Businesses around the world are grappling with a curveball nobody saw coming.

Amid the coronavirus health crisis, facing shrinking budgets and displaced spend, there’s extreme pressure for brands to figure out the right way to communicate with customers, and how they can still provide value.

And with media consumption habits changing dramatically, the need to reevaluate, reroute, or overhaul your advertising budget is now.

Data from the World Federation of Advertisers reveals four out of five multinationals (81%) are putting planned ad campaigns on hold because of the COVID-19 outbreak. In the meantime, the same percentage say they’re developing new marketing messages and tactics because of the crisis.

Paving a way through these challenging times means knowing how consumers are changing.

While it’s true the pool of receptive consumers might be smaller, appetite is still there – 60% of consumers surveyed across 17 markets still approve of brands continuing to sell non-essential products via their websites.

Leveraging our latest coronavirus research into changing media habits, collected between March 25-30th in the U.S. and UK, we outline the four most important considerations for brands while navigating this increasingly challenging situation.

1. Start with scenario planning.

Scenario planning should be top of the agenda. In every crisis, planning and proactiveness results in better decisions being made.

Scenario one: pause all or most of ad spend temporarily.

Marketers are already cutting ad spend significantly because of uncertainties around consumer buying, especially if products and services are being affected due to supply chain and logistical issues.

If the virus is contained, displaced budgets could be reallocated towards the second half of the year. This could, however, push up costs as competition for advertising space intensifies.

Brands should ask:

- What’s the risk/benefit of the campaign being aired later in the year (or at a different time to what was originally planned)?

- Will the messaging need to be tweaked as a result of it having been delayed?

- Will there be any low or no budget activity in the interim, and what would the purpose be?

Scenario two: reallocate ad spend significantly in the short-term.

If restrictions across most countries still in lockdown heighten and last longer than anticipated, economic consequences for brands are likely to become more serious.

Consumers will remain indoors, cinemas will cease to open, more sporting events will be put on hold, and OOH advertising – originally tipped to engage consumers in more sophisticated ways than ever before in 2020 – will continue to suffer, receiving a fraction of projected reach, particularly in key transport locations.

In the event of prolonged disruption and lower consumer spending, some brands are considering a halt on reputation building, and big brand work entirely, switching to performance marketing for short term tactical gains.

The emphasis in brand messaging may shift, with greater resource needed to reconfigure media plans, but effective channels to reach consumers remain. Most obviously, internet investment is growing fast, with online ads accounting for over half of a forecasted $660bn global ad spend for the first time this year, according to WARC data.

Brands should ask:

- What will the financial implications of redirecting spend from one channel to another be?

- What resource is needed? (To build new creatives and distribute messaging in different formats, for example.)

- Which media are consumers engaging with most amid the outbreak, and why?

- Which digital platforms are most important in consumers’ path to purchase?

2. Keep track of how media consumption is changing.

Consumers’ routines are changing – some, more drastically than others – but we do have solid visibility over how consumers are occupying their time, despite being in lockdown.

Consumers have essentially become a more ‘captive audience’ in their own homes, with 87% of U.S. consumers and 80% of UK consumers consuming more content as a result of the outbreak.

Broadcast TV, online videos, and online TV streaming take the top spots overall for increased media consumption, providing ample opportunity for brands to reach consumers through these mediums especially.

We’re seeing coronavirus content dominate consumers’ time online across markets, income groups, gender and most generations – except for Gen Z, who are more slightly likely to be listening to music (71%) than searching for coronavirus updates (67%).

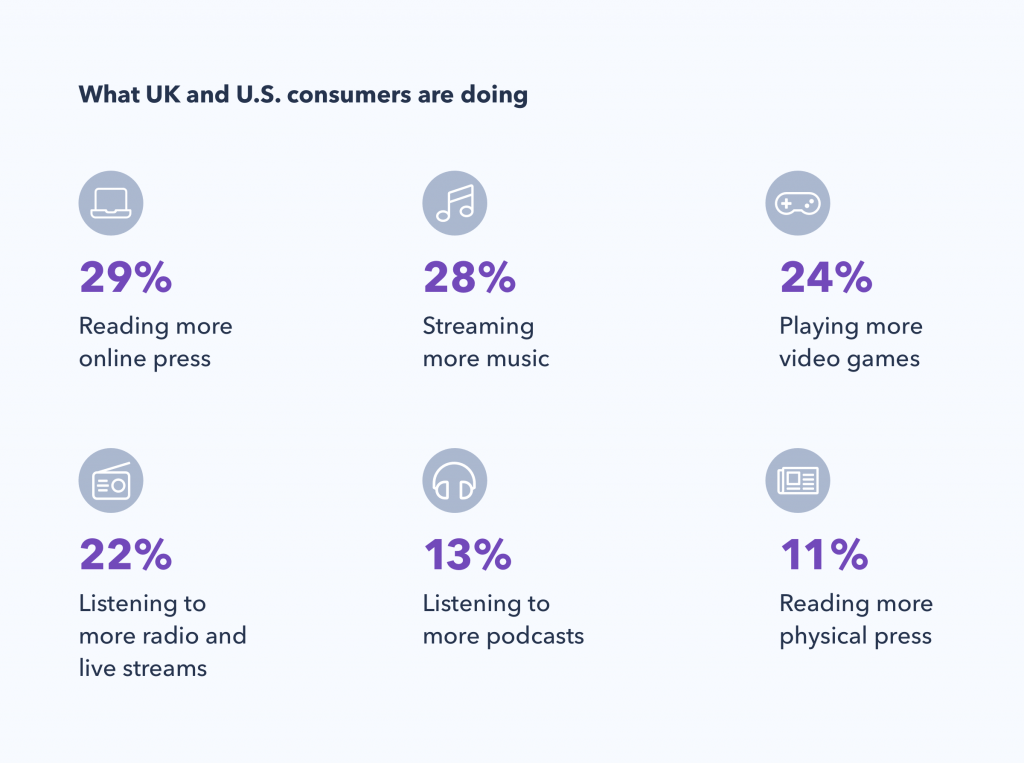

In addition to consuming broadcast and online TV, plus video content, consumers are also engaging in more of the following activities.

