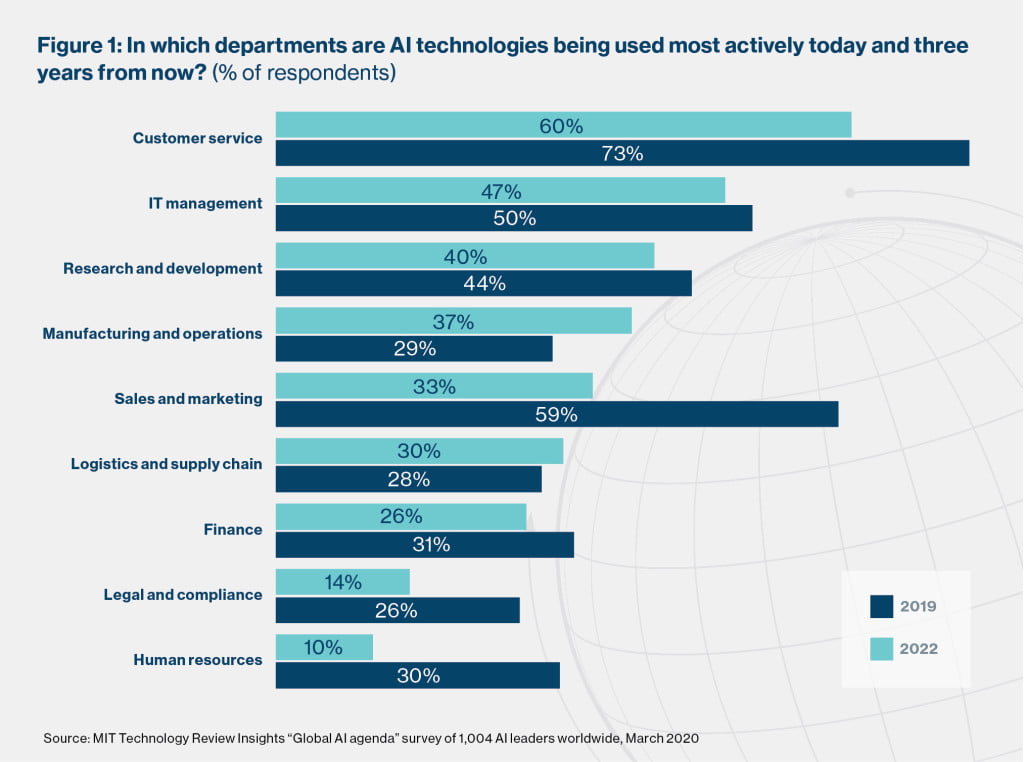

AI is rapidly transforming the way that companies interact with their customers. MIT Technology Review Insights’ survey of 1,004 business leaders, “The global AI agenda,” found that customer service is the most active department for AI deployment today. By 2022, it will remain the leading area of AI use in companies (say 73% of respondents), followed by sales and marketing (59%), a part of the business that just a third of surveyed executives had tapped into as of 2019.

Intimacy and efficiency

In recent years, companies have invested in customer service AI primarily to improve efficiency, by decreasing call processing and complaint resolution times. Organizations known as leaders in the customer experience field have also looked toward AI to increase intimacy—to bring a deeper level of customer understanding, drive customization, and create personalized journeys.

Genesys, a software company with solutions for contact centers, voice, chat, and messaging, works with thousands of organizations all over the world. The goal across each one of these 70 billion annual interactions, says CEO Tony Bates, is to “delight someone in the moment and create an end-to-end experience that makes all of us as individuals feel unique.”

Experience is the ultimate differentiator, he says, and one that is leveling the playing field between larger, traditional businesses and new, tech-driven market entrants—product, pricing, and branding levers are ineffective without an experience that feels truly personalized. “Every time I interact with a business, I should feel better after that interaction than I felt before.”

In sales and marketing processes, part of the personalization involves “predictive engagement”—knowing when and how to interact with the customer. This depends on who the customer is, what stage of the buying cycle they are at, what they are buying, and their personal preferences for communication. It also requires intelligence in understanding where the customer is getting stuck and helping them navigate those points.

Marketing segmentation models of the past will be subject to increasing crossover, as older generations become more digitally skilled. “The idea that you can create personas, and then use them to target or serve someone, is over in my opinion,” says Bates. “The best place to learn about someone is at the business’s front door [website or call center] and not at the backdoor, like a CRM or database.”

