Africa has been a laggard in ecommerce for many reasons, including lack of internet access, poverty, a high rate of illiteracy, and logistical inefficiencies. Most of these problems persist but technology advances — notably smartphones — have given millions more Africans access to the internet and mobile payment systems.

Consequently, the continent may be the next emerging market to make significant strides in online shopping. Research firm Statista estimates that the ecommerce sector in Africa generated $16.5 billion in revenue in 2017 and forecasts revenue of $29 billion by 2022.

Africa is home to 54 countries and 1.25 billion people. Internet penetration is only 35 percent according to Emergent Payments, a payment platform provider. Few consumers own desktop or laptop computers.

Thus Africa is primarily a mobile ecommerce market. Mobile devices, in combination with mobile-friendly payment systems, have opened up new shopping opportunities in places where physical stores often don’t exist, and infrastructure is lacking.

Impediments to Ecommerce

- Africans are apprehensive to purchase online due to fraud and delivery difficulties.

- The lack of a national street address system in most African countries is a major obstacle. The delivery person and the customer often have to stay in constant touch by mobile phone on the day of delivery. This, in combination with the lack of paved roads, keeps global logistics companies out of most countries. Last mile delivery is extraordinarily expensive, and transportation costs are at least three times higher than they are in developed countries. Couriers riding bicycles or motorbikes make most deliveries in Africa.

- A large segment of the African population is unbanked. However, almost 280 million Africans have mobile wallets, which is three times more than the number of Africans with bank accounts. The typical African digital consumer is young — the average age is 19. Older consumers prefer cash on delivery, which is still the dominant method of payment in Africa.

- Ecommerce merchants have to set up country-specific sites because of payment issues (most payment solutions operate in only one country), logistics problems, cultural differences, and taxes.

Countries

Three countries — Nigeria, Kenya, and South Africa — dominate ecommerce sales.

Nigeria, with a population of 195 million people, is the most populous country in Africa and is the largest economy in terms of gross domestic product. It also has the most ecommerce sites — 40 percent of Africa’s ecommerce ventures have headquarters in Nigeria. However, it has an internet penetration of only 48 percent.

South Africa with a population of 55.5 million has a 54 percent internet penetration. It has a substantial middle class and is perhaps the country with the best cross-border potential.

Kenya has a population of 48.5 million and an impressive 79 percent internet penetration. This is because Kenya is home to M-Pesa, the mobile wallet provider started by mobile telecom provider Safaricom. The availability of a secure payment system encourages internet access and online buying.

More than 45 percent of Kenyan adults use M-Pesa according to Emergent Payments. Safaricom also recently established a partnership with PayPal to enable Kenyan customers to easily transfer money between PayPal and M-Pesa mobile wallets. This collaboration will open global marketplaces to Kenyan entrepreneurs and businesses that wish to sell abroad.

Local Ecommerce Platforms

Selling online in Africa is not easy. Even Amazon has shown no interest in the African market. Seventy percent of ecommerce startups are unprofitable according to publisher Disrupt Africa’s report “Afri-Shopping: Exploring the African E-commerce Start-up Ecosystem Report 2017.”

Disrupt Africa counts 264 ecommerce start-ups across the continent. The largest websites are in English. The report also states that 90 percent of investment is going to startups in five African countries.

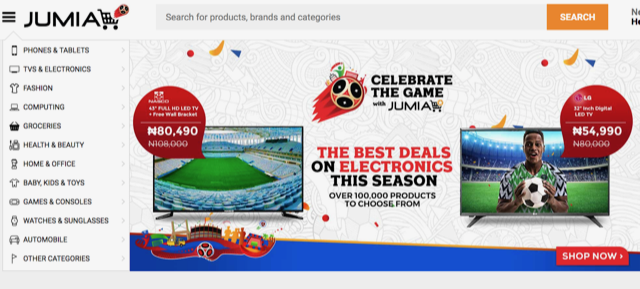

Nigeria-based Jumia Group, which was founded in 2012 by the Berlin-based Rocket Internet, has more than 3,000 employees and is Africa’s best-funded ecommerce startup. It operates in 14 countries in Africa and the Middle East, with each country having its own site.

Nigeria-based Jumia is Africa’s best-funded ecommerce startup.

In Nigeria, Jumia has created a logistics infrastructure with more than 500 motorbikes and trucks that deliver to customers in the country’s eight largest cities. Jumia accepts COD, which, again, is the preferred payment method for most Africans. Jumia is also among Africa’s best-funded ecommerce sites, having raised $150 million in 2014 alone.

Konga.com was founded in 2012 in Nigeria and initially sold only baby and beauty products. It does not operate outside of Nigeria. In 2014, Konga opened Seller HQ, a third-party marketplace. The site has about 1 million customers and receives over 300,000 unique visits daily.

Konga has its own logistics network — KOS Deliveries — with a fleet of over 200 vehicles (vans, trucks, and motorbikes). Also available are pick-up points and distribution centers in every part of Nigeria. Konga.com has about 1 million customers.

