In November 1997, on the ground floor of a Dallas office building, Tom “Gollum” Dawson won the FRAG (Foremost Roundup of Advanced Gamers), widely seen as the first official gaming tournament.

He took home $1,000 in gaming merchandise as his prize. In the summer of 2019, Kyle Giersdorf won the inaugural Fortnite World Cup, and made himself a millionaire.

Last year, we asked if esports could make it into the mainstream.

A year on, it seems above all, the Fortnite World Cup has brought it into the fold, with Giersdorf even appearing on The Tonight Show in the wake of his success. But this isn’t all.

The Washington Post started hiring esports reporters, the Danish Prime Minister launched his own esports strategy, and it even made its way onto The Simpsons.

TV, newspapers, and even governments are realizing the power of esports. But what does the data say?

Esports continues to grow, and so do the sponsors.

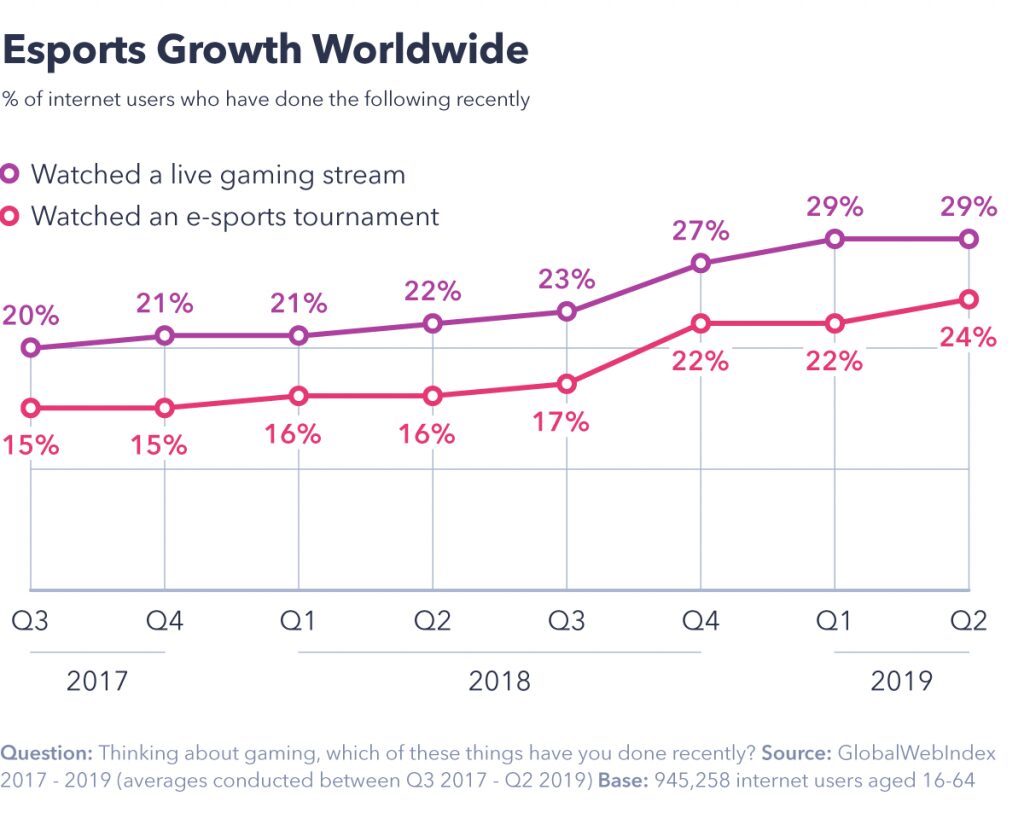

Our latest research shows esports viewership has increased by 50% over the past year among internet users aged 16-64, with China and South East Asia continuing to be the engine for the trend’s global growth. The corresponding rise in gaming livestreams underlines how spectator gaming is driving esports overall.

We also conducted a bespoke survey, repeating what we did last year, to better understand the growth of esports in the UK and U.S.

Straight off the bat, we saw an increase in awareness of esports as a form of entertainment, rising from 69% to 76%.

The reasons why internet users have chosen not to engage with it were much the same as last year; it either comes through not having checked it out yet, or because traditional sports are preferred.

