As restrictions continue to ease in many parts of the world and more countries enter a recovery phase, our fourth multi-market release examines how consumer sentiment is being impacted.

Are we seeing growing levels of optimism and hope? Are consumers still planning on cutting back their spending or permanently changing their behaviors? And what – if anything – has shifted in relation to themes prominent before the outbreak, such as sustainability growing in importance?

Fielded in 20 countries between May 19 – 26, our fourth research wave takes the pulse in Australia, Belgium, Brazil, Canada, China, France, Germany, India, Ireland, Italy, Japan, New Zealand, the Philippines, Poland, Romania, South Africa, Singapore, Spain, the UK and the U.S.

In our report, we provide an updated view on many of the themes covered previously, while examining in more detail what the “new normal” could look like.

Here we summarize eight of the report’s key findings.

As with all of our dedicated research on this topic, the data and reports are free for everyone to access, and you can keep up-to-date with all of our releases via our hub.

1. Levels of concern are dropping.

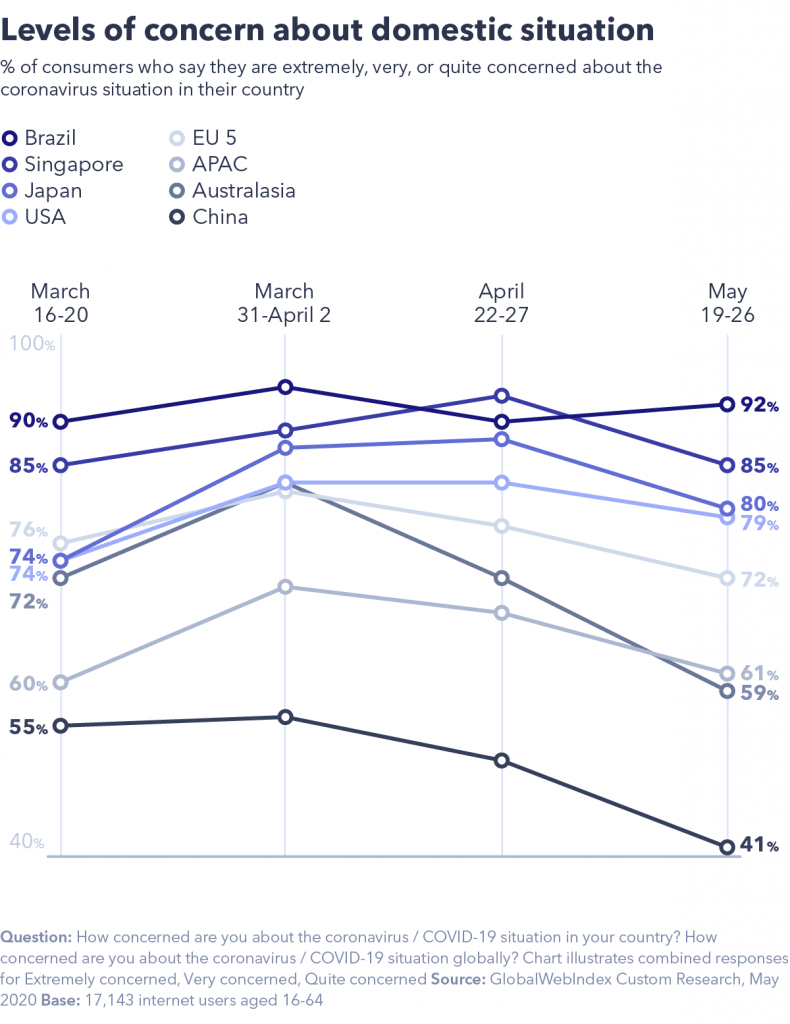

Looking at our trended data, it was late March / early April where most regions and countries saw a peak in the numbers of people who were concerned about the coronavirus situation in their country.

Since then, figures in many places have started to tick down – giving hope that the consumer mindset will begin to focus more on what comes next, as well as what’s appropriate for a “recovery” period rather than a “lockdown” one.

However, look closely at our chart and you can see how each country’s unique circumstances can influence sentiment.

Despite being the first country to experience a major outbreak of the virus, China’s swift action and apparent success at limiting deaths meant that levels of national concern were already comparatively low when our first wave of research was released mid-March.

Across April and May, concern in China has decreased further still, with just 4 in 10 expressing this feeling.

In Australia and New Zealand, which started experiencing cases some time after the initial outbreak in China, concern was still growing by the end of March, hitting a high of 83%.

But with both countries managing to largely contain cases – and with New Zealand able to announce relatively early that it had ended local transmission – there was a rapid improvement in consumer sentiment. Along with Germany and Poland, these two countries now show the lowest levels of concern outside of China.

Elsewhere in APAC, both Singapore and Japan took a different course.

Despite Singapore being hailed as a success story earlier on in the crisis, the fact that small numbers of cases continued to be confirmed exerted a major impact on concern levels, seeing them peak in mid-April at 93%. Only in May has this started to ease down.

Similarly, criticism over Japan’s initial determination to hold the Olympics as normal, together with mounting domestic negativity over Prime Minister Abe’s handling of the crisis saw concern levels remain on an upward trend there too. And, as with Singapore, only now have they started to ease.

