Executive summary

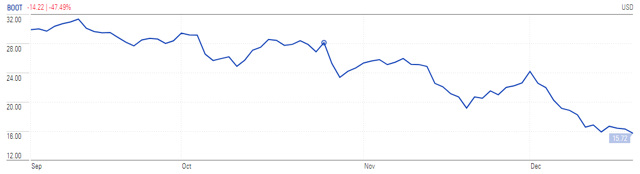

Boot Barn (NASDAQ:BOOT) has declined 47% since early September, along with the market rout, and the company now trades at very attractive multiples.

(Source – Morningstar)

The overall fundamental picture of the company is promising, supported by growing earnings, improving balance sheet strength, and increasing free cash flows. The company management has introduced an array of initiatives, which are aimed at achieving robust financial performance in the coming years, and in my opinion, these initiatives will drive company profits in the future. The macro-economic environment remains positive for company operations, but there could be headwinds for the company, if economic growth slows down. Even after factoring in such a slowdown in economic growth, I find Boot Barn to be still undervalued, which presents investors with an attractive investment opportunity.

Company overview and business strategy

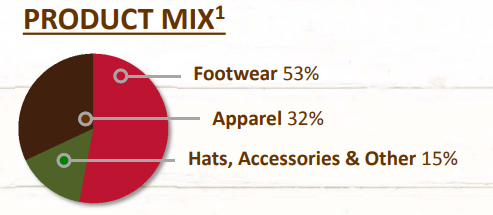

Boot Barn Holdings is a lifestyle retail chain, operating specialty retail stores in the United States. The company specializes in offering western and work-related footwear, apparel and accessories. Not surprisingly, the footwear segment dominates company operations and accounts for more than 50% of company revenues.

(Source – Company presentation)

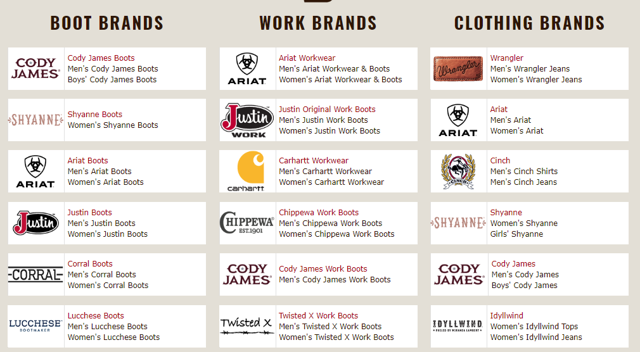

The brand portfolio of the company is impressive, and is spread across boot brands, work brands and clothing brands.

(Source – Company website)

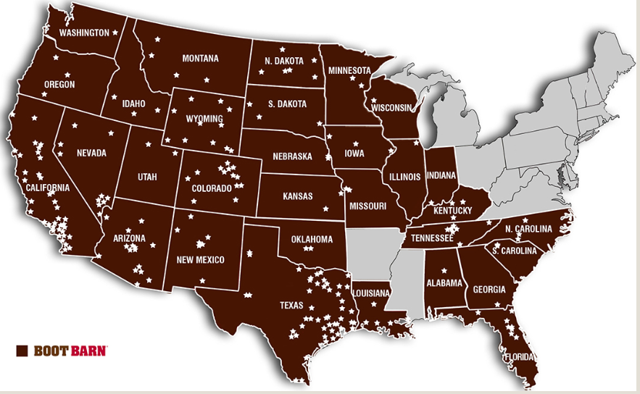

Boot Barn currently operates more than 200 stores in 31 States, which is proof of Boot Barn’s wide reach.

(Source – Company website)

While the company remains focused on expanding its store network and growing same-store sales, the company management has placed a special emphasis on improving the e-commerce segment, which will be a catalyst for future growth, as consumers are more inclined to make online purchases, rather than visit brick and mortar stores. This strategic move will play a key role in expanding the brand name internationally, and the company has taken commendable measures to support international shipping.

