Coronavirus is on all of our minds, screens and feeds – and for good reason.

The outbreak is causing fluid and unpredictable changes to our day-to-day lives, and businesses everywhere are understandably worried about the impact it will have on them.

Our role is to keep you clued into what’s happening across the consumer landscape; how people are reacting, how behaviors are shifting, where they’re turning, and what this means for businesses of every kind.

COVID-19 is already having a drastic impact on consumer outlook, perceptions and behaviors. The findings from our first survey on the topic across the U.S. and UK prove it.

Here are the most important things to know.

1. Concern is widespread, but younger consumers are worried most.

With over 100 countries having reported coronavirus cases and as a result of high-profile media coverage, it’s not surprising that over 90% of consumers in the U.S. and UK now feel concerned.

But the strength of this concern varies significantly by age.

While 96% of Gen Zs are concerned, this drops to 90% among baby boomers.

And whereas almost 60% of Gen Zs and millennials are very or extremely concerned, the same sentiment is felt by just 40% of boomers.

2. 8 in 10 consumers have changed their behaviors because of the virus.

Our research shows widespread concern has quickly translated into direct action.

Over 80% of those we surveyed have made at least one change to their day-to-day lives as a direct result of the coronavirus outbreak.

Understandably, the most popular response is to wash hands more frequently (6 in 10), but that’s not the only change we’re seeing.

- 4 in 10 are reading the news more frequently.

- 3 in 10 are trying to avoid touching public surfaces such as door knobs / elevator buttons.

- 2 in 10 are altering their daily routines to avoid rush hour and crowded places.

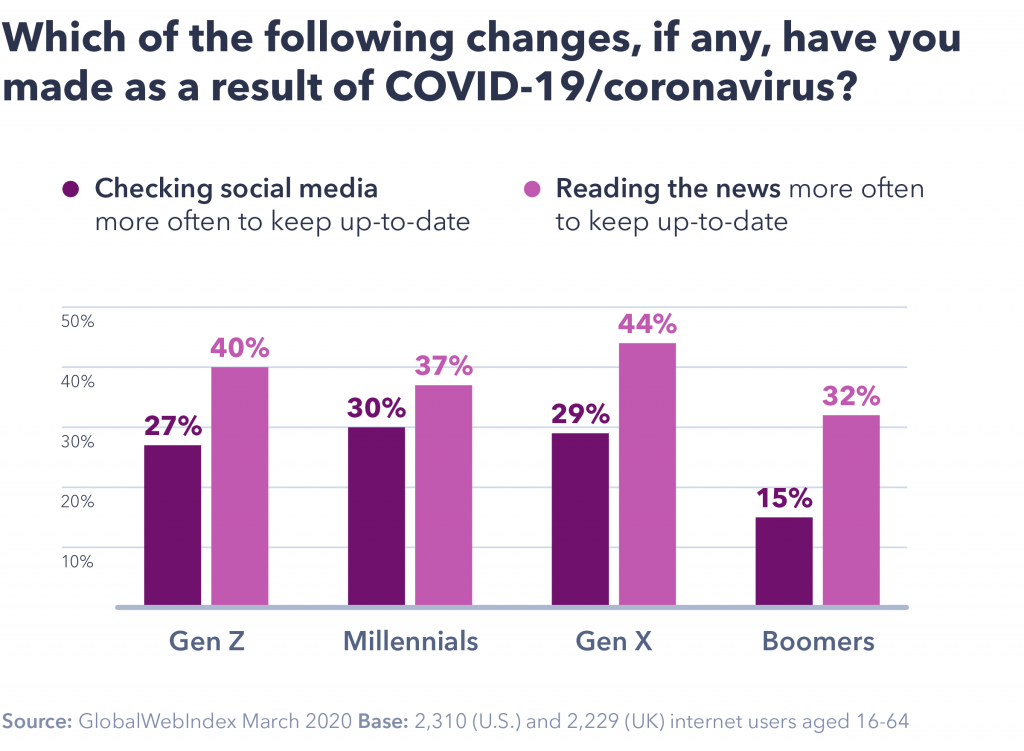

Generational differences are once again key here.

