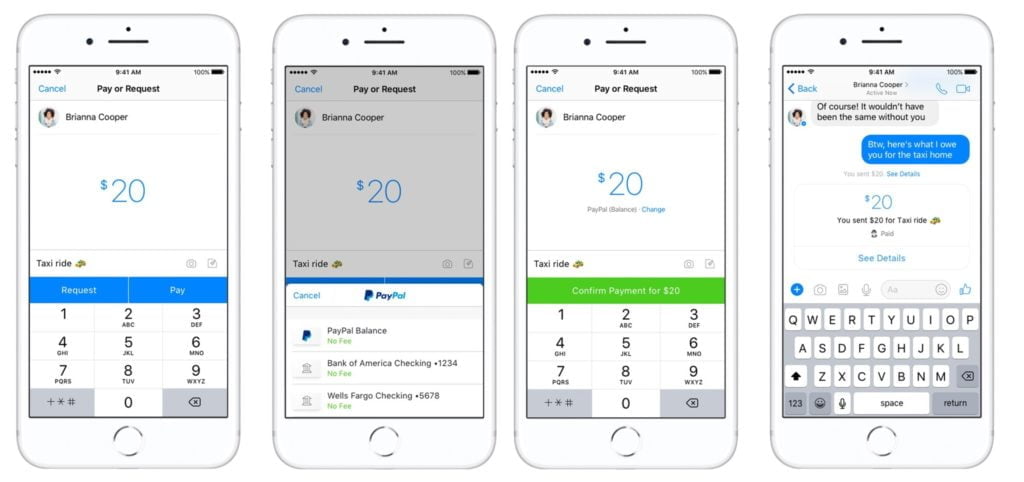

Facebook continues to improve its in-app payments options, announcing a new partnership with PayPal which will enable US users to send and receive person-to-person payments via Facebook Messenger.

Facebook first announced a partnership with PayPal last October, when they launched an integration which enables people to use PayPal as a payment option across Messenger when interacting with certain businesses. This new process expands on that arrangement, giving users more options when exchanging money between themselves.

Facebook’s working hard to evolve their payment options. Back in July, as part of Messenger Platform 2.1, Facebook launched an improved payment process within the chat app, while last month, we reported that Facebook had introduced two new Messenger payment options for users in the Philippines.

The focus on Messenger specifically is part of Facebook’s broader ambition to follow the lead of Asian chat apps like WeChat, which is now an essential tool for many of its 963 million monthly active users. WeChat users turn to the app for everything – from staying in touch, to doing their banking, and – most importantly from Facebook’s perspective – for shopping.

Seeing the way in which WeChat has transformed the consumer process in China has fuelled Facebook’s broader ambitions for Messenger, but thus far, consumers don’t appear to have warmed to the expanded Messenger options like Bots and eCommerce.

Improved payments could change that – and this is especially important given that Amazon, too, is looking to get into the messaging space. Of course, Amazon will have a hard time competing against Facebook’s scale, but their 1-click payment process could make it more of a destination for commerce transactions. And then, of course, you have Pinterest on the other side who are also evolving their eCommerce model, which could take more users away from The Social Network.

The expanded partnership with PayPal gives Facebook more options – P2P payments are not as directly linked to their expanded eCommerce options, but they help further solidify their payments back-end, and will help make users aware that they can quickly and easily make such payments within the app.

And where P2P payments might come in particularly handy is within Facebook’s Marketplace and buy and sell groups, which now have more than 450 million users each month.

That could present expanded opportunities – in August, Facebook added in eBay ‘Daily Deals’ to the Marketplace listings, further broadening the option.

That could pave the way for wider Marketplace use, and with payments immediately available, it may become a key vehicle in raising awareness of what’s possible within the app, from an eCommerce perspective.

Combine that with the addition of new Shopify Tags on Instagram, and it’s clear that Facebook’s making moves towards a significant expansion of their online transaction potential.

As payments become easier, you can bet more consumers will increase their reliance on Facebook’s platforms for more of their day-to-day tasks – they’re already spending so much of their time in Facebook’s apps anyway. It makes sense to use them for expanded purpose.