Paid media is coming back into its own as a strong marketing choice as the promise of other channels has faded or been assessed more realistically, according to a study by Gartner.

Getting the media mix right is critical. Consumers’ attention represents a finite quantity spread more thinly than ever. Financial marketers find themselves not only up against other banks and credit unions and fintechs, but anybody vying for that attention, including, in digital channels, any brand on the planet, potentially. Measurement of results both in specific channels and for marketing efforts overall is proving more critical than ever as financial marketers need to pick and choose among options with finite budgets.

Gartner’s “Annual CMO Spend Survey 2019-2020” makes a handy yardstick for seeing how your financial institution’s budgeting picks, priorities and processes compare to many other firms. The annual research is based on a study of spending by larger companies in both North America and the U.K. (Another pair of handy tools that are even more specific are The Financial Brand marketing budget reports for banks and credit unions. Readers can also download detailed Excel documents for deeper digging.)

Marketing budget growth in Gartner’s CMO surveys has been relatively flat in the last five years, coming in around 11% of annual company revenue. Budgets took a slight tick down in 2019, to 10.5%, according to the firm. In a related series of surveys among CEOs, 61% anticipate increasing their company’s marketing budgets in 2020, according to Ewan McIntyre, Vice President and Analyst, though the research also found that the potential state of the economy makes this prediction less certain than usual.

The Gartner research, and a related webinar, look at the channels marketers are using and how the mix is evolving; how companies set marketing budgets; and the variety of metrics CMOs rank most highly when determining if they are hitting the mark. McIntyre and co-author Anna Maria Virzi, Principal Analyst, correlated marketing study findings with additional Gartner research for a fuller picture.

Paid Media Makes a Comeback, Search Spending Adds Up

The research underscores how what comes to be accepted wisdom in marketing can seemingly overnight lose its credibility — and how sometimes you can miss the shift if you blink.

Take social media. Many believed that simply devising excellent tweets, posts, and updates would save buckets of money by replacing outreach that banks and credit unions pay for.

“But organic reach on social platforms has pretty much reached zero,” says McIntyre, at least on “traditional” social media channels like Facebook. If you want substantial traction on social, he says, you have to be using some form of paid advertising on each platform.

Another example: The social-media-based strategy of influencer marketing, McIntyre states, is not always delivering what it was supposed to for brands. More and more articles have been appearing reflecting increased questioning of the validity of the whole concept of influencer marketing. Government entities like the Federal Trade Commission have increased their pressure on elements of that strategy.

As a result, says McIntyre, “paid media is back.”

“Word on the street was that paid media was no longer worth the investment, and advertising was reported to be dead,” says McIntyre. However, because enthusiasm over some newer options has flagged, “paid media presents more positives than negatives to CMOs.” Gartner’s research indicates that paid media spending rose from 23% of the total marketing budget, on average, to 25% in 2019, and that it could rise further in 2020.

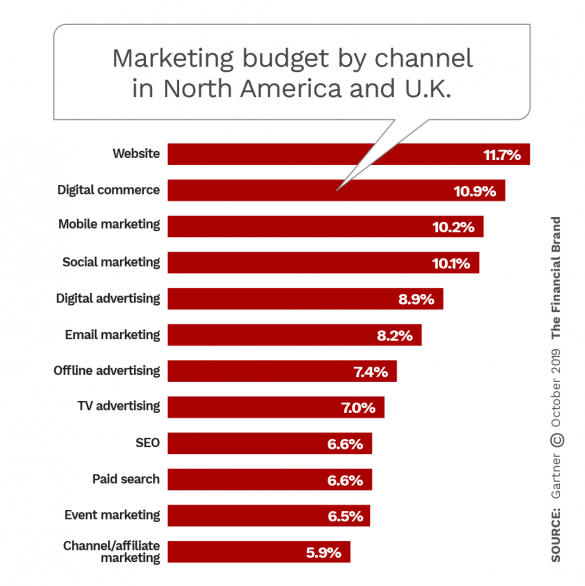

The study looks at multiple categories of marketing channels, as shown in the chart below. Of the paid media channels, digital accounts for 8.9% of budgets; offline, 7.4%; TV, 7%; and paid search marketing, 6.6%. (Offline includes outdoor advertising, print ads, and more.)