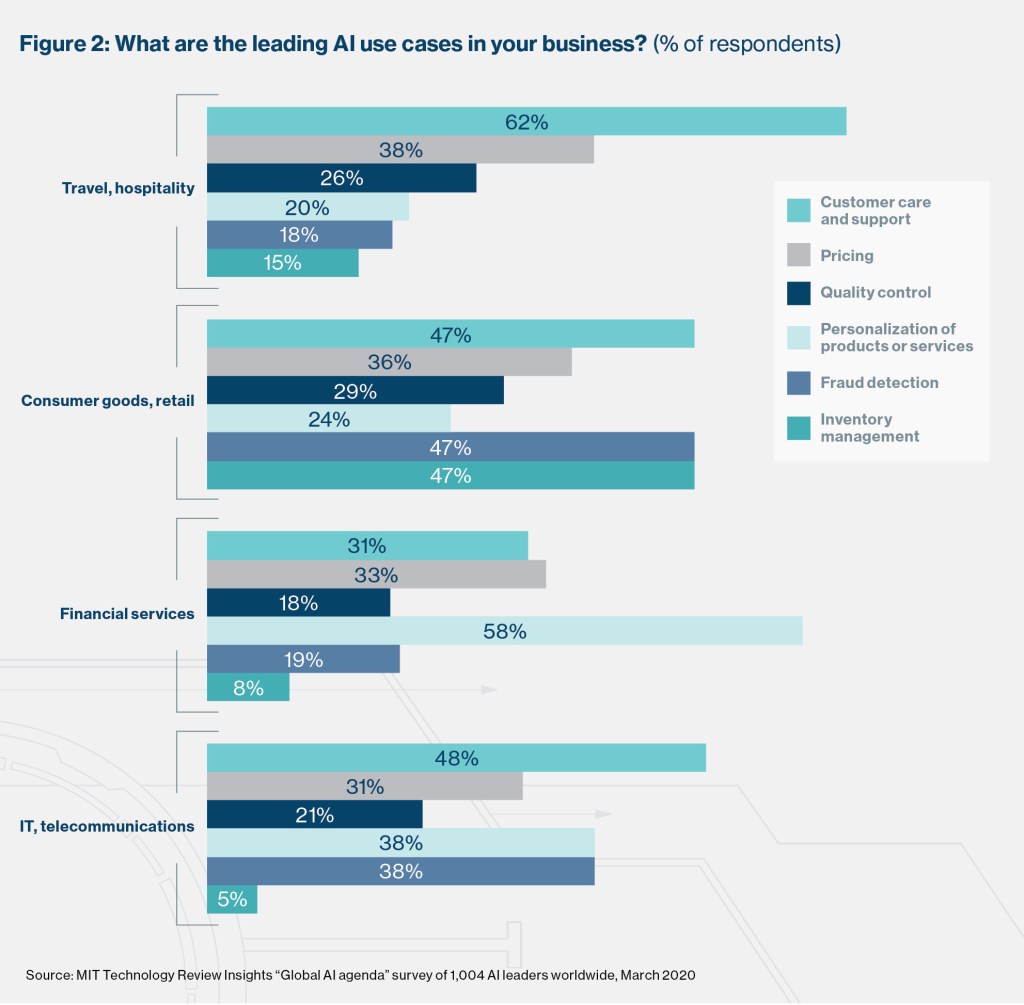

The survey data shows that for industries with large customer bases such as travel and hospitality, consumer goods and retail, and IT and telecommunications, customer care and personalization of products and services are among the most important AI use cases. In the travel and hospitality sector, nearly two-thirds of respondents cite customer care as the leading application.

The goal of a personalized approach should be to deliver a service that empathizes with the customer. For customer service organizations measured on efficiency metrics, a change in mindset will be required—some customers consider a 30-minute phone conversation as a truly great experience. “But on the flip side, I should be able to use AI to offset that with quick transactions or even use conversational AI and bots to work on the efficiency side,” says Bates.

Building connectivity across data sets

With vast transaction data sets available, Genesys is exploring how they could be used to improve experiences in the future. “We do think that there is a need to share information across these large data sets,” says Bates. “If we can do this in an anonymized way, in a safe and secure way, we can continue to make much more personalized experiences.” This would allow companies to join different parts of a customer journey together to create more interconnected experiences.

