How to start an eCommerce (business on a budget)

The eCommerce market has been growing at a tremendous rate in the last ten years. According to the data available on Statista.com, about 1.66 billion people made an online purchase in 2017.

Logically, many people are thinking about pursuing a career in that field. Launching an e-store is usually perceived as a demanding and time-consuming process. People spend day after day analyzing prominent eCommerce websites, trying to spot the products that could make them the new Jack Ma or Jeff Bezos. Also, you might think that launching and maintaining an online store costs a lot of money. While the expenses might grow in the latter stages of its existence, the initial phase doesn’t require that much money. In this guide we’re going to give you some practical tips on financing an e-store before you win over your first customer.

1. Use a free eCommerce platform

If you type “free e-commerce platform” in Google, you’ll get dozens of different free solutions. Still, it’s extremely important to choose a reliable platform, which is why you should opt only for well-known brands.

Even though some no-name e-commerce solutions could offer better conditions, it’s a double-edged razor. Their functions might work perfectly and then again, they might let you down when you’ve already started acquiring clients.

While our goal is launching a successful e-store without spending money before you get the first customer, using an untested platform is a bit risky.

Source: Quora.com

What you can do instead is choose one of the familiar eCommerce platforms, but start with their basic, free package. For instance, Magento, WooCommerce and other similar e-Commerce platforms have open source versions.

Also, Shopify offers a 14-day trial period for their services. Maybe you’ll manage to start your sales quest during that fortnight period and make enough money to pay the basic ($29/month) Shopify package.

If the products you’ve offered and your activities across social media are done effectively, you’ll soon gain your first customers. In turn, this will open room and budget for investing in additional features of your e-store.

2. Consider credit cards for financing

Credit cards are bread and butter for financing initial investments for many small eCommerce business owners. The rule of thumb when using credit cards, in general, is to separate your personal and business cards. This will ensure that you manage your business and private accounts in a more efficient way.

First and foremost, you should contact several banks to check out their credit card terms and conditions for new business owners. It’s important to find out more about their interest rates, as well as their bonuses, if any. Many credit card providers and banks offer certain bonuses, based on your overall annual expenditure, your travel expenses, or your airfare costs. Your homework is to compare their terms and choose the ones that you can follow and return the invested money through your sales.

In order to qualify for these extras, you’ll need to spend a certain amount of money in the particular period of time. This is a great deal if you’ve already planned to invest that amount of money in your e-store, but you didn’t have it in cash. Now you have a chance to use that sum wisely and kick-start that website.

However, such expenditure has to come with a clear vision and a detailed plan that will make it only an investment. Otherwise, you might end up paying interest rates and installments for the investment that won’t pay off.

3. Bank loans for eCommerce rookies

In addition to credit cards, a new eCommerce owner who needs an extra financing hand in the initial stage should take into consideration bank loans. The main difference between this way of financing and credit cards is that a loan is a set amount of money you get only once, whereas credit cards can be used in different ways over a course of time.

When you’re shopping around the banks, looking for the best loan for your needs, check out their annual percentage rate (APR). Unlike interest rates, which only refer to the sole amount of the lent money, the APR includes other bank and state fees. While it’s expressed on an annual level, you can also get the separate monthly percentage for that rate. So, when you’re comparing terms for business loans in commercial banks, pay great attention to the APR.

Apart from that, the payment period is another important condition that every small business owner needs to know. Naturally, the faster you pay back the loan, the sooner will you be able to start making profits without these additional expenses. In line with that, you can go for a shorter payback period, but higher monthly instalments.

As opposed to that, those e-store owners who don’t like to take big risks will opt for lower monthly payments over a longer period of time. In that case, negotiate the option to pay back the entire sum in advance, if your revenues and profits take off sooner than you expected.

For all these reasons, it’s crucial to ask your bank assistant for a detailed payment plan for every loan, credit card, or any other type of financing you’re about to take. You can work on several different versions before you spot the one that will meet your current financial and business demands.

4. Choose the warehouse space

Running an e-store includes some serious offline business decisions. The most important one is definitely finding the right warehouse space. Your products can’t just lie around your home, but you need to find the right space for them.

When you’re at the beginning of your eCommerce quest, the wisest thing is either to rent a warehouse on your own, or to join forces with another entrepreneur and share a warehouse. The latter option will lower your expenses, while providing you with proper space for your items.

The former deal, on the other hand, is a better solution if you already have a larger amount of products to sell. For instance, the strategy to sell goods in bulks will require a warehouse dedicated only for your storage needs.

Also, make sure that you include the warehouse expenses into your bank loan plan, as well as in your business plan. That way you’ll already prepare the assets needed for those expenses in advance.

As time goes by and your eCommerce business keeps growing, you can consider other options, like buying a warehouse.

