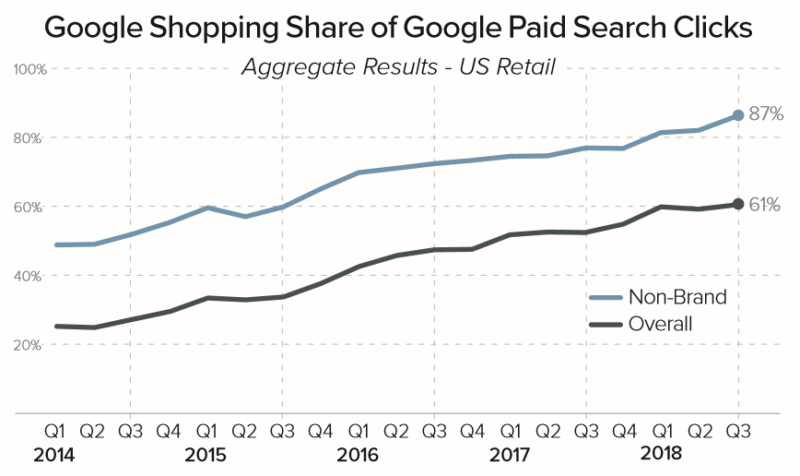

Google Shopping has long been a key driver of U.S retailer online sales, and in Q3 2018 accounted for 87 percent of all Google non-brand paid search clicks for Merkle (my employer) advertisers.

As such, the paid search results of the upcoming holiday season will be heavily dependent on Google Shopping performance for many retailers.

Part of what will determine Google Shopping success is the strategy of several massive competitors which offer products in many different categories. These brands are large enough to swing wide-ranging auction dynamics simply by way of increasing or decreasing their Shopping presence, and several updates over the last year make their likely strategies during the holiday season a bit of a mystery.

I’ve divided them into three weight-classes:

- The Big Box Titans – Target and Walmart

- The eCommerce Giant – Amazon

- The Wild Card – Google Express

Let’s explore how each of these are competing in the auction today and how that might change over the coming weeks.

The big box titans

I analyzed the Google Auction Insights reports of a set of retailers that see all four of Target, Walmart, Amazon, and Google Express as regular Shopping competitors. The large Merkle retailers studied offer a wide range of products and have collectively accounted for more than 150 million Google Shopping clicks in 2018 so far.

I found the following median impression share for our big box titans over the last year.

As you can see, Walmart generally has a significantly higher Shopping impression share than Target and is at times twice as prevalent in Shopping Auctions against the advertisers studied as Target.

Looking back at the holiday season last year, we find that Walmart’s impression share trailed off in November and December compared to Q3, while Target’s impression share throughout Q4 was stronger than in Q3. Both stores saw impression share drop in January 2018, but Walmart’s decline was much more pronounced, with all but one advertiser studied seeing Walmart’s impression share drop from December to January.

Fast forward to October 2018, we find these two behemoths are a touch lower in terms of impression share this year than last October, but roughly in the same ballpark.

However, these brands aren’t just competing in the Shopping auction by way of their own websites, as they are both also part of the group of retailers selling products through Google Express. As such, they’re eligible to show via Shopping Actions in the Shopping carousel.

According to Google, impressions for retailers that show Shopping Actions ads will be attributed to the retailer featured, not Google Express. As such, any Shopping Actions expansion should benefit the impression share of retailers selling through Google Express.

More on Google Express and Shopping Actions later. For now, it’s on to…

The eCommerce titan

Amazon declined to participate in Google Shopping for several years once it became pay-to-play but reversed its decision the last week of 2016 to begin wading into auctions for home goods products. Since that time, Amazon expanded its presence both in home goods auctions as well as entered some home goods-related product categories such as office supplies and electronics.

It briefly paused Shopping campaigns entirely beginning in late April 2018, but has since climbed back to roughly the same presence it had at the end of 2017.

Heading into last holiday season, it seemed as if we might see Amazon put its foot on the gas in Shopping, much like it does on the text ad side of things where we consistently see its impression share expand starting in late November. However, I found that its Shopping impression share actually declined, with the black and green lines in the chart below indicating Black Friday and Cyber Monday, respectively.

Given Amazon’s shiftiness in Shopping auctions over the past year, it seems like any strategy might be in play this holiday season. It could expand into essentially every product category given its expansive offering, or go the opposite direction and reduce its Shopping presence while focusing on text ads. How that turns out is anyone’s guess.

Even more of a mystery is how competitive Google Express listings will be over the next couple of months.

The Wild Card

As mentioned earlier, Shopping Actions listings are attributed to the retailers which fulfill orders for these Google Express-powered “transactional” units, as Google describes them. Separately, Google also runs “house ads” for the Google Express service itself and these are the listings that should be attributed to Google Express in Auction Insights.

These house ads have been present since at least April 2017, when Google Express began appearing in Auction Insights reports as a competitor in Shopping auctions. Their prevalence increased meaningfully in Q4 2017, and remained steady until July 2018, when we found that its impression share jumped once again.

In October its impression share returned to around what we observed earlier in 2018.

If Shopping Actions take off, we should see Auction Insights impression share for Google Express decline, since Shopping Actions impressions are assigned to the retailer selling through Google Express (again, according to Google). As such, it would be surprising to see Google Express impression share grow during the holiday season like we saw last year, though such a trend might indicate complications with the rollout of Shopping Actions.

Whether through Shopping Actions or “house ads,” any listings in which Google is advertising its marketplace over a retailer bidding to pay cold hard cash for clicks is a bet on the user converting through Google Express. This is because Google only makes money from Google Express listing clicks if they end in conversions, unlike traditional Google Shopping listings which are paid for by retailers as soon as users click them.

While the number of retailers on Google Express’s roster has grown meaningfully over the last six months, there remain obstacles to declaring it a viable competitor to Amazon as a marketplace. Notably, it lacks a Prime-style subscription program which has conditioned tens of millions of Prime users to turn to Amazon first. There are also minimum order value requirements to receive free shipping, and fulfillment times can vary in speed.

Thus, it would seem a risky proposition to replace the paid ads driving the vast majority of retailer paid search growth over the past couple of years with listings for a marketplace which hasn’t fully found its footing, and which only provides Google with a return when users convert. That seems particularly true during the busy holiday shopping season, but I suppose anything can happen.

Conclusion

Obviously, these competitors don’t account for all the moving pieces during the holidays, but their actions do provide insight into how some of the biggest online retail debates are shaking out.

Many are asking if advertiser budget is shifting away from Google to Amazon, but Amazon has long poured money into Google as one of the biggest spenders on text ads and recently expanded that investment by getting into Shopping. It will likely continue to do so for the foreseeable future.

Big box retailers like Target and Walmart have long been some of the biggest Shopping advertisers, but are further buying into Google as a place to reach consumers by participating in Google Express.

Google Express itself seems to be a big question mark for Google. Does it convert at a high enough rate to warrant stealing clicks away from traditional Google Shopping ads? When will Shopping Actions supplant Google Express “house ads” as the listing of choice for Google’s marketplace?

How these situations play out during the holidays will be fascinating to watch. In addition to impacting retailer paid search performance, it could shed light on the future of how products will be sold online in the years to come.

Opinions expressed in this article are those of the guest author and not necessarily Search Engine Land. Staff authors are listed here.