This isn’t a straightforward transition for most organizations, as the majority of businesses are structured in silos—“they haven’t even been sharing the data they do have,” he adds. Another requirement is for technology vendors to work more closely together, enabling their enterprise customers to deliver great experiences. To help build this connectivity, Genesys is part of industry alliances like CIM (Cloud Innovation Model), with tech leaders Amazon Web Services and Salesforce. CIM aims to provide common standards and source code to make it easier for organizations to connect data across multiple cloud platforms and disparate systems, connecting technologies such as point-of-sale systems, digital marketing platforms, contact centers, CRM systems, and more.

A future of data sharing?

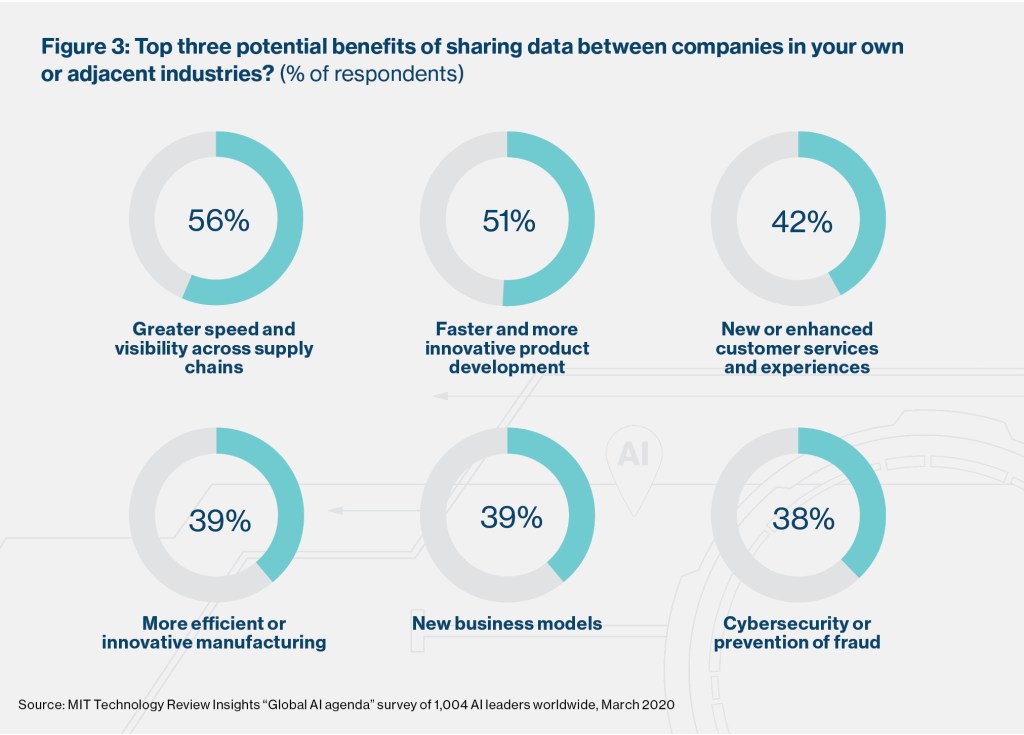

Data sharing has the potential to unlock new value for many industries. In the public sector, the concept of “open data” is well known. Publicly available data sets on transport, jobs and the economy, security, and health, among many others, allow developers to create new tools and services, thus solving community problems. In the private sector there are also emerging examples of data sharing, such as logistics partners sharing data to increase supply chain visibility, telecommunications companies sharing data with banks in cases of suspected fraud, and pharmaceutical companies sharing drug research data that they can each use to train AI algorithms.

In the future, companies might also consider sharing data with organizations in their own or adjacent industries, if it were to lead to supply chain efficiencies, improved product development, or enhanced customer experiences, according to the MIT Technology Review Insights survey. Of the 11 industries covered in the study, respondents from the consumer goods and retail sector proved the most enthusiastic about data sharing, with nearly a quarter describing themselves as “very willing” to share data, and a further 57% being “somewhat willing.”

Other industries can learn from financial services, says Bates, where regulators have given consumers greater control over their data to provide portability between banks, fintechs, and other players, in order to access a wider range of services. “I think the next big wave is that notion of a digital profile where you and I can control what we do and don’t want to share—I would be willing to share a little bit more if I got a much better experience.”