The growth rate of cryptocurrency and the adoption of blockchain technology by businesses may be the final nail in the coffin for paper transactions. Most businesses and banks are already moving toward digital only, and as accessibility and popularity for digital currency grows, it is likely to be the future.

Here’s why cryptocurrency might be right for your business:

Cost-Effective Business Transactions

Businesses lose a lot of profit due to middleman transaction fees. The average business pays fees for credit card acceptance directly to the credit card company, on top of fees for using a third-party payment processor. This can add up fast.

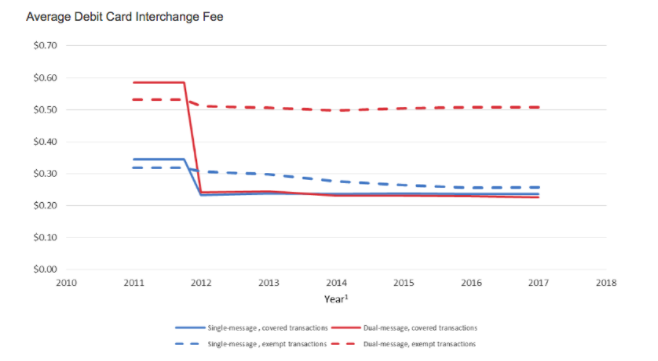

According to the Federal Reserve, PIN-authenticated transaction costs can be as high as $0.25. The “average interchange fee per exempt transaction” is between $0.26 and $0.51 per transaction.

Average Debit Card Interchange Fee:

However, the blockchain technology that supports cryptocurrency can cut out the middleman, thus increasing your profits by avoiding high transaction fees.

The decentralized nature of blockchain transactions can save you up to 5% per transaction. And with no middleman, you don’t need to wait days for transactions to process.

Real-Time Digital Currency Exchange

Waiting for your funds to process can be frustrating, especially if your operating costs are high. By accepting cryptocurrency on your website, you can avoid long transaction times. Typically, digital currency transactions occur in real time, or within minutes.

Digital currency transaction times do depend on the type of currency you choose to accept. For instance, Bitcoin Cash is slightly faster than Bitcoin transaction times. Ripple takes up to five seconds, while Litecoin processing takes two to five minutes.

Businesses that accept digital currency can get instant gratification on every customer purchase. Each transaction is also more secured due to the blockchain verification process.

More Secured Transactions with No Chargebacks

All digital currency is supported by blockchain technology that offers the most secure form of payment ever conceptualized.

For each and every transaction, a block is created, verified, secured, and enforced. This protects businesses from chargebacks, because customers need to show proof of funds before the transaction is completed. This is far superior to traditional transaction processing currently in place.

“The records on a blockchain are secured through cryptography. Network participants have their own private keys that are assigned to the transactions they make and act as a personal digital signature. If a record is altered, the signature will become invalid and the peer network will know right away that something has happened.”

~Curtis Miles of IBM

By accepting cryptocurrency, you are securing your business’ data and the data of your customers.

Enter the Global Marketplace

Cryptocurrency adoption makes international transactions easy by minimizing the cost and time involved in processing them.

You can accept payments internationally with cost-effective fees and little to no processing wait times. This makes your business a go-to for many digital currency holders abroad.

By accepting cryptocurrency, you are also able to make payments to international vendors easily. This can cut international purchase costs for your products, impacting your bottom line in a very positive way.

From gaming to medical marijuana, there are a number of industries already benefiting from digital currency adoption. It is even profitable to have a cryptocurrency portfolio to create passive income for your small business.

![]()

If your business is in any of these industries, it is essential to your future success to implement a cryptocurrency payment option on your website.

All You Need to Know About Digital Wallets

A digital wallet is a software or app that stores private and public keys, or unique identifiers that mark ownership of cryptocurrency tokens. In a way, digital wallets are analogous to decentralized, unregulated bank accounts.

About 300,000 new Bitcoin wallets are created every month, and it’s expected that this number will continue increasing as digital wallet technology continues to become more accessible and easy for the average person to use.

Many digital wallets are currency-specific, such as Bitcoin Core, which only stores and spends Bitcoin, but others are capable of holding multiple currency types for added convenience.

The digital wallet makes cryptocurrency accessible to both business owners and customers and it takes just minutes to set up.

The exact process varies depending on the wallet, but generally, the user needs to:

- Choose a wallet solution. Popular choices include Exodus and Jaxx, both of which support multiple cryptocurrency types.

- Download the software client and follow the installation instructions.

- Encrypt the wallet, usually with a one-click option on the software client.

- Install the mobile app for on-the-go access to funds and transactions.

Don’t be intimidated by the complexity of blockchain technology; the average business owner never interacts with the actual tech aside from the digital wallet and payment acceptance apps.

Chances are a few of your competitors have already implemented it.