Primarily endorsed with the tag of being an extremely consumer-driven vertical, nutritional lipids industry has emerged as one of the most opportunistic, versatile, and rapidly evolving business spheres of the food & nutrition industry. This evolution can be essentially credited to the growing trend of maximizing nutritional credibility in daily diet and the rising consciousness toward understanding the nutritional importance of lipids. Nutritional lipids have already registered themselves as vital ingredients in balancing the nutritional deficiencies in human body that can often lead to serious health concerns comprising diabetes, stroke, cardiovascular, inflammation, obesity, and even cancer. A substantiation authenticating the same is USDA’s claim stating that nearly half of the U.S. population develops diet related chronic disorders, ultimately leading to an annual healthcare costs soaring over USD 250 billion.

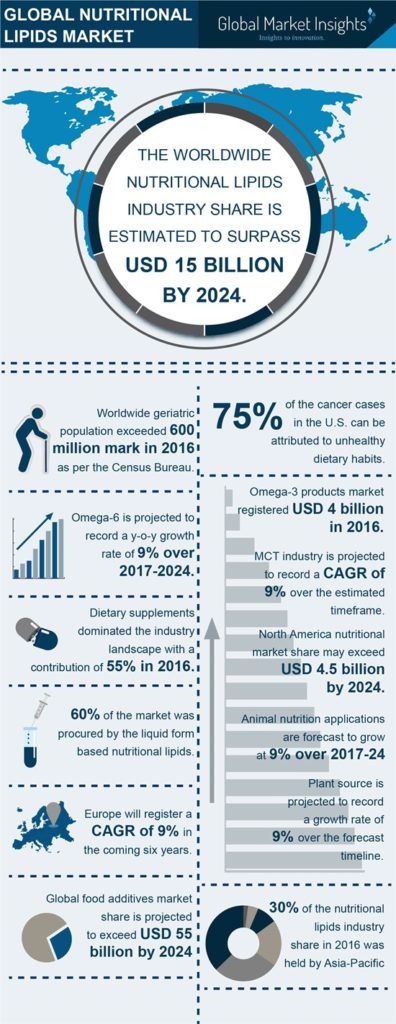

In consequence of this not-so-positive scenario, global nutritional lipids market has been gathering substantial proceeds from the rising demand for dietary supplements, which as per reports accounted for more than 55% of the overall industry share in 2016. The data clearly throws light on the rising nutritional importance of lipids in the form of liquids and powder supplements that include DHA, EPA, and ARA elements. Further elaborating on the current nutritional lipids industry outlook, it is imperative to state that this business sphere is strongly characterized by profound investment trends in research and development activities. This certainly underpins the robust growth prospects of the product and application spectrums of this space. Indeed, nutritional lipids market has already registered itself as a lucrative business fraternity, having garnered a valuation of more than USD 6 billion in 2016.

Omega 3 products to gather substantial momentum in nutritional lipids industry

Omega 3 fatty acids, undoubtedly, are very important for the optimum functioning of body organs and the brain – in fact, that’s the reason they are categorized under essential fatty acids. However, quite surprisingly, despite these lipid sources being crucial to health and wellbeing, it has been found that an alarming proportion of the global populace has not been consuming omega 3 as recommended. Clearly, the deficiency of this fatty acid does not get as much of attention as other traditional nutrient deficiencies. Reliable research reports, in fact, state that deaths due to omega 3 deficiency have reached a toll of over 96,000 per year in the United States and the condition is now ranked as the sixth biggest cause of mortality in Americans. Quite overtly, this is not a scenario that is uniquely confined to U.S. but would instead be apt on a global level. This has in turn, compelled several regulatory bodies to set a recommended daily intake of this fatty acid.

The U.S.-based National Institutes of Health recommends an adequate dietary intake of 650 mg EPA/DHA (notable sources of lipids) per day, while the International Society for the Study of Fatty Acids & Lipids encourages 500 mg per day of EPA/DHA for adults. Pretty evidently, Omega 3 dosage is not a one-size-fits-all formula and varies according to the background diet in different countries. However, with the growing number of initiatives to advocate proper omega 3 and omega 6 intake, nutritional lipids are likely to garner momentum in terms of expanding product sales.

