Where is the biggest opportunity in marketing at the moment?

According to Sophie Moule, Head of Marketing at Pi Datametrics, it’s the sheer amount of customer data that we can get from search.

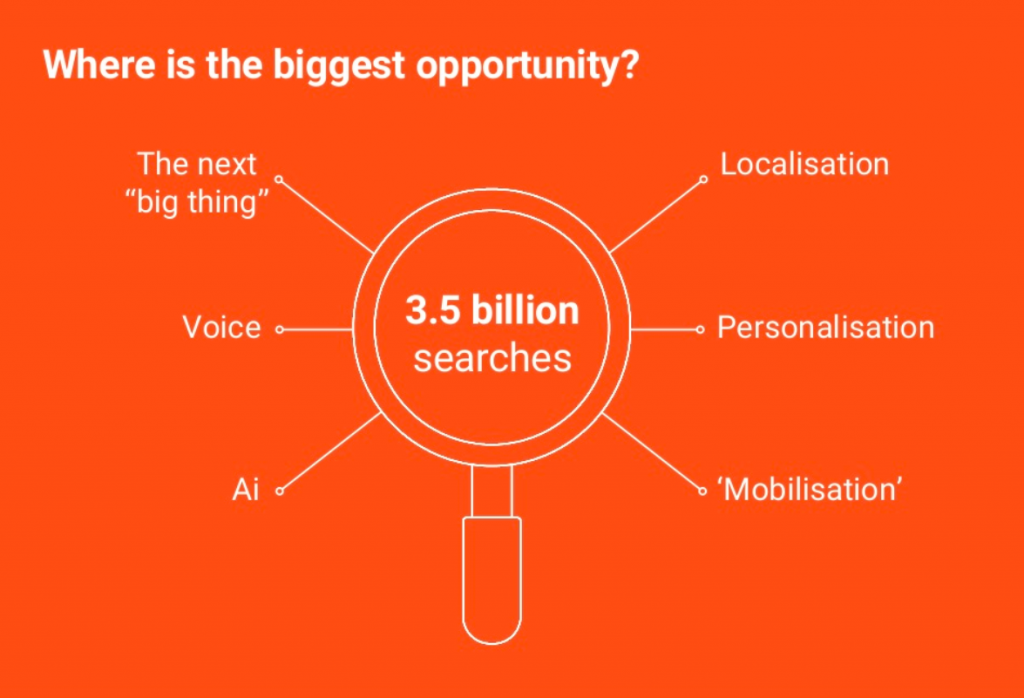

With 3.5 billion searches per day being carried out by Google, not to mention on vertical-specific websites like Amazon, YouTube and Pinterest, there is a huge sea of data available on customer intent which marketers should be taking advantage of.

But what is the best way to go about doing so? Having reams of data available to you is all well and good, but as any marketer knows, the tricky part is in knowing exactly how to sort through that data, find trends, and apply it to your marketing strategy.

If you can get it right, however, it can elevate the topic of SEO within your business and bring about great results.

At the Figaro Digital Marketing Summit in London, Moule gave a jam-packed presentation on exactly how to look for customer intent trends in search data, and how to align your marketing strategy with these trends to take advantage of research and buying behaviors at exactly the right time.

Data, data, data

The evolution of search on the web has been driven by data. All of the major developments in web search – from localization to personalization to the rise of mobile – are being powered by a huge epicenter of data.

Google, Bing, Yahoo and other search engines use data from their users’ searches to learn about habits, language usage, search intent and more, and develop their search platforms based on what they’ve found.

But search engines aren’t the only ones who can use the data behind search to evolve their approach; marketers can too.

Tools like Google Trends, Google Insights for Search, Google Keyword Planner and Pi Datametrics, can produce data that gives a view of search trends over time. Using this data, search marketers can:

- Discover customer trends – Uncover peaks and troughs in when customers search for things

- Hone in on commercially valuable keywords – By adding another layer of data using cost per click and competition information, marketers can concentrate on the keywords that have buying intent

- Analyze patterns – Go back in time to see how trends have evolved (Moule gave the example of “make-up” becoming a top search for the Beauty industry between 2014 and 2017, when a new market of buyers came online thanks to the popular explosion of beauty YouTubers).

