Throughout our latest Covid-19 research, it’s abundantly clear that optimism is a crucial factor in how people are choosing to navigate the crisis.

What’s also clear is that various groups, businesses and institutions have a role to play in fostering this optimism by playing their part during the crisis.

This is an uncertain time for all, but alongside supporting efforts against the pandemic, there are proactive measures brands can take as they too weather the storm. Much of these will be determined by consumer sentiment and behavioral changes, which we explore below.

This data is taken from our latest multi-market research into the impact of coronavirus on consumer attitudes and behaviors. The research was collected between 16-20th March.

We want anyone who needs this data to have access to it. You can track the latest reports and updates on our dedicated hub. And if you want to analyze the data in more detail, you can access the results from this survey in our platform.

Here are some of the most important insights gathered from our international study.

People are generally optimistic.

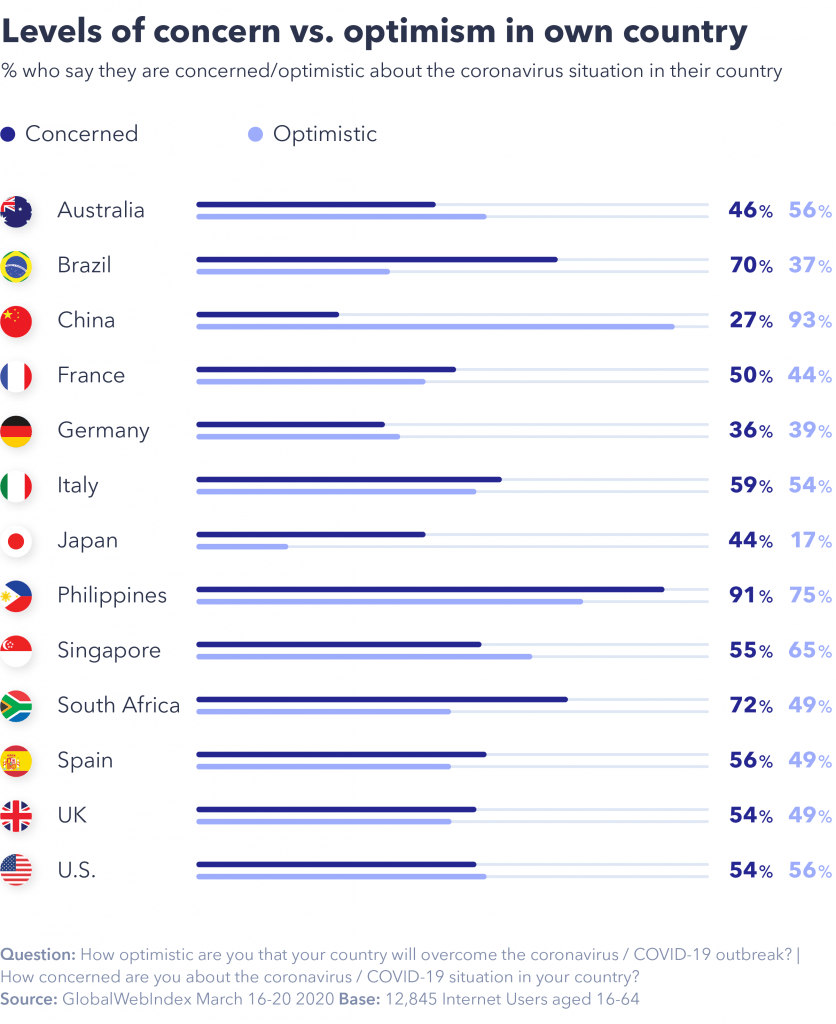

Levels of optimism and concern among consumers in regards to the situation in their own country vary greatly between markets.

China is among the most striking here. Having now found some respite in the pandemic, and with elements of normality reappearing in society, it’s no wonder those in China have such a positive attitude towards the situation in their home country.

On top of this, and perhaps reassuringly for other countries looking on, China has extremely low levels of concern about the situation in their country. This is despite having experienced some of the worst of the pandemic so far in relation to elsewhere.

