The recent commissioning of a new specialty chemicals plant in Saudi Arabia by Dow and Aramco will have a major impact on specialty chemicals industry, given that geographical expansion is one of the key growth strategies adopted by vital industry players. The chemicals giant and the Saudi petroleum behemoth have jointly established this integrated chemical production complex which is dubbed as one of the world’s largest ones, constructed in a single phase. Spanning a gargantuan expanse of the overall chemicals sector, specialty chemicals industry is on its way to become one of the fastest-growing industrial domains of recent times, given the extensive product utilization across the lubricants, food additives, agrochemicals, oil field chemicals, electronics chemicals, paper & textile chemicals, surfactants, adhesives & sealants, polymers, construction chemicals, plastic additives, and specialty coatings sectors. The year 2015 witnessed specialty chemicals market observing a revenue generation of a humongous USD 830 billion. One of the principal reasons why specialty chemicals industry has gained such an enviable popularity is that these chemicals cater to the requirement of myriad industrial sectors through their deployment in the production of innovative products.

Specialty chemicals market is essentially defined as a business arena that forges the sale of numerous, uniquely designed, extensively required products. However, when the it comes to innovation, it has been observed that a gradual shift has taken place in this business sphere, as opposed to a statistical shift as is analyzed for most markets. During the phase in the mid-90s, when specialty chemicals industry had been gaining ground, North America, being the most developed economy, was the obvious choice of geography that depicted the maximum growth and held a sizable portion of the revenue. With the changing trends across numerous industrial domains, such as those of construction and automotive, specialty chemicals market players headquartered in North America have gradually been collecting a whopping chunk of their revenues beyond the frontiers of the home ground. As reported by analysts, the construction, automotive, paints & coatings, and agrochemicals sectors have been lately experiencing an exponential growth across the APAC belt. Estimates claim APAC to contribute nearly 50% toward global construction sector revenue by 2020, estimated to cross the USD 10 trillion mark. This estimate is evidence enough to prove the robust growth of myriad end-user sectors across the Asia Pacific, which will gradually spur specialty chemicals industry, subject to the requirement for construction chemicals, agrochemicals, and the like. The escalating growth trends of the agrochemicals market and the construction chemicals industry will substantially lead Asia Pacific to emerge as the fastest-growing region in specialty chemicals market, galloping ahead of North America.

North America specialty chemicals industry

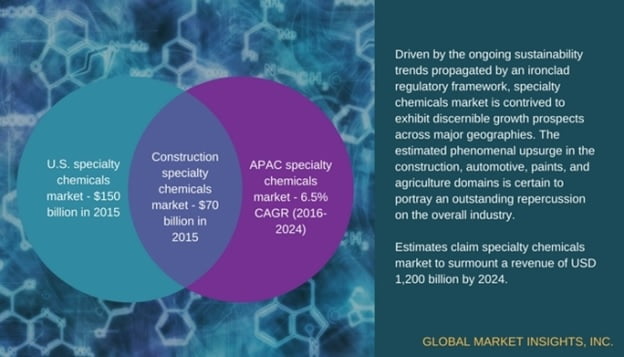

North America has always been at the pinnacle of excellence as regards to the growth spectrum of specialty chemicals market. Since the last few decades, the region has been experiencing a rapid momentum in the development of the construction sector, thereby augmenting the demand for construction chemicals. The U.S. especially, being one of foremost developed economies across the globe, has always exhibited excellent growth prospects for specialty chemicals industry – in 2015 alone, the United States specialty chemicals market generated a valuation of more than USD 150 billion through product sales, out of the regional revenue generation of around USD 200 billion. If analyst predictions are fathomed to be authentic, the region has been forecast to witness a lucrative growth path in the years ahead, pertaining to the expanding oil & gas, lubricants, and constructions sectors.

North America, in the year 2017, has witnessed a plethora of M&As that will undoubtedly leave a pronounced aftermath on the regional specialty chemicals industry. A couple of them have been outlined below:

- DuBois Chemicals, owned by The Jordan Company LP, has recently acquired BHS Specialty Chemicals, one of smaller but crucial players of specialty chemicals market, as a part of its growth strategy. DuBois Chemicals aims to make use of BHS Specialty Chemicals’ diversified product range for food safety and water treatment, to strengthen its position and emerge as one of the global leaders in specialty chemicals industry.

- Novacap, a renowned player in specialty chemicals industry, recently announced its acquisition of Chemoxy International Ltd., to augment its product offering of resilient and high-grade chemicals and consolidate its position in specialty chemicals market.

Asia Pacific specialty chemicals industry

Asia Pacific is touted to be one of the largest markets for specialty chemicals, given the extensive demand for paints, coatings, adhesives, sealants, agrochemicals, and lubricants in the region. As per an industry forecast, APAC dominated the overall specialty chemicals market in 2015. As rightly analyzed by industry experts, the credits for this appreciable revenue generation should be given to the rising automotive and constructions sectors in the region.

