US, Europe and Worldwide display ad clickthrough rates statistics summary

I’ve put this compilation together to help marketers and students studying interactive marketing create direct response conversion models for digital marketing campaigns.

When I originally compiled these stats from different sources, social media ads were only in their infancy, but they are now established as a mainstay of online advertising. More recently I have added a comparison of CTRs for Facebook and Twitter and paid search rates (AdWords or SEM) at the end of post.

If you’re looking to get more from your display advertising we have a premium members’ paid media playbook.

Display Ad CTR benchmarks – January 2018 update

Through 2018 we update our statistics summaries with the latest research as it becomes available.

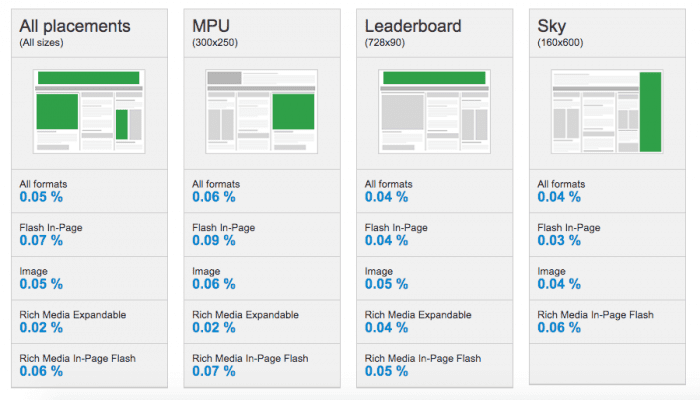

The best source for current benchmarks is Doubleclick (the display advertising part of Google) who have this regularly updated interactive Display Benchmarking tool as part of Think Insights. You can select by country, sector and ad format to create your own benchmarks. Google no longer update this monthly. At the time of our last update the latest figures were for last April. Here’s our summary of current global Ad CTRs:

1. Overall Display Ad CTRs

Across all ad formats and placements Ad CTR is just 0.05%

So, this is just than 5 clicks per 10000 impressions showing the difficulty of driving direct response from online display or banner ads.

While this is a really low CTR, however you look at it, cross media optimisation research we have seen show that online ads do help increase brand awareness and purchase intent, particularly when combined with offline media. It’s not the case that the majority of ad viewers have ‘banner blindness’ and are not aware of ads which are viewable placements. If this were the case, businesses wouldn’t invest in the level of display and programmatic ads that they do.

Tests from the likes of Dynamic Logic and Millward Brown conclusively show that display ads also encourage site visits (viewthroughs) and searches even where people don’t click on ads.

We also see much higher CTRs online for other online ad formats like Google AdWords and Facebook – these can exceed 1%, so are more effective in driving volume and also typically have higher intent, so conversion rates are higher.

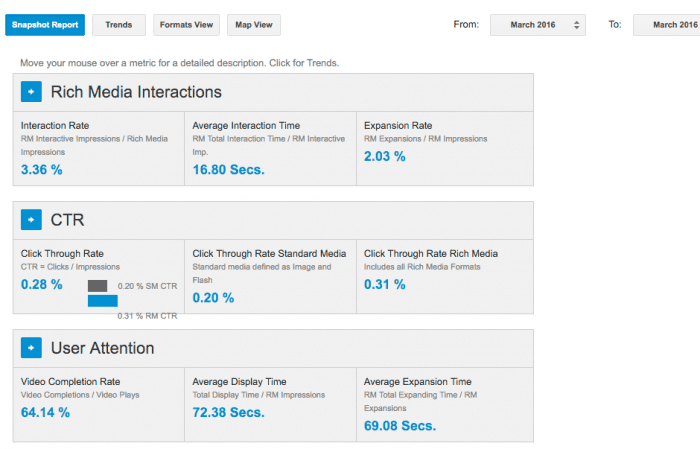

2. Rich media CTRs

Rich media Ad CTR is 0.1%

Across standard and rich media, this shows an ad clickthrough rate of 0.14% which is more realistic estimate if ads will be placed on the fold. For Smart Insights advertisers we offer an MPU in the right sidebar above-the-fold and this has a typical CTR of 0.15 to 0.22% depending on the creative and content asset on offer.

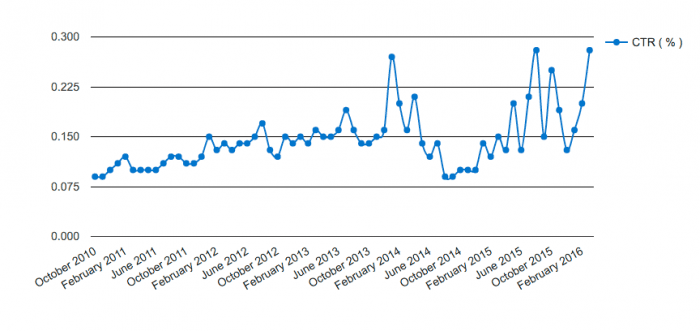

3. Ad CTR trends

This chart, also from Google-Doubleclick shows that the 0.1% CTR has been an average for some time although the recent fluctuations cast doubt on the data accuracy.

