The ability to develop an efficient and effective budgeting and forecasting process requires extensive experience and on-the-job training that can take years before your boss finally – if ever – says, “You don’t need me anymore.”

Accurate forecasting (even close to being in the ballpark) is the hallmark of the great marketers I have worked with. Sadly, I can count them on one hand. In addition to a wide-ranging combination of consumer, channel, process and delivery knowledge, they were also comfortable and capable in the numbers department.

Although we’ve introduced different forecasting techniques to brief marketers on how to use a more data-driven approach, the concept of zero-based budgeting is becoming a popular technique.

As campaigns running all around us right now prove, anyone can invest/spend/blow (take your pick) money that flows from the magic money tree that makes a brief appearance each year during the annual budget review. During this use-it-or-lose-it process, financial plans for sales, revenue resources, costs, expenses, cash flows etc are set for the coming year, based on last year’s figures with a random percentage increase.

This process ignores the fact that the coming year is highly unlikely to be a repeat of the last. The competition might finally get their act together. Someone might ‘go Uber’ in your sector. Suppliers might change their prices. Consumers might decide to shop elsewhere.

By adopting zero-based budgeting, your business can create more accurate budgets that more accurately reflect your company’s upcoming challenges, activities, and aspirations.

Zero-based budgeting (ZBB) is an approach in which brand-new budgets are always calculated from a zero base, rather than estimating it based on past budgets.

Traditional budgeting carries over the previous years’ allocation, often accounts for a 2% increase, and then analyzes new expenditures that need to be accounted for. This means old expenses can be forgotten about and overall spending can inflate as teams adopt a ‘use it or lose it’ mentality to ensure the next period’s budget is adequate.

When you use zero-based budgeting, you start at zero every time and must justify all expenses to create an organization, business, or department’s budget. By doing this, you scrutinize both old expenses and new based on your expected activity and only budget for what you need.

In their article Zero-based productivity—Marketing: Measure, allocate, and invest marketing dollars more effectively, McKinsey explains the rational for zero-based budgeting as follows:

Zero-based marketing—a comprehensive approach that extends zero-based budgeting principles to marketing categories across the enterprise—can uncover opportunities for savings worth 10 to 25 percent of spending in certain categories, and these funds can be reallocated to higher-value areas. In fact, with the rare exception of industries that are in a global state of decline, a well-executed reinvestment in high-ROI opportunities will deliver a greater return than “banking the savings” will.

A recent McKinsey survey revealed businesses that are methodical about investing funds unlocked through zero-based budgeting and other programs into growth—either proven winners or future products and services—outperform the market. Notably, often more than 50% of these savings can be achieved in the first 12 months of a zero-based marketing effort, allowing for rapid reallocation.

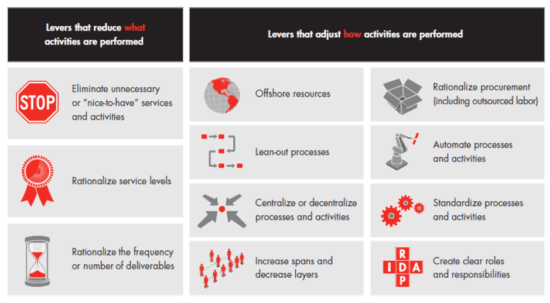

This visual from consultants Bain usefully shows how zero-based budgeting focuses on improvements using both ‘what’ and ‘how’ savings. They point out that the aim should be to reduce cost, but at the same time avoid inhibiting growth.

Unilever brands are examples of consumer brands successfully applying ZBB. In a recent financial report they say that zero-based budgeting is “improving our productivity in brand and marketing investment as we reduce the cost of advertising production and increase investment in media channels. ZBB is also eliminating waste in those areas where we have over-saturated traditional media channels, as well as reducing overheads.” They introduced this programme by test and learn in different markets. Unilever piloted zero-based budgeting for one year in Thailand, for instance, which reduced its overall spending by 2% as a share of sales.

The potential of digital transformation projects, data-driven marketing strategies and real-time targeting acquisition and retention tactics in digital channels is outpacing our ability to allocate budget and resources with a corresponding degree of agility. Zero-based budgeting is an attempt to focus our attention, budgets, and resources on existential opportunities and threats in the marketplace.

How zero-based budgeting can be applied

As an example, see how zero-based budgeting might affect a team’s activities mid-campaign, using the Ansoff Marketing Opportunity Matrix as a framework:

Market Penetration – the ZBB team conducts an LTV audit and makes a temporal shift in acquisition budgets and resources to retention.

Market Development – the ZBB team discovers that local markets and segments have reached saturation point and temporarily reassigns budgets and resources to a 90-day expansion launch in an overseas target market.

Product Development – the ZBB team identify an opportunity to introduce and new product line and temporarily reassigns acquisition budgets and resources to a rapid product update. Budget is re-allocated for this new opportunity.

Diversification – the ZBB team has calculated that a recent brand campaign has created an opening in a new product category and temporarily reassigns retention budgets and resources to a sourcing initiative or collaborative partnership. An actionable and accountable plan is developed, delivered and optimized against KPIs, AMC and CPS targets

As you will have noticed, ZBB only works if the working environment and the teams are collaborative, adaptive and always focused on the collective objective. Not to mention collectively rewarded. You can’t run a system like this without considering an aligned remuneration system.