Throughout this crisis, many commentators have looked to APAC as a sign of what will come in other world regions. While there’s certainly merit in this, nuances are clearly needed; we need to look primarily at countries in this region which had relatively early success in tackling the outbreak, and which have since maintained this.

As China, Japan, Singapore, Australia and New Zealand have shown, one world region can contain a range of very different stories.

Indeed, it’s worth noting that even in mid-May, consumers in India and the Philippines continue to express some of the highest levels of concern of any country – both polling above 90%.

The EU 5 and America are similar in their patterns. Concern was high in mid-March, and rapidly increased towards the end of the month as lockdowns became a reality and numbers of cases rocketed.

By April however, the EU 5 were already on a downward trend – consumer concern began to lessen, led in particular by Germany (another sign of how important a country’s perceived success is in reducing consumer anxiety).

With the U.S. a couple of weeks behind, we’re only now beginning to see a reduction in concern there.

The exception to the rule in our latest wave of research is Brazil – the only country among the 17 where we have trended data which has recorded an increase in concern since April. That’s a direct result of the rapidly growing number of cases being confirmed there (and in LatAm generally) and would appear to confirm the fears of many commentators that this region is becoming the new epicenter of the outbreak.

2. Concern about the global situation remains acute.

While consumer concerns about national situations are beginning to ease notably in many places, worries about the global outlook remain pronounced in all markets.

Although some have recorded a small decline in this metric since April – typically of 3-4 percentage points – concern levels remain over the 80% mark in most countries. As our chart illustrates, this means we’re beginning to see the emergence of two distinct clusters.

In the first of these, concerns about both the national and global situation remain equally pronounced: typically, this pattern is found in countries where lockdowns are only now beginning to ease or where domestic situations remain critical. It’s here where we still find the majority of countries.

The second cluster are those markets where global concerns considerably outpace national ones. In this group are all of the countries which are furthest along the road to “recovery”, such as Australia, Canada, China, Germany, and New Zealand. As arguably the two biggest success stories, China (46 point gap) and New Zealand (37 point gap) see the largest differences of all.

What this tells us clearly is that domestic success in tackling the crisis won’t necessarily lead to a reduction in concern about the global pandemic.

Until more markets move firmly into recovery stages and can declare that they’re not recording new cases, we can expect global worries to remain pronounced.

Also notable here is that Brazil is the only country where the domestic figure outpaces the global one in terms of concern.

Although the difference is very small, and other markets have figures which are equal for both metrics, it’s yet another indicator of the current severity of the situation in parts of LatAm, as well as the likelihood that June will see this region overtake the U.S. as the epicenter of the crisis.

3. Expected length of disruption is growing – and quickly.

In almost every single country where we have trended data, more people now expect the coronavirus outbreak in their country to take 6 months or longer to overcome.

This is true even in markets which are furthest along the perceived recovery path – such as China (+6 points since April), Australia (+9 points), and New Zealand (+3 points).

Some of the biggest increases have been in the European countries hit particularly badly. In Spain and the UK, there’s been an 18-point rise in the numbers expecting it to take 6 months or more (climbing to 70% and 74% respectively); in France it’s risen by 10 points to 66%, and in Italy it’s up 8 points to 65%.

It’s a similar picture in the U.S. where the figure is up 16 points to 68%.

This is a clear sign that consumers are beginning to understand the long-game nature of the outbreak, and that while levels of domestic concern in many countries might be dropping, there’s greater realization that disruption periods will be longer.

4. We’re still seeing huge disconnect around the expected financial impact.

When asked how they expect the coronavirus outbreak to impact finances, there’s still a huge difference in expectations for personal finances vs the national or global economy.

In almost every one of the 20 markets surveyed, consumers are much more likely to expect a big or dramatic impact on the national economy rather than their own financial situation.

With exception to the Philippines, being the only market where the two are relatively close (but even then, it’s a 9-point gap).

Furthermore, we’ve seen a meaningful decrease since April in the numbers expecting a hit on their personal finances in 13 of the 17 countries where we have trended data.

In places like Canada, China, and France, this decrease reaches 8-9 percentage points. In contrast, we’ve yet to see such big decreases for expectations about the impact on the national economy.

There are two takeaways here. First, the consumer continues to expect a far worse situation for everyone else than for themselves. This is a natural protectionist mindset that often emerges in a time of stress, and is echoed elsewhere in our research where people expect other countries to fare worse – and take longer to recover- than their own one.

Nevertheless, it does suggest an artificial degree of optimism (or, perhaps, a slight lack of realism) about the potential personal impact that might be felt by many consumers as the longer-term economic implications of vast state bail-outs become clearer.

5. Staycations and domestic vacations top consumers’ travel wishlist.

Vacations continue to be the purchase consumers are most likely to have delayed; globally, 51% say they have done this, hitting 60% or more in markets like China and Romania.

When asked what type(s) of vacation people intend to take in the next 12 months, domestic vacations (49%) and staycations in the local area (30%) top the list, scoring considerably more than short-haul foreign vacations (12%) or long-haul ones (9%).