At the other end of the spectrum we have Japan.

Given the wider cultural environment in Japan tends to view strong public expressions of opinion with suspicion, the extreme responses we see among Japanese consumers throughout this research study are particularly poignant.

Just under half in Japan are pessimistic about the situation in their country, and this rises even higher among younger age groups.

This compares to just 10% in Italy who say the same, and just under 20% in Spain and the UK. Users in Brazil are also fairly pessimistic in their outlook (33%), and again, it’s younger age groups who tend to display a more negative sentiment.

Japan’s bleak outlook on the situation is accompanied by a relatively low level of concern towards their own nation compared to other countries in the study. This implies that alongside fears around the impact of the virus itself, negative perceptions over how the crisis is being handled are compounding the issue, something we explore further later.

Communication is the key to optimism.

Just as governments, businesses, populations and any other groups or institutions should be mitigating against the spread of the virus, they should also be fostering optimism, and there appear to be factors which can contribute to this.

Aside from household essentials and preventative equipment like face masks (already in short supply in countries outside of Asia) and hand sanitizer, one of the most important factors in fostering optimism is information, and thereby, communication.

Optimistic consumers are notably more likely to say they have good access to information on the long-term plan to tackle coronavirus, the situation in their local area and their country as a whole.

In fact, the optimists are around 80-100% more likely to say they have good access to information on their local area and their country compared to the pessimists.

Communication is something everyone – from governments, to companies and individuals – has a stake in, and it’s an area where businesses have an important role to play.

In this respect, the pivotal role played by social media companies is also extremely clear in our data, given especially consumers’ increase in engagement with social channels in light of the virus.

By some margin, consumers’ expectations of these platforms primarily revolve around information vetting around fact checking and screening fake news (over 65% expect this).

This puts expectations above and beyond social media companies fostering community and supporting live streams of events.

The resulting disruption is expected to be over by Christmas.

Although there’s much uncertainty among official governing bodies about when we can expect things to return to normal, consumers generally anticipate the pandemic to be over within the next 4-6 months in their own countries.

Chinese internet users anticipate the shortest timeframe for things to recover; on average expecting the outbreak to last just over 2 months.

As the epicenter of the pandemic has moved into Europe (and now towards New York), the most affected regional countries so far – Italy, Spain and France – are anticipating a fairly prompt recovery, especially compared to the UK, which is believed to be experiencing a slightly earlier stage in the outbreak.

Like the UK, other countries including South Africa, Australia, Singapore and Germany think the outbreak in their country will be over by October.

A return to normality on a global level is believed to take much longer, with consumers on average adding around two and a half additional months onto the anticipated recovery period.

Companies need a post-covid plan.

The majority of consumers in these markets (almost 80%) have opted to delay the purchasing of various products in light of the outbreak, with vacations (41%) having predictably taken the biggest hit.

In addition, around a fifth have delayed the purchasing of concert/theater tickets and everyday items. In most of the 13 markets, these purchases will be postponed until the outbreak in their country is over. But in the rest of the countries, consumers remain uncertain. The only exception here is Singapore, where people are most likely to wait until the situation recovers globally.

We can also segment perceptions on when people expect to resume these purchases by the type of product purchase which has been delayed.

In almost every case, consumers say they’ll wait for a full recovery, with the only major outlier here being insurance. For insurance, people are most likely to purchase once they start seeing signs of recovery in their country.

According to the consumer view, that means that in most cases purchases won’t resume until the latter end of this year. But the situation is moving extremely quickly, and consumer sentiment is heavily influenced by new developments.

All eyes should be on China right now, which serves as an important example for Western companies.

Although the economic recovery in China so far might be vulnerable, there have been plenty of examples of businesses which have prioritized agility to ride the storm and prepare for what comes after, with many early success cases.

The speed and prospects of recovery will differ between countries, but the case of China highlights how businesses can redirect their resources, during the crisis, by preparing detailed recovery planning scenarios – which can take a long time.

Alongside this, they should be supporting societal efforts through pivots in production where relevant, and though strong communication efforts.

