Technology is revolutionizing the retail sector. Whether that’s reimagining physical stores, changing consumer demands, rethinking brand marketing, or bolstering back-of-shop efficiency.

Retailers who want to succeed need to reevaluate their current operations and adapt if they want to thrive. We broke down the 4 most important retail trends hitting the industry this year to see how they’re going to do just that.

1. Online and offline retail are coming together.

In recent years, various media outlets have been suggesting that the humble retail store will soon fall victim to the unstoppable power of online retail commerce.

This is often coined the retail apocalypse. However, we’ve found that such claims may be exaggerated.

The high street is not the same as it once was. Businesses that are unable to adapt to the internet age are facing serious challenges.

For example, Toys ‘R’ Us and Mothercare are no longer regular shopping spots. And recently, one of the UK’s biggest property funds, M&G, suspended its £2.5bn property portfolio blaming the retail downturn for its problems.

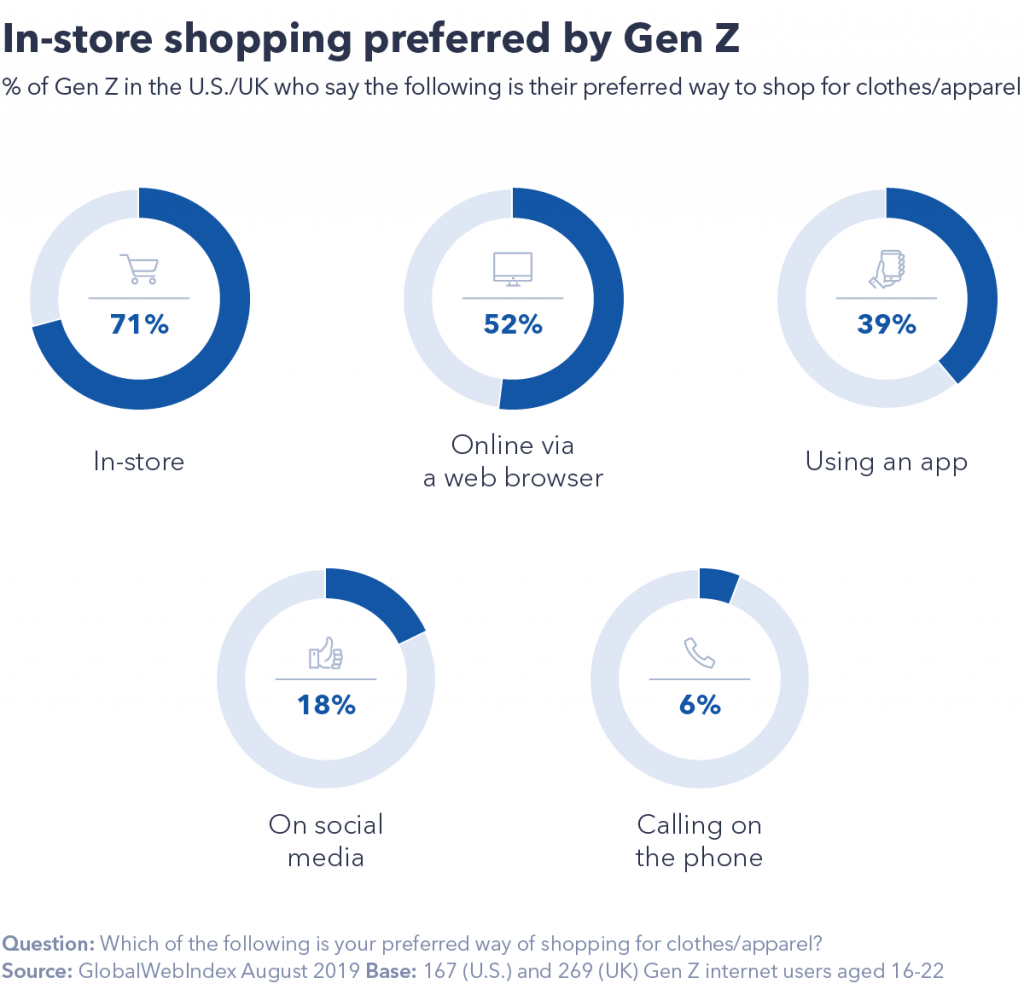

Our data found that the retail store is here to stay: 3 in 4 internet users in the U.S. and UK say shopping in-store is their preferred way of shopping for clothes. Interestingly, this figure doesn’t even fall below 70% for the digitally-native Gen Z, illustrating how offline fashion has a truly cross-demographic appeal.

