Shopping ads show no sign of softening, according to two reports on fourth-quarter search spending trends.

The findings. Marin Software, which aggregates performance data across customers using its campaign management platform, reported monthly spend on Google and Bing Shopping ads increased 5x between January and December 2018.

Across all verticals globally, Google Shopping ads captured 36 percent of search spend in Q4. Isolating accounts buying in USD currency, Shopping ads accounted for 27 percent of spend in Q4, down slightly from 28 percent in Q3, Marin found.

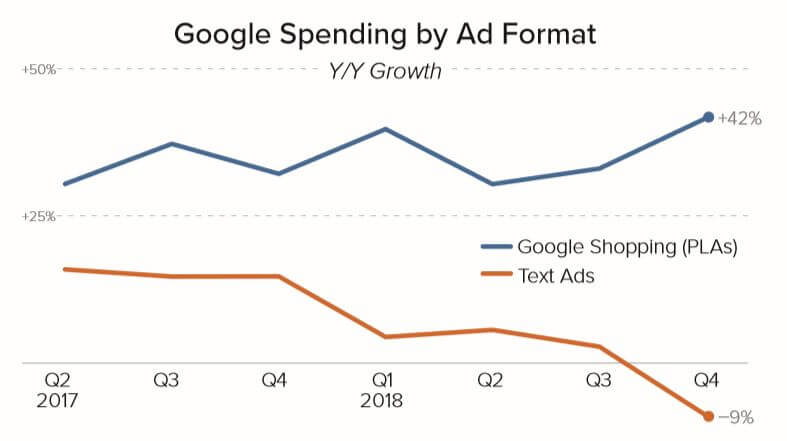

Performance agency Merkle reported spending on Google Shopping ads saw the highest rate of growth since mid-2016, with a year-over-year increase of 42 percent in Q4 among its customer base, which skews large retailer.

Shopping’s click share of Google search ad clicks for retailers also hit an all-time high of 63 percent.

Meanwhile, text ad spending dropped by 9 percent compared to the previous year.

Mobile Phone impressions for Google Shopping ads shot up 107 percent in Q4 2018 year over year, Merkle found.

Why you should care. “eCommerce is growing as an advertising channel and as a result, we’re seeing the industry shift more spend toward lower-funnel ad formats, such as Google Shopping Ads and Dynamic Product Ads on Facebook, that allow brands to capture consumers’ attention at the most critical points in the purchase journey,” said Wesley MacLaggan, SVP of Marketing at Marin Software.

Amazon Sponsored Brands and Sponsored Products are in that lower-funnel ad mix sellers on that platform as well.

On Google, the growth in Shopping ads — and further eclipse of text ads — shows no sign of slowing down. As competition Google Shopping keeps escalating, it becomes more critical for advertisers to ensure they are optimizing their product feeds, bids and budgets to maintain profitable campaigns. The growth of mobile Shopping impressions and clicks also means retailers need to pay extra attention to optimizing their site experiences for mobile.