For anyone researching trends in display advertising in different countries or sectors you could try the Doubleclick Ad Research page – these reports don’t tend to be updated so frequently though.

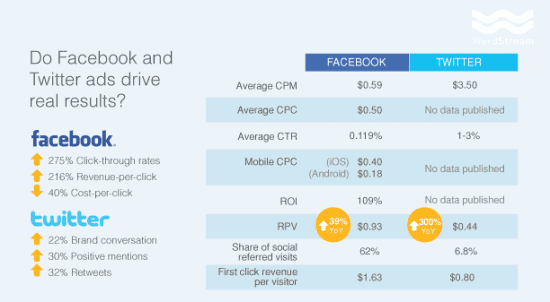

Social media ad clickthrough rates – a comparison of Facebook and Twitter CTRs

Wordstream have posted an interesting analysis comparing Facebook and Twitter. It’s generally known that Facebook has low CTRs because ad units are not that prominent – it’s similar with LinkedIn. Although this is changing as more prominent ad units are created, particularly on mobile.

You can read the full analysis from Larry Kim on Facebook vs Twitter CTRs on Wordstream which includes a wider analysis of the importance of their advertising including mobile.

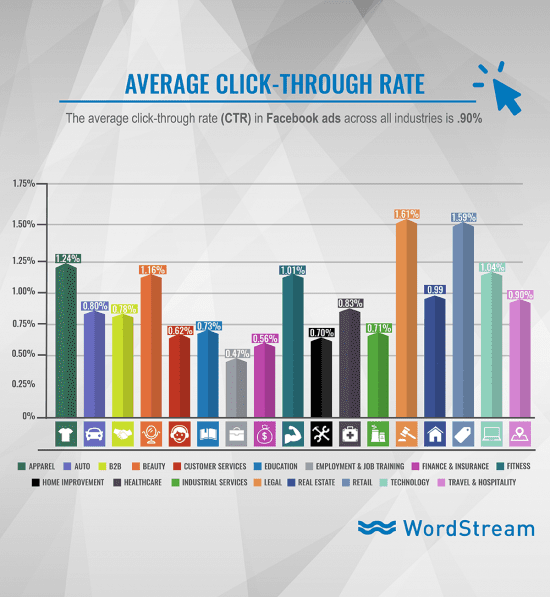

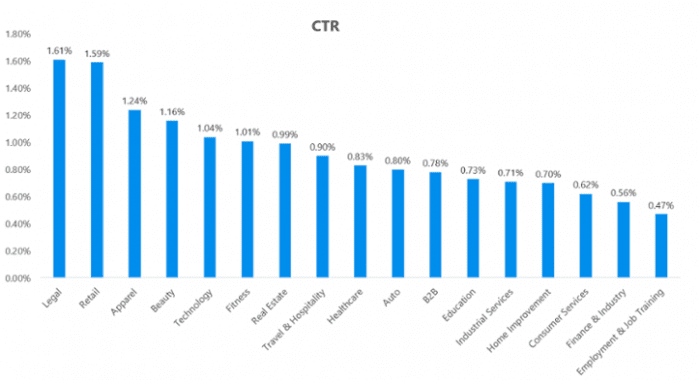

There is also newer 2017 research Facebook Ad CTR from WordStream’s Facebook advertising customers showing that across sectors clickthrough rates (CTRs) vary from around 0.5% through to 1.6%.

Pay-per-click or SEM clickthrough rates (e.g. AdWords and Bing)

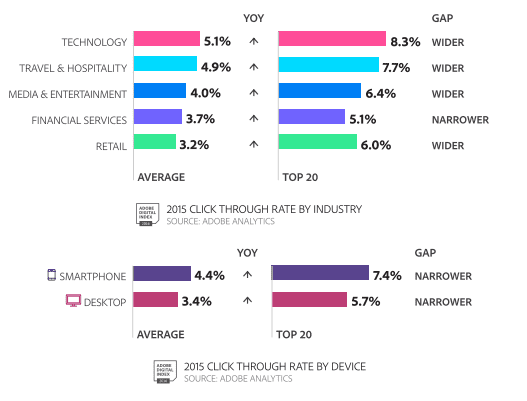

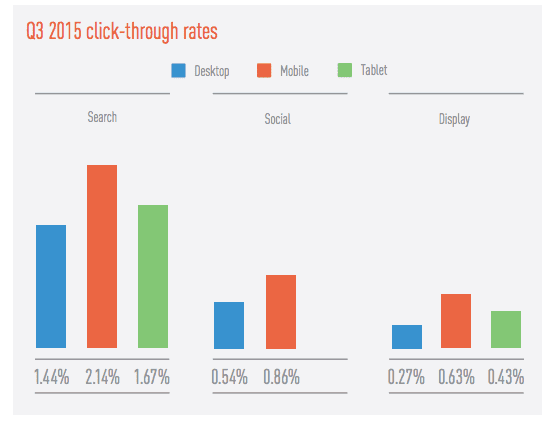

These statistics are courtesy of the Adobe Digital Index reports, published annually for their customers across 200 billion site visits.

