Hear from CIOs, CTOs, and other C-level and senior execs on data and AI strategies at the Future of Work Summit this January 12, 2022. Learn more

Payhawk, an integrated financial software platform that combines corporate cards, bill payments, expenses management, and more in a single system, has raised $112 million in a Series B round of funding.

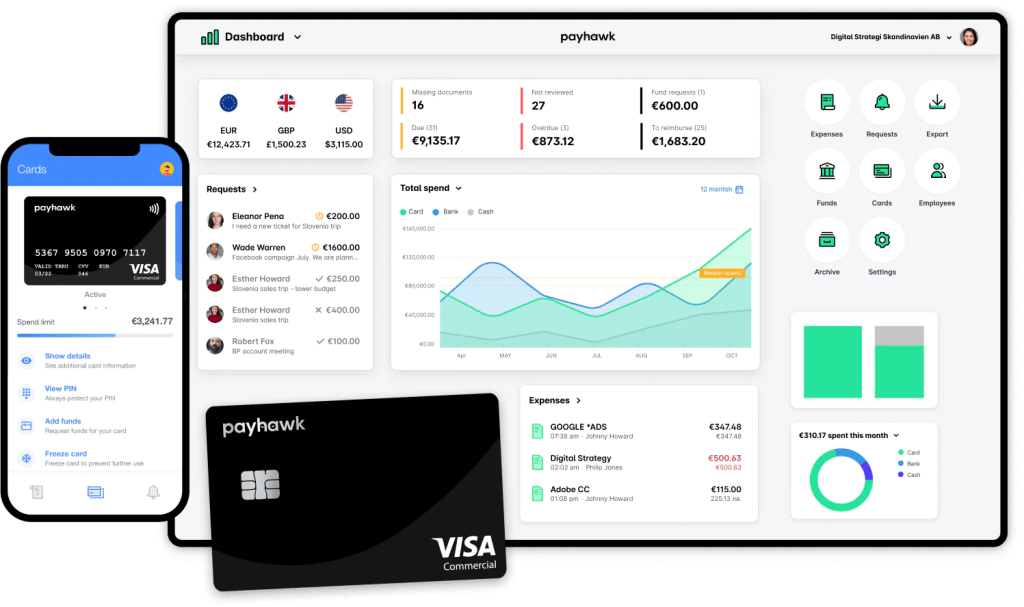

Founded in 2018, Payhawk is pitched as an easy way for finance teams to replace manual processes and disconnected tools with a unified platform for SMEs and enterprises to easily integrate and automate myriad financial processes.

“Payhawk consolidates all company spending policies and workflows into a single system — cards, bills and reimbursements,” Payhawk CEO and cofounder Hristo Borisov told VentureBeat. “As it stands, finance teams in large enterprises typically use four to five systems, or more, to manage all payments — with Payhawk, they can use a single system across all their businesses.”

For now, Payhawk is limited to European entities, but the company is now gearing up for a U.S. launch next summer, and plans to also launch in Australia, Canada, and Singapore by the end of 2022.

Integrated financial management

Above: Payhawk

In addition to a physical Visa debit card that employees can use to cover all their expenses, companies such as Luxembourg airline Luxair use Payhawk to synchronize their expenses and receipts with their accounting and ERP (enterprise resource planning) tools of choice, including Oracle, SAP, QuickBooks, Sage, and Xero. Admins and finance teams can use Payhawk to define specific spend policies, for example, setting limits for individual workers or teams, and can also approve particular expense requests on a case-by-case basis.

As part of its recently launched Enterprise Suite, Payhawk also now offers larger businesses additional tools such as single sign-on (SSO) functionality.

Payhawk’s raise comes just a month after corporate travel and expenses management company TripActions raised $275 million at a $7.25 billion valuation, which serves as further evidence of the growing demand for controls and big data insights into corporate spending.

Payhawk had previously raised around $24 million, and for its latest series B investment, the London-headquartered company ushered in a slew of institutional investors including Greenoaks (which led TripActions recent funding too), QED Investors, Earlybird Digital East, and Eleven Ventures. With another $112 million in the bank, this round that values the company at $570 million, Payhawk is now well-financed as it prepares to launch its product outside of Europe over the next year.

VentureBeat

VentureBeat’s mission is to be a digital town square for technical decision-makers to gain knowledge about transformative technology and transact.

Our site delivers essential information on data technologies and strategies to guide you as you lead your organizations. We invite you to become a member of our community, to access:

- up-to-date information on the subjects of interest to you

- our newsletters

- gated thought-leader content and discounted access to our prized events, such as Transform 2021: Learn More

- networking features, and more

Become a member