COVID-19 Impact: Trucking Industry

The ongoing pandemic situation and the resultant lockdown to combat the spread has once again underscored the importance of, and the inefficiencies in, the trucking industry. The subsequent actions and inactions have led to transporters facing problems during the lockdown, and will have a major impact even when the lockdown is eventually lifted.

Overall Economic Impact on India

FY21 Growth Pegged to be the Slowest Since LPG Reforms in 1991

The pandemic has struck at a particularly unfortunate time when India’s economy is slowing down. Growth in FY20 is estimated to be around 4.8%-5%, and according to the South Asia Economic Focus report by the World Bank, the economy is expected to grow 1.5%-2.8% in FY21. In fact, multiple international bodies have forecasted a slowdown in the growth of the Indian economy. During the lockdown period, a less than quarter of the Indian economy is operational. 53% of Indian businesses have indicated an impact of COVID-19 on business operations, according to a FICCI survey. Around 42% of the respondents said that it could take up to three months for normalcy to return, after the lifting of the lockdown. The major sectors impacted are transport, hospitality, and real estate.

Foreign Trade to Take a Massive Hit

Exports in the country are expected to suffer massively as demand dies in trading partners of India who are the hardest hit by the coronavirus, countries such as China, Spain, Italy, Japan, South Korea, the US, and Iran. Exports to these countries are now limited to only essential commodities with exports contracting by 34.6% in March 2020. China reopened its manufacturing units after temporarily shutting them down, providing a bit of relief to industries that are dependent on the country for imports of raw materials. India’s imports mainly electronics and chemicals, a key component in India’s massive pharmaceuticals industry. The slowdown in the imports of chemicals will massively hinder the domestic production of essential medication and generic drugs for import.

Lockdown’s Impact on Trucking Sector

Entire Transport Industry Halted with Small Fleet Operators Severely Affected

Impact of COVID-19 on India Trucking Market

With only essential commodities being permitted to be transported, many trucking companies are without business. Even though the trucking industry has been striving its best to ensure the availability of essential goods, it has not come without its own challenges. Even those who are out there distributing commodities faced harassment by police and local authorities, which is again deterring transporters from accepting loads due to fear for the safety of their drivers. Many drivers have left their trucks stranded on highways and have gone home due to a lack of access to food due to the closure of dhabas along highways. An estimated 3.5 million trucks are stranded on India highways with the cost to the trucking industry estimated around ₹ 1,500-₹ 2,000 crores per day.

Small Fleet Operators Hardest Hit

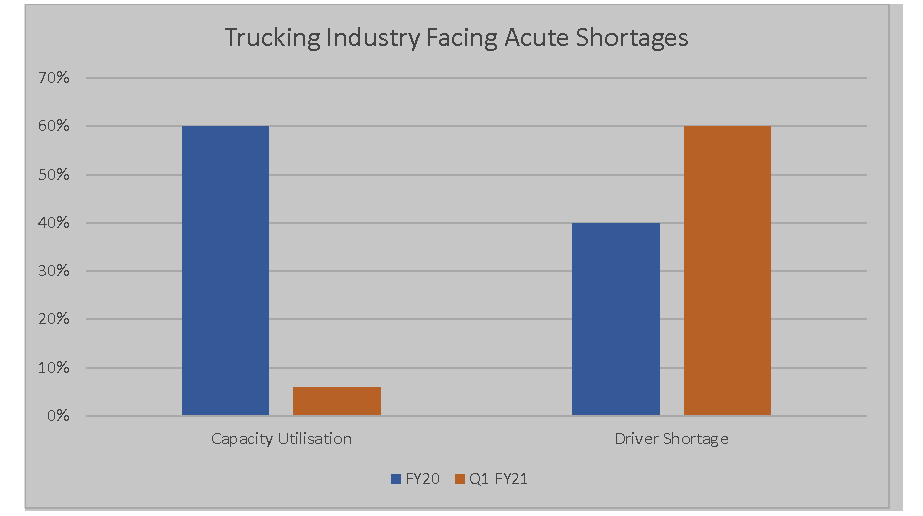

Small fleet operators (transporters owning less than 5 trucks) own the majority of the trucks in the country and carry the large chunk of volume of goods. They usually subsist hand to mouth, and with no new loads, their very existence is threatened. The primary concern for them is they might be unable to pay their EMIs for their trucks, due to which their trucks might get repossessed, which was addressed by the government when it announced a deferment of EMI payments. But even with that safety net, the loss of business would set back the industry and can have attrition of drivers in a market already faced by driver shortage.

Short Term Impact on Business in Trucking Industry

Industry Anticipated to Face Pressure of Lockdown in H1 FY21; Slight Recovery in H2

The trucking industry is anticipated to feel the stress of the lockdown at least by the end of H1 FY21. The International Energy Agency (IEA) in its latest report said that India’s annual diesel consumption – a proxy for diesel demand – will drop by 6.1%. The diesel demand is affected by the death of demand in at least Q1 FY21, with trucks being utilized at only 10% of pre-lockdown levels. The ban on the manufacturing and logistics of non-essential items to control the spread and prioritize the production of essential food and medical items. The trucking industry is expected to contract by around 5% in FY21 due to lack of demand in Q1 FY21, and the slow pickup of major sectors post-lockdown on which the industry is majorly dependent on, industries such as automobiles and cement. The industry will also be impacted by the reduction in the foreign trade and slow return of normalcy of EXIM levels. With the lockdown being partially lifted on the 20th of April, and trucking and logistics services being permitted for all commodities since 30th March, the trucking industry is expected to incur a loss of around ₹ 40,000 crores, down from an estimated ₹ 80,000 crores had the lockdown not been lifted. Almost all trucking companies are expected to run into losses, with asset-heavy companies suffering the most, due to high fixed costs.