Digital has come to be the leading form of paid media spending, McIntyre notes, and breaks down further:

- Paid social media advertising, 23.7%

- Display advertising, 20%

- Digital video advertising, 19.6%

(Additional forms, such as affiliate and co-op ads — 19.2% — and Amazon advertising — 17.4% — are less likely to be used by banks and credit unions at present. But not so long ago, Amazon just sold books.)

“Even in the face of economic uncertainty, 37% of the CMOs expect to make increasing investments in digital advertising to keep their strategies on track,” says McIntyre. Should the economy continue to be positive, four out of five CMOs expect to increase digital spending. This reflects a strong degree of confidence on many CMOs’ part in those channels, chiefly because digital advertising can be measured.

Read More:

Spending on Some Channels Hinges on Economic Trend

McIntyre notes with some surprise that offline spending continues to be at so high a portion as it is. However, he says indications in the study are that should budgets be chopped in a downturn, the comparative difficulty in measuring results for offline channels will make it harder to justify using them. And while TV continues to hold a decent share at 7%, with financial services companies particularly strong users of it, about a third of respondents say they would cut TV spending in the face of economic uncertainty.

Not that plotting and measuring digital marketing doesn’t take money and expertise.

“Digital’s efficacy is in danger if marketers can’t get the data and the capability to effectively target audiences with the right messages at the optimal points along the customer journey,” says McIntyre. “We have evidence that CMOs struggle to acquire capabilities to build, deliver, and optimize digital advertising campaigns.”

One wrinkle in the numbers regarding search: While paid search only accounted for 6.6% of marketing budgets in the study group, McIntyre notes that search engine optimization also represents 6.6% of budgets. He believes the two complement each other, and that they should be considered together.

That means search spending overall accounts for over 13% of budgets, which would place the combination ahead of all other categories in the chart above. Similarly, combining the 8.9% of budgets allocated to digital with the 6.6% for search engine marketing would come in even higher at 15.5%.

But there’s another wrinkle: Undermining this, McIntyre acknowledges, is that over half the brands surveyed “lack a discernible search strategy.” He adds that other Gartner research indicates that only one brand in ten maximizes the opportunity that search strategy offers.

McIntyre stresses the need to be current. “Even among digital channels, assumptions are being heard based on performance of two or three years ago,” he says. “You’ve got to check back to see if those assumptions are still true.”

Read More:

on-demand webinar

Winning At Acquisition In Times of Change

Technology is developing as rapidly and the consumer mindset about finance has shifted. How can you continue to attract high quality new households, deposits and cross-sell accounts?

INSTANT PLAYBACK – WATCH NOW!

Forms of Marketing Management Radar Favored by CMOs

As the study’s discussion of paid media channels demonstrates, gut feelings about what works and what doesn’t mean little at the micro level. Increasingly both marketers and managers want to see what every buck spent here or there produces.

