The challenges facing the world right now are shaking up global economies, pushing healthcare systems to their limits, and upheaving people’s daily lives.

Currently, more than one-third of the world’s population is under some form of lockdown. To put it simply: there isn’t a business, government, or person that hasn’t felt the effects of coronavirus, even to some degree.

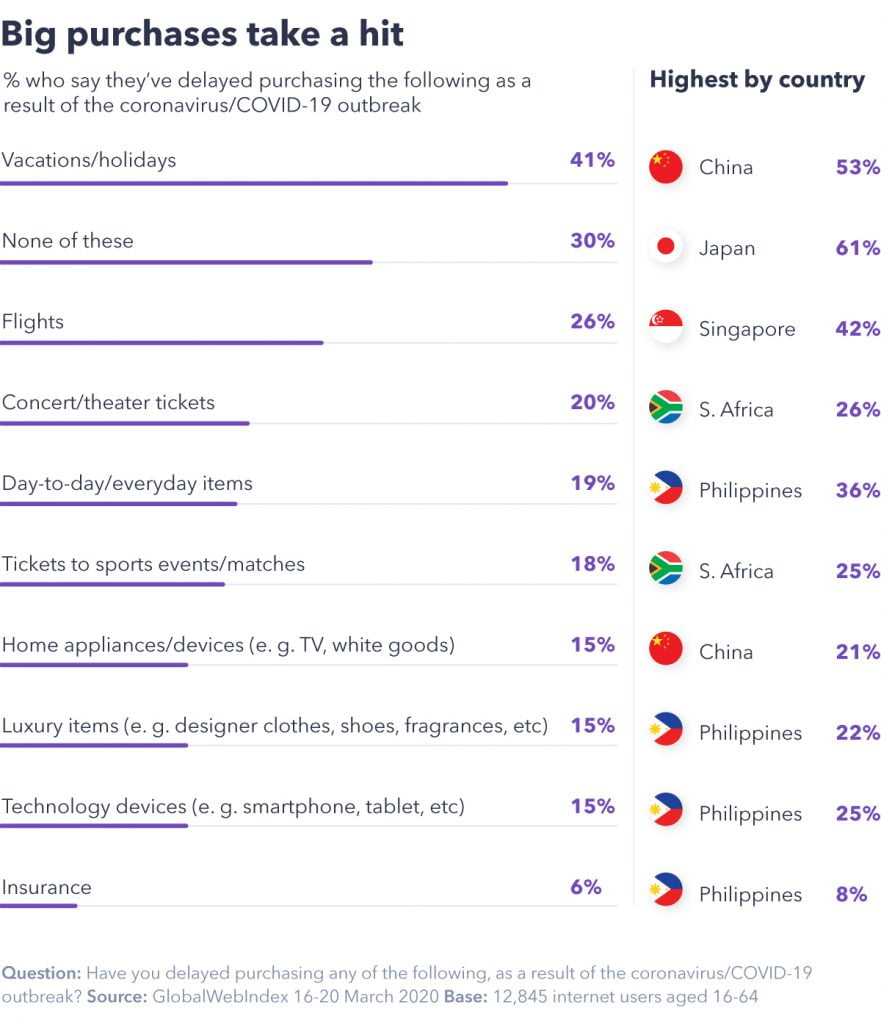

One very noticeable impact of the outbreak is its influence on how and what people purchase. This is having a knock-on effect on various industries and key groups.

Our latest COVID-19 research, conducted between 16th-20th March among 12,845 internet users across 13 markets, shows how purchase behaviors are changing amid the crisis and what this means for brands.

Find full reports and frequent updates on the consumer response to COVID-19 in our hub. If you want to analyze the data in more detail, you can access it for free in our platform.

Travel purchases are taking the brunt.

More expensive purchases, and those that involve travel, are the most likely to be delayed while the outbreak is still ongoing.

For example, 41% of global consumers have delayed purchasing vacations and holidays.

This rises to 53% in China, a country that has been in lockdown for over 6 weeks and is only starting to re-emerge on the other side.

1 in 4 consumers have also delayed purchasing a flight, jumping to over 2 in 5 consumers in Singapore.

Heightened delays in Singapore are likely because of very early restrictions that were implemented there, such as strict border controls, aggressive testing measures, intensive tracing of carriers, and surveillance actions.

The country has managed to contain the virus so far but, understandably, consumers are still cautious about booking new travel.

Among travel enthusiasts (those who express an interest in travel), around half say they are delaying purchasing a vacation and close to 1 in 3 are delaying purchasing a flight.

On the other hand, only 9% of Japanese internet users say they’re delaying purchasing flights and just 14% say they’re delaying booking a vacation or holiday – the lowest of all countries we’ve tracked.

Additionally, 61% of consumers in Japan selected “none of these” as an option, suggesting that they’re not delaying purchases on the same scale as other countries.

Interestingly, even though they’re not as prohibitive with their own plans, Japanese consumers are the least optimistic of all markets surveyed that their country and the world will overcome the coronavirus outbreak.

Japan has certainly been the exception so far, having seemingly managed to dodge the explosive rates of the virus that other countries have experienced.

Despite concerns that they’re being too optimistic and lenient, daily life seems to continue as normal for many, with people flooding national parks and gathering in large groups at various events, which may partly explain why consumers there are less inclined to delay purchases.

Luxury is taking a backseat – especially in China.

The luxury market is also taking a hit, with 15% of consumers delaying purchases of luxury items.

This rises to 22% in the Philippines and 20% in China.

And among an audience of affluent, luxury buyers in China, around 2 in 5 say they’re delaying purchases of luxury items.

For brands operating in China, this presents a serious blow as this country currently dominates the luxury purchases market and in fact, is expected to account for 41% share of the global luxury market by 2025. On Singles Day last year, Alibaba saw revenues of $38.4 billion.

