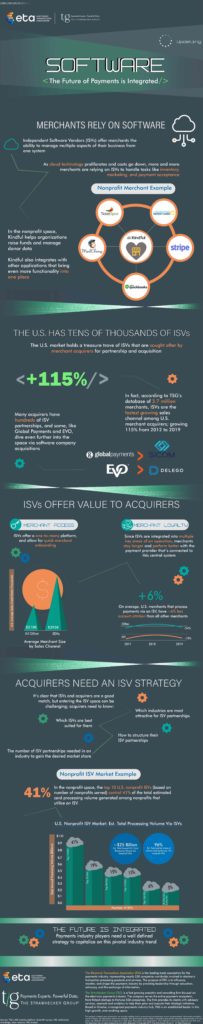

Payment options for small businesses continue to explode. As a result, so many different solutions exist. The ecosystem seems more complex than necessary. An infographic by the The Electronic Transactions Association looks at how Independent Software Vendors (ISVs) provide options for merchants.

For example, integrated payment solutions simplify the ecosystem with software.

The ETA says the future of payment is integrated. For example, new payment options not only include payment. But also the different aspects of running a business. This includes inventory and marketing to provide a comprehensive solution.

Most small businesses operate using a model in which physical and digital commerce work together. As a result, successful integration mist address this reality.

In an email interview with Small Business Trends, Jodie Kelley, CEO of Electronic Transactions Association, explains the importance of integrated payment systems.

Why should small businesses have an integrated payment system?

Kelley: Your relationship with your payments provider is no longer limited to just payments acceptance. By incorporating an integrated strategy, business owners have access to customizable software solutions. They use payments data and powerful software to manage inventory, schedule employees for peak revenue times, run loyalty programs and help keep their books. These types of solutions can save business owners time and allow them to focus on their passion: growing their business.

Achieving New Levels of Efficiency

According to the infographic, U.S. merchants processing payments through an ISV have 6% less account attrition. The efficiency also translates across merchant activities, from payments to managing loyalty programs.

What are the efficiencies a small business can expect from adopting such a solution?

Kelley: Small business owners and employees can expect to save time on essential business and performance tasks. From the point of sale (POS) terminal – usually a familiar off-the-shelf device like an Apple iPad or Android tablet – they can make sure customers are efficiently being seated and served. It goes on to maximizing revenue during peak times, monitoring inventory, sales, and customer spending habits in real-time. Businesses can leverage this data to schedule their employees, integrate their accounting software to simplify reporting and manage loyalty programs and discounts. All these functionalities create a centralized, efficient hub to run their business.

There is also efficiency in terms of cost-benefit. By automating many of the functions small business goes through in any given day, owners can save a considerable amount of money.

Since cost is always on the mind of small business owners, what is the cost-benefit of having an integrated payment system?

Kelley: Time spent manually pulling reports, sending invoices, and managing employees, is significant and adds up. An Integrated payments platform is affordable and offers business owners something more valuable than money: their time.

Finding Payment Providers

The good news for small businesses is there are many providers in the marketplace. According to the infographic, the U.S. has tens of thousands of ISVs. And these companies have integrated payment solutions to address virtually any business application.

Kelley concludes by saying, “Reach out to your payments provider and ask them what solutions are available. It’s most likely that they have invested heavily in creating an integrated payments solution. And if you’re looking to add payments acceptance to your business, shop around and find the payments solution that is right for your business needs.”

Take a look at the infographic below.

Image: Depositphotos.com