Chart of the Week: 83% of customers feel rewarded by cash back, making it the most popular type of loyalty scheme

Customer loyalty is a big aim for any e-commerce brand. Not only do loyal customers mean repeat purchases, they also recommend your brand to others and are more likely to become social advocates for it.

While businesses know the importance of customer loyalty, it seems that very few are doing anything to really encourage it.

How are loyalty schemes getting it wrong?

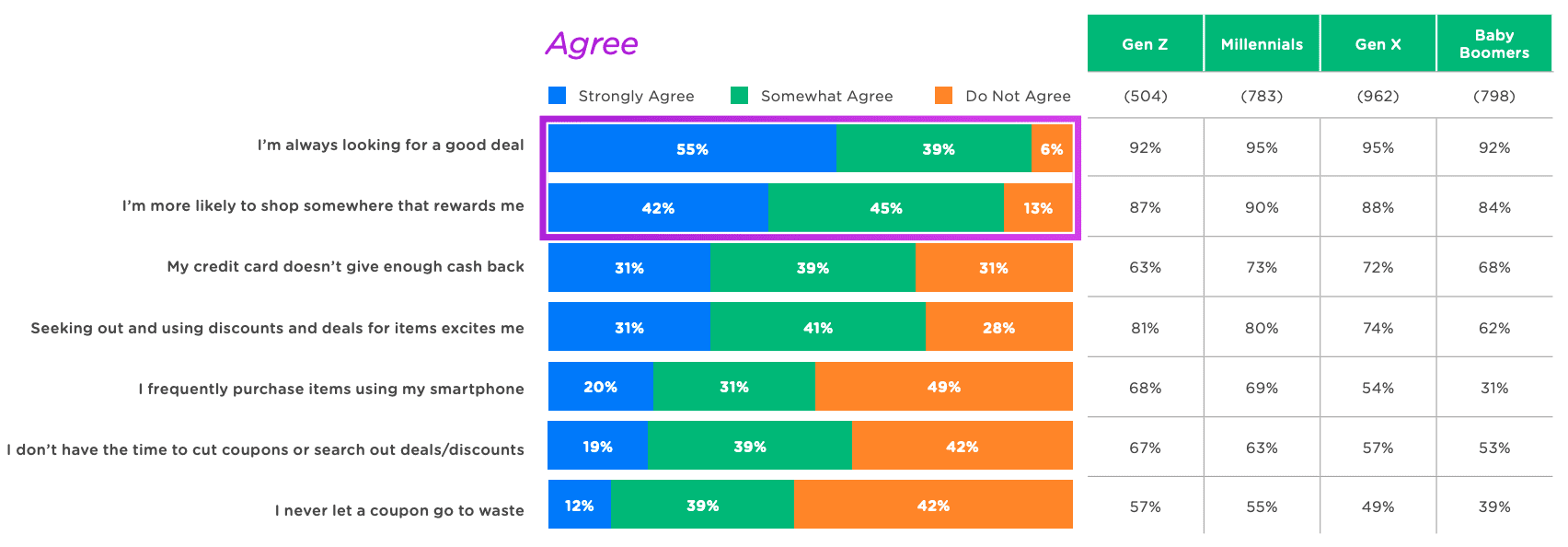

According to new research from Dosh, 48% of customers don’t feel as though their loyalty is valued by major retailers. This could mean that current loyalty schemes aren’t quite hitting the mark, meaning there is a lot of opportunities for retailers – especially as 87% of consumers are more likely to show somewhere that rewards them.

The research reveals that existing customer loyalty schemes aren’t resonating with customers, perhaps because they lack immediate rewards and tend to require work from the consumer. The lack of immediate incentive means customers don’t have an extra reason to return. Especially as 91% say they don’t feel rewarded by tiered systems and 89% saying there is little to no reward from retailer credit cards.

