In a prepared statement to a House oversight committee, Facebook CEO Mark Zuckerberg said plans to launch a global payments system will remain on hold until U.S. regulators approve it. The comments end speculation Libra coin could go live in nations where there is no government pushback.

The statement, published today, will be part of Zuckerberg’s planned testimony before the House Committee on Financial Services on Wednesday. The committee announced in August it would continue reviewing Libra and hear testimony not only from Zuckerberg but also government officials and regulators.

In June, Financial Services Committee Chair Maxine Waters asked Facebook in a letter to pump the breaks on its Libra launch, “given the company’s troubled past,” until officials can examine issues associated with it more closely “and take action.”

Libra cryptocurrency and its Calibra online wallet had been scheduled to launch in 2020, but U.S. regulators argued too little was known about the digital money and its potential to enable money laundering, adhere to know-your-customer rules, and could threaten user privacy. French and German regulators also said they would not allow Libra to launch within their borders because it could threaten the Euro’s value and unlawfully privatize money.

It’s not the first time cryptocurrency has been challenged by governments around the globe. Last year, the Reserve Bank of India (RBI), the country’s central bank, announced a ban on the use of Bitcoin and other digital money by any regulated financial entity because of risks associated with it. China has also banned the use of some cryptocurrencies, while also planning a launch of its own digital money.

In his statement, Zuckerberg warned of the risks of not innovating on financial infrastructure, which he called “stagnant.”

Facebook

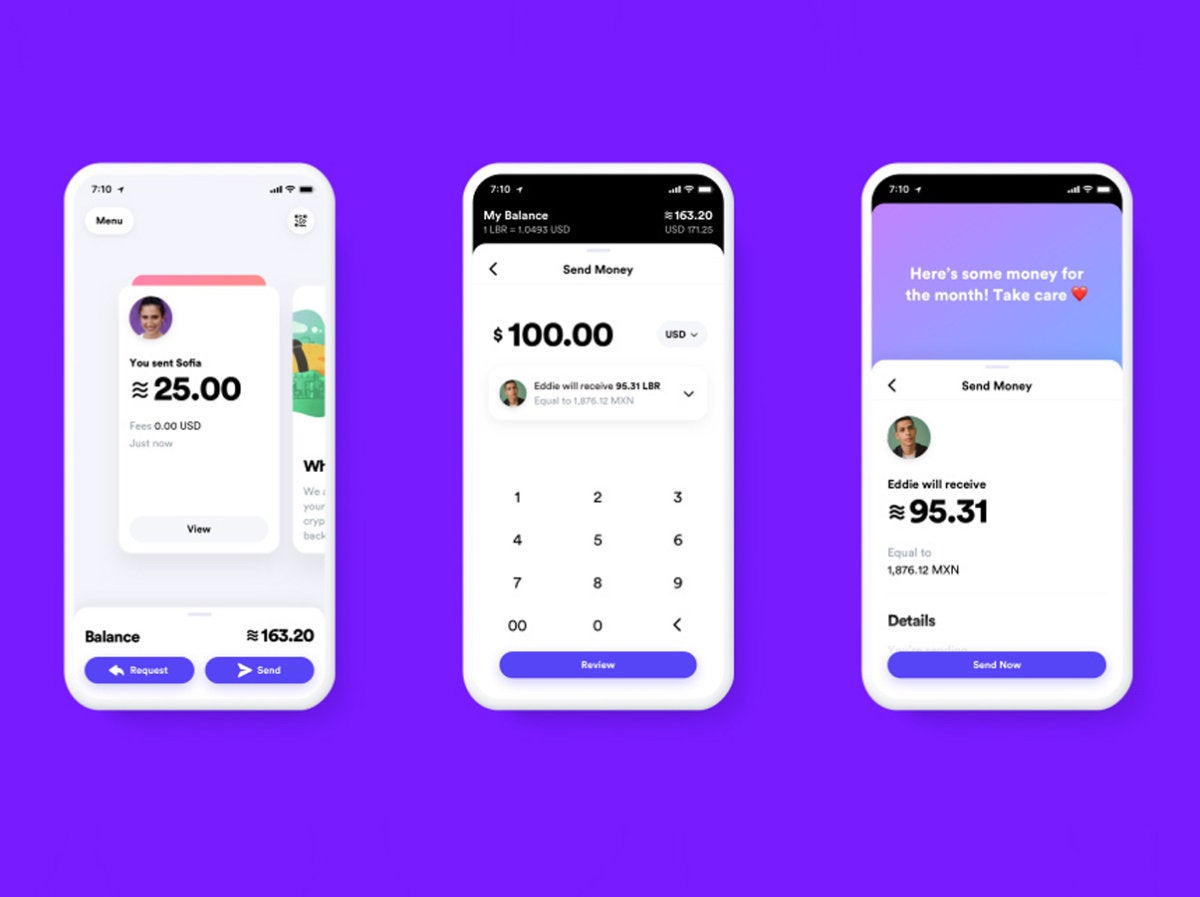

FacebookImages of the Calibra digital wallet app.

