In 2017, Google rolled out 43 separate updates and changes to its AdWords platform.

From showing local information to display ads to the launch of Smart Display campaigns to visibility over landing page performance, each update from Google – whether big or small – has an impact on the way that PPC practitioners and search marketers go about their craft.

Going by the major announcements we’ve already seen from Google in January, with the roll-out of an Actions directory for the Google Assistant, home hubs with smart screens, and a significant update to its mobile algorithm to take page speed into account, 2018 is going to be an even bigger year for Google all round. AdWords is likely to be no exception to that.

Meanwhile, there’s another key player on the horizon: Amazon. With the saturation of the Google Shopping landscape, Amazon Shopping is opening up as a potentially lucrative new avenue for retail search marketers.

I caught up with Ashley Fletcher, VP of Marketing at Adthena and former Product Manager at Google, to talk about what we’re likely to see from AdWords and paid search in 2018. Ashley Fletcher has been in the industry for 12 years, with five of those spent at Google working on a range of products including Google’s Compare products, Google Express, and Google Shopping in its infancy.

Fletcher shared his thoughts with me on the overarching trends in paid search, why PPC still needs a human touch, and why search marketers should be getting in early with Amazon Shopping.

Keeping up with the pace of change

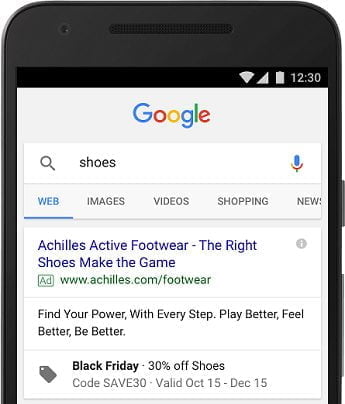

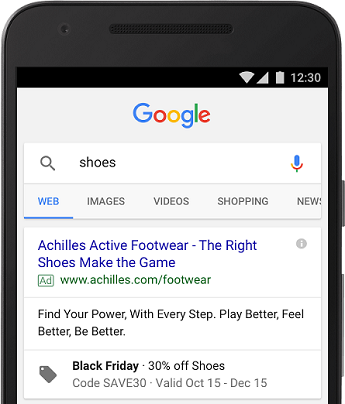

Last November, Google unveiled a revamped version of its AdWords product just in time for the holidays. The new AdWords platform was redesigned in Material Design, Google’s design language, and built on top of a new infrastructure, meaning faster-loading pages and a cleaner look.

The redesigned AdWords also brought with it custom intent audiences to help marketers reach people as they’re making a purchase decision, and promotion extensions that serve up special offers for products and services.

Image: Google Inside AdWords

I asked Fletcher how advertisers can get the most out of AdWords in light of the November redesign, and other recent updates.

“My overarching feeling is that it’s highly customizable,” says Fletcher. “That plays into the advertiser’s hands, because you can shape the metrics and views to your needs.”

This is important as advertisers now are working with increasing amounts of data from different sources, making it crucial to have that level of customizability and flexibility in visualizing it all.

“Advertisers are accessing increasing amounts of data via APIs,” Fletcher explains. “More and more advertisers are getting comfortable using something like Data Studio to ingest all of the AdWords metrics, plus all of the metrics from an independent source like ours, and overlay them onto their day-to-day KPIs.”

Not all advertisers are comfortable with using APIs, however, and for AdWords – as well as for external tools like Adthena – there is a need to strike the balance between making great data insights available via an API, versus adding more bells and whistles to the interface.

The metrics that advertisers are working with can often shift partway through the year as Google rolls out an update. For example, in October 2017 Google uncapped the daily budget in AdWords, making it possible for advertisers to spend up to twice the daily budget that they had allotted. This type of change directly affects the metrics that go into an advertiser’s dashboard.

But rolling with the changes has become par for the course in paid search. “There’s a huge dependency on the part of AdWords advertisers to keep up with the pace of change,” says Fletcher. “There’s always something else to learn and adapt to.”

On the topic of change, what does Fletcher believe is on the horizon for AdWords in 2018?

AdWords and automation

“The first thing I would say is that we can expect more automation,” says Fletcher. “Google has been focusing a lot on developing its AI and machine learning capabilities, and we’re likely to see that continue.”

He pointed to the example of Dynamic Search Ads, which is heavily reliant on automation to help users scale their campaigns. DSA have seen widespread adoption amongst advertisers, and Fletcher predicts that this particular feature is likely to evolve over the coming year.

