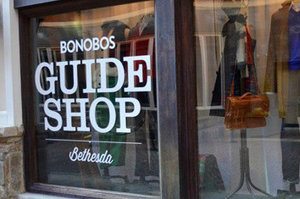

Online apparel merchant Bonobos has set up “Guide Shops,” where men can be guided through putting together outfits, then receive the clothes later in the mail. Nordstrom, the traditional brick-and-mortar retailer, is experimenting with a similar concept.

The theory behind experiential retailing is that people are bored with buying tangible goods; what they really crave is experiences. When shoppers really need things, they can buy them online and have them delivered. Visiting a store is just too tedious.

Global mall operator Westfield conducted a survey of its shoppers in the U.S. and the U.K. in 2015 and found that people want a multisensory experience when going to a store. Buying a new dress or a new pair of shoes is no longer enough to satisfy them. They now require entertainment as part of the process, a concept known as “retailtainment.” As more brick-and-mortar stores close, mall operators and chain stores are getting onboard with the concept.

- Mall owners are retooling their properties and rethinking the concept of the anchor store.

- Owners are seeking out smaller specialty stores that combine physical goods with interactive experiences and incorporating more technology.

- Owners are changing the store mix — relying more on restaurants, nail salons, beauty salons, and fitness businesses to lure people to malls. Upscale malls now include yoga studios, meditation centers, and art galleries.

- Stores are offering more interactivity. Sporting goods stores may offer rock climbing walls and golf stroke simulators. Outdoor outfitters offer lectures and classes for first-time adventurers. High-end cookware stores offer cooking classes as well as demonstrations. Upscale grocery stores are opening beer and wine bars next to their coffee bars.

Stores without Inventory

A more radical approach that is gaining interest is to treat the purchase of physical goods as an afterthought. Stores without inventory are becoming popular based on the premise that holding physical inventory is too expensive.

Online menswear merchant Bonobos, recently purchased by Walmart, is a pioneer in inventoryless stores. Currently Bonobos operates over 40 “Guide Shops,” where men make an appointment online and then go to the Guide Shop to try on clothing, receive advice from “guides” who help them put together outfits. If they like the results, they can make a purchase and have the outfit delivered by 2-day air.

Nordstrom is now following Bonobos’ example. It recently announced “Nordstrom Local,” a line of small (3,000 square feet) stores. The typical Nordstrom store has 140,000 square feet. The first Nordstrom Local store will open in West Hollywood, Calif. in October. It will have eight dressing rooms where shoppers can try on clothes, but all purchases will be shipped to the customer. Personal stylists will be available to select outfits for shoppers. The shops will also have bars where shoppers can order juice or wine.

Other planned offerings at Nordstrom Local locations include manicures and on-site tailoring. Nordstrom’s “Buy Online, Pick-Up In-Store” service will also be available. If customers order online by 2 p.m., they can pick up their items at the store the same day. Curbside pick-up will also be provided. Returns can be dropped off at any Nordstrom Local.

On the technology side, the Nordstrom Local store will provide a style board that lets stylists create a digital catalog with items personalized for a customer. In the future, customers can purchase items from their style board and also communicate with stylists through that catalog application.

Other Strategies

Going against the micro-store strategy, clothier and lifestyle merchant Anthropologie is opening several larger stores — between 20,000 and 30,000 square feet. The stores have 12 full-scale, elaborately decorated rooms and offer home styling consultations. Sensory elements include mood lighting, music, and art. The goal is to make people feel as if they are in a luxurious home where they can relax.

Experiential retailing is not limited to apparel and housewares. Lowe’s, the big box hardware chain, caters to do-it-yourself types and some of its stores have a dedicated room for virtual reality do-it-yourself learning. Shoppers don a pair of goggles, and use a controller to complete a virtual project. The experience gives them greater confidence to complete a real project in their own homes.

Will Experiential Retailing Succeed?

While retail chains are responding to what they believe consumers want in a shopping experience, success is not assured. Malls may recover by switching to service businesses but retailers that sell physical goods need to make sales. The risk is that customers may browse, have a glass of wine, try on a few things, and walk out the door and never order anything — either in-store or online.

There has already been one setback in the experiential shopping realm. Premium kitchen and bath retailer Pirch announced store closures in four cities. Pirch’s showrooms are elaborately designed and shoppers can even take a shower. However, the showrooms have high fixed costs and the goods target wealthy customers.

Experiential retailing may turn out to be a short-lived fad. It targets shoppers who have the time and need for retail entertainment. This could be relatively small slice of the public.