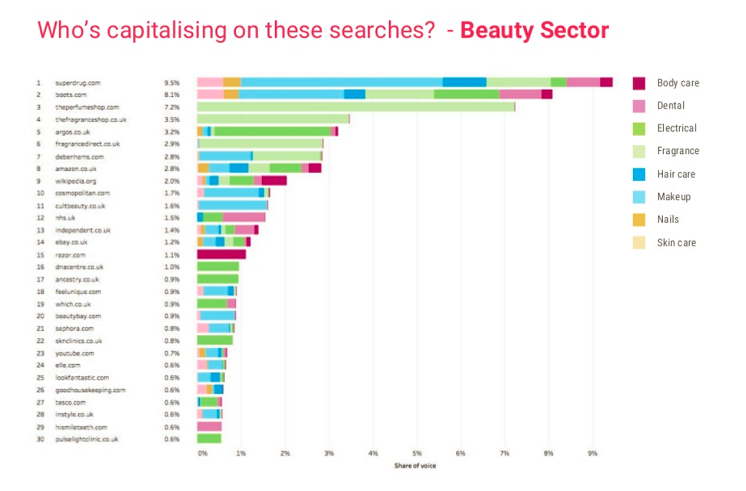

By analyzing the share of SERP real estate between different companies in your target market, you can also find out exactly who is capitalizing on these searches. This shows where it might be better to sell and advertise your products as a brand, by indicating which stockists, partner stores and publications have the greatest visibility.

Looking at the share of voice in the beauty sector, we can learn that stocking our make-up products with Superdrug instead of Boots would provide better visibility, as Superdrug pulls in more traffic and impressions online in the make-up category.

This also gives an overview of the vast array of different companies competing for attention within the space – showing that your competition online may be very different to the competition you had in your head.

Using search trends to build strategies (plan, influence, peak, repeat)

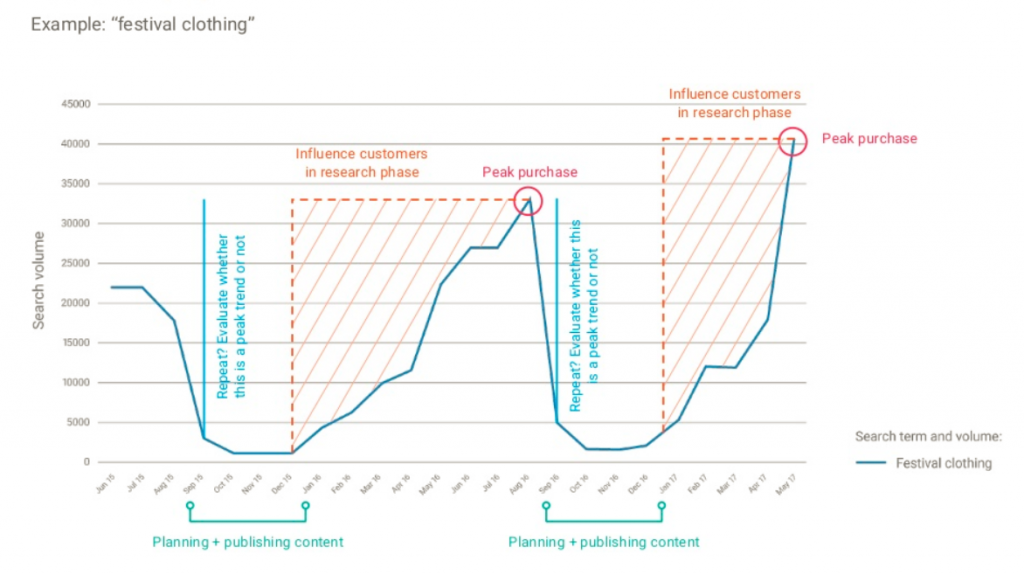

By looking at the peaks and troughs in search volume data over time, Moule explained that search marketers can plan their campaigns around different phases of the buyer journey.

She called this approach “Plan, Influence, Peak, Repeat” – identifying when you need to be planning; seeing when people are ready to be influenced; identifying peak buying trends; and finally assessing whether a pattern will repeat, or whether it was a one-off fad.

As an example, let’s take a look at a search trend graph for the term “festival clothing” over a period of two years. This is an event-triggered trend, so the same pattern is likely to recur year-on-year:

The peak purchase times in this graph are easy to isolate, but your products don’t only need to be in front of consumers at these times. The trough periods, where search volume is lowest, are a good time to plan ahead, take stock of your content, consider how you want to target consumers, and make sure it’s optimized and published early before buying interest starts to climb.