But the latter has seen a decrease in percentage points, alongside other factors like not understanding how the league works, or not relating to the community. All these indicate internet users, even those who don’t watch it, are at least a bit more familiar with all its different parts.

As esports has grown, so the sponsors have followed. We talked last year about more “non-endemic” sponsors coming into the scene (meaning products/services not directly related to esports), and mentioned energy drinks as an industry that had gone all-in, benefiting from a close association between product and athlete.

So it’s truly a sign of how deeply ingrained non-endemic brands have become to see that Anheuser-Busch has filed a trademark request to become “the official beer of esports”.

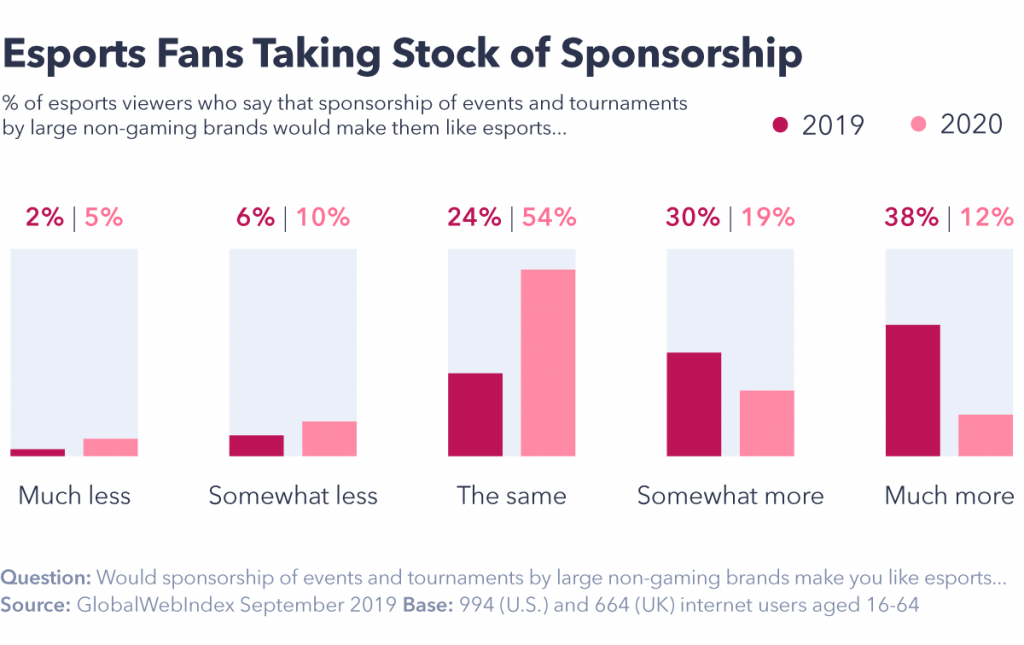

Our latest survey, though, shows that while esports has grown, attitudes to sponsorship have cooled slightly. Fewer esports watchers say that the addition of sponsors would make them like esports more, though it has to be said most of them say it wouldn’t make a difference either way.

But it highlights that esports can’t just be exploited in a sponsorship gold rush, and its audience has to be treated with respect. It’s likely that esports is moving from a stage where sponsorship is welcomed in order to validate its growth into one where the community can be more selective about potential suitors.

Not all gaming genres are created equal.

In addition to capturing these year-on-year changes, we added some fresh questions to our survey to better understand esports as it stands in 2019.