90% of Gen Zs are making changes to their daily lives. This is compared to 75% of baby boomers.

Men are more likely to be making work-related changes around upcoming trips or commuting patterns, while the U.S. has a significant lead over the UK in terms of checking social media more frequently.

3. Personal financial concerns aren’t (yet) top of mind.

At the moment, consumers in the U.S. and UK are most concerned about the following:

- The speed at which the virus is spreading.

- The lack of a vaccine.

- The chances of their friends, family or high-risk groups being infected.

All of these rank ahead of the fear of catching the virus themselves.

Currently, only 20% are concerned about the impact it will have on their personal finances (dropping to 10% among Gen Zs).

Interestingly, it’s also one of the areas of concern where there’s minimal difference between high versus lower income groups (just 5 percentage points).

This suggests consumers in all income brackets haven’t yet begun to consider the longer-term implications on their family finances, and are still more focused on the immediate spread.

4. Knowledge levels vary – especially by age.

When we ask consumers to identify fact from fiction when it comes to coronavirus, we can begin to understand why levels of concern might be slightly lower among older age groups.

Baby boomers are the most likely to know how to minimize the risks of infection (e.g. by avoiding touching their eyes, noses or mouths with unwashed hands).

Boomers are also the least likely generation to believe the urban myths that have been circulating in some corners: of the 8 myths we asked about, Gen Z were almost 60% more likely than boomers to believe at least one of them.

There are profound country-based differences too:

2 in 3 in the UK believe that “most people recover from the diseases without special treatment”, compared to less than 1 in 3 in the U.S.

5. Work routines are already changing, especially for millennials.

Changes to work routines are most pronounced among males and millennials.

Currently, millennials are the most likely to report altering the way they commute, as well as increased levels of remote working.

In terms of changes enacted by companies, employees report the most common measures being the provision of sanitization products, as well as more regular communications and more frequent office cleaning.

Only 10% currently say that remote working is being encouraged.

Some 15% say they’ve seen no changes at all, with business carrying on as normal. As government-implemented restrictions increase over the coming days, we would expect these last two measures to change the most dramatically.

6. Airlines are seen as having a particular responsibility.

When we asked consumers what steps they felt were necessary to manage the spread of the virus, over half said that airlines should be reducing and cancelling flights to high-risk destinations.

However, the generation splits here are once again profound, with boomers often having a 20-point lead over their Gen Z counterparts.

The only reversal of this comes in relation to closing all schools where (with a vested interest) Gen Z takes the lead.

7. There’s considerable enthusiasm for digital health appointments.

Digital / virtual health appointments have been suggested as one way to deliver health assistance while minimizing the spread of the virus. And there’s considerable consumer support for this:

Over 6 in 10 believe they’re effective, and would consider using them.

Belief that digital health appointments are effective remains consistent across geography, age and income.

But while only about 15% of people say they’re definitely not open to them, this rises to over 25% among boomers.

Older consumers will therefore need the most convincing and reassurance over their efficacy.

8. Fears of a global recession are pronounced.

Over half of consumers in the U.S. and UK think a global recession is now likely. A further 1 in 3 are unsure, leaving fewer than 1 in 10 who think a recession is unlikely.

Once again, generational differences are dramatic here.

From an age perspective, Gen Zs are more likely to be in the “uncertain” group. High-income groups are twice as likely as lower income ones to think a recession is extremely likely, while men are ahead of women.

The impact this could have on spending decisions is clear, and we’ll be examining this in more detail in our upcoming blog series on the impact of COVID-19.

Moving with consumers

All of this research tells us one thing for certain: consumers are changing. It’s obvious of course – in the face of a pandemic, the way we think, behave and perceive the world starts to alter. But what’s crucial for brands is knowing how that change is manifesting itself – and how they should be reacting.

Our upcoming series on the COVID-19 outbreak will be analyzing exactly that, as we conduct several dedicated studies to stay on top of this fast-moving situation.

More to come.

All stats: GlobalWebIndex March 2020 custom survey among 2,310 (U.S.) and 2,229 (UK) internet users aged 16-64.