Of course, these figures are averages and in reality, CTRs tend to be higher for brand searches.

We also have a comparison of Google Clickthrough rates by position.

4. Comparison of display, search (AdWords) and social ads CTRs

This comparison of average online media clickthrough rates from Marin is useful for modelling the response of digital media for top-level budgets.

Facebook ad clickthrough rates by sector

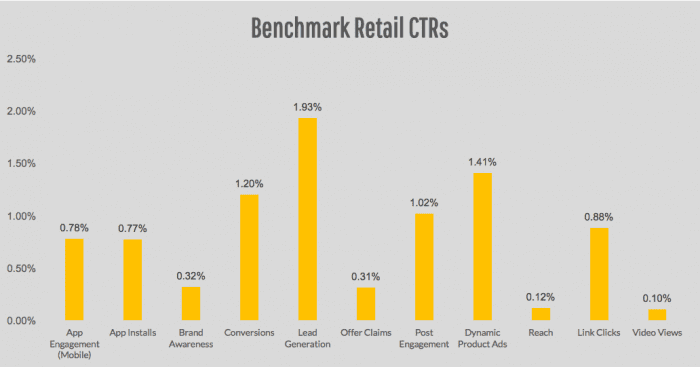

Facebook offers different forms of ad formats with different goals will naturally vary in response as these retail Facebook ads from. You can see that Facebook ad CTRs which may be more highly targeted that display ads have significantly higher CTRs, particularly for Lead generation (i.e. adding subscribers to a retailers email list) and Dynamic Product ads (retargeting visitors who have already visited a site with relevant offers).

Wordstream also have these summary Facebook ad CTRs by sector:

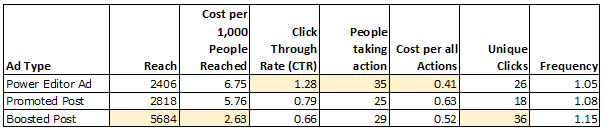

These Facebook Ad CTRs for different types of ad formats are taken from a test run by Smart Insights contributor Marie Page. They show that by using targeting in Facebook it’s possible to improve on general Internet ad clickthough rates.

The challenge of online ad viewabililty

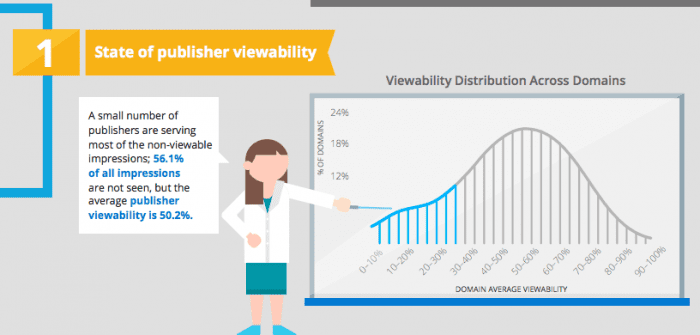

Viewability is another issue for advertisers to consider when evaluating online ad effectiveness as measured by clickthrough rates. Ad blocking also has an impact since ad blockers have increased in popularity across countries and demographics, accounting for 35% of ads in some countries.

Viewability refers to the percentage of ads in a campaign or on a publisher site that are potentially available for clickthrough. Just 44.9% of all ads are clickable according to Google-published viewability data since ads may be below the fold and users do not scroll to see them. This varies across publisher and content category.

Given the impact of viewability and ad blocking on online ad clickthrough rates you can see that there are moves in the industry to only charge for viewable ads, which with increasing options for native advertising will potentially improve the effectiveness of ads.