As we’ve seen in previous waves, staycations and domestic vacations are most favored by those who express less concern about coronavirus in their own country – which is what we’ve seen happen in countries which have moved furthest along the recovery route.

From this, we can conclude that as consumers develop more of a recovery mindset, they’re more pragmatic about the steps they need to take in order to enjoy vacations, manifested mainly in a desire for breaks close-to-home.

Local staycations have particular appeal in China and Japan, while domestic vacations score very strongly in Australia, New Zealand, Poland, Spain and China.

In many European countries, there’s a notable above-average desire for short-haul foreign vacations; this reflects the geography of the region but will also be influenced by proposals for travel “corridors” or safety “bubbles” between nearby countries.

Overwhelmingly, it’s a feeling of safety that people are looking for in their next vacation.

Nearly two thirds specify this as an important factor, vs half who want relaxation and a third who think price will be important.

Tellingly, price is relatively more important to those who remain most concerned about coronavirus, whereas relaxation moves ahead for those who are unconcerned.

Globally, 28% aren’t planning any vacation in the next 12 months – peaking at around 40% in Belgium, Canada, Japan and also among lower income groups.

6. Sustainability looks set to become more important than ever.

Many commentators have voiced concerns about whether the outbreak would reverse some of the pre-coronavirus momentum gained by climate campaigners.

There’ve been questions about whether it would be possible to restore levels of enthusiasm / perceived importance, and whether some might have felt less compelled to reduce single-use plastic consumption after it played a vital role in some aspects of the coronavirus response.

However, sentiment from consumers across 20 countries shows that the topic of sustainability is actually set to receive heightened attention and importance.

Globally, almost 3 in 4 say it will be important for companies to behave more sustainably.

2 in 3 think it will be more important than before to reduce their personal usage of single-use plastic, and 7 in 10 feel there will be heightened importance on reducing their personal carbon footprint / environmental impact.

Of course, we might question whether expressed sentiment will always convert into actual behaviors, but three things are particularly important here:

- Firstly, across each of these three areas, less than 10% think these issues will be less important than previously.

- Secondly, figures are consistent across all major demographic groups. Even if we look at audiences who weren’t interested in environmental issues prior to the outbreak, over 6 in 10 now place more importance on reducing their personal environmental impact.

- Thirdly, we often see a much bigger gap between the responsibility people place on companies vs. what they’re willing to undertake personally. Although a discrepancy between these figures still exists, the fact that it’s such a small one should offer encouragement.

7. There’s widespread – and growing – approval of brands advertising as normal.

Across the 20 countries surveyed, only 12% of consumers disapprove of brands running “normal” advertising. That dips to as low as 6% in New Zealand.

The numbers who either approve of, or have neutral views about, “normal” advertising have grown consistently since March and April.

They hit 90% or more in Australia, Italy, New Zealand, Singapore, Spain, and the UK – showing that sentiment for a return to normality is particularly strong in some of the countries that are furthest ahead in their recovery or which are starting to emerge from particularly tough lockdowns.

In New Zealand, the figures have increased from 75% in March, to 85% in April, to 94% in May.

Conversely, we’re seeing small but consistent decreases in approval for coronavirus-related advertising.

Although overall approval for this still remains very high in all countries, the numbers have successively ticked down in over twelve of the seventeen countries where there is trended data available across March-April.

When asked about brands and businesses returning to normal (e.g. opening shops, running regular advertising, etc), it’s 9 in 10 globally who think this is important. Figures peak in Italy and Romania, as well as among baby boomers and the higher income group.

As a comparison, just over 6 in 10 think it’s important that sports leagues / competitions resume, while around 8 in 10 place importance on cafes, bars and restaurants being able to reopen.

In terms of the measures they want to see in public places, regular cleaning / disinfecting (68%), social distancing measures (58%) and provision of hand sanitizer (57%) are the biggest priorities for consumers. As might be expected, many of these safety-related measures are most important to baby boomers.

Cashless payment options should see a boost; globally, about 40% say these will be important to them in public places, but here we see the opposite age trend at work: Gen Z (41%) and millennials (42%) are over 10 points ahead of boomers (30%) for this. The younger generations also have a notable lead for self-service payment options.

8. Alcohol behaviors have diversified during the outbreak.

For the first time in this wave, we asked consumers how their alcohol consumption behaviors have changed during the outbreak.

Across the 20 countries, 12% say they’ve consumed alcohol at times they normally wouldn’t have,

A further 14% feel that their overall consumption levels have increased. The UK (19%), Ireland (18%), the U.S. (17%), New Zealand (17%) and Brazil (17%) are the places where people are most likely to feel they’ve drunk more alcohol overall.

New types and brands of alcohol have also been discovered during the lockdown period. Some 12% say they’ve tried new brands, with a similar proportion reporting trying new types or varieties.

In both cases, the figures peak among millennials and the top income group.

During lockdown, it’s also millennials who have spear-headed the drive towards buying more alcohol online for home delivery; globally, 15% of this generation report having done this, vs. just 4% for baby boomers.

Offline, Gen Z and millennials have collectively been at the forefront of buying alcohol directly from licensed premises to take home.