There’s also a need to be mindful of the lasting impact of such a monumental global event on consumer behaviors.

Although our 46-country Q1 2020 wave of syndicated research is still being collected, we’ve seen some interesting early indications of behaviors changing from month to month in light of the virus…

The most striking of these have been in media consumption shifts, with sharp increases between January and March in time spent online on mobile, news consumption, and in time spent on social media.

Widespread remote working practices adopted by many industries as a COVID-19 precautionary measure may incite a reinvention of the office as businesses come to realise the benefits of flexible working practices.

At a personal level, consumers may also change behaviors following a dramatic shift in their daily routines.

For example, newfound reliance on social media to fulfil every social need in countries with restricted movement has resulted in broad shifts in the way people use these platforms, especially when it comes to commerce and entertainment activities in European countries.

Business approval ratings are high.

There have been encouraging reactions to the ensuing pandemic across a range of industries.

From alcohol brands, to retailers and luxury brands, companies with the right expertise and means of production have been pivoting their manufacturing to help fulfil shortages in essential items like hand sanitizer and face masks; items which as we saw earlier, have a strong impact on optimism.

As we covered in our recent blog summarizing the key findings from our latest multi-market study, people are most in favor of brands responding to the outbreak by providing flexible payment terms (83%), offering free services (81%), closing non-essential stores (79%) and helping to produce essential supplies (67%).

The most affected countries in our study serve as examples in this respect. Internet users in Italy, the Philippines, Spain and France are the most likely to strongly agree with companies taking these more supportive steps.

It’s in these same countries that large corporations enjoy such strong approval ratings in their handling of the crisis, putting them on par with governments.

Through the support of unprecedented economic stimulus packages and state welfare reform measures, businesses are also receiving more assistance than they may have anticipated to help them stay afloat and support their staff.

This has no doubt impacted approval ratings for employers too, which stand strong at almost 70%.

There are interesting results here when we segment by industry too: industries which have been most affected by the pandemic like travel, transportation/distribution, retail, hospitality and healthcare, as well as industries which typically first feel the shocks of an economic crisis like building/contracting, have the lowest approval ratings. But even here, the majority (over 50%) of consumers in these industries approve.

Japan once again stands as a notable outlier here. In Japan, approval ratings are remarkably low for every group and institution, and especially for the government (at just 23%).

Low levels of approval felt towards a range of organizations are likely to correlate with the low levels of optimism around the coronavirus outbreak in Japan. The negative sentiment also potentially reflects the strong criticism aimed at the Japanese government in its handling of the Diamond Princess cruise ship – causing nearly 700 people to become infected when the ship docked near Tokyo.

These approval ratings also give us a glimpse into the different forms of community spirit which have proved pivotal during the crisis, especially between collectivist and individualist countries.

In Western countries, the highest approval ratings – and by some distance – are for local shops, highlighting the central role of local community ties and support which may see a resurgence in light of the decline of traditional community in these countries.

In China and Singapore, a much more collective sense of community emerges. Governments and populations post much stronger approval ratings than that seen in other countries. Heavy-handed but effective state measures in managing the outbreak in these markets may also be the reason why governments are the most approved-of entity in our list.

But in every country included in this study, consumers recognize the efforts of a wide range of groups and organizations.

At times like this the motivational among us often invoke the Chinese expression for “crisis”, which is composed of two characters: “danger” and “opportunity”.

The impact of the virus affects everyone, and that sense of “we’re all in it together” has created opportunities for companies to prove their value to consumers in such a crucial time for society, especially when trust in large corporations has been in such short supply up until now.

Notes and Methodology

All stats in this report are from a GlobalWebIndex custom recontact survey fielded March 16-20 among 1,004 (Australia), 1,001 (Brazil), 1,003 (China), 1,016 (France), 1,010 (Germany), 1,010 (Italy), 1,079 (Japan), 1,008 (Philippines), 1,008 (Singapore), 573 (South Africa), 1,005 (Spain), 1,040 (UK) and 1,088 (USA) internet users aged 16-64.