Without an iota of doubt, the specialty chemicals industry stands to gain immeasurable monetary benefits from the automotive sector. These chemicals are utilized for polymers, paints, adhesives, sealants, and additives that are pervasively utilized in the automotive domain. As per statistics, India, U.S., China, South Korea, and Japan collectively accounted for more than 55% of the global commercial vehicle production in 2015 – a fact which has majorly contributed toward shaping the growth trends of APAC specialty chemicals market from the automotive sector.

Currently, owing to the robust economic growth in the region, the population has been experiencing a noticeable change in the per capita income, which has consequently led to an upsurge in consumer purchasing power. Undeniably, this trend is forecast to cast an impact on the automobile sales in the continent, not to mention, the housings sector, thereby unplugging lucrative opportunities for specialty chemicals market players to cast their nets. Pertaining to a slew of factors including the high disposable incomes, changing consumer lifestyles, and the expansion of prominent end-use domains, APAC specialty chemicals industry is predicted to grow at a rate of more than 6.5% over 2016-2024.

Asia Pacific, analogous to its western counterpart, has also witnessed numerous M&As that leave a profound influence on the regional specialty chemicals market. A couple of such instances have been documented below:

- UPL Ltd., the Indian agrochemicals manufacturer, had recently made it to the front page for exploring bid worth USD 4 billion for the agrochemicals sector of the Platform Specialty Products Corporation. Given the extensive propagation of agriculture in the country, coupled with the government encouragement to utilize agrochemicals, UPL seems to be teetering on hedge of a rather profitable acquisition, which will undeniably help to expand its footprints in the overall specialty chemicals industry.

- The Japanese textile manufacturer, Toyobo Co, Ltd., has recently established a new group firm in Germany, in a bid to enlarge its product sales across EMEA specialty chemicals market.

The emergence of two major trends that may influence specialty chemicals industry:

Sustainable chemical production

Driven by a stringent regulatory landscape, specialty chemicals market players have recently been focusing on manufacturing bio-based alternatives, having committed to the ‘green energy’ trends. As per statistics, nearly 67% of manufacturers claim that they have a green chemicals production strategy in the offing. In addition, many specially chemicals industry participants have been investing rigorously in R&D activities to develop bio-based counterparts of regular chemicals. This trend will particularly mark the continuation of the green chemicals era in specialty chemicals market, given that the depleting fossil fuel sources have led to their increased costs and subsequently rising demand for bio-based specialty chemicals.

Chemical digitization

Digitization has left its imprint on every industrial domain, specialty chemicals industry being no exception. Data organization, logistics, manufacturing equipment dispensing and storage, production, costs, and regulatory paperwork – every one of these tasks is being undertaken in companies by means of deploying advanced technology. Numerous specialty chemicals market giants have been adopting digital processes to terminate the occurrence of human errors in chemical manufacturing. In addition, the deployment of IoT is projected to streamline the logistics operations, providing more leeway for companies to focus on their core competencies and research programs, providing a lucrative boost to specialty chemicals industry.

Investors betting big on specialty chemicals market may very well witness a positive growth curve for their investments ahead, as it has been observed, that the average ROI for companies partaking in specialty chemicals industry share is nearly double than that of the ROI obtained by companies dealing in commodity chemicals. This may possibly be attributed to the growth strategies adopted by the players of both these business fraternities. Furthermore, a major factor that may impact the business position of market players is that of distribution channels. With the trends of IoT and digitization, online retail and digital sales have emerged as the latest distribution channels for specialty chemicals industry giants, given that they encompass an extremely broad consumer base. In addition, the traditional distribution channels including independent dealerships, company retail stores, hardware stores, home centers, and big box retailers will also have a crucial role to play in the development of specialty chemicals market, given the diversified product offering.

It is noteworthy to mention that mergers and acquisitions hold unprecedented importance in the growth estimation curve of specialty chemicals market. Numerous business divestures, large-scale investments, and launching product manufacturing facilities in collaboration with other companies, have become the norm in the competitive landscape of specialty chemicals industry. Over the forthcoming seven years, say analysts, specialty chemicals industry, augmented by a plethora of transformative trends and the development of myriad end-uses sectors across principal topographies, is anticipated to grow at an estimated CAGR of 4%, generating a mammoth valuation of USD 1,273 billion by 2024.

Global Market Insights, Inc. has a report titled “Specialty Chemicals Market Size By Product (Agrochemicals, Polymers & Plastic Additives, Construction Chemicals, Electronic Chemicals, Cleaning Chemicals, Surfactants, Lubricants & Oilfield Chemicals, Specialty Coatings, Paper & Textile Chemicals, Adhesives & Sealants, Food Additives), Industry Analysis Report, Regional Outlook (U.S., Canada, Germany, UK, France, Russia, Poland, China, India, Japan, Australia, Indonesia, Malaysia, Brazil, Mexico, South Africa, GCC), Application Potential, Price Trends, Competitive Market Share & Forecast, 2016 – 2024” available at https://www.gminsights.com/industry-analysis/specialty-chemicals-market