“While we debate these issues, the rest of the world isn’t waiting. China is moving quickly to launch similar ideas in the coming months,” Zuckerberg said in the prepared remarks. “Libra will be backed mostly by dollars and I believe it will extend America’s financial leadership as well as our democratic values and oversight around the world. If America doesn’t innovate, our financial leadership is not guaranteed.”

Martha Bennett, a vice president of research at Forrester, called Zuckerberg’s warnings about China gaining a lead in the crypto race nothing more than fear-mongering.

“China won’t launch a cryptocurrency as such; it may launch a digital currency that leverages some of the technologies involved, but it’ll be a centrally controlled artifact. Not comparable at all [to Libra],” she said via email. “Facebook still has a long way to go to address regulatory concerns.”

Libra coin will be managed by the Libra Association, a separate entity from Facebook comprised of financial services firms, fintech companies, retailers and even ride-sharing companies such as Lyft, as well as non-profits. When Facebook originally announced its cryptocurrency and Calibra digital wallet plans in June, it had 27 backers. Today, it has 21.

Earlier this month, more than a half-dozen members of the Association, including PayPal, Visa, Mastercard, eBay, Stripe, pulled support for the project and left the group as regulatory pressure mounted and a deadline to formalize their commitment approached.

Twitter

Twitter A chart created by a Twitter member using Facebooks original graphic depicting its Libra Association members.

In separate statements after their departures, eBay and payment software provider Stripe said they “respect” or “support” the vision of the Libra Association.

“However, eBay has made the decision to not move forward as a founding member. At this time, we are focused on rolling out eBay’s managed payments experience for our customers,” the company said.

All Libra Association members were expected to accept Libra as a form of payment, but firms such as Visa and MasterCard were also going to convert national fiat currencies into Libra and back again.

“…Even though the Libra Association is independent, and we don’t control it, I want to be clear: Facebook will not be part of launching the Libra payments system anywhere in the world until U.S. regulators approve,” Zuckerberg said in his statement.

Gartner Vice President of Research Avivah Litan believes big banks such as JPMorgan Chase are behind the effort to pressure credit card companies and others to pull out of the Libra project.

“There’s a lot of lobbying going on against Libra. They obviously face problems from Congress – from these Democratic senators who wrote those letters threatening these companies to pull out – and my own view is they were lobbied to do that by big bank credit card issuers who feel threatened by this,” Litan said.

In September, the Federal Reserve asked some of the nation’s biggest banks what they thought about Libra; they responded saying it could threaten the U.S. financial system by creating a ‘shadow banking’ system.

Earlier this year, JPMorgan Chase announced plans to pilot its own cash-backed cryptocurrency for cross-border clearance and settlement purposes for institutional clients. JPM Coin, would not, however, be a monetary system for the unbanked of the world like Libra coin could, Litan said.

“I think the bank lobby won. I’m sure they’re behind the temporary pause of Libra in the U.S.,” Litan said.

The idea behind Libra, Zuckerberg explained, is to make sending money as easy and secure as sending a text message. Unlike Bitcoin, which has no intrinsic value, Libra coin would be a type of “stablecoin” backed by a reserve of cash “and other highly liquid assets.

“I believe this is something that needs to get built, but I understand we’re not the ideal messenger right now,” Zuckerberg said. “We’ve faced a lot of issues over the past few years, and I’m sure people wish it was anyone but Facebook putting this idea forward.”

In a mea culpa to the committee, Zuckerberg said people shouldn’t be discriminated against on any of Facebook’s services, and it now has policies in place to prevent hate speech and remove harmful content.

“But discrimination can also show up in how ads are targeted and shown. As part of a settlement with civil rights groups, we’ve banned advertisers from using age, gender, or zip codes to target housing, employment, or credit opportunities, and we’ve limited interest-based targeting for these ads,” he wrote.

Facebook also needs to do more to address diversity among its employees, most urgently among its leadership, which is underrepresented by people of color, and women in technical and business roles, Zuckerberg said.

“We’ve made diversity a priority in hiring, and we’ve made a commitment: within five years, we want at least 50% of our workforce to be women, people of color, and other underrepresented groups,” he said. “We’ve made some progress.”

Litan said she was amazed by Zuckerberg’s statement, and said it’s likely the result of pressure by regulators, not only over Libra but also about breaking up Facebook, which has been viewed by some as a monopoly.

“If he defied them [legislators], then they would be even angrier. His whole company’s at stake,” said Litan, a supporter of cryptocurrencies that enable the unbanked to participate.

Libra and other cryptocurrencies backed by fiat currency, such as JPMCoin, have the potential to serve a vast population in developing nations with no access to banking services.

Globally, 1.7 billion adults or 30% of the world’s population remain unbanked, yet two-thirds of them own a mobile phone that could help them access financial services, according to a 2018 report from The World Bank.

The highest global economic growth rates in the next 50 years will come from Africa, where mobile money is already driving higher financial inclusion rates in Sub-Saharan region, according to the World Bank.

Pushback by regulators and legislators on cryptocurrency does have the potential to leave the U.S. and Europe lagging in the development of worldwide digital financial networks, Litan said.

“The U.S. is falling behind because of incompetent government and agencies,” she said. “Once China starts moving on this [cryptocurrency] everyone will begin moving and competing; government and banks just don’t know how to innovate on user experiences.”

Copyright © 2019 IDG Communications, Inc.