Consumers value the tangible connection that physical stores give them. They want to be able to feel, smell, and try the products they buy, which is one of the primary reasons why they keep coming back to stores.

Essentially, we’re seeing a new kind of coexistence emerge, one where the offline and digital worlds work together and complement each other seamlessly. This is happening in two directions:

- Online giants are investing in the physical retail space, e.g. Amazon’s launch of Amazon Go.

- While traditional retailers are developing their online presence, such as Walmart’s acquisition of digitally-native, Eloquii.

In 2020, successful retailers will be those that focus on the customer experience rather than transactions.

Whether that’s implementing immersive technology features like smart mirrors, or more practical elements like a cafe, transforming the in-store experience based on consumers’ needs is increasingly important to not only drive traffic but to keep consumers engaged for longer.

Almost a quarter of in-store fashion buyers say they shop in-store because they enjoy the experience.

It’s also pivotal that retailers actively promote this online and offline integration. We know from our data that online shoppers would be encouraged to shop in-store for a number of reasons, such as if they were able to order out-of-stock merchandize for delivery (26%) or pay without waiting in a queue (30%).

The process of online and offline integration is not just driven by consumer demand for omni-channel capabilities – increased efficiency for the retailer is also a major contributing factor. For example, by encouraging in-store pick up, retailers can have a much better understanding of localized consumer demand.

Not only does this improve Corporate Social Responsibility (CSR) by reducing oversupply and subsequent waste; the reduction in last-mile delivery costs can be substantial.

Improvements to CSR are welcomed in any industry, but in retail, sustainability is of particular relevance.

2. Sustainability is more important than ever.

Globally, 64% of millennials and Gen Z try to buy natural or organic products.

In the past, buying sustainable products was often unaffordable for many; today, alternative eco-friendly products are much cheaper. This is especially true in consumption-based industries such as retail. They’re no longer a show of status, they’re simply just the right thing to do.

This is also a topic that touches a nerve, especially among younger generations. In fact, as much as half of Gen Zs in Europe and North America do not feel positive about the future of the environment.

And retailers are taking note.

For fashion retailer Timberland, sustainability is key to its purpose as a brand, and its overall identity.

In November last year, the company launched its first “purpose-led” flagship store in London. With real trees, a full-height living green wall, and natural elements throughout, the aim was to bring nature into the city and encourage customers to interact and explore the brand in a more physical way.

Not only is this an example of reimaging physical stores, but it shows how sustainability – as part of the experience – is key to that.

Consumers are more informed about the sustainable qualities of retail products, and they’re also cautious of quantity. Responsible consumption has already developed in the food industry but the fear of living a wasteful life is starting to take effect in other industries too.