In addition, our global research found that 65% of Chinese consumers say they try to buy the premium version of a product, compared to 55% of global internet users. This underlines the challenges facing brands in the luxury sector who rely heavily on Chinese consumers.

Age is also a strong influencer for delaying purchases. We found that Gen Z are most likely to be delaying purchases in several categories, no doubt in part to their lower average income levels.

Notably, over 20% of Gen Z say they’re delaying buying technology devices such as smartphones. This is important because Gen Zs are the biggest users of mobiles, spending an average of 4 hours and 9 minutes globally per day on their smartphone.

Purchases could be delayed for quite some time.

It’s clear that purchasing habits could take a long time to return to normal.

Over 40% of consumers say they will buy major purchases only when the outbreak decreases or ends in their country.

But close to 20% say they will wait until the outbreak decreases or is over globally.

Chinese consumers are most likely to say they’ll resume purchasing when the outbreak decreases or ends on a national level (52%). In comparison, Singaporean consumers would prefer to wait until this happens globally (35%).

Younger generations are also more inclined to wait until the outbreak improves on a national level. Similarly, the top income group are most open to making their purchases once the national situation begins to improve.

All categories risk being affected significantly until the crisis is over. Looking at our breakdown, around half of consumers who are delaying purchases of flights and technology devices say they will buy these only when the outbreak is over in their country or globally.

And 53% of those who are delaying purchases of vacations or tickets to sporting events say the same – increasing to 56% among sports fans.

Consumers aren’t just delaying purchases either; when it comes to travel, many are abandoning their plans entirely. 22% of global consumers say they have canceled planned trips to another country (rising to 49% in Singapore) and 35% have canceled planned trips within their own country (rising to 46% in China).

Consumers are struggling to buy essentials.

Many of us are now familiar with the sight of empty supermarket shelves, devoid of the essentials we usually buy. Fear has undoubtedly taken over consumer’s usual shopping behaviors. Pasta, toilet rolls, hand sanitizer, and other long-life foods are just some of the products that consumers have been loading up on in recent weeks.

45% of consumers globally say they’ve purchased extra food and drink supplies.

While 43% say they have purchased extra household supplies such as toilet rolls, tissues, and cleaning supplies.

According to Helen Dickinson, Head of the British Retail Consortium, “There’s £1bn more food in people’s houses than there was three weeks ago”. Retailers are facing the level of demand that’s typically seen around Christmas time, which unlike now, is expected and they have time to plan for.

Many retailers say they have enough food supplies, but they’re struggling to get items into stores as fast as consumers are purchasing them.

This has left many supermarkets in the UK, such as Tesco and Waitrose, with no option but to limit the amount of items a person can purchase. And the UK government is urging consumers to shop responsibly and to be considerate of others.

Many UK retailers have also implemented dedicated shopping hours for elderly, vulnerable groups, and NHS medical staff to allow them to get the items they need.

We’re certainly seeing the impact of this excessive behavior across markets.

Our data shows that Australians are struggling the most to buy fundamental household and food items.

Two-thirds of Australian consumers say they’re struggling to buy essential household items like toilet rolls, compared to just 8% in China and 7% in Italy.

Also, just over a third of Australians are also having a difficult time purchasing food and drink items (globally just 11% say the same). This is partly because of supply issues from countries Australia relies on for trade, such as China.

There also seems to be an information gap in South Africa. For example, 29% of South Africans have the biggest issue with getting up-to-date information about the situation in their local area and 22% struggle to get up-to-date information about the situation in their country.

This highlights just how important accurate, timely, and trustworthy news is at this time.

PPE and medical supplies are in high demand.

Face masks (45%) and hand sanitizer gel (30%) are the top items globally that consumers are struggling to purchase.

By country, Japan sees the highest struggle to buy face masks at 78%, while the Philippines struggles the most to purchase hand sanitizer gel at 70%. This is a common occurrence across most countries.

Google searches for hand sanitizer have skyrocketed, while many pharmacies and stores have sold out. With the increased demand, Amazon and Walmart sellers have also been criticized for price gouging

But some brands have been lending a hand. Louis Vuitton owner, LVMH, started making hand sanitizer to meet demand and SpaceX is also manufacturing its own hand sanitizer and face shields with plans to donate materials to hospitals.

The onus is on brands to do more.

More than ever before, consumers are expecting brands to take action. As we covered recently, brands are being put to the test to see how they respond and consumers are taking note.

Around 80% of global consumers agree that brands should close non-essential stores.

But there are notable country differences here. There are some countries that are overwhelmingly in favor of brands closing non-essential stores, such as Italy, Spain, and France.

In the worst and second worst hit countries in Europe, Italy and Spain, 93% of consumers in both markets agree that brands should close non-essential stores.

In contrast, just 36% of consumers in Japan feel the same. This is likely because their current situation is very different to countries like Italy and Spain. Notably, Japan is the least likely of all countries to believe lockdown is necessary. Just 16% believe the whole population should be locked down at home compared to 79% in France and Spain and 74% in Italy.

Brands around the world are stepping up and closing stores to protect staff and the public. But some brands, whose response has not been as strong, have come under scrutiny.

Recently, UK retailer, Sports Direct, came under fire from the government and social media users after it went against the advice of the government to close non-essential stores.

In an open letter, Sports Direct, owned by Mike Ashley’s Frasers Group, claimed that its sports equipment stores were an essential service in the fight against the pandemic and would remain open. But after serious backlash from the government and users on social media, the company did a U-turn on its initial stance.

It’s an important lesson that during times like these, brands will be remembered for putting public benefit ahead of profits and for taking action that supports the uphill battle we all face.