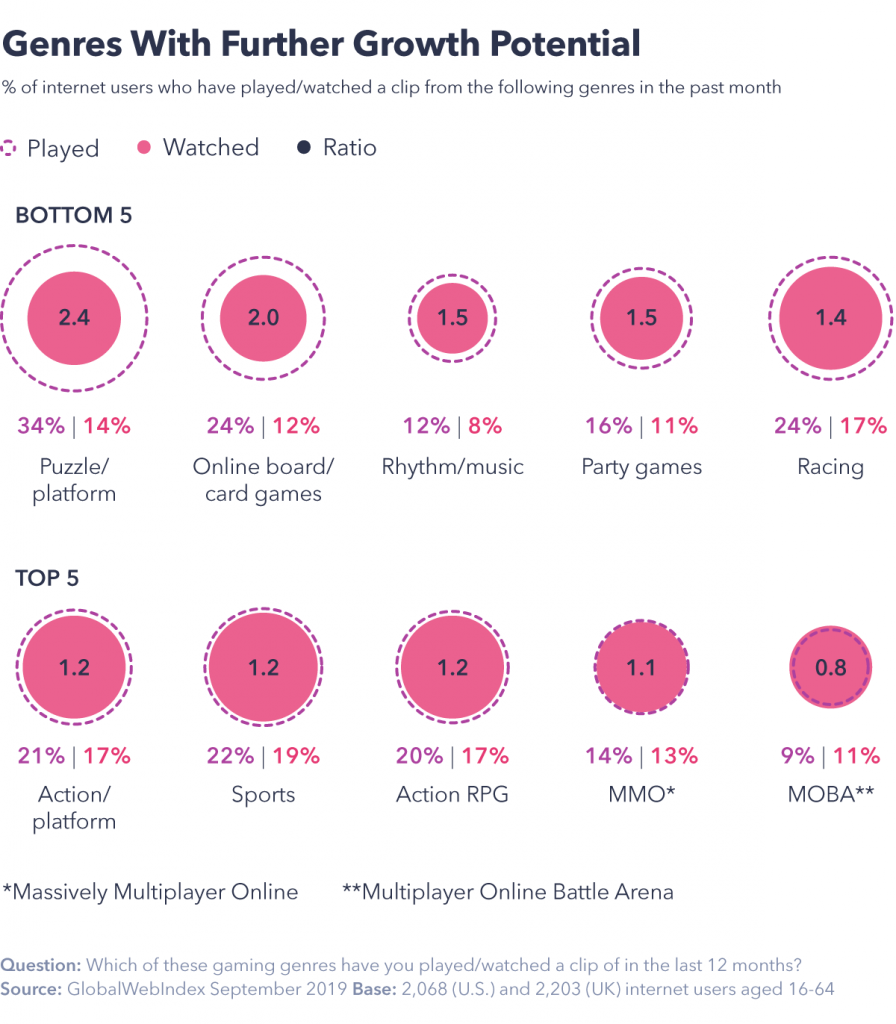

We asked which game genres internet users had played in the last 12 months, and those which they had watched a clip of in the same period. It’s often said (but also often forgotten) that esports is a broad church, including a wide range of game genres and franchises. Understanding the scene through this lens is crucial.

In putting this data side-by-side, we can see which genres “overperform” for watching games.

The only type of game more popular to watch than to play is the MOBA (multiplayer online battle arena), the genre of favorites like League of Legends and Defense of the Ancients.

In our core data we get a glimpse into just how much of a role MOBA games have played in esports’ expansion, as the markets where MOBAs are relatively most popular (China and Vietnam) are also the most popular for esports.

But perhaps the most interesting insight appears among genres in which watching trails playing the most, as these could be where the ground is most fertile for growth and partnerships.

The puzzle/platform and board game genres seem hard to imagine in an esports context, but it’s a real testament to its pull that Wizards of the Coast is making significant plans to make Magic: the Gathering a potent force.

Another intriguing one is racing. Racing and sports have a lot in common, but sports is, for the moment, converting more people into gaming viewers.

With Ferrari completing the roster of teams in the Formula 1 Esports Series in 2019, it appears industry stakeholders are now on board, following the example of tie-ups from the sporting world like the ePremier League.

Reaching the esports fan in 2020

There are many ways you could define something entering the mainstream, but it really does feel like esports has become part of the cultural fabric in 2019. And our research bears this out, showing continued impressive growth for spectatorship. There are plenty of gaming genres with more scope for growth too.

Esports may be open for business, but as it transitions into more mainstream entertainment, a blanket approach to marketing isn’t enough. Each gaming genre has a distinct audience that needs tailored messaging, and attitudes to sponsorship are shifting.

In 2019, sponsors provided the validation it needed to grow. In 2020, the esports community will be more discerning. Brands will have to fully understand what drives its varied sub-groups to ensure that the right messaging lands in the right place.