Industry analysis

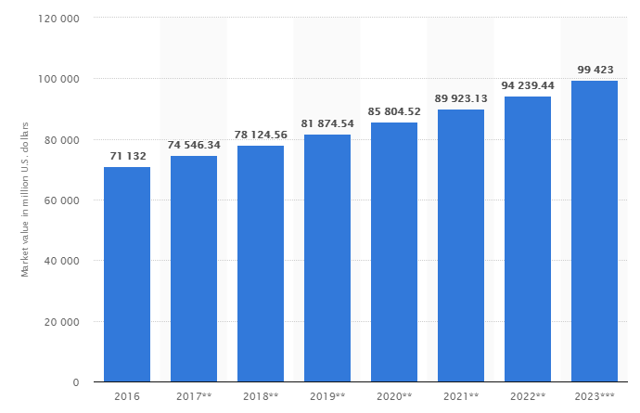

The western wear market value on a worldwide basis is set to grow at a stellar rate for years to come, as per latest analyst estimates. Such industry-wide growth will surely help companies representing the industry, but the industry might become much more competitive than it is at present, which would result in lower profit margins.

Western wear market value (2016 – 2023e)

(Source – Statista)

The workwear industry, on the other hand, is expected to deliver robust growth, driven by a few catalysts.

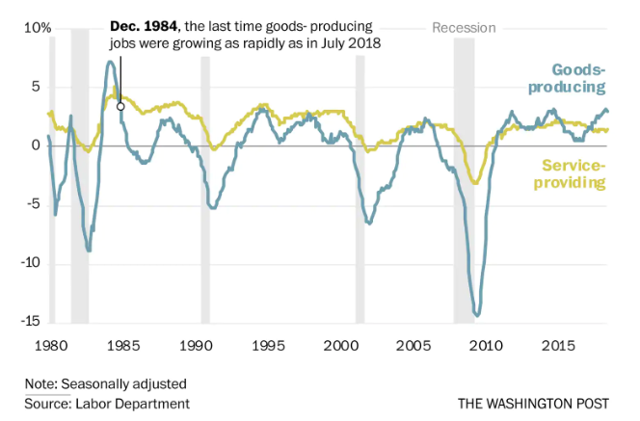

Blue collar jobs growth hit a 30 year high in 2018, which is as healthy as it can get for the workwear industry. Significant growth in blue collar jobs will present a robust growth opportunity for companies operating in the workwear segment.

(Source – The Washington Post)

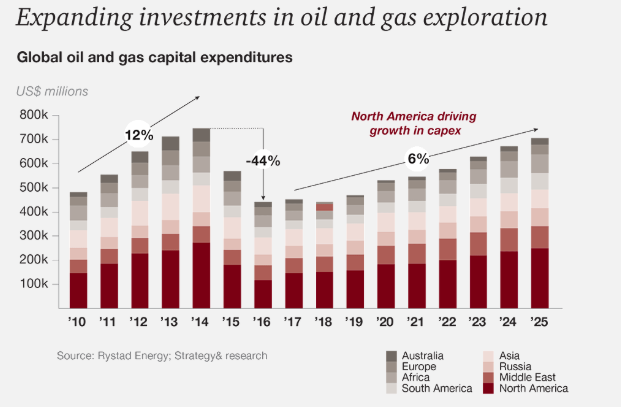

The recovery of the oil and gas industry has been a major growth driver for the workwear industry, in the recent past. However, oil prices have fallen drastically over a couple of months, and this could affect the growth in workwear industry, as exploration related activities might subside. The massive growth in jobs surrounding oil exploration activities should cease to grow, and existing jobs might turn out to be at risk, if oil prices continue to decline, resulting in lower profits for companies representing this industry.

However, despite the recent pull-back in oil prices, PwC estimates that the North American region will continue to invest billions in the oil and gas industry.

(Source – PwC)

Demand for workwear was fueled by the strong growth in construction spending, particularly in the North American region. While this has supported the workwear industry during the best part of last 2 decades, the future does not look as impressive as it did a year back. Construction spending in the U.S. fell 0.1% in October, even though economists had predicted an improvement.

Company performance and financial statements analysis

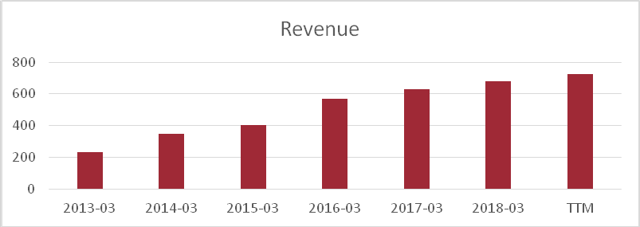

Boot Barn has been a true growth story, as the company has been able to grow its revenues more than three folds over the last 5 years.