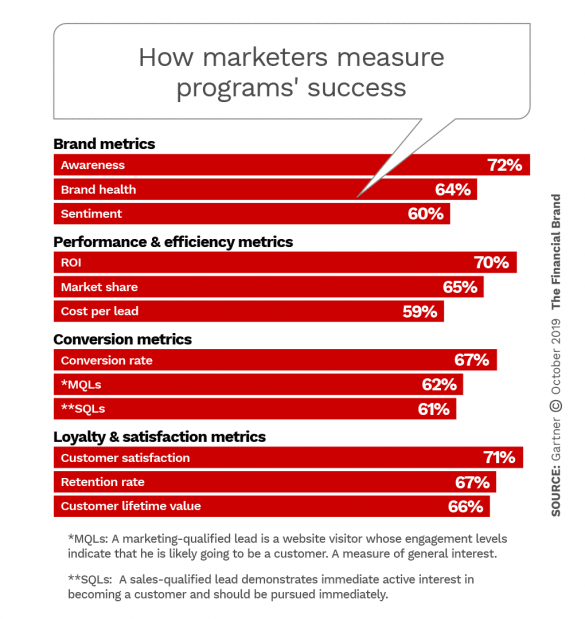

This attitude increasingly plays a role at the macro level as well. There are multiple methods for taking such measures. The Gartner research breaks them into the four categories shown in the chart below. The subcategories ranking most highly are shown in the bars.

Some familiar methods of evaluating success of programs didn’t rank in the top three of the four groupings. For example, in the Brand Metrics area, “share of wallet” didn’t make it, with only half of the CMOs citing its importance. That was the lowest-ranking methodology in that category.

In the Performance and Efficiency metrics group, Return on Investment ranked most highly. The Financial Brand‘s bank and credit union marketing budget analyses each contain tables concerning ROI. LINKS

The study includes a somewhat critical observation about the metrics that the marketers favor: They have a tendency to focus on metrics that measure volume rather than value.

“Do these metrics reflect a balanced view of marketing performance? Do these metrics fully articulate the value marketing delivers to the enterprise, allowing CMOs to course correct as and when required?” the report asks. “Brand measures such as brand awareness and brand health are vitally important, but they’re not enough to convey the value brand investments bring to the enterprise.”

Even ROI leaves something to be desire.

“ROI’s reliability depends on a solid understanding of what it does (and doesn’t) tell you based on your individual organizational circumstances,” the report states. Gartner recommends devising a scorecard for marketing that includes both near-term measures of revenue as well as longer-term measures of value.

Read More:

How Do You Set Next Year’s Budget?

Ultimately what a financial marketer must be able to do is come up with a workable budget that won’t get shot down by the CEO, the CFO or other parts of top management. Indeed, the report suggests that CMOs must work at forging a positive relationship with Finance.

“How you define your marketing budget is part of your responsibility as a CMO,” says McIntyre.

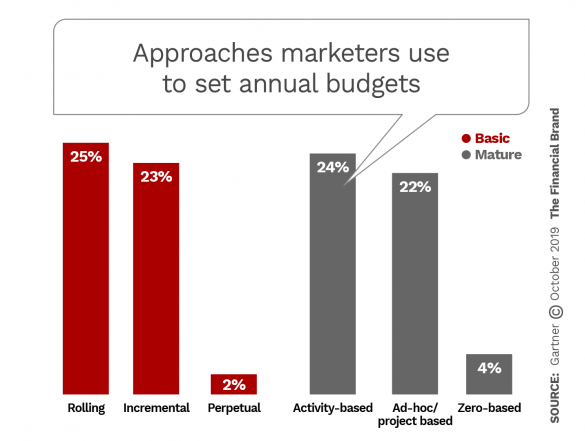

There are multiple methods to devising a budget. Among the basics are:

- Rolling budgeting: Updating budgets on a continuous or set schedule, such as quarterly.

- Incremental: The traditional approach of using the current year as a baseline for increasing or decreasing by some percentage.

- Perpetual: Automatic budget extensions.

- Activity-based: Allocations based on performance of an activity, rather than assuming increased year over year based on inflation.

- Ad-hoc/Project-based: The cost of each project must be justified for its own budget to be approved. McIntyre notes that interest in this approach is picking up where agile development is being adopted.

- Zero-based:The entire budget gets built from scratch, with every expenditure subject to approval, based on expected returns.

Of the last, McIntyre observes that while it is frequently discussed, it is still rarely implemented. Two years ago only 4% of companies in the study used zero-based budgeting, synching with the 2019 results.

“It’s difficult for CMOs to embrace,” says McIntyre. “It’s an onerous exercise.”