Keeping track of expenses is one of the many jobs of small business owners. And as jobs go, it is very important. Whether you have a software or you’re doing it old school, you need up to date and accurate view of your total spend.

Bill Pay is a new solution from Divvy designed to provide better visibility into budgets along with total companywide spend. According to the company, the goal is to replace traditional invoice processes. And these traditional processes usually cost businesses more money.

In an emailed press release, Blake Murray, co-founder and CEO at Divvy, explains why a new process is necessary.

Murray says, “We designed Bill Pay as a modern approach to an outdated process, giving leaders real-time control and visibility of credit card and non-credit-card spending, all in one place and tied to one budget.”

Small Business Trends also asked Tyler Hogge, VP of Product at Divvy, how does this solution benefit small businesses?

Hogge answered, “Small businesses can spend less time completing time-consuming invoice processes and more time growing their business. “

Hogge goes on to say, “Currently, businesses must manage credit card spend and invoices (checks, ACH transfers, etc.) under two completely separate budgets, making spending expectations unclear and unorganized.”

Bill Pay Features

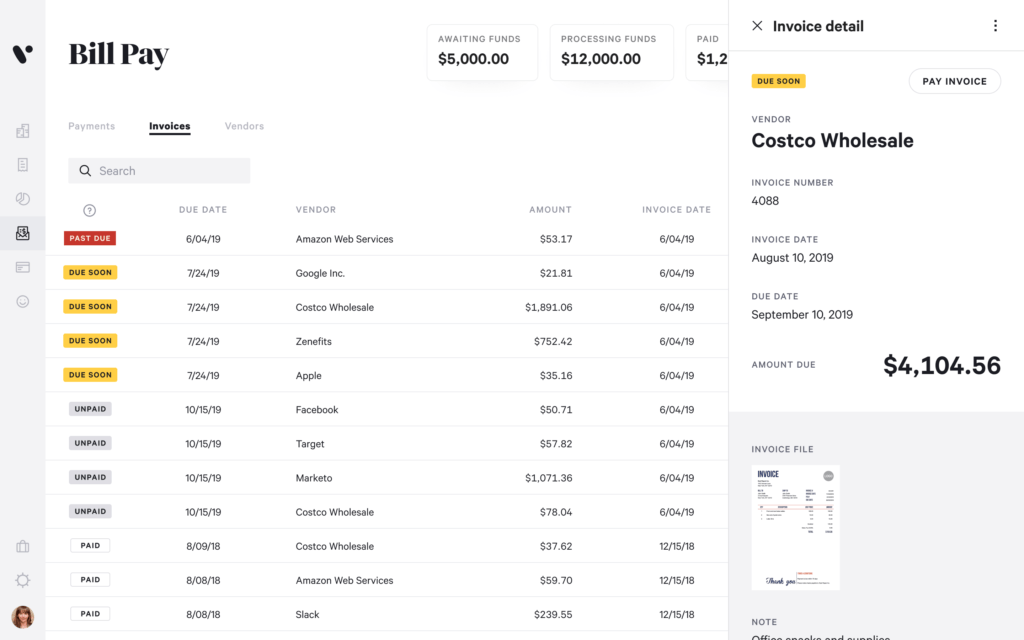

Bill Pay is part of the Divvy platform. Divvy provides a comprehensive view of budgets and spending within an organization. And as part of this platform, Bill Pay is going to let you pay your bills and invoices faster.

You start by adding your vendor and creating a payment. And Divvy takes care of the rest.

When it comes to funding, your Bill Pay account is funded at the time of payment from your bank account.

Data and Control

The data a small business generates can improve operations across the board. With Bill Pay, you can export your data along with invoice images from Divvy into your accounting system. You can use this information to get a better picture of your finances and find ways to improve this process.

The admin control in Bill Pay is a security measure which ensures only authorized individuals get access. In addition to the personnel, you can control which vendors can be paid, which invoices get fund, and when.

Like Divvy, Bill Pay is a free service and it is currently in private beta. If you want to give it a try you can request early access here.

Image: Depositphotos.com