A brand’s purpose is its reason for being – or so it’s been seen for some time now. For some, it’s merely a buzzword, for others it’s formed the most crucial aspect of their business.

Whatever the belief up to now, the coronavirus outbreak is giving brand purpose a whole new meaning.

Presenting unprecedented challenges for people, governments, and businesses alike, if ever there was something that would put this concept to the test, this is it.

The crucial test here presents brands with a question: how will you respond? And consumers are paying attention. Using our very latest COVID-19 research into 13 markets, released just this week and available in our hub, here’s what we know so far.

Consumers have clear ideas about how they want brands to respond.

As the pandemic has spread across the world, normal life has been put on hold for many people. Right now, a third of the global population is under lockdown, according to some estimates.

Typical buying behaviors are on hold, old certainties are being shattered, and – most importantly – many are fearful about their future prospects.

Because of this, consumers are now broadly in favor of some seismic changes to how businesses work.

83% think brands should provide flexibility in payment options, while 81% think they should offer free services to help pitch in.

Even under normal circumstances, consumers probably wouldn’t object to flexibility and free services, so perhaps more striking is that 67% think brands should suspend factory production to make essential supplies, and 79% think non-essential stores should be closed down.

Those are enormous changes that require sacrifice on the consumer’s behalf. The fact that so many want this globally illustrates what kind of situation we’re now in.

Only 37% of consumers want brands to continue to advertise as normal.

This is the clearest sign that brands have to interact with the market in a fundamentally different way. Using the lens of brand purpose helps ensure that any activity at this time isn’t perceived as profiteering, but as a contribution to a bigger battle.

The most effective responses will go beyond just messaging and draw on other parts of the business.

But there is another way we can test how many people are putting a fresh onus on brands.

As the data in this blog came from a recontact study in 13 markets across the world, we can apply an audience of internet users who usually want brands to be socially responsible, and see what differences exist between them and the average internet user.

This would let us see if attitudes to brand response differ between those who normally want brands to act in a purposeful way, and those that normally have less of an interest.

What the data tells us is there’s no distinction. The current sentiment isn’t being driven by the most vocal advocates of brand purpose; it’s coming from everyone. Regardless of previous sentiment, consumers of all kinds support these far-reaching measures.

At this point in time, brand purpose is everyone’s concern.

Corporations are taking the lead where governments aren’t.

Consumers are one group that decides the business response to COVID-19. The other is governments. Brand purpose has to be high on the agenda because consumers are actively looking to corporations to lead the fightback where governments can’t or won’t.

While coronavirus is ultimately a political issue, political leadership has been slow to emerge in some countries. CEOs have the power to make change while governments dither.

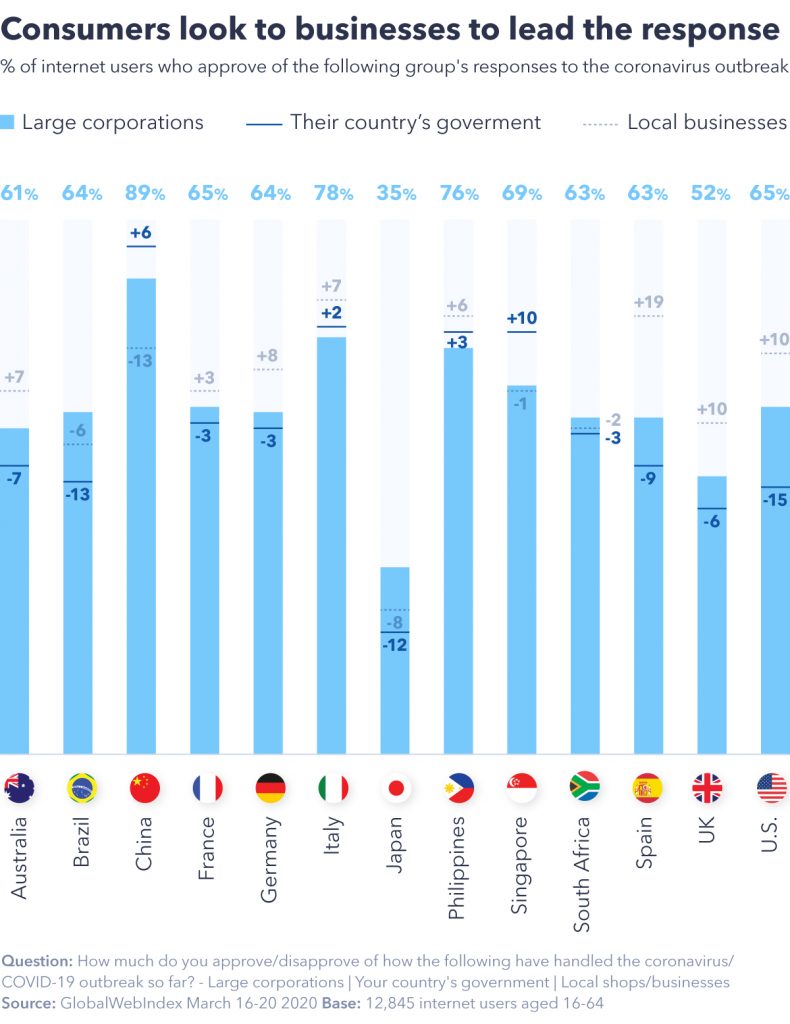

This is a pattern we’ve uncovered in our research, especially when broken out by country.