(Source – Author prepared based on company filings)

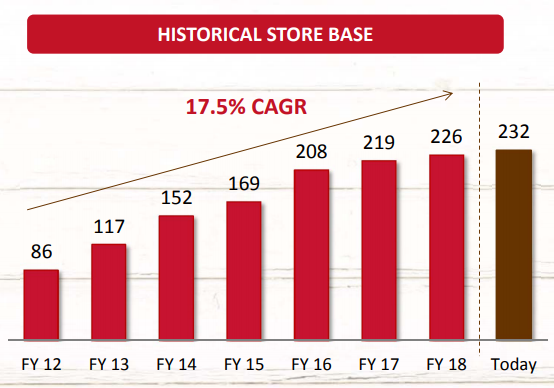

On top of favorable industry conditions, forward-looking strategies that were implemented during this period were instrumental in achieving this growth. With a view of capturing the massive growth opportunity presented by changing consumer preferences, the company has expanded its store network rapidly, developed a streamlined online purchasing platform and focused on driving same-store sales growth.

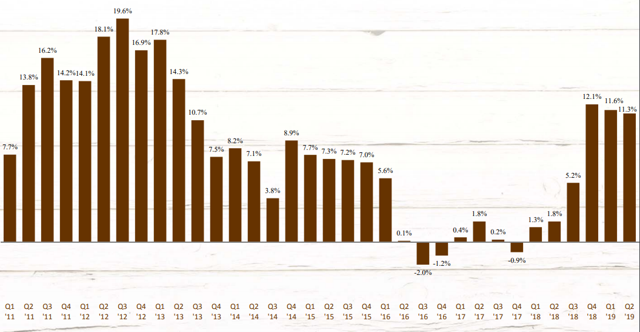

Same-store sales growth over years

(Source – Company presentation)

Historical store base

(Source – Company presentation)

In my opinion, the expanding store network will continue to boost revenues for the company, coupled with same-store sales growth. Western and workwear segments have room for growth, and can be seen as relatively under-penetrated, in comparison with other retail categories. Operating in a macro-economic environment of this nature, the company will benefit from relatively low competition, if the company can expand its store network to regions that are barely touched by its competitors.

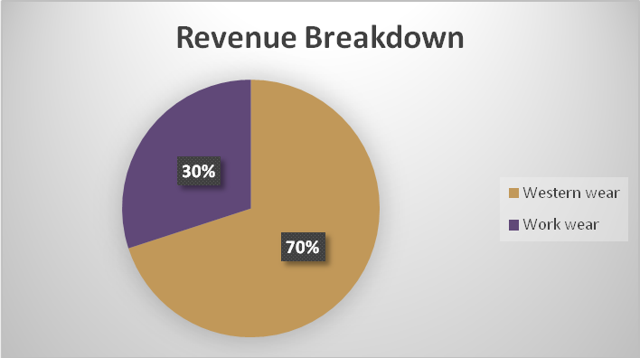

As of the fiscal year ended 31st March 2018, the western wear segment accounts for 70% of total revenue, which I consider as a healthy trend. The workwear segment is more susceptible to an economic slowdown, and this segment could be hurt badly if growth in industrial segments slows down.

(Source – Author prepared based on company filings)

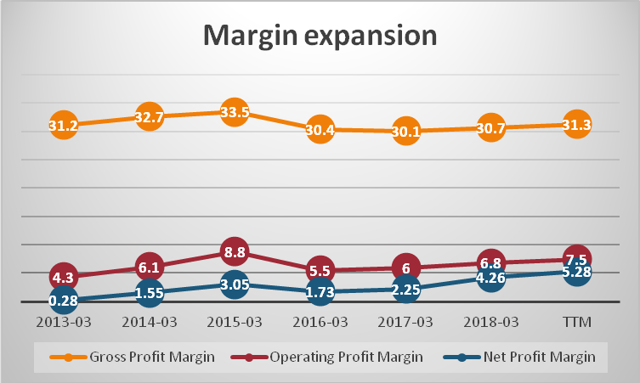

Boot Barn has seen its margins expand over time, in line with revenue growth. Expanding margins place the company in a better position to face industry-wide headwinds in the future, and the company will be able to keep its profitability intact, even if revenues take a hit.

