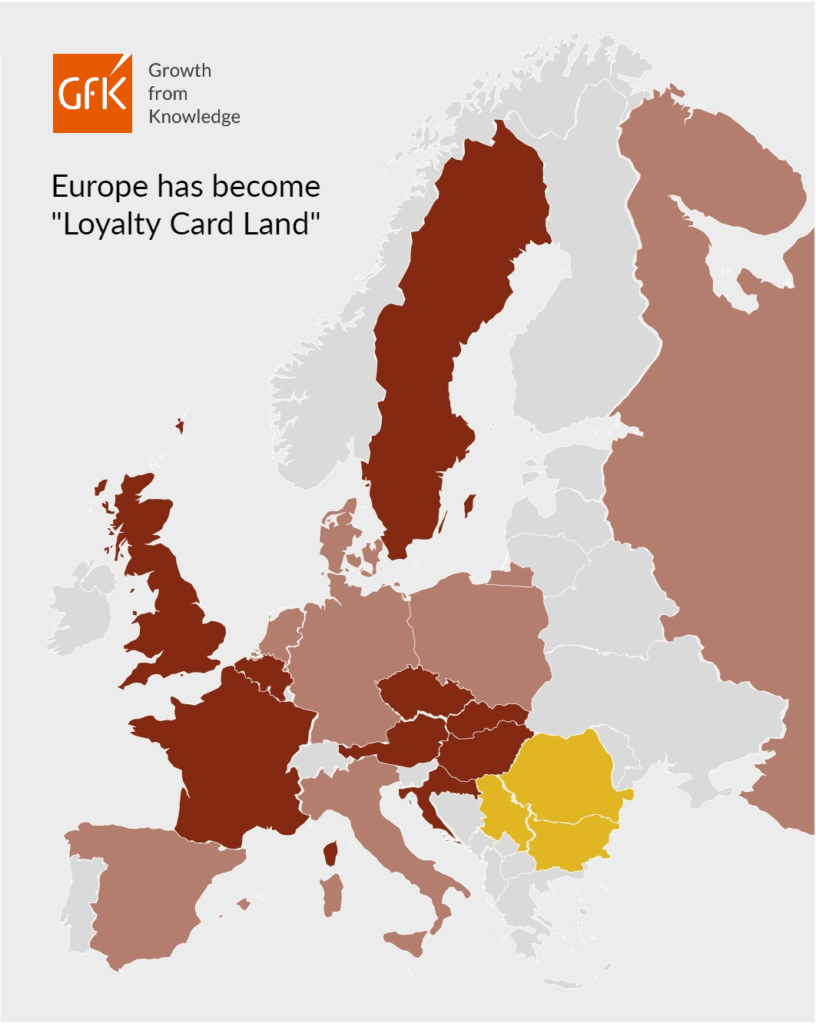

Love them or hate them, you can’t ignore loyalty cards, but just how widespread is their use across Europe, and what innovations are shaking up the existing schemes? In our whitepaper Keeping Shoppers Loyal – An inventory of FMCG loyalty card programs in Europe, we address key questions about loyalty schemes and their effectiveness in FMCG retail. We compare retailer-run and multi-partner programs in 19 individual markets and examine how the landscape differs by market.

The insights are based on data and analyses from all major markets in Europe. Powered with figures from GfK and Kantar, Worldpanel division, and each country’s expert knowledge, this white paper provides a solid foundation for your business decision-making. We address key elements of FMCG loyalty cards including:

-

• Penetration rates by market and channel

• The pros and cons of multi-partner versus retailer-run programs

• Consumers’ appetite for schemes, and how many they will realistically juggle

• Measuring the success of FMCG loyalty card programs in Europe

• The rise of ‘paid for’ programs

Get inspired by innovative moves in Austria, Great Britain, Germany

We shine a spotlight on three markets so you can gain valuable insight that can be applied to your business into different ways loyalty schemes are evolving. In Austria, we investigate how retail giant Lidl uses the market to test new concepts prior to launch in Germany. It was here that their app was first trialed, and REWE launched its multi-partner Bonus Club. Since the 1990s, the Austrian market has been innovative when it comes to implementing FMCG loyalty card programs within Europe. The high penetration rate confirms the overall acceptance in the market.

In Great Britain, we show how Tesco has used a paid-for loyalty scheme to maintain its sizeable shopper base in the face of stiff competition from the discounters. Rival Sainsbury’s new app-only offer is discussed in light of how consumers feel about doing away with physical cards made from plastic and managing grocery shopping from their phones.

In Germany, we asked how a saturated market with price-conscious shoppers can make room for even more loyalty cards. It certainly seems it can, as new schemes continue to launch and attract members, so read more to find how they have succeeded. And for retailers looking to enrich their loyalty programs with data, there’s a solution as well.

COVID-19 impact on shoppers and loyalty FMCG loyalty card programs in Europe

After we went to press, the coronavirus crisis began to unfold, and we’ve updated the report to address the implications of this situation on shoppers and loyalty schemes.

First and foremost, in the immediate crisis shoppers reacted by buying the basics, so bargain-hunting was forgotten as people sought to find any toilet roll or pasta, not a particular product or brand in their favorite store. Next, shoppers were asked to minimize what they touch and checkout procedure had been complicated through hygiene measures, such as plastic walls, etc. All in all, a situation which is not the setting that drives an extra card to be scanned. But this could be completely different when it comes to loyalty programs that are integrated in an app – in particular, when combined with mobile payment.

As the crisis evolves and supplies return to shop shelves, the next hurdle will be economic; many people have lost their jobs or had their incomes cut. Shoppers will need to manage on reduced funds, and at this time, we believe loyalty schemes will have an important role to play. Retailers will rely on them to attract and maintain their shopper base, and shoppers in turn will want to maximize their benefits and points to make their money go further.

It has always been essential to understand how consumers behave if you want to succeed. Now more than ever, understanding what shoppers want becomes extremely important if you are to engage with your customers and get the right offers to them and be seen to support them in these tough times.