Speaking along similar lines, nutritional lipids market trends are also profoundly influenced by the proven research finding and rising consumer awareness regarding the health benefits of incorporating essential fatty acids into daily diet. Consumption of these lipids have documented positive results in restoring good heart, eye, and brain health. In consequence, nutritional lipids industry has found lucrative growth avenues from medicines and products that are used to prevent heart diseases, depression, and anxiety. As per reports, omega 3 nutritional lipids market size was pegged at USD 4 billion in 2016 and further stands as a profitable ground for potential stakeholders.

In this regard, it is prudent to mention that Ocean Nutrition Canada (ONC) is allegedly touted as the world’s largest supplier of vital Omega 3 DHA and EPA ingredients from fish oil. Its MEG-3 products are popular for their pure and high-quality properties. The MEG-3 products are also available for dietary supplements and as a powder-base for functional food. For the record, ONC was acquired by nutritional lipids industry major DSM in 2012. Since then DSM has been investing proactively to upgrade and expand all its facilities, which vividly portrays the long-term growth potential of omega 3 ingredients market. With such growth strategies and a broad range of product segments, DSM undoubtedly has demonstrated strong leadership & commitment in this market. The company is further likely to bag significant nutritional lipids industry share by introducing new technological advancements in the ensuing years.

Technology interventions to sway the industry landscape

A recent scoop that has brewed fresh storm in this business space is that of the strategic partnership between the digital health company Mixfit and DSM. The collaboration reportedly aims to provide individuals with necessary nutrient data that are essential for optimal health through its comprehensive set of activity and health measurements. Elaborating further, reports reveal that the unique partnership is set to combine DSM’s expertise in essential micronutrients and Mixfit’s technological edge to deliver health data in real-time that can address nutritional gaps and promote a healthy lifestyle. If experts are to be believed, DSM’s effort in taking personalized nutrition to the next level is poised to have a substantial impact on the growth statistics of nutritional lipids industry share.

The company further revealed that its soon-to-be-launched Mixfit’s Intelligent Nutrition Assistant (MINA) will enable consumers to receive the essential nutrients they need in much more convenient manner, as MINA will provide users with proactive nutritional recommendations.

This is not the only instance that depicts how strategic alliances and product innovation techniques fare in the competitive landscape of the global nutritional lipids industry. Avanti Polar Lipids, Inc., is another major nutrition company that has entered into a distribution agreement with MilliporeSigma to supply its research lipids product range outside of the United States. Analysts further deem that Avanti will utilize MilliporeSigma’s e-commerce and marketing platform to effectively distribute its lipids portfolio among a larger consumer base.

Looking at the dynamic competitive landscape of nutritional lipids market, it is undeniable that this fraternity is poised to significantly expand its commercialization and profitability quotient. On regional terms, Asia Pacific has already made a pronounced impact on global nutritional lipids industry – the region seemingly accounted for over 30% of the market share in 2016. APAC no doubt, has now become a lucrative investment hub for industry players in the last half a decade. This can be credited to the massive growth of the regional pharmaceutical and dietary supplement sectors, particularly in emerging economies such as China, South Korea, Malaysia, and India.

Unrefutably, aided by a progressive competitive spectrum, nutritional lipids industry stands to gain heavy profits in the ensuing years. However, the market may face several challenges from the extraction of lipids, high processing & raw materials cost, and stringent norms enacted by the FDA on fish oil and Antarctic krill. Nonetheless, advancements in new harvesting technologies, the emergence of micro-encapsulation – a relatively new concept, and the extraction of EPA & DHA from algae will emerge as the next-gen trends that are likely to keep this market size afloat. Analyzing its potentially strong scenario presently, Global Market Insights, Inc., claims that nutritional lipids market is certain to accrue profitable outcomes with global valuation projected to top USD 15 billion by 2024.

Global Market Insights, Inc. has a report titled “Nutritional Lipids Market Size By Product (Omega-3, Omega-6, MCTs), By Application (Dietary Supplements, Infant formula, Pharmaceuticals, Food Fortification, Animal Nutrition), By Form (Liquid, Powder), By Source (Plant, Animal) Industry Analysis Report, Regional Outlook (U.S., Canada, Germany, UK, France, Italy, Spain, Russia, Poland, China, India, Japan, South Korea, Australia, Indonesia, Vietnam, Brazil, Mexico, Argentina, Colombia, Saudi Arabia, UAE, South Africa, Egypt), Growth Potential, Price Trend, Competitive Market Share & Forecast, 2017 – 2024” available at

https://www.gminsights.com/industry-analysis/nutritional-lipids-market