The coronavirus outbreak has put much of the world on lockdown, with many resorting to exploring new hobbies and activities, or rekindling familiar ones.

Alongside companies in the food delivery and remote working software industries, a handful of entertainment platforms have been among the few experiencing an increase in demand. The beginning of the new decade has been marked with a sudden shock in the way media is being consumed among all demographics.

In times of uncertainty, revenue losses, and a looming recession, it’s more important than ever that advertisers and media planners leverage data to drive fast, but informed decisions.

Our latest international research conducted between March 16th to March 20th in 13 countries sheds light on how entertainment engagement is being redefined by the crisis.

With nearly 7 in 10 internet users in the countries we surveyed being confined to their homes or choosing to self-isolate, this data gives us essential clues as to how people are spending their time while on lockdown.

Later this week, we’ll be analyzing how media and entertainment is shifting in much more detail, including video calling and changes in social media consumption in the U.S. and UK.

Find full reports and frequent updates on the consumer response to COVID-19 in our hub. If you want to analyze the data in more detail, access the results from this survey in our platform.

The appeal of group activities has risen due to social distancing.

When asked what they’ve been up to in their homes during the outbreak, consumers cited three top activities:

- 67% are watching more news coverage.

- 53% are spending more time socializing as a family.

- 51% are watching more shows on streaming services like Netflix.

Watching more news coverage tops the charts for each generation, with Gen X leading the way (68%). However, the data tells an interesting story when we look at their second most prominent answer:

- Gen Z are spending longer on messaging services (62%)

- Millennials are streaming more films online (58%)

- Gen X are spending more time with their families (52%)

- Baby boomers are watching more broadcast TV (51%)

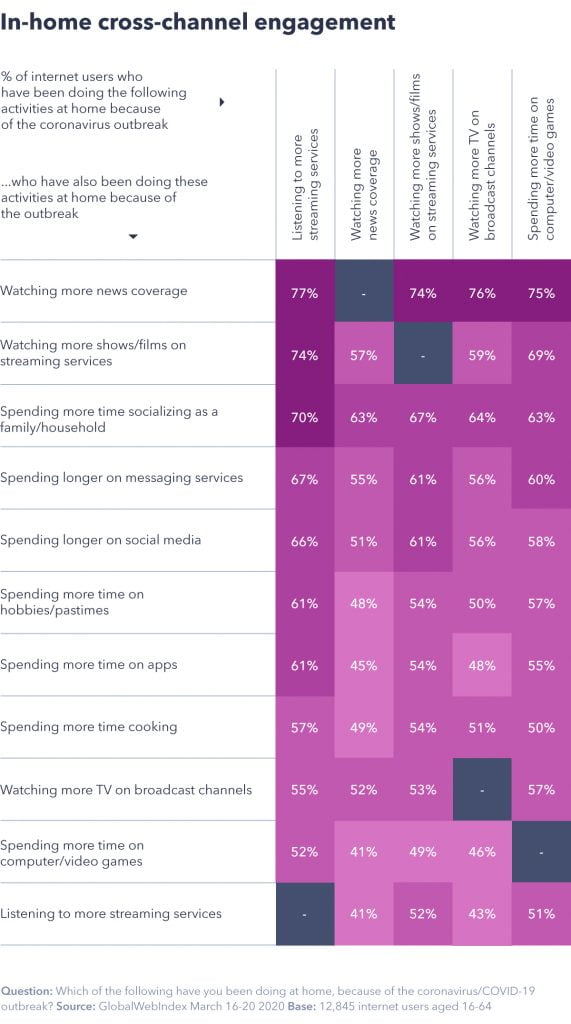

However, not all behaviors are taking place sequentially. On the contrary, a lot of activities occupying people’s time are happening simultaneously, and we need to move beyond demographics to explore these cross-channel behaviors.

In this graph, we can see that those devoting more time to streaming services like Spotify are the most likely to be engaged in the other at home activities as well.

Over 7 in 10 of those listening to more streaming services are watching more news, streaming more online TV and spending longer socializing with their family.

Though the opposite isn’t true. Streaming music doesn’t prove as popular among those devoting more time to other entertainment activities while at home.

For example, those spending more time reading news and watching broadcast TV are actually more likely to do all of the activities listed in the chart other than streaming music.

This suggests that amid social distancing, streaming music isn’t as central to our lives as activities that keep us in touch with what’s going on around the world.

For many, listening to music is heavily linked to commuting. And with over half of consumers avoiding public transport today, the absence of their regular commute could be bringing music streaming figures down.

Spotify’s figures confirm this. For example, Italy, the current epicenter of the pandemic, has experienced a drop in the average number of streams by approximately 4-million when compared to February last year.

Our data shows that of the 25% in Italy who report streaming more music because of the outbreak, only 9% said they spend significantly longer doing this.

According to Spotify, this trend is also present in the U.S., UK, France, and Spain.

However, it’s worth noting that streaming music is a part of the top 10 activities Gen Z report doing more of (57% say this compared to only 39% of millennials) and it’s also central in China (49%) and the Philippines (43%).

