There are an increasing number of surveys about data privacy — now coming almost weekly. These studies help gauge consumer sentiment but are typically fairly abstract. By contrast, privacy and data sharing are often highly situational.

Emerging privacy narrative. At the highest level, most of these recent surveys tell some version of the following story:

- Consumer concern about data privacy is growing.

- Consumers are now more engaged with online privacy, often changing settings or denying access to their data (e.g., location).

- Consumers want more control over who can access/use their data.

- Many consumers remain confused about how their data is used by marketers and brands.

- Consumers (especially younger adults) are willing to share data under specific when benefits are clear and they understand how it’s being used.

A new survey of 1,002 smartphone users in the U.S., commissioned by location intelligence provider Factual, reinforces this general narrative, with a few twists.

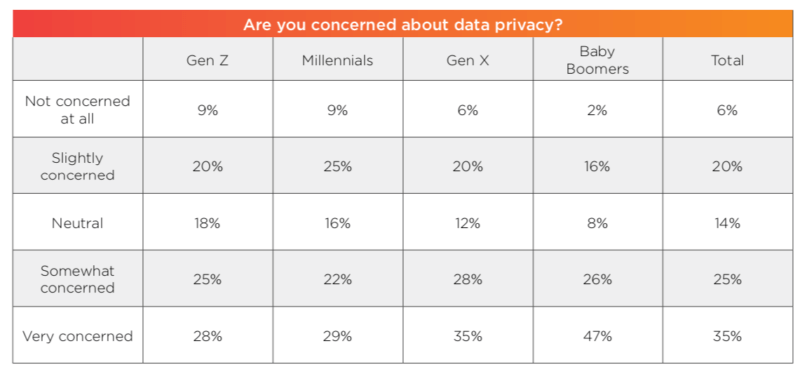

Generational differences. Among different generations, the Factual survey confirms the conventional wisdom that younger users are less privacy sensitive than older adults. Baby Boomers are the age group most concerned about privacy; Gen Z and Millennials are the “least concerned.” However, 53% of Gen Z and 51% of Millennials were either “somewhat” or “very” concerned about data privacy.

Concerns about data privacy by generation

A host of privacy concerns. The top specific privacy concerns were the following (percent concerned):

- Identity theft and fraud — 72%

- Stolen passwords — 64%

- Not knowing what personal information is being used for — 59%

- Information being sold for profit — 54%

- Location tracking — 53%

Asked to rank categories of sites respondents were most and least comfortable sharing personal data with, entertainment sites/apps (e.g., Netflix), navigation sites/apps (e.g., Waze) and “utility” sites/apps (e.g., weather, cell carrier) were the winners. On the opposite end of the spectrum, people expressed the most discomfort sharing data with social networking sites/apps (e.g., Facebook, LinkedIn) and then gaming sites/apps.

Types of companies consumers comfortable sharing data with

The Facebook paradox. Despite being least comfortable sharing data with social networks, Facebook was one of the places people most wanted to see personalized content. Factual observes, this indicates a “gap between [consumer] understanding and application.” (This is the broad theme of the company’s report.)

Here’s the top five places consumers said they wanted personalized content/experiences:

- Google — 44%

- Amazon — 42%

- Email — 40%

- Facebook — 39%

- Mobile apps — 29%

Only a minority want personalization. It’s worth nothing that none of these categories/providers breaks the 50% barrier. In other words, only a minority of consumers (though substantial) are seeking personalization. Roughly 39% agreed to some degree with the statement “Personalization improves my digital experiences.”

One of the most interesting findings in the study reflects the perceptions of who benefits most from consumer data collection and usage. Roughly 63% of consumers believe that brands benefit, while 46% believe that consumers do. This is another important gap.

Perceptions of who benefits from consumer data collection and usage

Why we should care. The survey report explains that consumers are willing to share data under specific circumstances: when they trust the organization or provider, when they believe their data are secure and when there is a clear link between data sharing and benefits received.

Factual concludes, “The more understanding and control a user has over their data collection and usage, the more willing they’ll be to share and engage with those who employ it.” This requires greater transparency and more consumer education by brands and marketers, as well as genuinely giving consumers more control.

But the report also debunks the idea that consumers always value personalization and are always willing to trade their personal data to get it.