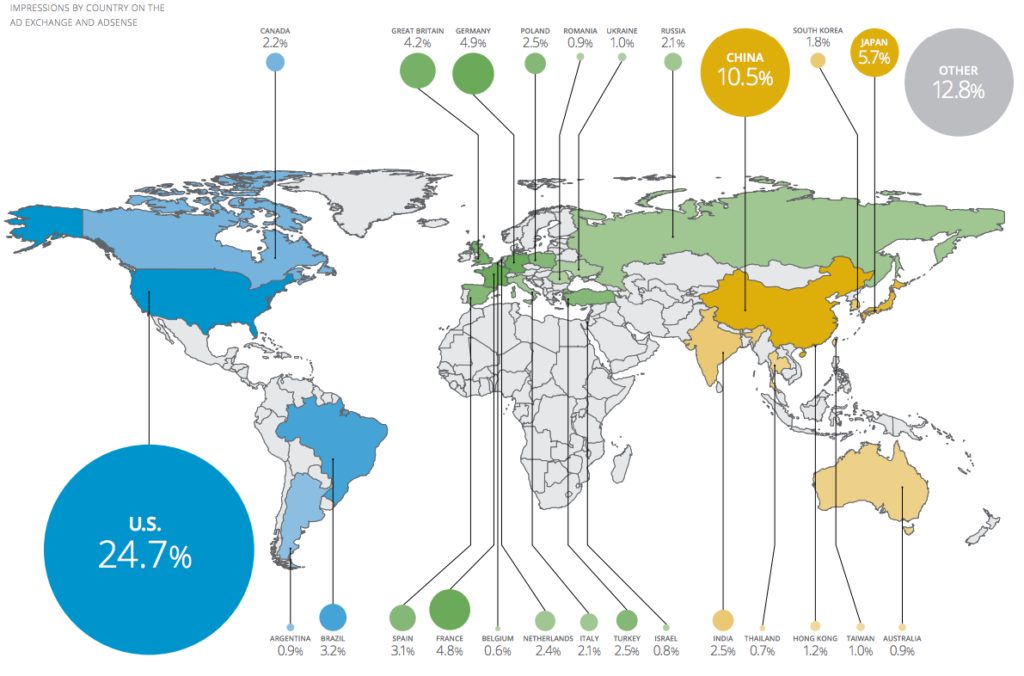

Variation in online ad clickthrough rates by country

This is historic data for reference – for the latest use the interactive Display benchmarking tool.

| Region | Overall Click-through Rate Percent (%) |

| North America | |

| Canada | 0.09% |

| United States | 0.10% |

| EMEA | |

| Austria | 0.11% |

| Belgium | 0.13% |

| Denmark | 0.12% |

| Finland | 0.05% |

| France | 0.12% |

| Germany | 0.11% |

| Greece | 0.17% |

| Ireland | 0.10% |

| Italy | 0.10% |

| Luxembourg | 0.09% |

| Netherlands | 0.14% |

| Norway | 0.11% |

| Spain | 0.12% |

| Sweden | 0.08% |

| Switzerland | 0.12% |

| United Arab Emirates | 0.18% |

| United Kingdom | 0.07% |

| JAPAC | |

| Australia | 0.07% |

| China | 0.12% |

| Hong Kong | 0.17% |

| India | 0.18% |

| Malaysia | 0.30% |

| Singapore | 0.19% |

Source: DoubleClick for Advertisers, a cross section of regions, January and December 2009, Published July 2010

For latest data see Doubleclick Display Ad Benchmark Statistics.

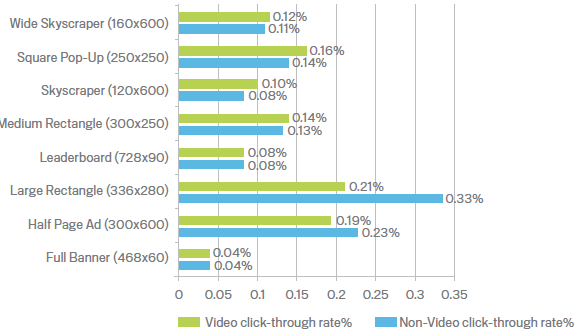

Variation in online ad Clickthrough Rates by ad format

Ad clickthrough rate naturally varies according to placement (position on screen) and ad format (shape and size). The traditional full-banner performs very poorly compared to skyscrapers, the ubiquitous medium rectangle and the newer large rectangle format.

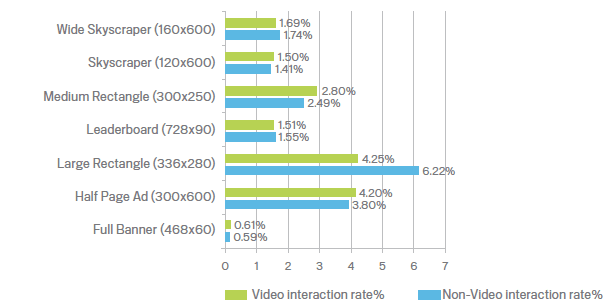

Variation in online ad Interaction Rates by ad format

Interaction rates differ for different ad formats in a similar way to ad formats.

Interaction rate definition:

Interactions are defined as the user does one or more of the following:

- Mouses over the ad for 1 continuous second

- Clicks an Exit link

- Makes the ad display in Full Screen mode

- Expands the ad