Digital devices offer new ways for audiences to engage with content. Latin Americans are using their laptops, mobiles and tablets to consume a wealth of online media from short clips, streamed music and radio, as well as TV and print content. In Mexico, mobile video content is driving the web. When audiences turn to their devices for mobile or web viewing of online media content, we observe brands such as YouTube, Spotify and Netflix – as well as local TV brands and radio channels in the top 10 most used media channels.

The rise of online TV brands

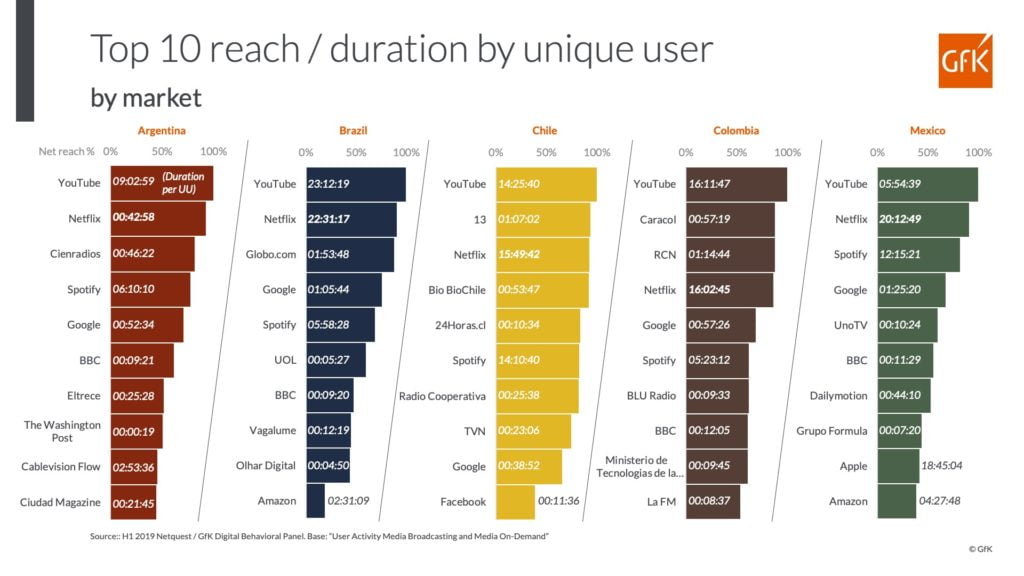

The popularity of YouTube across the globe is well known, and the Latin American markets are no exception to this general rule. What is stark however, is how much time Latam audiences spend with Netflix online, particularly when contrasted to the local TV services. Of course, Netflix offers long-form content and so a high level of time engagement would be expected. However, its prominence does raise questions about how well local media organizations are adapting to this new landscape.

The new video consumer is hungry for content and will seek out services that deliver the entertainment they desire. Local players have developed VOD app services, but with continued threats from global players like HBO Go and Amazon Prime Video, how can local media organizations deepen their content and digital strategies to better engage their audiences?

Local TV brands deliver the reach but there are opportunities to build more time spent

Across all markets, Netflix is in the top 5 media brands in terms of its reach for both the total Media Broadcasting and Media On-Demand activities. It also dominates time spent, along with YouTube and Spotify.

However, in all markets, there is a strong presence from local TV brands and in some markets, they deliver as much reach as Netflix (Globo in Brazil, Canal 13 in Chile and Caracol TV in Colombia). In Brazil, Globo.com reaches 88% of the online population, 13.cl in Chile reaches 94%, Caracoltv.com in Colombia reaches 88%, Unotv.com in Mexico reaches 60%. These brands now have the opportunity to better convert their audience reach into increased time spent with their digital services.

The only exception to this pattern is in Argentina where Netflix, despite its high reach, is not engaging audiences in terms of time spent. Here the key local TV brand competitor, EltreceTV, only reaches half of the online population, so there is an opportunity for a dual strategy to build reach and time engagement.

The only exception to this pattern is in Argentina where Netflix, despite its high reach, is not engaging audiences in terms of time spent. Here the key local TV brand competitor, EltreceTV, only reaches half of the online population, so there is an opportunity for a dual strategy to build reach and time engagement.

How are Amazon Prime Video and HBO Go performing in the region?

It is not just Netflix that local TV brands compete with, there are emerging services that will diversify the viewing choices further in the region.

While Netflix reach in Latam has been strong for a couple of years, our data demonstrates that Amazon Prime Video is beginning to cut through, mainly in Mexico and Brazil. In Q2 2019, Amazon Prime Video reached 24% of online adults in Mexico and 12% of online adults in Brazil.

HBO Go is also now cutting through in Brazil, Chile and Mexico. We can measure how people are accessing it, via their browser or the app.

How well are the local VOD app players performing?

The leading media organizations each have a VOD app service. Claro Video has achieved a presence across the region, with reach being strongest in Mexico (28%). It outperforms Amazon Prime Video currently. In response to Amazon Prime Video’s growth, Claro Video will want to build on its existing reach to continue to offer a unique service. The second strongest market for Claro Video is Colombia (17%), followed by Chile (12%) and Argentina (7%).

Globo Play has gained strong traction in Brazil at 17% reach, outperforming HBO Go and Amazon Video. Movistar Play reaches one in 10 online adults in Argentina and Colombia, and marginally higher at 13% in Chile.

2020 will demand a deeper audience, content and digital strategy

It’s evident that Latam audiences are seeking new ways to engage in content. Whilst the market has become used to Netflix dominating, new global entrants are emerging and will increasingly compete with local media players as consumers expectations evolve and increase around content and its delivery.

The year 2020 will be a pivotal year not only for local TV brands but for the rest of the local media organizations to see how well they can protect, build and capture audience engagement.

How we work with clients

GfK helps clients navigate through disrupted consumer markets. We respond to client challenges through our expertise in consumer insight, media measurement and digital analytics.

Our passive behavioral data gives us a unique opportunity to deliver a consumer-centric, cross device view of audiences and their attitudes and behaviors. We understand who is using different media services, the devices they use and how frequently. We can also evaluate cross media usage and track emerging behaviors or shifts in how your audience is consuming different media and apps. This data provides a wealth of insight but can also be applied to monitor ongoing performance, making insight more actionable within an organization.

Want more news about Media Measurement?