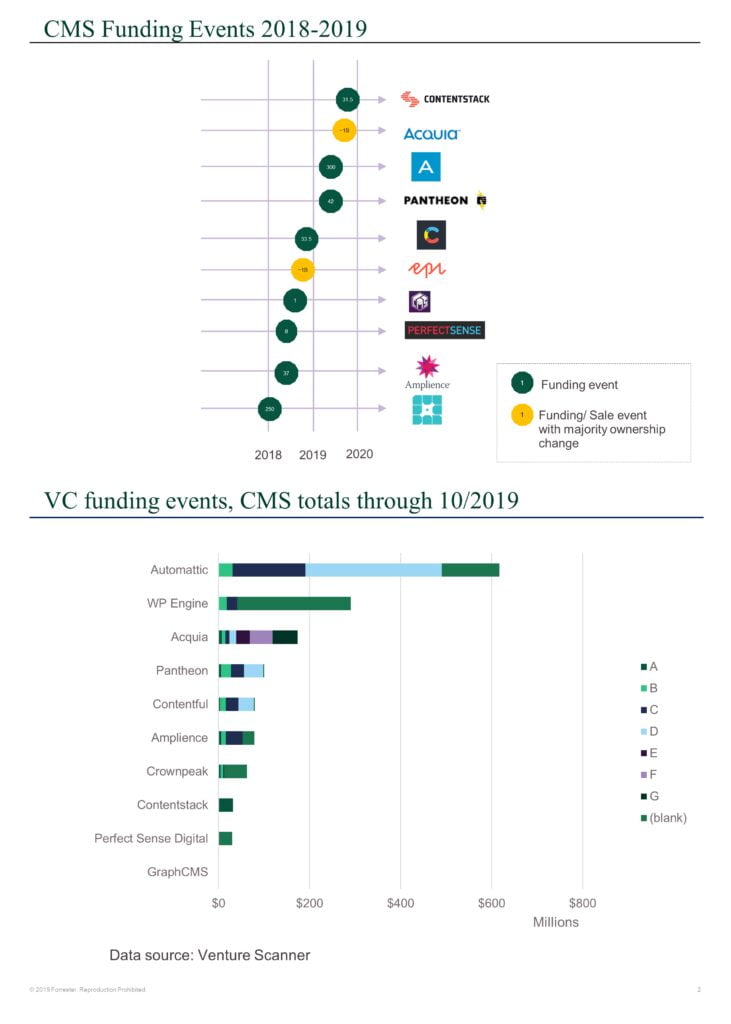

Recently, the CMS market has been swimming in funding rounds and PE buyouts, with many, many zeroes behind each announcement. Below is a recap of some of the most recent events, working backwards, since the beginning of 2018. So far, nothing out of the ordinary…but looking at this visually with a stacked bar chart using data from our friends at Venture Scanner, and the size and focus of these investments really jumps off the screen.

- October 2019: Contentstack took a $31.5M series A from Insight Partners

- September 2019: Vista took a majority position in Aquia with a valuation of more than $1B

- September 2019: Automattic took a $300M series D round from Salesforce Ventures

- March 2019: Pantheon took a combined $42M series D round led by Sageview Capitol

- December 2018: Contentful took a $33.5M series D led by Sapphire ventures

- September 2018: Episerver gained a new PE owner, Insight Partners, with a valuation of more than $1B

- June 2018: GraphCMS took a $1M seed round from Paua Ventures and Richard View Ventures

- May 2018: Perfect Sense orchestrated an $8M debt round from Silicon Valley Bank

- April 2018: Amplience took a combined $37M series C round from Octopus Ventures and Columbia Lake Partners

- January 2018: Silverlake Partners invested $250M into WPengine

While funding trends are just one measure of a market’s vitality, it’s a good proxy for where the heat is and where players from outside the market (like Salesforce) are placing their bets. While looking above, we can consider three trends that may signal the shape of the next phase of CMS:

- The CMS market is mature, yet still outpacing broader software spending. As of a year ago, we projected this ~$4billion market to keep growing at 8.7% CAGR. While this means it will outperform broader enterprise software spending (slowing to 4% annually in the next decade), there’s no mistaking that CMS is a mature market. CMS adoption in the enterprise has been steady for years, and the appetite to re-platform seems to have slowed, but still this is a sector with some upside even as the era of “classic” Web CMS is closing.

- The opportunity for market consolidation is coming. SaaS economics predict a “winner take all” outcome. While that theory is not without flaws, as we knock on the door of true-enterprise SaaS CMS, with all the benefits of multitenancy (horizontal scalability, zero upgrade pain, faster access to new features, etc.) the concentration of recent investments does support this thesis. Even so, the presence of a few new early rounds also highlights that even among the sequoias there are seeds still being planted with the hope of growing the next Automattic – or the next company they might acquire.

- “Open” strategies are being rewarded. While Amplience and Perfect Sense focus on deep vertical relevance (ecommerce and news media), the primary correlation across these investments is ‘openness’. Open source communities Drupal and WordPress embrace this notion of open, community-led development at a DNA level, which maps to Acquia, Automattic, Pantheon, and WPengine. Similar in spirit if not business model, Contentful, Contentstack and GraphCMS can be said to be broadly horizontal and open with well documented API’s and code samples, making them more ecosystem friendly.

So, are we at the end of CMS as we know it? Our call late last year around the rise of Agile CMS indicates YES. But does that indicate the end of the road for certain vendors in this sector? Recent funding activity gives another clue as to how the “smart money” is picking the strongest candidates to survive and thrive in 2020 and beyond.

Want to learn more about our take on the future of CMS?, How we see the prospects for various vendors? (and especially the role of content in the broader digital experience stack). Feel free to set up an inquiry with me (for clients!).