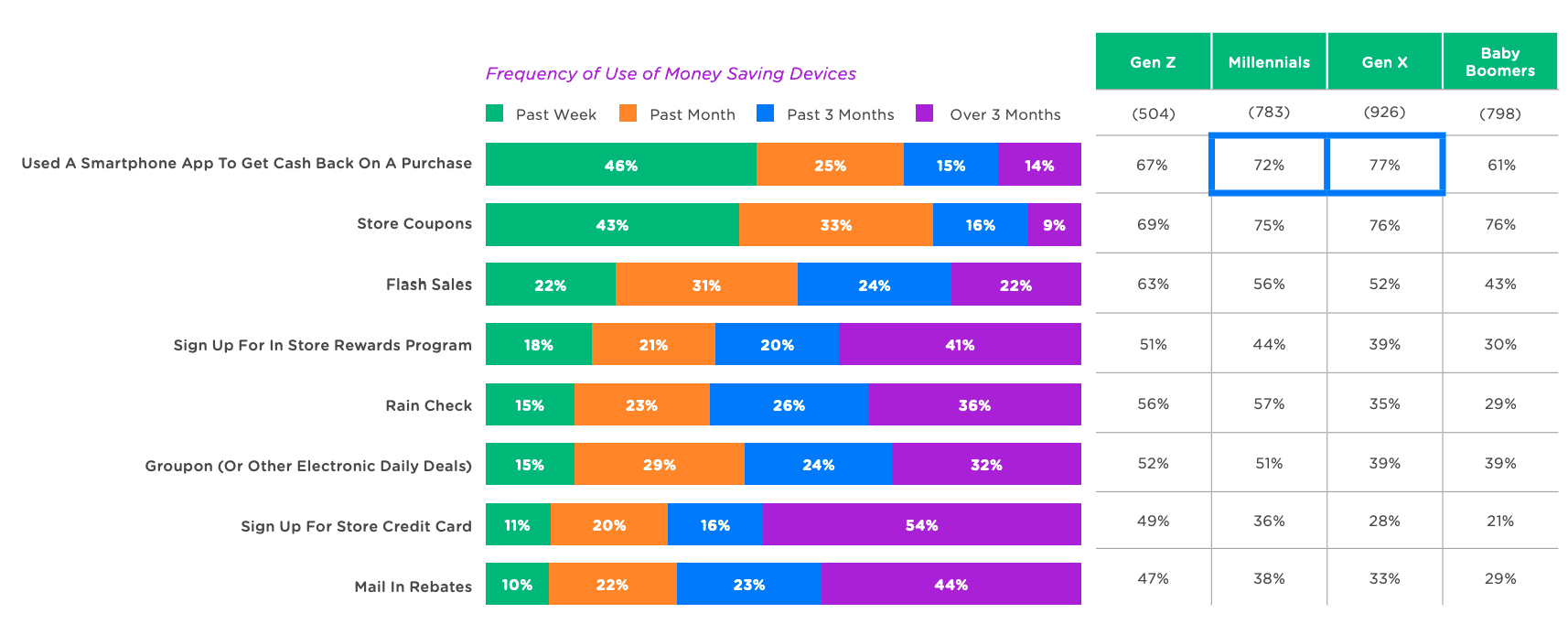

Retailers now need to consider what types of rewards they can implement that will allow their customers to engage with them seamlessly. This is especially important when it comes to engaging younger shoppers, who are less likely to be swayed by traditional loyalty schemes. In fact, only 43% of Gen Z shoppers said they had signed up for a rewards program in-store, compared to 53% of millennials and 57% of Gen X.

So exactly why type of loyalty reward is best for showing your customers you care about them and for engaging more people?

The best types of rewards

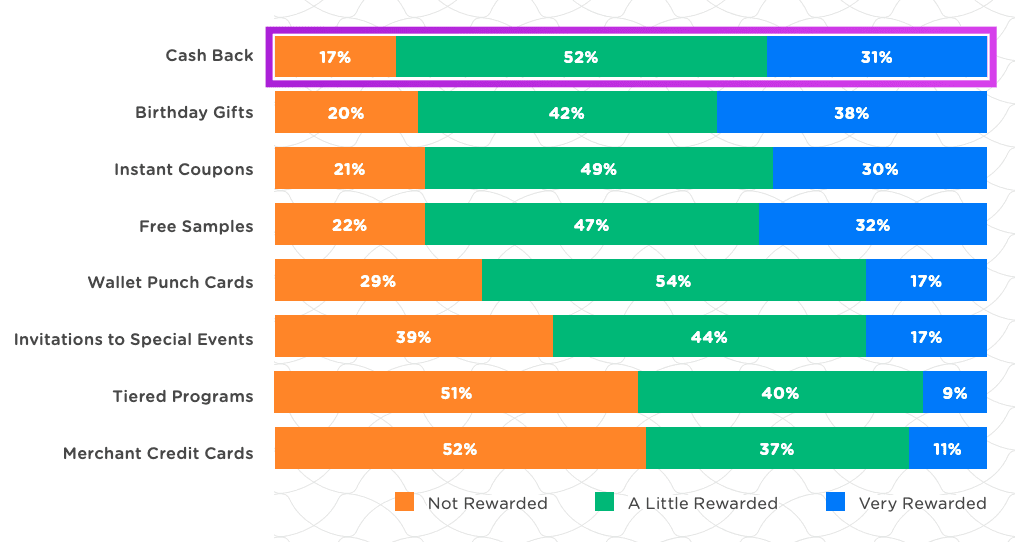

Moving away from traditional options like retailer credit cards, tiered programs and event invitations, the research found that the most popular type of loyalty scheme is one that offers cash back.

Ideal for offering an instant reward, cash back effectively helps customers save money without them having to cut out coupons or search for a deal. In fact, 83% reported that they feel rewarded when they receive cash back after a purchase. And this loyalty scheme is ideal for mobile too, with 45% of respondents stating that using a mobile app for cash back is easier than dealing with vouchers or coupons.

However, instant coupons still have a place in loyalty schemes, with 79% saying that vouchers they can use straight away to save money leave them feeling rewarded. Birthday gifts were also a big crowd pleaser, with 80% feeling rewarded by these, while 79% of customers appreciate free gifts.

A tech-first approach

While targeting Gen Z and Millennials is an important tactic, especially when it comes to e-commerce, these customers are very different to older consumers. The biggest difference is that Gen Z (81%) and Millennials (80%) are excited by the process of looking for deals and discounts, compared to just 62% of Baby Boomers.

They are also much more likely to purchase items using their smartphones with 68% of Gen Z an 63% of Millennials saying they do this. In comparison, only 31% of Baby Boomers make regular purchases using their smartphone.

Gen Z’ers and Millennials are also more likely to have connected their bank accounts to another app on their smartphone to make shopping easier, with only 44% doing the same.

This shows that if the younger generations are your target audience, you need to create a tech-first approach that heavily incorporates mobile.

The research also revealed that 72% of Millennials and 67% of Gen Z consumers had used a smartphone app in order to get cash back on at least one purchase in the month prior to the survey. In fact, even if the cash back amount for a purchase is small, respondents are happy to put extra work in to get it because the amounts add up over time, with 47% of all respondents saying they’d download a cash back app.

Final thoughts

This digital-first customer means that e-commerce sites have a lot of opportunities to improve customer loyalty. Developing a scheme that is highly targeted and offers faster rewards could help bring consumers back time and again. It could also be a key approach to ensuring your brand appeals to Gen Z and Millennial shoppers.