Display is another area in which Google has ventured into automation, launching smart display campaigns in April 2017. These seem to have been positively received, although Fletcher observes that automation can be a contentious topic among advertisers.

“How comfortable advertisers feel about [automation] is really 50/50 – some people like to go hands-on, others like to go hands-off. Working with advertisers over the Black Friday period, a lot of them opted to go with manual bidding because they felt they needed that control.”

Marketers may need to become comfortable with increasing automation in PPC – but there will still be room in the industry for the human touch

Given that the trend in the industry seems to be veering towards increased automation, does Fletcher believe that advertisers will need to become more comfortable with it in future?

“Yes. But any kind of automated feature also needs to be clearly measurable, and give advertisers the transparency they need. If you’re going to opt in to these features, you need to know what they’re triggering on, and what the content is.”

However, this is not to say that search marketers are going to be losing their jobs to the machines any time soon, as Fletcher believes firmly in the value of the human element in PPC, as does Adthena.

“We need to utilize machine learning to do the legwork and work out the smarts for those insights,” says Fletcher. “But the human piece will always be to action and verify those – and to pivot to bespoke business needs. One may be around cost-saving, one may be around entering new markets, one may be around customer acquisition.

“You need the human element to pivot to those goals – but I would certainly leverage the machines to give me the insights to go and action. It’s a fine balance you need to achieve between being hands-on with search and search advertising, and using machine learning where it’s suitable.”

The rise of Amazon Shopping in retail search marketing

Meanwhile, in retail search marketing, a different kind of shift is taking place – between two industry titans.

Since Fletcher started working at Google, he has observed the Google Shopping landscape becoming increasingly saturated and competitive, to the point where an additional half a percent of performance can be key.

“When I started at Google, Google Shopping was really taking off – the ad unit was getting bigger, and exposing on new queries. Now, Product Listing Ads trigger on 58% of all retail queries – which is huge. It’s a very big shift there.

“Meanwhile, Amazon Shopping has become a destination site, and that’s changing behavior.”

Amazon Shopping has become a destination site, which is changing both shopping and advertising behavior

We’ve covered this trend previously on Search Engine Watch, with studies showing that more than half of consumers begin their online product searches on Amazon instead of on Google.

“Amazon’s Shopping product is currently on the rise – CPCs are low, advertisers are enjoying really good ROI; but it’s only a matter of time before that landscape becomes saturated, too.”

Fletcher believes that the low CPC and high ROI currently available through Amazon Shopping makes now a perfect time for retailers to get in on the platform.

And Amazon is still expanding into new marketplaces across the world – Fletcher points to Australia, where Amazon launched for the first time in December 2017. Because we’ve seen Amazon launch and expand in more than a dozen countries over the years, it’s possible to predict with relative certainty how events will unfold, and so search marketers in those new markets need to be aware of the trends.

“We have the data points to say, ‘This is what will happen to your market’ – we’ve seen the market share that Amazon takes from search in the UK and the US, and we can forecast what’s likely to happen to Australia, in turn.”

Does a competitor intelligence platform like Adthena have the same level of insight on Amazon as it does on Google’s platforms? “We actually have more,” says Fletcher. “We can do a huge amount with Amazon, in terms of mapping out the market.”

Google Home: Coming soon to an AdWords set near you?

Overall, Fletcher believes that we’ll be seeing growth in automation products in AdWords over the next year, with Google continuing to develop what’s working well. He is confident that AdWords will continue to set the bar for campaign reporting, encouraging best practice in attribution across the paid search industry.

Following the announcement of smart screens for the Google Home at CES 2018, Fletcher also predicts that this year will be the year that Google offers campaign targeting for smart home hubs in AdWords.

“To me, screens seem like the first step towards monetizing smart home hubs. I think Google needs the screen in order to execute that, because it’s hard to see how else you would advertise on a voice device without completely messing up the user flow.”

Smart screens on the Google Home could be the first step towards making campaign targeting available for smart home hubs

Certainly, the closest thing we’ve seen to advertising on Google Home thus far – a possible plug for the Beauty and the Beast live-action film which Google denies was intended as an ad – was very jarring, and received a great deal of backlash from Home users, suggesting that Google needs to tread carefully if it wants to make monetization on the Google Home work.

“It’s still very early days – maybe Google was testing something with that, and maybe they weren’t. But if I were an AdWords advertiser, I wouldn’t expect it to be long before these devices feature in your set. By the end of 2018, I expect AdWords to have campaign targeting, or something like it, for Home devices.”