My wallet is full of loyalty cards, I’ve so many at the moment I’m using a spare wallet I got for Christmas just for loyalty cards. But am I the average customer? Do customers want, use and see value in loyalty schemes?

The loyalty market is in a state of flux, Sainsbury’s have recently acquired Nectar from Aimia, whilst Tesco are planning to cut back on their reward partner offers. Not so long ago, Morrisons launched their More card to give them the edge over ASDA and compete better with Sainsbury’s and Tesco. Loyalty schemes are expensive to implement, promote and very costly to manage. But are they making a difference? Do they increase sales and loyalty? I’m going to take a look at the market.

A selection of loyalty cards

The popularity of loyalty cards started a few years back, in the form of coffee shop stamps. We had endless cards for various chains. Now the stamps are in the form of an app for Starbucks and a points app for Costa. I have a lot of points on my Costa card and love the feeling of using my points when it’s the day before payday, and I can’t quite stomach the £2.20+ cost of a medium cappuccino. Despite the cost of managing loyalty programmes, it’s not a dead form of marketing. The Costa card, Morrisons More Card, Nectar card and many other large schemes are contributing to increased sales and loyalty.

As you walk along the high street and see (as you usually do) various coffee shops near each other, such as Starbucks, Costa, and Caffe Nero, I always choose Costa for two reasons: I like the value of their points on their loyalty card scheme, I know buying enough coffee there gets me free cups, compared to the Starbucks points app, which works slightly differently. I also prefer Costa coffee. This could be because my loyalty has increased due to using the points card and ultimately I’ve became used to the taste of Costa coffee. Their loyalty program has worked and I’m not usually brand loyal.

This is particularly true with supermarkets, I’m not brand loyal at all to them. For example, I go to all supermarkets, I live and work near a Morrisons, live near Aldi and prefer Morrisons because I know every now and then I will get a free £5 voucher. It’s also led me to prefer (as with Costa) some Morrisons own brand products. The loyalty programmes work, as they drive customers in repeatedly, it becomes a kind of proximity theory effect.

Though loyalty has worked and I definitely use Morrisons a lot, I also still use Tesco a lot, for different reasons, as well as ASDA (which has no loyalty card) M&S Food occasionally and the Co-Op. The Co-op also has a loyalty card and as you may have guessed I have one of their loyalty cards and actively use it. The Co-op card also donates money to local causes, as well as offering cashback on Co-op branded products. In essence, I shop in various places due to their different loyalty schemes.

The more you know about a brand and the most you use a service, the more familiar you are and the more used to something you become. Then the more likely you are to feel it’s a safe place for you to keep going. We see this with restaurant chains when people are in a different city many prefer to stick to chains as they know what they are getting and can usually be located quite easily and relied upon.

By carrying a loyalty card in your pocket, you may feel obliged to go to that brand and collect points. Customers get used to going to that brand and through proximity effect (a Psychological theory), you have a situation where people like something because they are “close” to it. It happens between people, people who spend more time together tend to like each other more. But I also believe it happens with loyalty programmes, we feel closer to brands, therefore, we naturally just start to like and prefer them more.

What’s happening in the sector?

Tesco Clubcard is one of the most successful loyalty schemes. Created by Dunnhumby, they use data from grocery purchases to provide FMCG companies with insights. No doubt the card also increases sales, loyalty, and use of other Tesco services, such as Teco card cards (Tesco bank) too. In early 2018, Tesco has cut the value of some partner rewards, assumingly to cust the costs of the loyalty scheme. There was a cut in the value of vouchers (exchanged from points to vouchers) for third parties, such as restaurant chain vouchers.

Sainsbury’s allow customers to use the third-party Nectar card to collect and spend points in Sainsbury’s stores. In 2015 they cut the number of points customers can earn. But, in a shock but frankly sensible move, they have acquired the whole Nectar scheme and company from Aimia, a Canadian company which previously owned Nectar.

This is a strong but bold move from Sainsbury’s, they now not only have their own loyalty scheme but a scheme in which other stores use (such as Argos, which Sainsbury’s now also own), BP and eBay.

This gives Sainsbury’s the same or possibly even stronger position as Tesco and Dunnhumby have. They also have the FMCG insight data, which is actively sold by Nectar and therefore will contribute to sales within the Nectar service, as well as the fees they charge partner clients and the savings from running their own loyalty scheme, instead of paying a third-party to manage everything.

Morrisons launched their “More” loyalty card in 2015, they originally launched with a complicated price matching offer (they price matched Aldi through the loyalty scheme somehow), it’s now been simplified and has been rebranded. Customers earn points on every purchase, at 5,000 points customers get a £5 voucher.