Konga also offers its own payment system — KongaPay — that works with all banks in Nigeria. The app ensures that the customer’s money is held in escrow until a sales transaction is completed successfully.

In March 2018 Konga was acquired by a local hardware and information-technology services company, Zinox. Financial losses and inability to fund growth contributed to the sale.

Kilimall, with headquarters in Kenya, also sells in Nigeria and Uganda. It offers affiliate programs for small African businesses as well as seller programs. It also sells goods from China.

Launched in 2017, Kenyan ecommerce startup Sky.Garden is a SaaS mobile commerce platform that has raised $1.2 million from Scandinavian companies. More than 3,000 sellers have Sky.Garden web shops and offer 23,000 unique products in 30 different categories. It only accepts M-Pesa payments from customers and pays all merchants using M-Pesa.

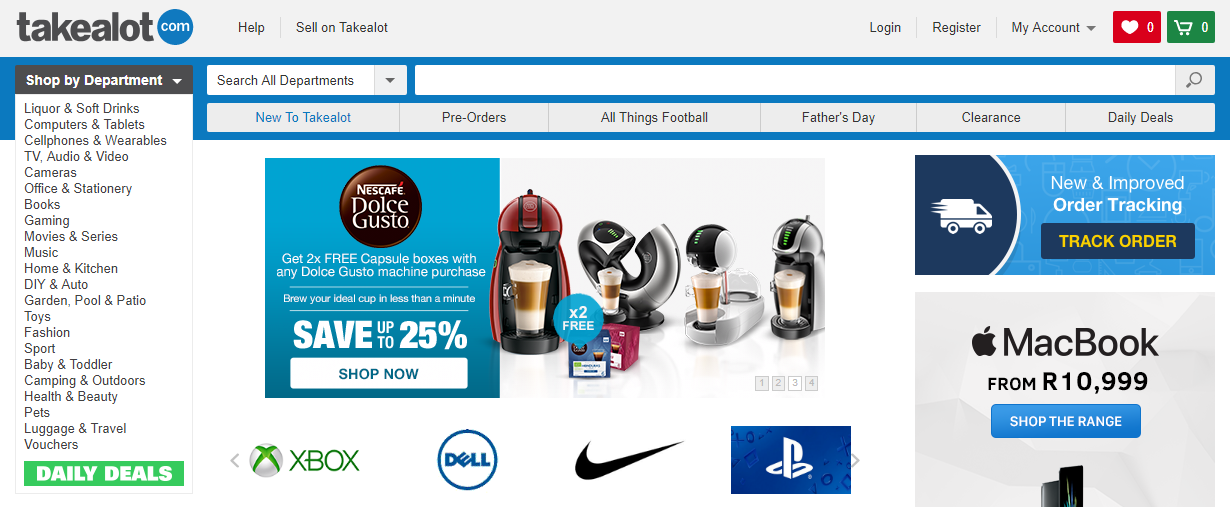

Tiger Global Management formed South Africa’s Takealot in 2011 as a result of an acquisition of an existing ecommerce firm. In 2014 Tiger Global invested $100 million in Takealot. Following that investment, Takealot purchased an existing logistics company, Mr. D Delivery, giving it its own delivery network with more than 900 drivers.

Besides delivery, Takealot offers pick-ups from its Cape Town warehouse seven days a week. For its marketplace merchants, Takealot offers storage, fulfillment and delivery, and customer service.

South Africa’s Takealot was formed in 2011 as a result of an acquisition. It now owns a delivery company.

Cross-border Opportunities

The lack of physical retail infrastructure in most of Africa has created a favorable environment for cross-border ecommerce, especially among millennials who want Western goods, but they want to purchase them from local online businesses that offer mobile payment systems in the local currency. However, online selling in Africa is so daunting that it is advisable for cross-border merchants to sell via an existing local platform.

Currently, China dominates cross-border sales as Africans value inexpensive items, which Chinese merchants can supply in abundance. In countries that were once part of the British Empire, U.K. goods are also highly valued.

Cross-border sellers should expect most sales to come from Kenya, Nigeria, and South Africa. South Africans are already shopping online on U.S., U.K., and Chinese websites. It is important that cross-border sellers in these countries form partnerships with local payment and delivery providers.

While most of the Africa-based ecommerce sites are marketplaces that welcome third-party sellers, they focus on small local businesses. The one site that focuses on U.K. and U.S. sellers is Nigeria-based Mall for Africa, which affords Africans the opportunity to buy from about 250 U.S. and U.K. websites — including Amazon, Amazon U.K., and eBay. Over 60 of those sites offer DHL Express shipping.

Available in 15 countries including Nigeria, Kenya, Ghana, Rwanda, and Uganda, Mall for Africa has pick-up locations in many of the countries it serves so that people without physical addresses can get their goods. Mall for Africa offers its own debit card called Webcard, which can be used to shop on over 180 U.S. and U.K. websites. Users can reload it with funds via an online transfer, wire, or through a local credit card. There is no transaction fee.