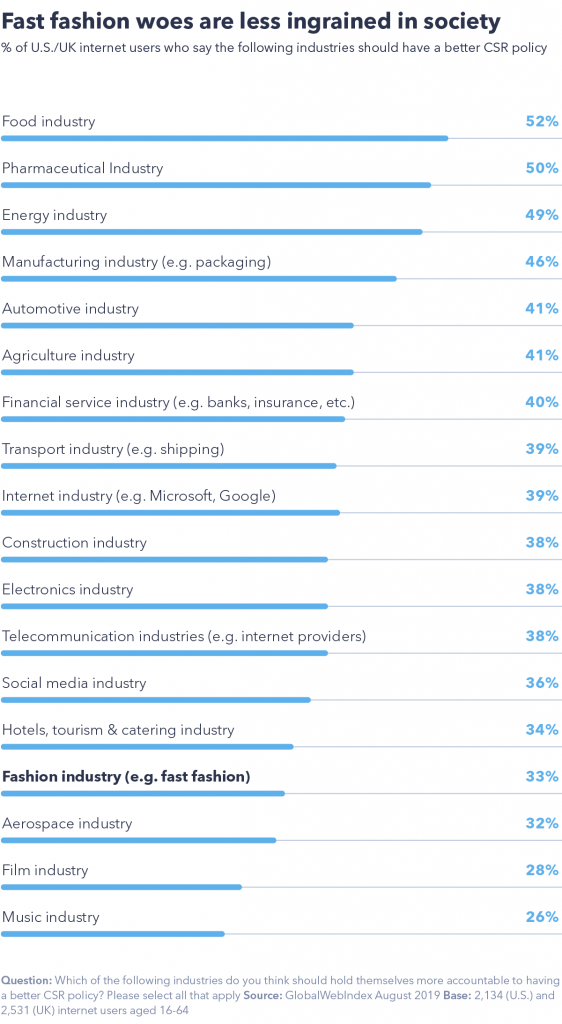

When we asked U.S. and UK consumers which industries should hold themselves most accountable to having a better CSR policy, the food and pharmaceutical industries came out on top – with over half of respondents selecting these.

In comparison, only a third of respondents thought the fashion industry needed to be more accountable to having a better CSR policy.

Despite many fashion brands driving the sustainability agenda, it’s clear the stigma surrounding policies in fast fashion is less ingrained in society than issues such as food waste. However, as movements propelled by Extinction Rebellion and Greta Thunberg build sustainability awareness, consumers will begin to demand more from retailers across the board.

We also can’t ignore the fact that if current fast fashion policies continue, the retail industry could consume a quarter of the world’s carbon budget by 2050.

Above all, consumer demands and expectations from retailers are changing. Our data shows that 48% of internet users want brands to be eco-friendly, rising to 52% for Gen Z.

Sustainability is increasingly becoming key to retail’s long-term success and it’s crucial that brands earn the loyalty of this young generation before it’s too late.

3. Social media is a key part of the purchase journey.

Efficiently optimizing social media in the online purchase journey will be key to being profitable in the retail space in 2020. The most successful retailers will be able to make use of influencers to drive purchases, rather than just brand promotion.

Influencer marketing is most relevant to Gen Z because globally they’re 34% more likely to find out about new brands and products through endorsements by celebrities or well-known individuals.

What’s more, 3 in 10 Gen Z and millennials typically discover new brands through ads seen on social media. As Gen Z grows older and their spending power increases it’s important that retailers are successful in engaging them.

A survey carried out using our custom research found that 48% of influencer followers¹ in the U.S. and UK want influencers to be trustworthy, making this the number one desirable attribute.

By partnering with trusted influencers, that trust is reflected in the brand. Using the right influencers in brand campaigns can be a powerful way to convert followers into brand customers and may be more effective than traditional advertising methods, especially for younger generations.

Over 40% of internet users in the U.S. and UK use Instagram to engage with influencers – making it the most popular platform to do this. As Instagram is currently experimenting with in-app purchases, influencer partnerships are set to earn retailers some serious rewards.

4. Efficiency is changing retail from the inside out.

A final major retail trend is how new technology is changing the way in which vendors operate their supply chain and optimize their inventory.

The technological advancements driving this trend, include, but are not limited to: artificial intelligence; the Internet of Things; motorized robotic micro fulfilment warehouses such as TakeOff; blockchain in the supply chain such as Wholechain; and autonomous vehicles in last-mile delivery such as Walmart’s partnership with Nuro.

To stay ahead of competition, retailers are looking to find the most efficient, cost-effective, and eco-friendly ways of operating their business.

This is something which chimes with consumer expectations, with around half saying they want brands to be innovative and smart.

Using our Work data set, we discovered that 40% of retail managers2 say improving efficiency and productivity is an important initiative for their company to drive growth next year.

This is their second highest priority behind cost cutting and highlights how technologies mentioned above will likely be in increased demand this year as retail managers attempt to do this.

Decathlon in Singapore is a great example of such technology adoption. The French retailer has equipped its stores with automated inventory management tools like RFID tags and a dedicated service counter to deliver efficient in-store pickup.

By optimizing back-of-shop efficiency alongside omnichannel retail, this brand is leading the way in the retail revolution.

This year will certainly prove to be an interesting one for the retail industry. As retailers learn to adopt new technology that helps them improve their store functions, CSR policies, social presence and back-of-shop efficiency; physical and online retail have every opportunity to thrive.

1Influencer followers refers to any internet user that engages with influencers on social media.

2Retail managers are defined as those who work in retail and have an executive, senior or departmental management role.