A new way of grocery shopping could be in the works.

Just last week in Seattle’s Capitol Hill neighborhood a brand new, state-of-the-art Amazon Go Grocery opened. Now, the cashierless, checkoutless store has everyone wondering: Is this the future of grocery shopping?

Amazon has already launched multiple Amazon Go c-stores to favorable reviews, which bodes well for the new Amazon Go Grocery.

But how will Amazon Go Grocery actually fare with shoppers? And, given the choice, could shoppers abandon existing grocery shopping methods (and retailers) for the convenience of “Just Walk Out”?

It’s early, but let’s get an indication. A lot’s at stake.

Special Report: Inside OGP – Insights into 7 Pressing Questions about Online Grocery Pickup. Download for free!

Mystery Shopping Amazon Go Grocery

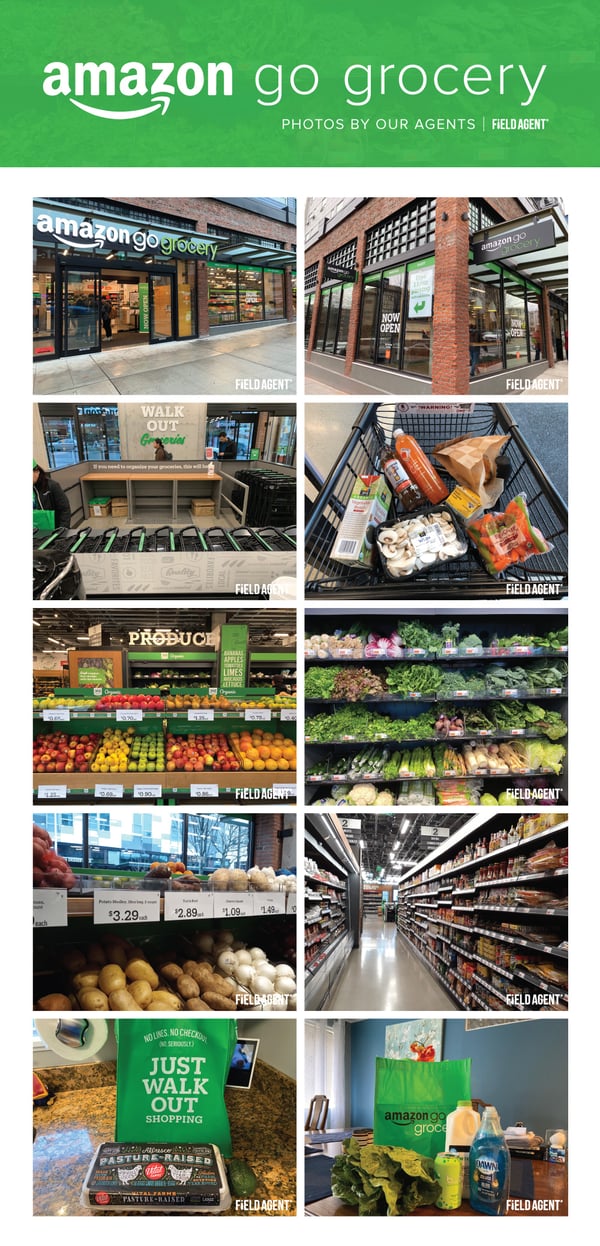

This past week, the Field Agent platform sent 10 agents to the new Amazon Go Grocery. Agents were asked to browse the store; take photos and videos; and make a purchase of at least $5, including one item of fresh produce. From there, we asked agents a series of questions about their experience inside Amazon Go Grocery.

For context: Customers must scan the Amazon Go mobile app upon entering the store. Cameras and sensors are located throughout the shopping area to track what items the customer takes. Once the customer leaves, the items are charged to his or her Amazon account.

The video below offers sights and sounds from the new Amazon Go Grocery, complete with sound bites from real shoppers about the in-store experience.

Then, scroll further down to view a photo gallery as well as how these agents rated Amazon Go Grocery on several key dimensions.

Amazon Go Grocery: What Shoppers Think

Following the shopping portion of the mystery shop, the Field Agent platform asked all 10 agents a series of questions about the Amazon Go Grocery experience. Here’s how they responded…

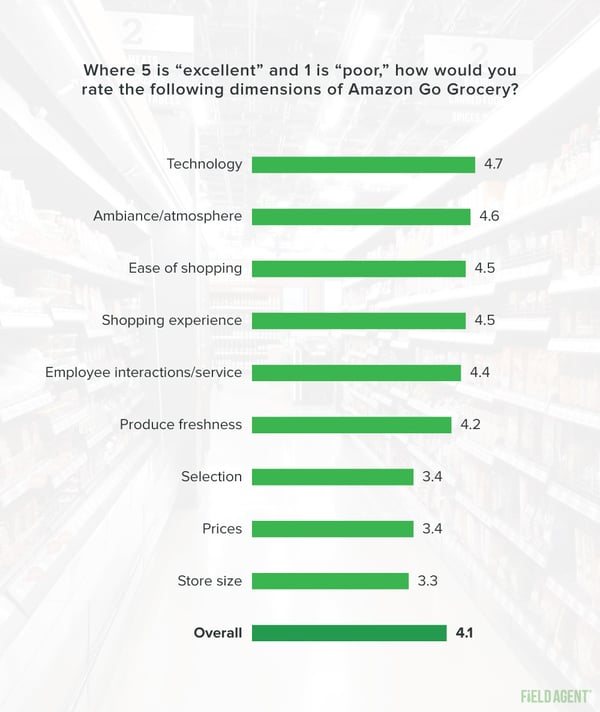

1. How would you rate Amazon Go Grocery?

Agents were asked to rate several dimensions of the Amazon Go Grocery experience on a five-point scale, with 5 “excellent” and 1 “poor.”