Let’s take a look at how complicated loyalty schemes are to manage

These schemes are not cheap to run, they are complicated and require capital. Schemes like Nectar are particularly complicated. They involve partners allowing their customers to collect points, some allowing customers to exchange points for a value towards a product, and some stores offer both. For example, I can collect points at Sainsbury’s and spend them on Virgin Trains after I’ve transferred the points into an evoucher for Virgin Trains. There are three businesses involved here, Nectar, Sainsbury’s and Virgin Trains. With the Costa app, it’s simpler. Customers spend at Costa and collect points and can then swap the points for a discount or value for coffee or products within Costa itself. 1 point per £1 spend is 1p value in coffee. It’s just a case of adding up and deducting points accurately.

Whether it’s an in-house managed scheme or being part of an external one, loyalty schemes require technology, resource, capital and purely people to manage everything.

Firstly, if cards are involved, there is the cost of temporary and permanent cards, as well as replacement cards too. Thousands of cards, leaflets, letters, you name it. This is not cheap.

Some companies use apps instead of cards, some use both (such as Costa), developing and managing an app is pricey but notably cheaper than printing and posting thousands of cards.

The database has to be managed and maintained. This is a big job, sometimes supported by third-party loyalty management companies or digital agencies, but this also requires in-house support.

Customer service for any loyalty scheme is also required, nectar receives loads of support queries daily on Twitter alone, customer service requires resource. As does Morrisons and Costa.

Point management is also tricky. Systems need to be in place to manage points being added to the card, deducted or used through third-parties. Systems need to talk to systems or resource needs to be in place to manually upload files containing user ID’s and points to be added or deducted.

Some use third-party rewards, for example, you can swap Tesco Clubcard points or Nectar points for a theme park voucher. This is another element which, if offered, needs to be carefully managed, with theme parks still receiving their payments where appropriate.

Marketing and promotion of loyalty schemes is something that can’t be ignored, there is no point having a loyalty scheme if not many people have joined. From TV ads, to print ads, radio ads, microsites, display ads online and ads across stores – multichannel campaigns are needed at launch and ongoing. Schemes should always aim to both retain members, reduce churn and to keep them grow in the most cost-effective way possible. The benefits of loyalty schemes shine through in the long term.

Businesses then need a joined-up approach of doing point offers (such as buy this product and get double points). Morrisons do this often, such as fairly recently I noticed it on free-from products (get 200 extra points when you purchase anything from this category). Loyalty is achieved even more when uxclusive offers are given to members of the club.

Does it pay off?

Loyalty cards and schemes do pay off, but they require investment and rewards for businesses tend to come in the long term. Tesco might reduce the number of points to save money but equally, they are still making a lot of money from the schemes in various ways. Some customers also don’t redeem points or take a while to do so, some businesses partner with others to allow customers to use the points, this in itself can promote further purchases or even be a source of revenue.

How do customers feel about loyalty schemes?

Research by Forrester found that customer engagement was higher amongst US consumers who were members of loyalty programmes. Their data suggests that the programs do influence where customers shop and those who are members of loyalty programs are more likely to rate customer experience as more positive.

Loyalty schemes work

Individual restaurants 50% off sale for loyalty card members.

Even smaller businesses are using schemes too, such as Individual Restaurants, a fairly small restaurant chain. They have a loyalty card which they use to increase visits through point offers when people join and for their birthday, January sales and so on. Quandoo, an online restaurant booking service, also offers points for every booking and they expire if customers don’t keep booking tables in restaurants. Online schemes like this are also fairly cheap to launch and manage. Dishoom, small popular Persian and Indian London restaurant chain has a stamp card and yes I really want my free bacon naan!

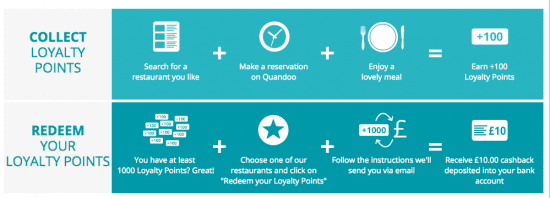

Quandoo loyalty programme

Things to consider if you’re thinking of launching a loyalty scheme

If you’re considering starting or joining a loyalty program for your business the first thing to do is a lot of research – test different promotions, loyalty program ideas with customers and be specific about how they would look. It’s best to test all of the specifics of potential programs in both a quantitative (surveys) and qualitative (focus groups and interviews) way.

The second stage would be to soft launch with some customers first by testing the new loyalty program with a pre-vetted, small group of customers who are engaged and interested in taking part. Remember, it might take them a while to see rewards as a result of their purchase so at this stage you just want to make sure everything (technologically) works.

Step three is the main launch stage and launch big, with a multichannel marketing campaign and strategy.

After this, check in and see how it’s going over time by conducting customer research with loyalty program members and check in weekly on new members and usage.

Finally, if you need help in doing customer research, our persona research guide can help.