Google says that this month it will “no longer charge partners for referral links on Google Flights.” As a result, the company is removing the “ads” and “sponsored” labels from Google Flights and the flights unit in Google search results.

Results ranked according to price and convenience. A Google spokesperson said in email that flight search results have been and will continue to be ranked on the basis of price and convenience (i.e., flight duration, number of stops, layovers, etc.). Google explained that compensation from airline and travel partners has historically not impacted rankings.

The “ads” and “sponsored” links were required because Google received booking referral fees from some airline partners. Failing to be transparent about this would have run afoul of FTC disclosure guidelines.

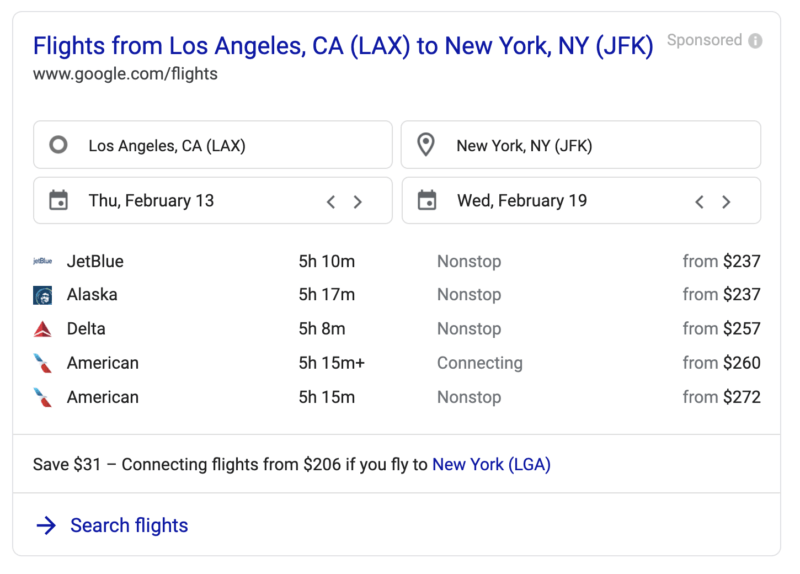

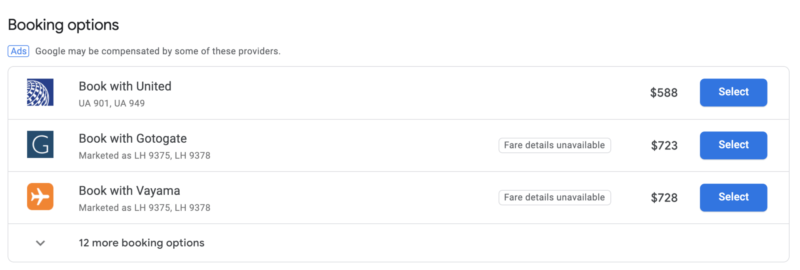

Ad labels will soon disappear. Below are two examples of the current ad labeling in Google search results and in Google Flights, which will soon go away.

‘Sponsored’ results for flight search on Google.com

‘Ads’ label in Google Flights

Disrupting established players. A decade ago Google acquired travel reservations platform ITA Software for roughly $700 million. At the time of the acquisition, then Google CEO Eric Schmidt said that the company wanted to deeply integrate the ITA software and data to create new and better travel search experiences.

Ten years later, after considerable experimentation and product iterations, Google is arguably delivering on that promise with richer hotel and flight search results and booking experiences. Google declined to provide data about travel usage or bookings, but said through a spokesperson that the company is “happy with user engagement on Google Flights.”

That’s having a concrete impact on incumbent online travel agencies such as Expedia, which now considers Google its biggest competitor. And TripAdvisor is “cutting hundreds of jobs” in response to Google competition, according to a report from Bloomberg.

Why we care. Spending on leisure and business travel is a more than $1 trillion market according to the U.S. Travel Association. And digital advertising in the travel vertical is now approaching $10 billion.

Google is aiming to capture more of those travel ad dollars, in part by making itself a preferred travel destination with better tools and content. For many travel marketers that means stepping up Google My Business participation. As a practical matter, it also means more paid search advertising for travel incumbents and most others in the vertical.