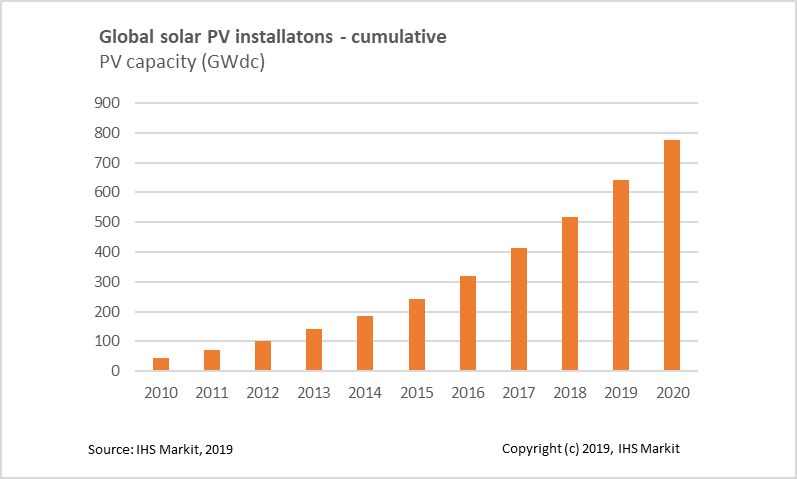

As photovoltaic (PV) installations continue to build throughout

the world, the global PV installed base is forecast to reach 780

gigawatts (GW) by the end of 2020, up nearly 2,000% from a mere 40

GW a decade ago in 2010. Although some of the strongest periods of

year-over-year growth in the global PV market are behind the

industry, IHS Markit predicts that global PV installations will

exceed 100 GW annually over the next five years.

That phenomenal expansion is fueled by many growth drivers,

including social and political factors related to climate change

and carbon emissions. But PV’s remarkable growth can also be

attributed to a rapid reduction in costs and technology

improvements, making solar-generated power more competitive with

traditional fossil fuel sources like gas and coal.

One challenge standing in the way of further growth in the space

is intermittency in the generation of renewables, with production

in the case of solar limited to daytime hours. This aspect of

renewables acts as a natural limitation for growth and requires

balancing with other energy resources, such as gas or other fossil

fuels. Increasingly, however, the PV market is seeing greater

diversity come into play as more countries begin to invest in

solar. While European markets like Germany traditionally led in the

PV space, new players like China, India, and the US have now become

powerful actors as well—a diversification that has been helpful

as well in spurring PV growth.

Battery storage as alternative power resource

Much of the skepticism against renewables as a stable and

predictable source of power vanishes if the science and mechanics

of energy storage, especially in batteries, could be

perfected—or so the argument goes. While battery-storage

technologies aren’t commonplace in electricity markets yet,

continuing advancements in the field have been helpful in spurring

growth in the entire energy storage space.

To this end, IHS Markit is forecasting demand for 80

gigawatt-hours (GWh) of energy from battery storage to be deployed

within the next five years, a cumulative increase of approximately

400% compared to the installed base at the end of 2018. Like the

spectacular expansion currently happening in the global PV space,

technological innovation and cost reductions will continue to fuel

growth in the battery-storage industry during the coming years.

The glowing prospects for battery storage will be good news to

proponents of integration with renewables, since solar and battery

resources can be combined in a relatively natural, organic fashion.

Abundant solar energy during the middle of a clear and sunny day,

for instance, can be used as a charging element for batteries. The

extra energy stored in the batteries can then be discharged and

made available for use as power after the sun goes down in the

evening.

Such a scenario is especially appropriate for the US market,

which is poised to become the largest market for solar paired with

energy storage over the next few years. The abundant deployment of

solar energy within the country, paired with growing demand for

more flexibility from American utilities and customers, will drive

deployments of hybrid solar and battery storage resources in the

United States.

Beyond the practical economics and advantages of integration

with renewable energy, batteries can provide additional value as an

independent resource in a variety of settings, including utility

applications or behind-the-meter applications for customers of the

electric power grid.

Costs in the overall equation

For both solar and battery storage, the ongoing reduction in

equipment manufacturing and deployment costs will be a critical

factor in propelling both industries forward.

With solar, incremental efficiency gains will continue to

optimize the manufacturing process across the supply chain, from

polysilicon development to semiconductor wafer and cell

integration. With battery storage—lithium-ion,

especially—the field will be the happy recipient of benefits

derived from the increased scaling of the electric vehicle

industry, with profound implications for the future as

electric-powered transportation gains greater market traction and a

switch to clean-fuel cars gets underway.

Within five years, IHS Markit believes solar and battery storage

technology costs will reach a tipping point that will allow such

resources to compete directly with natural gas, which has become a

global benchmark for new electrical generation. That tipping point

is the ability of solar and energy storage systems to generate

energy at an approximate cost below $50 per megawatt-hour. In turn,

the lower cost will help catalyze a paradigm shift for the global

energy industry to move to a cleaner and more resilient electrical

system.

Camron Barati is senior analyst for solar and energy

storage at IHS Markit

Posted 27 June 2019