Expedia‘s (NASDAQ: EXPE) adjusted profits fell 7% year-over-year due to the following reasons:

- incremental weakness in SEO volumes, due to headwinds from Google’s search engine practices in favor of its own Google Flights and Google Hotels

- a related shift to high-cost marketing channels as Google shifted more volume toward its own products

- softer than expected revenues at Trivago and Vrbo

- Houses and other non-hotel properties make up about 20% of accommodations, but they are growing in importance. In the recent Q3, investors were disappointed when VRBO grew bookings by just 5%.

View our interactive dashboard analysis on Explaining The Decline In Expedia’s Profits

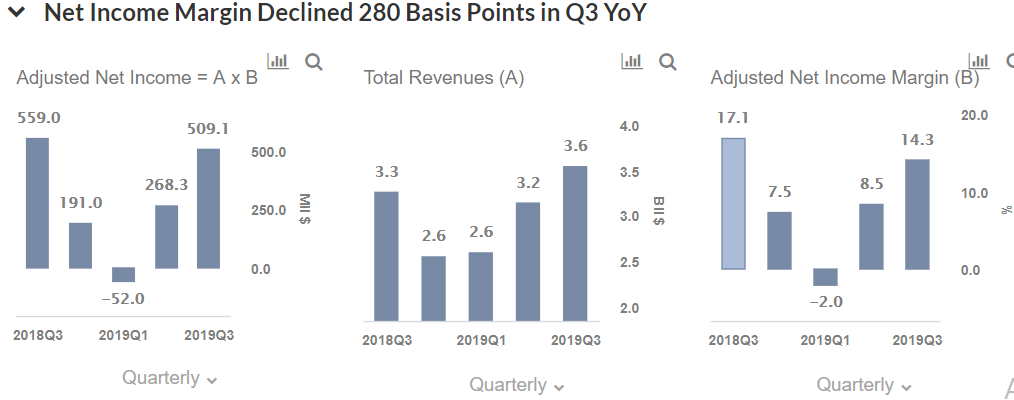

Net income margin increased sharply in 2019 following the investment in home-vacation rentals. However, it still fell 280 basis points year-over-year, due to ongoing challenges in search engine optimization and a normalization in average daily room rate growth in the industry.

Trefis Price Revision

We estimate the fair value for Expedia’s stock to be $121 based on our EPS estimate of $6.98 for full-year 2020, and using an implied P/E multiple of 17.3. Recent quarterly results led to a 30% stock plunge in the market, which led to our 10% downward price revision. However, we remain optimist about the company’s long term growth prospects, particularily its Vrbo division. In addition, we also expect significant growth across room nights booked and increased air ticket revenues following the upcoming holiday season. The company is also aggressively investing to migrate to cloud computing systems to cut costs and improve marketing to better compete with rivals such as Booking Holdings (NASDAQ: BKNG).

Expedia has focused more on expanding the company’s current brands and it has been working to integrate Vrbo into the rest of its websites. Vrbo basically operates an online marketplace for the vacation rental industry. We believe that Vrbo’s massive European presence, and its partnerships with OTAs in China seem to be promising in the long run. Although the company’s near-term outlook is a little bit of a drag for this business, we expect the idea of individuals renting out their home to make extra money to be quite lucrative going forward.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

More Trefis Research

Like our charts? Explore example interactive dashboards and create your own