Our research also shows a considerable overlap between online and broadcast TV, with 59% of those spending more time now watching linear television also streaming TV online.

These figures will be changing, and most likely increasing rapidly.

We’ll be diving deeper into the changing media consumption habits of UK users in our research later this week following UK PM Boris Johnson’s announcement of new, stricter measures in the country.

Lockdown means consumers are spending more time offline than before.

At the time this research took place, 27% of internet users across all 13 countries report not being able to leave their houses except for essential reasons. This figure climbs as high as 86% in Spain and 83% in Italy.

Such constraints are impacting consumer behaviors in unprecedented ways, and these ways differ dramatically from those who aren’t under such strict quarantine.

Our data shows younger users have made significant steps from passive content consumption to their own content creation.

Gen Z and millennials under quarantine are much more likely to be devoting more time to creating and uploading videos online on platforms like YouTube and TikTok.

In fact, 38% of daily TikTok users in lockdown say they’re creating videos while at home, compared to 13% of those who report no changes to their lifestyle.

But we’re also seeing evidence of people under quarantine turning to more traditional activities for entertainment.

People unable to leave their homes are over 30% more likely to report reading more magazines and listening to more radio.

And this isn’t something we’re seeing only among older consumers. Reading newspapers is one of the most distinctive activities quarantined millennials are spending more time doing since the outbreak.

Their older counterparts, Gen Xers and baby boomers, are more likely to take their eyes away from screens during the crisis, with talking on the phone and cooking being among their most distinctive quarantine activities.

Engagement with online TV is booming.

From our ongoing research, we know that online TV is catching up steadily with linear TV, with internet users spending around 1h 20m on the former and close to 2 hours on the latter each day in 2019.

This varies dramatically by region. APAC has already closed the gap, while in Europe and North America, online TV still has much ground to cover before it rises to the daily engagement levels of linear TV.

That said, younger age groups are closing the gap at a much faster rate in these regions.

In these unprecedented times, however, our data shows that engagement with both these channels is being largely redefined in most countries.

From the 13 markets we surveyed, consumers are more likely to spend more time than before on traditional TV in 7 of them.

These are primarily mature markets, like Italy, France, Germany and Japan, where internet users are known to favor broadcast TV.

What is surprising here are the markets notorious for their linear TV consumption like the U.S., where the same proportion of consumers report spending more time on streaming as on linear TV than before the outbreak.

Spain is also among the mature markets where online TV is seeing very high engagement.

With 58% of consumers spending more time streaming movies online, Spain ranks in third place – just behind China and the Philippines.

If we rebase this question among Gen Z and millennials, online TV is the clear winner. These groups are significantly more likely to say they’re spending more time occupying their time with streaming services compared to broadcast TV. For these younger consumers, this is especially true in the most affected European countries.

It’s clear that demand for both channels is higher than ever but streaming in particular is experiencing an all-time high.

In a bid to cope with demand, platforms like Netflix and Disney+ (which made its debut in Europe this week) are temporarily reducing video-streaming quality across Europe.

The ‘second screen’ is a place for brands to effectively reach their audiences.

From our ongoing Core research, we’re able to create five personas based on time spent each day on different media. We’ve since cross-analysed these audiences with our custom Covid-19 research.

Our five personas are high or heavy users (spending more than 1 hour per day) of the following media:

- Games consoles

- Social media

- Linear TV (spending more than 2 hours watching linear TV per day)

- Online TV

- Music streaming

These personas have all experienced dramatic changes to their lifestyle, which is reflected in the changes seen in their media consumption habits.

Self-isolation has meant they’re spending more time on different devices at home; especially on their smartphones.

Our youngest persona, the high/heavy users of social media, are the most likely to be spending more time on their phones, with 8 in 10 reporting doing so.

Games consoles enthusiasts, on the other hand, stand out for using PCs (43%), games consoles (32%) and tablets (31%) at a higher rate than any of the other personas.

With 74% of gaming console enthusiasts also using their smartphones more, mobile gaming engagement is set to reach record levels.

In fact, online gaming platform Steam is already seeing a surge in its concurrent users, passing the 20 million mark on March 15th.

But what other online activities are these personas engaging with while at home?

Watching films on streaming services emerges as the most popular form of online entertainment our personas are spending more time on than before. Console and social media enthusiasts are on par with online TV fans here, with 60% streaming more films online.

When it comes to messaging on platforms like WhatsApp, social media and online TV enthusiasts are the most likely to turn to these services more than they previously were, which suggests messaging is likely a second-screen activity.

In fact, 9 in 10 high/heavy users of online TV are on at least one more device while watching TV, with6 in 10 doing so to stay in touch with friends.

While the outbreak of coronavirus remains present in people’s lives, second-screening is sure to be more of a complement than a competitor to TV advertising.

As the integration of TVs and smartphone use continues to gain traction, the potential for TVs and smartphones to reinforce the same message is now very much present.

With a third of the world currently experiencing a lockdown, our research shows that consumers are turning to in-home entertainment on multiple channels and devices at once.

There’s a huge opportunity for brands to step up and interact with their audiences, provide support, and keep audiences engaged during an unprecedented period of ‘at home’ time – the new normal for so many.