Then, we enter the influence, or research phase (marked out in red in the above graph). “This is probably even more crucial for the digital department than it is for the search team,” said Moule. “Very few businesses actually capitalize on this research phase.

“I’ve so frequently seen people planning all their marketing campaigns around the peak, and not far enough in advance of it.”

Collectively, there are more searches taking place during this build-up than there are during the peak itself – representing a huge number of opportunities for customers to encounter your brand. This means that your site and content need to be ready to appear in front of consumers before they hit the research phase.

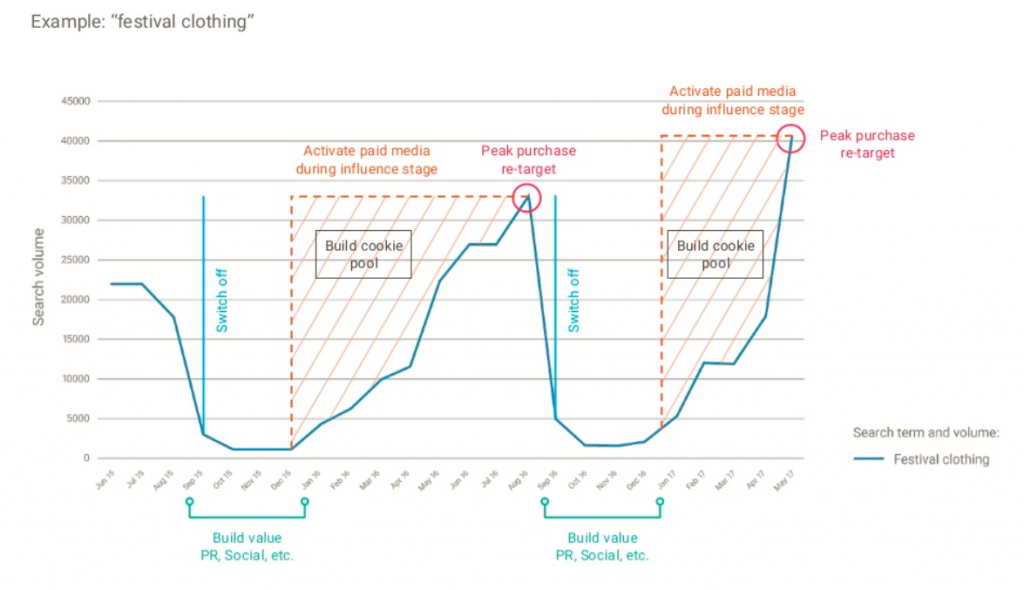

CPCs are also much lower during the research period as competition drops off – so if you’re willing to invest more in brand awareness than direct conversions, you can take advantage of the lower rates, and generate interest that will pay off during the peak period.

This means that by the time both sales and CPCs peak, you won’t have to worry about targeting consumers as aggressively, because you’ll have already laid the groundwork for orders and sales coming through.

Activating paid media during this period also brings a healthy amount of traffic to your site, which can build up a strong cookie pool for retargeting later on. You can then use that pool during the peak period, whether that be in retargeting display, RLSA, or retargeting email campaigns, and pull in conversions in a much more efficient way.

This data can further be used to benefit the rest of your organization, beyond the digital and SEO teams. What can you expect from the season to come? Is it the same as what we saw last season? Is there anything that might trigger slightly different trends? The influencer period is also a key merchandising period, so you should make sure that the products people might be researching are front of store, and displayed prominently on your website.

Then, in the aftermath of the peak sales period, you can determine when demand is dying down and it’s time to discount and sell off your stock. If your data tells you that you can expect another peak later in the year, however, you might want to hold onto that stock for later.

Customer data: Giving context to the searches

All of the “star performers” in retail put search data first when they build their strategies, said Moule – feeding it in an intelligent way to all of their channels. This gives teams a framework of data that they can plan around, instead of trying to retroactively crowbar it into plans that have already been set in stone.

Moule advised that you can give your data even more “oomph” by integrating it with other datasets, such as social conversations, and customer research. These kinds of datasets can give a vital context to the trends you’re seeing from search data – allowing you to understand not just which trends are taking place and when, but why.