As you can see from the chart, Amazon Go Grocery performed very well on experiential factors like technology, ambiance, shopping ease, and shopping experience but less admirably on pillars of grocery-retail like selection, prices, and store size.

2. What words would you use to describe Amazon Go Grocery?

The Field Agent platform asked each agent to identify three words they feel accurately describe the new Amazon Go Grocery.

Words cited more than once include:

- Fast (5 mentions)

- Convenient (3)

- Clean (3)

- Futuristic (2)

- Sleek (2)

- Affordable (2)

See Also: Kroger X – Inside the Customer Experience at Kroger

3. How would you prefer to pay for the items you purchased today?

Here’s a good question: Offered the choice between cashier-operated checkout, self-checkout, or “Just Walk Out,” which would shoppers say they prefer?

No need for a graph. All 10 participants said they would choose “just walking out.”

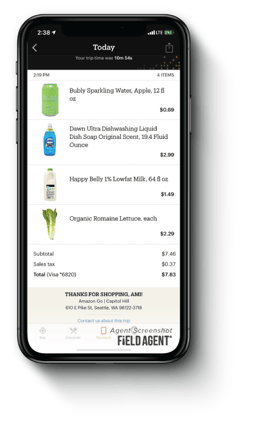

4. Were you charged the right amount?

All participants said the Amazon Go app (i.e., their digital receipt) reflected the correct prices and products, meaning they were charged the right amounts for the right items.

The sensors seem to work.

5. How many stars would you give the Amazon Go app?

The 10 shoppers in our study gave the Amazon Go app exactly 4 of 5 stars.

6. Will you ditch your primary grocer for Amazon Go Grocery?

The Field Agent platform first asked participants to identify their primary retailer for purchasing groceries. Exactly half identified Kroger/QFC/Fred Meyer as their primary retailer, while two identified Albertsons/Safeway, two Trader Joe’s, and one Whole Foods.

Agents were then asked, “Based on your experience today, would you rather shop for groceries at Amazon Go Grocery or the primary retailer you identified?”

In all, 7-of-10 said they’d stick with their primary grocers.

Why? Participants’ comments suggest Amazon Go Grocery will have to improve on the following to pry customers away from their existing grocers:

- Selection: “The selection is too limited at Amazon Go [Grocery].”

- Prices: “It comes down to price. The store is cool but it’s more expensive.”

- Geographic convenience: “QFC and Fred Meyer are each less than a five-minute drive from my house.”

7. How likely are you to shop at Amazon Go Grocery again in the future?

For this question, the platform asked participants to assume they have convenient access to Amazon Go Grocery. In other words, if the lone Amazon Go Grocery isn’t conveniently located, participants were asked to imagine one will soon open in their neighborhood.

Altogether, 4-of-10 said they’re “completely likely” to shop at Amazon Go Grocery again, 5-of-10 “very likely,” and one “moderately likely.” No shoppers said they’re “not very likely” or “not at all likely.”

Checking Out: What We Learned

Reviews of Amazon Go Grocery were overwhelmingly positive. Agents enjoyed the shopping experience; they especially liked “just walking out.”

As one said, “It’s wild! It’s all automated and easy to use…”

But participants’ comments may also suggest that, in its present state, some will see the store as a destination for fill-in rather than stock-up grocery trips. “Amazon Go Grocery is a nice urban store, great for those items you need but did not get on your normal grocery run,” said another shopper.

Although this is a very early indication provided by only a handful of shoppers, Amazon may have to scale-up on its selection and scale-down on its prices before Amazon Go Grocery rivals other retailers for stock-up grocery purchases.

Clearly, grocery retail is changing. But it was changing—and changing radically—well before Amazon Go c-stores and grocery stores opened their doors.

Online grocery pickup, or OGP, has been taking the country by storm.

Field Agent’s special report, “Inside OGP,” (see below) provides an up-close look at OGP across four major retailers: Amazon/Whole Foods, Kroger, Target, and Walmart.

Special Report: Inside OGP

Ready to go inside the shopping trend transforming how so many people shop for groceries?

Based on mystery shops of 84 pickup operations across four major retailers, Field Agent’s free report, “Inside OGP: Insights into 7 Pressing Questions about Online Grocery Pickup,” offers a data-driven, shopper-centered look at the OGP operations of Amazon/Whole Foods, Kroger, Target, and Walmart. The report deals with questions like:

- What do OGP users think about the online shopping experience?

- How fast are OGP deliveries?

- What do OGP users think about pickup sites and personnel?

- Are OGP users happy with the quality of their fresh produce?

Download this free report today, and go inside OGP today.