Alongside their exposure to coronavirus content, consumers are also looking to be entertained, with 70% in the U.S. and 69% in the UK approving of brands providing funny/light-hearted videos or content.

Finding entertaining content is especially important for the youngest generation we track – approximately 1 in 2 Gen Z consumers are looking at more memes online and watching more funny videos.

We’ll explore how age influences consumers’ media consumption in more detail below.

Get more targeted: compare each demographics’ preference for media.

Whether brands pause advertising activity altogether, put a temporary hold on strategy, or look for new tactics to reach consumers, consumers’ age shows clear differences in the media they’re most likely consuming now.

- Gen Z: just over half of Gen Z say they’re consuming more online videos like YouTube and TikTok, making it the top form of media they’ve increased using since the start of the outbreak.

- Millennials: livestreams (30%) and podcasts (20%) are more popular among millennials than other generations. Watching more online TV also peaks at 41% for millennials.

- Baby boomers: 42% of boomers are consuming more broadcast TV, compared to 24% of Gen Z. Just over 1 in 5 boomers are also spending more time watching online TV.

Beyond demographics, there are other equally important factors at play, which is why a focused approach, targeting the right consumers, is so important. Men and those in the higher income bracket for example, are more likely to say they’re consuming a variety of content, compared to women and those in the lower income bracket.

The more nuances brands can gather about their audience, the better.

If you want to analyze the data in more detail, you can access it for free in our platform.

3. Weigh up the tone and appropriateness of your messaging during the outbreak.

With more contingency plans being kickstarted, is regular brand messaging still viewed as acceptable?

Some brands have been applauded for their responses to the coronavirus crisis, others have missed the mark.

Amidst all uncertainty, misinformation is rife, which means brand reputation is at stake if consumers interpret messaging the wrong way. Marketers have a responsibility to keep customers, employees and the community safe, all the while knowing, consumers are more sensitive to content than ever before.

Only 9% of consumers believe updates from brands contain trustworthy information about coronavirus.

There’s no rulebook, but there are two things brands can do: pinpoint exactly how their consumers are feeling, behaving, reacting and communicate accordingly. Secondly, move quickly. As everyone can agree, sometimes, actions speak louder than words.

Lush, for example, is one example of a CPG UK retailer that was quick to take action. In the lead up to lockdown, before shops began to close, the toiletries retailer offered passers-by the chance to wash their hands in-store for free. In doing so, the brand was able to demonstrate they had consumers’ best interests at heart – adding value and gaining positive recognition in the process.

Though 72% in the U.S. and 74% in the UK approve of brands running advertising which shows how they are responding to coronavirus or helping customers, the key is to tread carefully.

With the exception of being transparent about the way the virus has affected company operations, brands in any sector should think carefully about whether they need to have a point of view on coronavirus or not – at least, one that’s ongoing.

Those in the field of travel and tourism, for example, one of the most hit hard sectors, naturally have more reason to communicate about the virus than others.

But, while coronavirus dominates demands for news coverage, consumers are also looking for positivity amid the pandemic at this point in time. For some, this means seeking escapism in the form of consumerism:

- As a result of the outbreak, 15% of consumers in the U.S. and UK are using social media to read more updates from brands.

- 19% of consumers are researching products to buy more.

Around a third of consumers in the U.S. and UK want to see more topics unrelated to the coronavirus, showing the importance of bringing in a sense of normality as the outbreak consumes nearly every aspect of daily life.

4. Think about surviving the short-term, but equally, think about what the future could look like.

Brands need a post-covid plan.

In our 13 market survey, collected between 16-20th March, almost 80% of consumers said they’d opted to delay the purchasing of various products in light of the outbreak.

That means brands will want to ensure these products are front of mind when the outbreak begins to improve.

Online videos could have the greatest staying power after the outbreak ends in the U.S., among Gen Z and millennials especially. 76% of U.S. online video watchers say they plan to consume just as much of this content when the outbreak is over compared to 58% in the UK.

The gaming industry could have more staying power for millennials, with 77% of this group saying they expect to continue gaming compared to 57% of Gen Z.

And, while men are more likely to continue livestreaming and playing video after the crisis ends, women are considerably more likely than men to continue reading and listening to podcasts.

Brands who tread carefully and are proactive will be rewarded

The economic effect of the coronavirus has posed serious challenges for brands, including the world’s largest. As lockdown spreads, so do brand expectations.

New data from the World Federation of Advertisers shows 34% of brands said they were planning short campaign deferments of one or two months, 28% have put back plans for a whole quarter, and 13% say they’ll wait six months before taking campaigns back to market.

There are big cues to help brands navigate, but as consumer behavior continues to be shaped and impacted, staying abreast of the current situation is key.

Brands have a role to play and they’re looked upon to help foster a sense of optimism amid the crisis.

There’s often discussion around the challenges of consumer attention being fragmented, and it being difficult to reach them. But, on the flipside, brands have the opportunity to occupy more channels than ever before, including relative newcomers such as TikTok.

Crisis or otherwise, the media industry’s expansion provides advertisers with more grounds for experimentation and campaign optimization than ever before.

Unfortunately, it’s likely we’ve yet to see the worst play out; but the battle isn’t lost. Every brand is facing its own challenges, and each should carve its own way forward – even if ‘forward’ looks a little – or drastically – different.