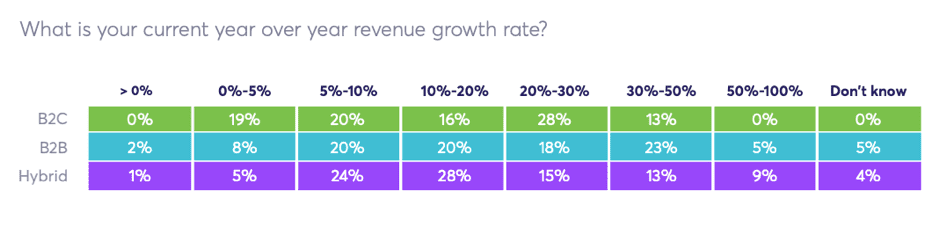

Despite organizations understanding that customer retention is vital to their business, only one in four subscription companies is growing by more than 30% year-on-year. Just 13% of B2C, 23% of B2B and 13% of hybrid companies are growing between 30% and 50% each year.

The next bracket is even smaller with no B2C 5% of B2B and 9% of hybrid companies growing by 50% to 100% YoY. While customer acquisition could help with these figures, the fact that it can be seven times cheaper to retain a customer than acquire a new one can means that growth may still be slow.

Final thoughts

Companies need to balance their focus between acquisition and retention in order to get the right payoff from both. The focus they put into retention – such as improving customer service – can ultimately become a big selling point and help them gain new customers. This is especially the case when existing companies become ambassadors for a brand, offering recommendations that could help to encourage a purchase.

However, in order to retain customers, you need to have the data to offer them the service and personalization they need. Categorizing at-risk customers can help provide valuable insights and develop retention initiatives that go beyond simple discounts, customer service and onboarding experiences.

Understanding why customers cancel and how you can offer personalized outreach at the right time to convince them to stay on could help to create an effective and multi-faceted approach to retention.