5. Set a profitable price

Now that you have the products and the platform where you’re going to sell them, it’s crucial to set a profitable price. If set properly, your price will attract customers to buy your products, while making profits for you.

This formula could be applied when you’re thinking about the price of your eCommerce products:

Retail price = [(cost of product)/ (100 – markup percentage)] x 100

The markup percentage is the difference between the selling price and the cost of the product when you’re buying it.

In line with that, the final selling price for a product that costs $20 and a markup percentage of 50% would be as follows:

Retail price = [($20) / (100 – 50)] x 100

Retail price = [($20) / 50] x 100 = $40

It’s good to know that this price doesn’t mean that your profit margin will be 100%, since you won’t earn $20 on each product you sell. The expenses such as shipping, warehouse costs, taxes and other costs will reduce your earnings. Also, if you’re a new player on the market, your markup will have to go below 50%. All these elements will affect your profits.

6. Team up with reliable investors

Launching an e-store without money doesn’t have to mean that you can’t raise some funds for your plans. Many investors are eager to invest their money in innovative and profitable business ideas, especially in eCommerce.

What’s important to know here is that you really need to stand out from thousands of wannabe lookalikes. Your business should offer something intriguing that will attract an investor to make a deal with you. In that case, the example with mobile cases from the previous paragraph might not be the best path to the heart of an investor.

As opposed to that, coming up with an original, authentic product is a completely different story. Let’s say that you’ve realized you’re adept in woodworking. Wooden toys have been popular over the last few years, so you could use that fad and your skill to launch an e-store that would offer something original.

Such ideas are more likely to raise investors’ interest in your business.

Of course, having an idea and a skill isn’t enough. You need to learn how to present that concept to an investor. Therefore, go through some tips on writing an eCommerce business plan. Investors like when entrepreneurs know how to shape and formulate their business ideas.

Also, the share of each party in this joint eCommerce effort will depend on your negotiating skills. Here are some things you should pay attention to when you’re accepting an investment and signing an agreement.

7. Bring a customer-centered return policy

No matter if your e-store is self-grown or you’ve teamed up with investors, the return policy should be as customer-centered as it gets. The eCommerce market is huge and it’s getting even bigger, which means that you need to offer something that will make people buy on your website.

A customer-friendly return policy should be highlighted throughout your website, as well as free shipping services. It’s not recommended to hide any additional costs or show them to your customers only when they’re on the checkout page.

Also, make sure that the money is returned to unsatisfied customers as soon as possible. In case they want to replace the purchased item with a different one, this should be done fast and without complaining. If you decide to be a service provider, you need to know that the customer is always right. Otherwise, you shouldn’t pursue an entrepreneurial career in eCommerce.

8. Sell items in bulk

When you’re a rookie in the field of eCommerce, it’s clever to apply the old rule regarding mass, which says that many small items make a large pile. Translated to the world of online trade –sell as many items in bulks as possible.

First and foremost, your suppliers will give you discounts if you’re purchasing goods that way. This will open some room for a profit-gaining price difference. If you’re using dropshipping as your initial eCommerce tool, it will give you more room for maneuvering.

For instance, when you’ve sold the first 100 mobile cases, you can use the money made that way to get a bulk of cases.

As an alternative, you can buy products in bulks and sell them as individual items. Still, this strategy is better for later stages of your eCommerce business, when you’re already going to have some assets on your account.

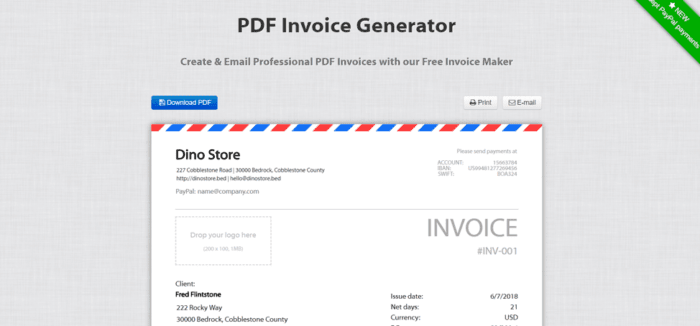

Finally, make sure that you create simple invoices online when you’re buying or selling items on bulks. This online invoicing will save some precious time and ensure timely payments.

Conclusion

Founding an online store and keeping it alive before the first purchase is made on it doesn’t have to be expensive. However, it does take some thinking and a lot of work. Doing some online research and polling will help you choose the right products. Also, you need to find the right eCommerce platform, as well as bring the right return policy for your store. If you find it better for your business intentions, try to work with an investor, to boost your business more quickly. Whenever possible, buy and sell items in bulks, but make sure to do all the payment-related paperwork immediately. All the guidelines presented in this article will help you prepare your e-store for your first customers.