As the number of people in the world aged 60 and above more than

doubles by 2050 from current levels, the planet’s aging

population—along with a corresponding rise in chronic illness

within the group—will pose a challenge to global healthcare

systems.

While healthcare stakeholders today face the daunting task of

delivering quality services across the care continuum, providing

healthcare for older populations is more expensive and requires

more resources. As people age, the incidence of chronic diseases

like diabetes and heart disease also rises, and treatment for

chronic illnesses is costly. As a result, health systems must

devise strategies to tackle the problem. Part of the strategy to

improve patient care—and boost efficiencies in the

process—is for medical establishments to invest in new

technology and devices to take advantage of new models of diagnosis

and therapy.

Medical imaging technology, for instance, will play a major role

in addressing chronic health concerns, with strategies focusing on

preventative health, which should promote the regular use of

medical imaging equipment. Diagnostic imaging, meanwhile, will play

a crucial role in the early detection of chronic diseases and the

monitoring of disease progression. For its part, interventional

imaging equipment will be utilized to guide an increasing number of

minimally invasive interventional procedures, including heart-valve

replacements and angioplasties.

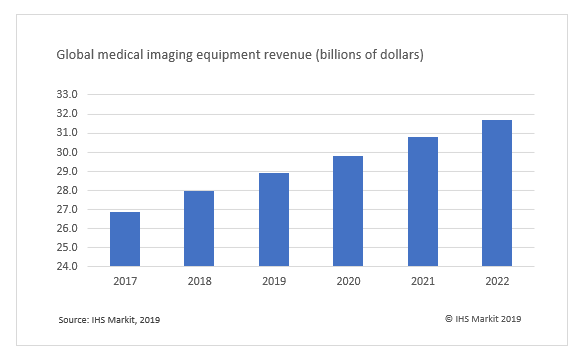

The global medical imaging market in 2018 was worth $27.9

billion. This year, the market is projected to rise 3.5% to $28.9

billion, as shown in the graphic below. From 2017 to 2022, the

world’s medical imaging market will expand at a compound annual

growth rate (CAGR) of 3.2%.

Over the years, demand for diagnostic imaging and interventional

procedures is projected to increase, and the market should

experience strong growth.

Even so, market expansion could be offset by the strain of

caring for an aging population, with health systems pushed to do

more imaging scans because of rising rates of illness and disease.

Given the increased financial burden placed by a larger populace

that is sick, medical systems could well reallocate healthcare

spending, moving funds away from medical imaging budgets.

New approach is needed in the face of consolidation and

changing dynamics

The financial burden on healthcare systems is creating an

environment in which hospitals are consolidating at a much faster

rate than in the past few years. Hospitals are purchasing medical

equipment in bulk, and major supplier contracts are often won by

the big three—American firm GE Healthcare, Philips Healthcare

of the Netherlands, and Germany’s Siemens Healthcare.

The three enjoy an enormous advantage because of their wide

product portfolios and capability to bundle imaging equipment

across a variety of modalities, such as CT, MRI, and ultrasound. Of

the total medical imaging equipment market in 2017, the three firms

accounted for nearly 60% of revenue.

A shift in the healthcare delivery environment will also require

medical imaging manufacturers to adjust their sales approach and

strategies. Medical reimbursement to healthcare providers is now

tied to patient outcomes instead of the number of services

performed—a change in approach from volume- to value-based

care—driving providers to find ways to achieve new economies of

scale to improve patient care while reducing their own costs.

This means that more than ever, medical imaging manufacturers

must demonstrate their equipment to have the best return on

investment (ROI), especially as purchasing decisions have moved

away from clinicians to hospital administrators and even C-level

executives.

To convince hospitals of the investment worth of their

equipment, medical imaging manufacturers are showing how their

devices can improve workflow efficiency and increase patient

comfort. And increasingly, manufacturers are finding ways to

incorporate into their product portfolios functionality that can be

tied to artificial intelligence (AI).

The most discussed subject today in the medical imaging

industry, AI has been shown to be more accurate when employed in

diagnosis than in radiologists working alone. With the potential to

improve patient incomes and drive down costs, AI integration will

be a key feature in all medical imaging products, with integration

projected to begin in the next three to five years, IHS Markit is

forecasting.

Manufacturers who establish themselves as a leader in this field

will have the best chance of claiming a major stake in this

potentially huge market.

Holley Lewis is senior analyst for healthcare technology

at IHS Markit

Posted 24 June 2019