Has Amazon Created a Culture of Shoppers on Autopilot?

How do you shop? I go to Amazon. There is a huge selection, prices are reasonable, there is a 5-star rating system, I can read reviews and I am a Prime member. I know that almost always, I will get what I order in two days or less, sometimes even within two hours, for no extra charge. Shopping is convenient, always-on, fast, and risk-free.

Those are all the rational reasons I shop on Amazon. But in reality, I am on “autopilot.” I rarely even think about going elsewhere to check prices, availability, or delivery options. I love “one-click” ordering! It’s only when an item isn’t available on Amazon, that I switch off autopilot and I am forced out of my habitual shopping behavior.

Frictionless Buying

Amazon Prime, “Buy now with 1-Click”, “Subscribe Now” and “Free next-day shipping” are addictive forms of frictionless buying.

Using Amazon Prime, 1-Click and auto-deliveries (Subscribe Now button), Amazon has created an optimized ecosystem for automatic, non-deliberative buying behavior, similar in effect to Daniel Kahneman’s System 1 behavior. But even more important, when you move to more deliberate decision behavior, this shopping ecosystem encourages you to find and compare products within the context of a set of choices curated by Amazon. Effectively, Amazon has not only created the autopilot context within which you shop, but they have also curated your decision set and made your decision incredibly easy with a default decision to click “Buy Now.”

And of course, there is a very clear, triggered reward with the arrival of the iconic Amazon box – Seven days a week!

A Curated Product Ecosystem

According to eMarketer, by 2020 US Amazon Prime will reach 69 million (55%) U.S. households.

Amazon has created a new form of commerce, compressing habitual and deliberate shopping behavior into a curated product ecosystem.

Companies need to understand and influence both habitual (autopilot) and deliberate decision behavior in this new intense and urgent environment. Their responses to it have huge implications on how they launch new products, communicate with their target audiences, set prices, and plan digital and social app strategies. For instance, part of autopilot behavior is the ability to reorder a product without much thinking or conscious decision making — it’s important to be sensitive to changes in a product’s visual, package size, quantity, or price. Doing so may result in Amazon’s curated list appearing, tempting customers to change from “autopilot” into a deliberate mode. In turn, opening up the possibility of a consumer selecting a competitor’s product, the “disruptor,” over your company’s brand.

Mapping Habitual and Deliberate Decisions

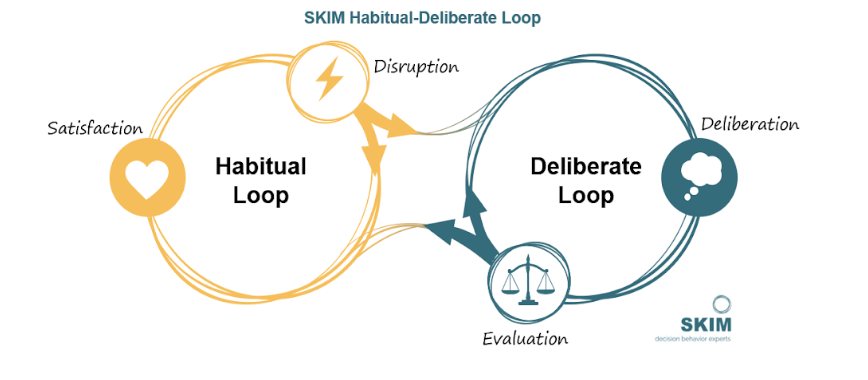

This new behavior environment is so different from the previous bricks and mortar environment, that it calls for a new way of looking at decision behavior. An example of how to think about and disrupt the new curated autopilot environment is shown below. We call it the Habitual-Deliberate Decision Loop.

The Habitual-Deliberate Decision Loop is a framework to understand how to analyze, disrupt and reinforce consumers’ decisions by identifying the habitual triggers and deliberate disruptors that influence, either implicitly or rationally, on consumer decisions. Brands have dual goals for their products: reinforce current customers to buy more and to disrupt competitors’ customers to try their product. In the case of Amazon and other online retailers, the goal is more specific – how-to insert themselves into the “autopilot” cycle. These loop models can be used to understand how the compression of habitual and deliberate applies to a set of products and buying decisions for a brand’s online go-to-market strategy.

For instance, take me – for a brand to cause me to make a deliberate decision about a purchase in an autopilot process, there would have to be an external disruptor, some sort of change in the product. An example is running shoes. I am a runner and have purchased Saucony 7 Glide shoes on Amazon for years. I buy a pair every six months, like clockwork, with a 1-click purchase. Guess what – Saucony decided to stop making that model. They have a replacement, but they forced me into a deliberate behavior mode of trying the new model out. I don’t like the replacement and, in fact, I chose a different brand. As you can imagine, there are a lot of implications and “what ifs” from Saucony’s product introduction and migration strategy.

As can be seen, my experience, having a clear understanding of the components and interactions in consumers’ Habitual-Deliberate Loops can help integrate short- and long-term product introduction strategies, execution plans, and mitigate changes in product and pricing. It can also help guide a company’s insights into strategy, including where to best allocate research spending. As an example, Saucony could have included a coupon and information about their upcoming product change in their shoebox, giving me time to get familiar with other choices they have. And if they really wanted to have a DTC strategy, they could have invited me to their website.

After assessing the habitual and deliberate behavior of consumers, brands still need to develop and optimize products for this environment.

Testing and Optimizing Products, Formats, Claims, Ads, and Pricing for an Autopilot World

Consumers (and Amazon) in this ecosystem are forcing companies to develop new go-to-market strategies. As a result, strategies, products, packaging, and bundles, optimized for online shopping and decision (and autopilot) environments, are emerging. However, Amazon and other online commerce platforms are quite unwilling to share consumer information with suppliers creating what are called “walled gardens”. As the brand chief at P&G states, walled gardens are here to stay.

Therefore, suppliers are very concerned that they don’t have the consumer decision behavior information they need to optimize their product selection for consumers.

Another concern that companies have is how to develop and test and optimize new products and configurations for Amazon and other online platforms without telegraphing their intentions and strategies to competitors.

A/B testing works in some cases, but companies using it for online shopping environments run the risk of introducing confusion and mistrust to their consumers. Especially if they present product images, new products, bundles and pricing that are not actually being offered.

An alternative is using replicated website testing platforms to recreate the shopping environment of a particular website in a confidential setting. SKIM’s version is called DigiShop. These environments can be a powerful and agile way to help companies develop and modify successful products for online shopping. These website testing environments work well for a variety of settings — on a product level when introducing and optimizing “hero image” products, banner ads and web pages, and in both the western and Asian markets. Also, they work well for various types of product categories, from shampoo to alcoholic beverage brands, to be sold through a big-box warehouse, and specialty online retailers.

Summary

The strategic and executional eCommerce challenges that brands are facing in a shopping context, curation, autopilot, disruptions, and decision behavior are extremely challenging. And they are changing daily, as companies, like Amazon, build on their momentum and power. We are intensely engaged in helping clients understand and succeed in this new and very fast-changing environment. It is indeed a fascinating time to be engaged in understanding and influencing consumer decision behavior!