(Source – Author prepared based on company filings)

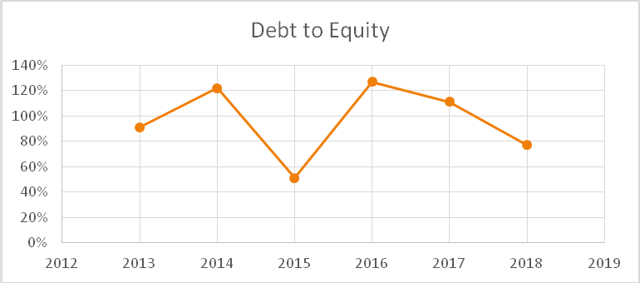

Despite being engaged in growth activities, Boot Barn has a strong balance sheet, which is reflected in the manageable level of debt in its capital structure, healthy cash balance and impressive current ratio.

Debt to equity

(Source – Author prepared based on Morningstar data)

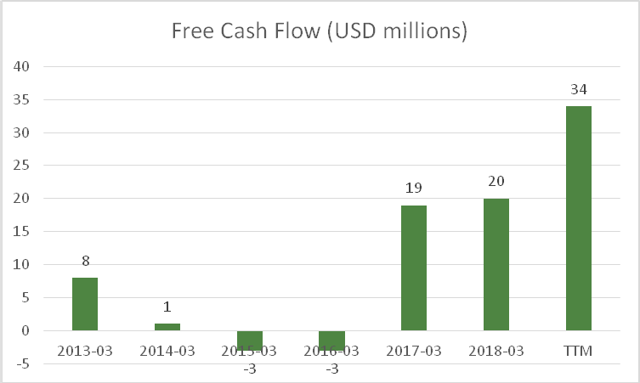

While free cash flows are important to any company, this is especially true for retail companies, as there are a lot of cash related expenses to deal with. I believe the company’s ability to generate healthy free cash flows will be instrumental in achieving future growth through expanding its store network, extending the product line and penetrating additional markets. All of these growth projects are capital intensive, and Boot Barn’s ability to generate sufficient cash to support these growth operations is critical to its future growth.

(Source – Author prepared based on company filings)

Overall, the company has performed soundly over the last few years and is expected to carry forward this momentum to the future. Despite possible industry-wide headwinds, Boot Barn’s prospects look attractive.

Future outlook

Driving same-store sales remains a core strategy of the company, and will remain the same in the future. In line with this strategic objective, the company has upgraded the look of its stores along with its product offering, which will lead more potential customers to its stores.

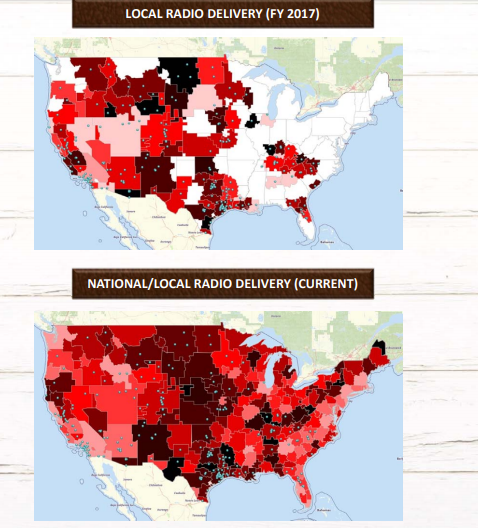

In comparison to FY 2017, the company has revamped its marketing strategies as well, with the objective of increasing same-store sales and repeat sales. The company is seeing better returns on dollars spent for marketing, which will prompt the company to further ramp up its spending on marketing to attract and retain customers.

(Source – Company presentation)

Improving the e-commerce segment is another initiative, which will drive future sales and support the thesis for overall company growth. The company management has implemented strategies to enhance Search Engine Optimization (SEO), improve the overall look and feel of their websites and enhance the product listing. On top of these, the company has launched a few additional websites, including wonderweststyle.com and Shyanne.com to cater to a more niche customer base, which, in my opinion, will help the company gain traction in these segments.

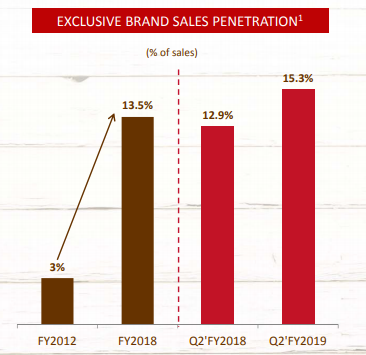

Apart from these strategies with a focus on improving sales, the company is planning to build a loyal customer base around its exclusive branded products.