The situation is anticipated to get better with stimulus packages by the government, regaining of consumption demand at large due to positive consumer outlook, and restoring of manufacturing production to pre-lockdown levels. The industry is expected to pull off a moderate recovery in H2 FY21, with the regaining of growth starting in FY22.

Initiatives to Improve the Situation

Government Providing Relief and Safety Nets to Protect the Industry

The government has announced a slew of measures to help the lifeline of the country operational. The government has announced the deferment of the EMI payments for 3 months and the Ministry of Road Transport and Highways (MoRTH) has extended the validity of permits and licenses till June 30th. The government is also expected to introduce a short-term insurance cover for truckers and helpers transporting essential goods. Industry associations have also been stepping up to feed stranded truckers and have launched helpline services.

These measures will provide immediate relief and provide transporters/truckers with a little more liquidity for operational expenditure during these tough times. With the industry being largely credit-driven with the payment period between 45-60 days, more measures are needed to ensure that truckers are able to receive timely payments on their loads. The industry requires long-term plans to reach pre-lockdown operation levels.

Key Segments Covered: –

Freight Forwarding Market

By Revenue by Mode of Transportation

Road Freight (Volume and Revenue)

Rail Freight (Revenue)

Sea Freight (Revenue)

Air Freight (Revenue)

Warehousing Market

Space by Business Model

Industrial/Retail

CFS/ICD

Cold Storage

Agriculture

Warehousing Space by Region

NCR

Mumbai

Bangalore

Pune

Chennai

Kolkata

Hyderabad

Ahmedabad

Others

Space by End User

3PL

E-Commerce

Retail

Engineering & Manufacturing

Electronics

Others

Cold Chain Market

Revenue by Service

Cold Transportation

Cold Storage

Revenue by Temperature Range

Freezers

Chillers

Ambient

Snapshot on Co-Packing Market in India

Companies Covered

TCI

Agarwal Packers and Movers

Varuna Group

Gati

VRL Logistics

Blue Dart

DTDC

Safexpress

NTC Logistics India

KerryIndev Logistics

Stellar Value Chain

Shree Shubham Logistics

Central Warehousing Corporation

Avvashya CCI

Rhenus Logistics

Avanthi Warehousing Services

ATR Warehousing

Snowman Logistics

Coldman Logistics

ColdStar Logistics

ColdEx

Gubba Cold Storage

Crystal Group

Key Target Audience

Freight Forwarding Companies

E Commerce Logistics Companies

3PL Companies

Consultancy Companies

Logistics/Warehousing Companies

Real Estate Companies/ Industrial Developers

Time Period Captured in the Report: –

Historical Period – 2014-2019

Forecast Period – 2020-2024F

Key Topics Covered in the Report: –

India Logistics and Warehousing Market Introduction

Logistics Infrastructure

India Logistics and Warehousing Market Size

India Logistics and Warehousing Market Segmentation

India Logistics and Warehousing Market Future Outlook

India Logistics and Warehousing Market Future Segmentation

India Freight Transportation Market Size

India Freight Transportation Market Segmentation

India Freight Transportation Market Future Outlook

India Freight Transportation Market Future Segmentation

India Warehousing Market Size

India Warehousing Market Segmentation

India Warehousing Market Future Outlook

India Warehousing Market Future Segmentation

India Cold Chain Market Size

India Cold Chain Market Segmentation

India Cold Chain Market Future Outlook

India Cold Chain Market Future Segmentation

Regulatory Environment

Issues and Challenges

For More Information on the research report, refer to below link: –

India Trucking Industry

Related Reports by Ken Research: –

UAE Cold Chain Market Outlook To 2025 – By Cold Storage (Ambient, Chilled And Frozen Warehousing) And Cold Transport (Land, Sea And Air), By End User (Dairy Products, Meat And Seafood, Pharmaceuticals, Fruits And Vegetables And Others) And By Ownership (Integrated And Contract Logistics)

UAE Logistics And Warehousing Market Outlook To 2025 – By Road , Sea And Air Freight Forwarding; Domestic And International Freight, Major Flow Corridors, Integrated And Contract Freight Forwarding; By Warehousing (Industrial / Retail, CFS / Inland Container Depot & Cold Storage, Agriculture), End Users (Manufacturing, Retail, Food And Beverage, Automotive, Oil And Gas, Healthcare), Type Of Warehouses; By Courier Express & Parcel Market , And, E-Commerce Logistics

Turkey Logistics And Warehousing Market Outlook To 2025 – By Domestic And International Freight Forwarding Throughput, Revenue & Flow Corridor (Road Freight And Pipelines, Sea, Air And Rail Freight), By Warehousing (Industrial / Retail, Container Freight / Inland Container Depot & Cold Storage), By 3PL, Courier Express & Parcel, Domestic And Cross Border E-Commerce Logistics

Contact Us: –

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249