Unlike traditional search engines that are used to find more general information, consumers typically use Amazon to search for products. And, increasingly, the site offers organic and paid opportunities that enable brands to capitalize.

An April 2017 Forrester study said 31% of US online adults who made a purchase in the past three months started their shopping research on Amazon – and they did more than 200 bn searches on the site in 2016.

Similarly, a 2016 study from personalization platform BloomReach found 55% of consumers turn to Amazon first when looking for products online.

“It’s just a different mindset,” said Joe Migliozzi, managing director of e-commerce and retail media unit Shop+ and lead of media company Mindshare North America. “On Google, they might be doing research, but on Amazon, they’re actually looking for a product to put in a basket.”

So how do brands ensure their products appear prominently before these eager shoppers?

The short answer: It both is and isn’t like optimizing for Google.

Relevance and importance

According to Nathan Grimm, director of marketing at Seattle-based agency Indigitous, all search engines – Amazon included – are looking for relevance and importance.

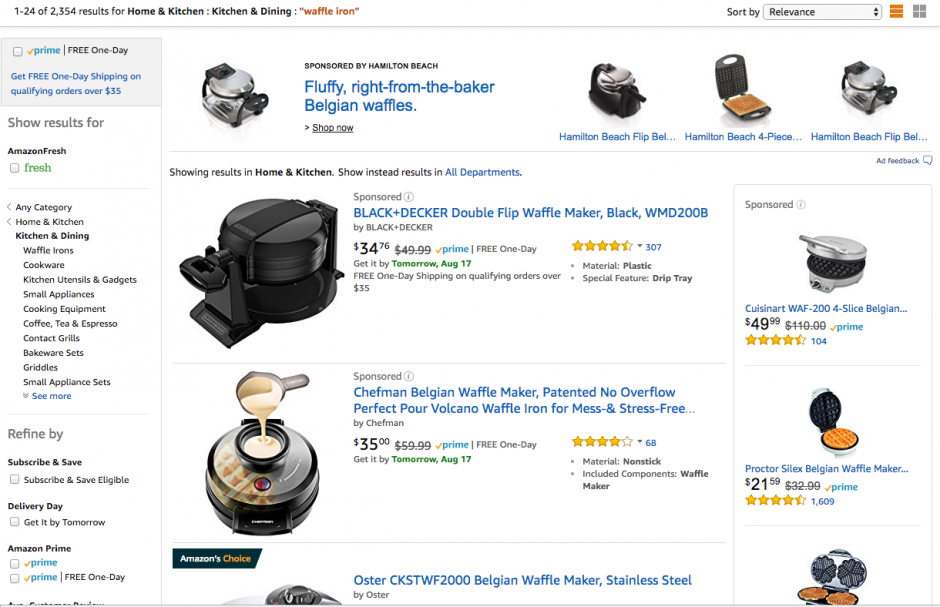

For Google and Bing, that means analyzing the content of a page and the sites that link to it. For Amazon, however, it’s about trying to understand the relevance and importance of specific products, particularly when Amazon sells so many different versions of, say, umbrellas or coffeemakers or waffle irons.

But, like traditional search engines, Grimm said keywords and content help establish relevance and importance even if Amazon is analyzing a smaller set of more structured data than Google thanks to product categories and category-wide attributes like size, weight and materials.

“So the relevancy job is a little easier [for Amazon] – the data is categorized and sorted,” Grimm said.

Like traditional search engines, keywords are important.

In other words, keyword-rich content matters as much to Amazon as it does to Google and Bing.

And, Grimm said, marketers can use a number of tools to determine which keywords are important on Amazon. For his part, Grimm uses the search terms report in the Amazon Retail Analytics (ARA) Premium service and performance data from his Amazon Marketing Services PPC campaigns to determine which keywords have a high search volume and convert well on Amazon. However, he noted ARA Premium provides a ranked list of keywords by volume, but doesn’t reveal how much search volume exists.

In addition, Migliozzi said brands may find new potential keywords in customer reviews.

Jos Smyth, vice president, group director and national lead of SEO at marketing and technology agency DigitasLBi, agreed consumer reviews play a big role in determining rank on Amazon and they’re a valuable source of information.

“By scraping these reviews we’re able to mine the linguistics and identify themes around consumer experiences with the products and then feed this information into the product description, website copy and even the product development process through adding features that are broken or desired,” Smyth added.

Unlike traditional search engines, sales matter, too.

But, Grimm said, instead of building links as in traditional SEO, Amazon ranking also comes from generating sales.

“[Amazon’s] goal in sorting products is to make themselves a lot of money,” Grimm said. “The [product] you’re most likely to buy is #1 and next most likely is #2. The best predictor is those that have sold in the recent past.”

Michael Dobbs, vice president of SEO at digital marketing agency 360i, agreed Amazon’s algorithm takes into account “things that maybe are more price-driven.”

“Also how much product is ultimately selling is really the big driver of Amazon’s algorithm…,” Dobbs added. “Amazon is focused on moving as much inventory [as possible].”