(Source – Company presentation)

Contribution from the exclusive brands segment to company revenue has increased over time, and this is a positive sign for the company, as margins in this segment are comparatively high.

The growth story of Boot Barn is intact, driven by major initiatives taken by the company management to drive future revenues. As the brand value expands, Boot Barn would be able to price their products much better and expand its margins further, as economies of scale comes into play.

Valuation

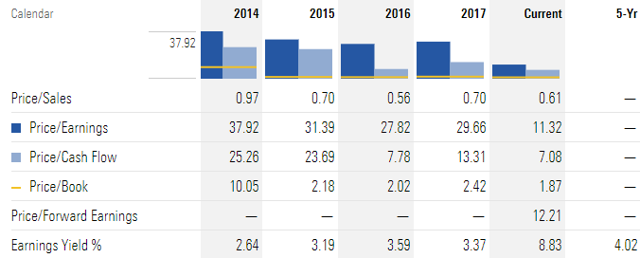

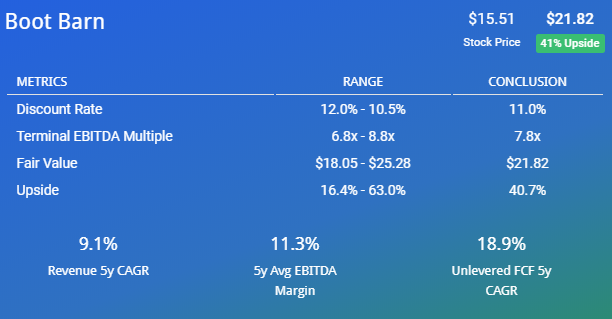

As growth prospects improved for Boot Barn over the years, shares tended to trade at rich valuation multiples. However, along with the recent downturn in broad markets, the share price has declined to lows which now undervalues company prospects significantly. In my opinion, the current valuation multiples fail to capture the expected revenue and profit growth of Boot Barn.

(Source – Morningstar)

At just 12 times its forward earnings, the company is attractively priced to capture future growth. The company need not converge with its historical valuation multiples to yield an attractive return to investors, as a partial convergence will still provide a formidable return.

By performing a Discounted Cash Flow analysis along with EBITDA multiples to calculate terminal value, I arrived at a fair value estimate of $21.82 for Boot Barn, which represents a 40% upside.

(Source – Author calculated and prepared on Finbox.io, with data from company filings)

Management review

James Conroy serves as the president and CEO of the company, and has been serving in these capacities since 2012. James has been employed in the retail industry for over 22 years and can be considered an industry veteran. His expertise in streamlining operational activities is driving the company forward in achieving not only revenue growth, but cost savings. Cost savings will be key in expanding profit margins further, which will in turn increase the profitability of the company.

Greg Hackman serves as the Chief Financial Officer of the company, a position he has occupied since 2015. He also hails from the retail industry and has more than 20 years of experience in the industry.

Risks and uncertainty

A global economic slowdown remains the primary risk of investing in Boot Barn, as it will not only result in a decline in discretionary spending, but will also affect the workwear segment. A particular decline in oil exploration related activities could drive revenue in the workwear segment lower, in which case the company would not be able to achieve its same-store revenue targets. The company has already embarked on a journey to expand its store network, and an economic slowdown will adversely affect the company as newly opened stores will fail to capture desired results, driving overheads higher.

Even though the company is operating in a niche segment, competition will build up eventually. Increased competition will have a negative impact on profit margins, as Boot Barn would be forced to give away its economic profits to remain the leader in a niche segment.

The company faces another inherent risk in the retail industry; changing consumer preferences. Retail companies have had a tough time in keeping up pace with dynamically changing consumer preferences, both in the way they shop and products they chose, and the situation will only aggravate in the future. Companies who fail to innovate and address growing demands of consumers will fail to grow.

Conclusion

Boot Barn is a retail growth story, that serves a niche segment, and the company is expected to grow in line with the initiatives taken by the management to secure a market leading position in the western and workwear segments, in the United States. Even though there are industry-wide headwinds, Boot Barn will benefit from its exposure to the western wear segment, which is independent from the workwear segment. Even if the global economy contracts, Boot Barn does not deserve to be trading at current valuation multiples, and presents an upside of above 40% from the current market price.

Disclosure: I am/we are long BOOT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.