This is important, because if you can determine the external influences on your market, you can predict and prepare for them in the future.

As an added benefit, these kinds of data sets can help you get buy-in for your strategy from other parts of the business, who might be less familiar with search data, but feel more confident basing their decisions on social or customer research data.

A case study in aligning datasets

An excellent example of how this can work in practice is a case study carried out by Pi Datametrics with social listening tool Brandwatch, which used social discussions to give context to search trend data about personal debt.

Looking at the search trend data, Pi found it easy to identify some patterns, most notably that searches about personal debt regularly peak around January of each year.

This is to be expected following the heavy spending period of Christmas, where people might splash out on gifts for their loved ones, only to find themselves facing a mounting credit card bill come January.

When Brandwatch dived deeper into the tweets that were being sent out around that time, they found that many of the conversations revolved around getting debt-free as a new year’s resolution. Not only did this validate the patterns that both companies were seeing in the search data, it also added a layer of sentiment analysis to the dataset.

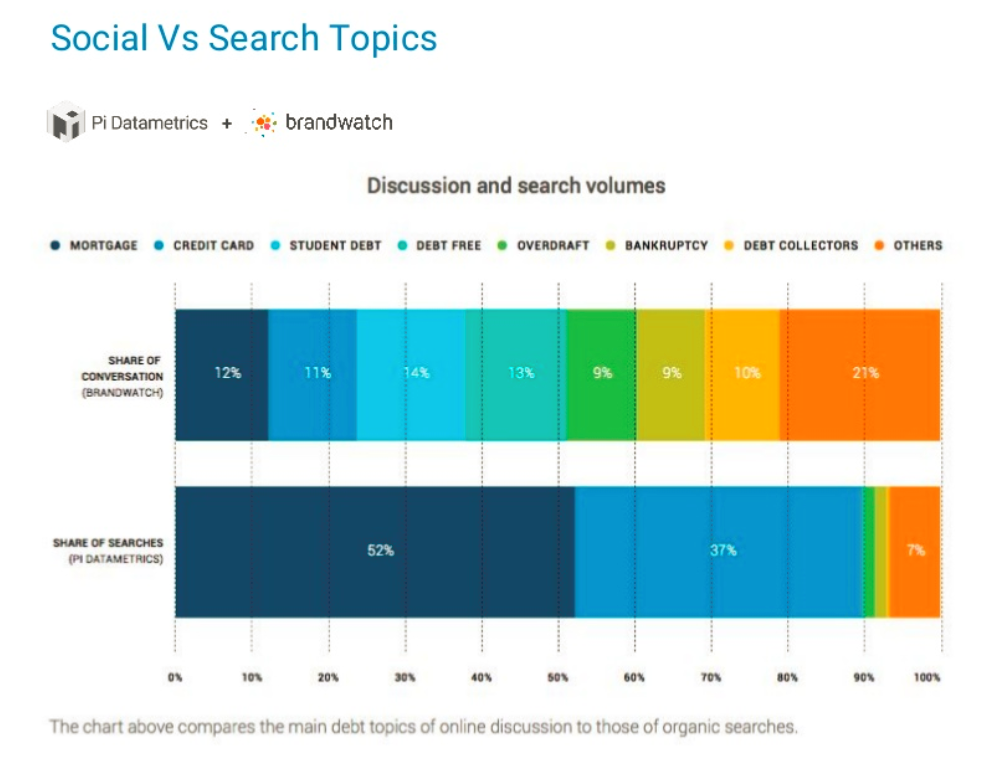

When compared alongside search data, social data can further give an insight into the diversity of conversations taking place in your industry.

Pi and Brandwatch found that people’s searches were heavily focused on mortgages and credit cards, but on social media, the conversation was very evenly spread across the spectrum of personal finance topics: everything from student debt, to going debt-free, to bankruptcy and debt collectors.

“If I were a brand in the financial sector, I might look at this and think, ‘Am I creating enough content to be able to join in with all these types of conversations?’” said Moule. The diversity of social conversations can give you many more opportunities to get your brand in front of people.

Key takeaways

To sum up, here are the key points to remember when delivering a data-driven search marketing strategy:

- Think of the customer needs first, and technology after

- Use search trends as customer research data

- Look at value, not just volume

- Get organizational buy-in for your data for aligned planning

- Integrate with other datasets for a truer view of customer intent.