In countries where governments have taken robust action early (Singapore, Philippines) or imposed restrictive measures once the crisis escalated (Italy and China), they’re felt to be doing a better job than large corporations. But corporations are still rated quite highly, and will have a big role to play.

Tackling coronavirus will need a collective effort, where brands listen to consumer concerns and work with governments to produce solutions and assistance.

In markets where governments have been slow to react, or dismissive of the threat (the UK, the U.S., Brazil, and Japan), approval of the government is lower, and approval of large corporations is higher. Consumers in those markets expect businesses to lead.

Edelman’s research into trust and coronavirus tells a similar story; businesses are seen as leaders in the coronavirus battle.

Because of this approval gap, playing safe, or doing nothing, just isn’t an option. Businesses have a responsibility to step in where government approval lags behind.

This is bigger than marketing – it’s providing a public service.

Many marketers are understandably anxious about looking like they’re trying to profit from a crisis. Looking at it this way helps remove some of that threat. By considering what businesses can provide that governments can’t, it can feel like less of a commercial exercise.

Scottish brewer, Brewdog, has emerged as one of the leading lights of brand response, producing free hand sanitizer for those that need it, as well as opening virtual bars to help consumers undergoing social distancing.

This, while sending a note to its shareholders that it had lost 70% of its income overnight, and was forecasting some difficult months ahead. Brewdog’s two measures show that brand purpose during coronavirus is multi-faceted.

It’s not just about supporting healthcare initiatives, but going above and beyond to give consumers some assurance or entertainment in troubling times. It doesn’t have to involve a complete compromise of traditional brand values.

Even though businesses are rated higher than governments in many markets, there’s still work to be done. More context can be drawn by comparing how consumers view the response of large corporations compared to local businesses.

In most markets, consumers feel local businesses are doing more than large corporations.

The nature of the outbreak and its effects, particularly social distancing, makes a local connection with consumers important, and they’ve probably had to be more nimble in their response.

But it shows that larger brands, as well as having the resources to make meaningful change happen, can aim for the level of intimacy with consumers that local businesses have.

Because of this vacuum in leadership, brands will be defined for years to come in how they reacted. With so much scrutiny on them, those that took up the fight in a global crisis will be remembered, whereas others may end up on the wrong side of history.

As lockdown spreads, so do brand expectations.

Because of how COVID-19 has spread, it has deeply affected some countries before others have followed suit.

This was evident in the recent film project 10 Days, where Italians recorded messages to themselves sharing what they wished they’d known 10 days ago, before coronavirus ravaged the country. The film was created with a view to warning other countries about complacency.

This lag between countries presents a pattern our research bears out, particularly when it comes to how brands should respond.

We can get a rough metric of the extent of its spread by looking at what lockdown measures were in place at the time of research. By this measure, Spain (86% on full lockdown), Italy (83%), France (67%), the Philippines (59%) and China (31%) were most impacted.

It’s no coincidence, therefore, that these countries are the most demanding when it comes to brand expectations. Italian consumers are keenest for suspension of normal factory production, and they tie with Spain for wanting widespread store closures the most.

Consumers in China lead in wanting free services.

To put it frankly, when a lockdown is instituted, and most activity stops, the brand-consumer relationship significantly changes.

As more countries, including the UK, have gone under lockdown since we carried out the research, we can expect consumers in countries like it to follow the Italian and Chinese examples and demand more from businesses. It’s important to act in these countries now and anticipate the change that’s coming.

Brand purpose is no longer about brand health.

One of the first coronavirus initiatives from a brand to get serious attention was LVMH’s transition to making hand sanitizer, as it was such a profound move from a brand usually focused on exclusivity.

Not all businesses can make hand sanitizer. Not all have factories or networks of stores to draw on. How exactly businesses contribute depends on each case. This isn’t a one-size-fits-all situation. But there are creative ways to do so, and businesses have to look at some of the longer-term implications of the COVID-19 outbreak.

Brands that have pursued a more aspirational or fun image can still contribute by making a virtue of these qualities. It doesn’t have to be doom-and-gloom. People will be faced with social isolation, financial precarity, and will lose much of their regular sources of entertainment, fitness, and other important things in their life.

These are all places where brands can make a difference beyond the initiatives more directly linked to healthcare, like making hand sanitizer, or face masks.

It’s fair to say the general approach from brands to coronavirus until now has been one of caution, but we’re past that stage now. It may well end up riskier to do nothing.

Brands may be wary of association, but just as dangerous is the association with not contributing to a global crisis.

While it shouldn’t be the focus right now, brands that do this will emerge as leaders after the crisis.

Any business has to look at the resources it has available and see how they can be utilized for the benefit of all – particularly for markets where governments have been slow to lead, corporations have a responsibility to take positive action.

Right now, purpose isn’t about brand health – it’s about public health.