The Forrester study said it shouldn’t be surprising Amazon ranks best-selling products higher – and some brands have even found Amazon cares more about recent sales than long-term sales history.

As a result, Smyth said one way to enhance organic rankings in Amazon is through sponsored listings, which drive sales. This sets Amazon apart from Google as the latter has “consistently made it clear from the start that running paid ads do not increase organic rankings in any way.”

That being said, Grimm said he’s seen evidence the products with the most traffic and sales rank highest, meaning conversion rate in and of itself could be less important.

Other ranking factors

The Forrester study also listed fulfillment as an Amazon ranking factor as Amazon wants its “highly profitable and loyal” Prime members to be happy and it is in its own best interests to incentivize merchants to help it deliver products within two days. As such, the fulfillment option Amazon Shipped and Sold has the highest correlation to greater search ranking, Forrester said.

The research firm also found images play a role in Amazon rankings as they help customers “confirm that the product is what they want.”

Amazon Advertising

And, of course, brands can always advertise with Amazon to boost rankings, even if Jason Snyder, global chief technology officer at brand experience agency Momentum Worldwide, called the platform a walled garden and Dobbs said there is a knowledge gap among marketers.

“The ad platform is new, it doesn’t offer tools that more sophisticated platforms like AdWords do,” Dobbs added. “There are a lot of questions being asked of Amazon on how brands can increase [and] improve visibility.”

Amazon Marketing Services, the Google AdWords of Amazon

Amazon ad products are available through Amazon Marketing Services (AMS), which, per Amazon, “help more shoppers discover and buy your products.”

Specific products include: headline search ads, which are keyword-targeted cost-per-click search ads that appear at the top of the first page of search results; sponsored products, which are keyword-targeted cost-per-click search ads to help drive sales at Amazon.com and appear at the right side or the bottom of search results, as well as on product detail pages; and product display ads, which are cost-per-click ads that help drive sales and traffic to a product’s detail page that can be targeted by specific products or shopper interests.

What’s more, Migliozzi said these Google-like ad products are a “big, growing piece of the marketing solution on Amazon” and it “will be a bigger part in the future.”

At the same time, Forrester said Amazon has a long way to go in advertising and noted its three ad formats are “in a basic state.”

“Amazon doesn’t allow for dayparting so that advertisers can assign time periods for when ads go on and off,” the study said. “It doesn’t assign quality scores for ads to understand how relevant they are for a given keyword query. And it doesn’t provide bidding governance support for multibrand advertisers so similar product ads don’t bid against each other.”

AAP – the next big DSP?

Amazon’s DSP is the Amazon Advertising Platform (AAP), which allows advertisers to buy display ads on Amazon.com “or across a huge portion of the Internet as well to drive traffic back to Amazon or another website,” Grimm said.

Kevin Mannion, chief strategy officer at Advertiser Perceptions, which provides business intelligence for the ad industry, likened AAP to commerce marketing firm Criteo, which remarkets outside walled gardens.

“The ad can follow the Amazon user as they are in another open web environment…versus a typical DSP that is not just remarketing, but [providing] a whole range of advertising to users – display, video, mobile and so forth,” Mannion said. “In some respects, you might say DoubleClick Bid Manager and the Trade Desk and MediaMath are more classic DSPs and AAP is more of a retargeter that is DSP-like.”

And AAP is growing, too, becoming an increasingly viable resource for marketers and agencies.

Grimm said AAP has a unique selling proposition as a DSP for three reasons:

- Amazon has its own exclusive placements on Amazon.com and other Amazon properties that other DSPs can’t reach;

- Amazon can offer targeting of groups based on what they’re shopping for on Amazon, including those looking at products in specific categories and within specific timeframes;

- And Amazon can report on sales that happen on Amazon.com, as well as on how purchase and search behavior changed on Amazon while specific ads were running.

For his part, Mannion attributes this growth to its ability “like no other brand [to understand] buying behavior” thanks to highly personalized data about intention. Thereby “Amazon becomes a very rich ground…for advertisers to then retarget them as those users go on the open web.”

Migliozzi also pointed to the data Amazon has about Prime members in particular, which has also helped grow its media network.

In fact, in June, WPP agencies Mindshare and Possible announced a joint offering to help brands “leverage their media and e-commerce investments across the entire Amazon ecosystem.”

“We set it up because we saw a greater need for clients to understand Amazon capabilities,” Migliozzi said. “Every day, there’s something new that’s going on that [Amazon is] announcing. It’s becoming a bigger part of the media landscape.”

In addition, Advertiser Perceptions’ Q4 2016 Programmatic Intelligence Report found Amazon has “arrived in a big way” as a DSP as it was ranked the most-used DSP and the most preferred DSP.

Mannion said Amazon was a surprise in this particular survey, but also performed well in a more recent study, confirming Amazon is a “significant player” among DSPs and “certainly it was not a blip.”