Ever since smartphones and tablets became an integral part of our daily lives, things have gotten a lot simpler. We can look up an address at the last minute, compare prices online while we’re in-store, look for a restaurant and book a reservation, and even make payments in just one quick click.

Mobile payment is a convenient transaction as there’s no need to take out your credit card from your wallet every time, nor enter any codes. Everything is pre-registered in your mobile device. This convenience is quickly making its way into becoming a consumer habit. In fact, mobile payments have grown exponentially in recent years, with research from TrendForce revealing that consumers worldwide will spend $620 billion in mobile transactions this year. This number is expected to reach $1.08 trillion by 2018, which is almost twice the current figure.

If mobile payments make sense for your business, you can’t afford to think of them just as a technical service and neglect them as a key aspect in your marketing strategy. It’s important to consider every stage of the path to purchase, which includes the actual purchase. However, many consumer mobile marketing strategies leave out the key service of mobile payment.

It’s critical that once your buyers are committed to buying your product, the transaction is easy for them. Payment needs to be convenient, so buyers can make the transaction from whichever device they’re on, and it also needs to be trustworthy, so they don’t have to worry about fraud. Implementing mobile payments is well worth it, and here are six ways to effectively use mobile payments in your marketing mix:

1. Think Mobile from the Start

Mobile capabilities extend throughout the customer lifecycle, from finding a product through mobile search and ads, to learning about it through different channels (social media, website, etc.), and finally deciding to buy it. In this entire process, everything should be mobile-optimized, not just the last phase. Mobile payment will come off as isolated, incoherent, and scarcely useful if it isn’t inserted into an overall mobile marketing strategy. If your website does not work well on mobile, it’s unlikely that consumers will continue to shop on it and make a purchase. Or if your social media promotions are too content-heavy for mobile users, they probably won’t click through to download the offer. Therefore, it’s critical to regularly review your marketing channels and ensure that they’re optimized for mobile.

2. Simplify Your Check-Out Process

Quick action on mobile is essential. In general, people appreciate quick services that do not consume their time. Lengthy wait times often discourage customers from making a purchase, but mobile payment solves this problem, allowing you to complete the transaction much faster than with a normal credit card. Be sure to fully exploit this advantage. For example, you can create special counters or codes for those paying through this system or payment points within the store that don’t require customers to go and pay at the counters.

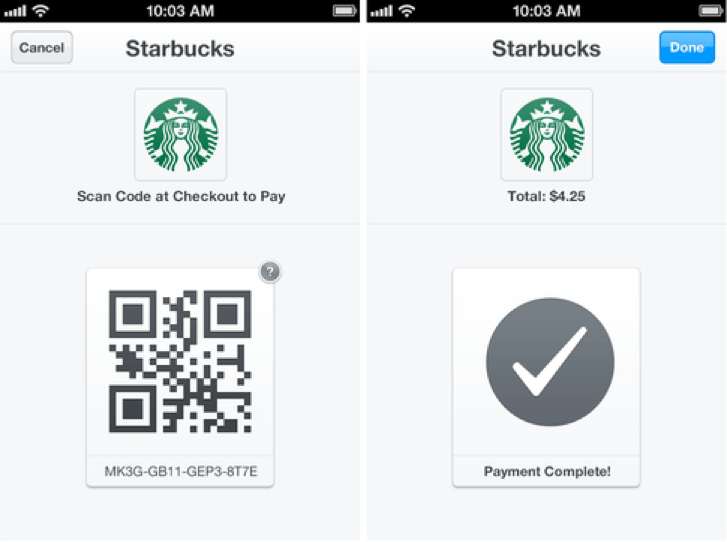

When it comes to a company that does this right, consider Starbucks, whose CEO, Howard Schultz, defines as an “undisputed leader in mobile commerce.” Thanks to the investment they made several years ago to develop their own app for mobile payment, Starbucks is now one of the best-known and prime case studies of the strategic value of mobile payment. According to Starbucks, 21% of their transactions in the U.S. are made using mobile devices, for a total of six million transactions per month.

3. Watch Out for Fraud

In many cases, mobile payment is more secure than traditional payment systems because it stores financial data, which means your customers don’t have to type it in each time they make a purchase. However, this data can be hacked without the right security measures in place. According to a report by LexisNexis and Javelin Strategy and Research, a fraudulent mobile transaction can cost a company three times the value of the actual product stolen due to payment-processing fees, fraud investigation, and restocking stolen goods. So how do you prevent these unfortunate incidents from happening in the first place? Authenticate mobile transactions, track fraudulent activities, and report suspicious activity to the authorities. You will help yourself, your customers, and other businesses by making mobile payments more secure for all.

4. Track Behavior and Transform It into Action

Keeping track of consumer behavior gives you deep insight into what they actually do—not what they say they do. With mobile payments, you can automatically collect data, thanks to the transaction itself, to understand how often consumers are purchasing from you and when (time, day of the week, season, etc.). Make the most of this opportunity and dig into data frequently to see what the best-selling products are in a certain period, whether a promotional activity is actually generating purchases, and how to improve your services. For example, if a certain product is particularly popular on the weekends, you can increase the stock for it during those two days and place it out in the front of the store. In addition, you can offer specific mobile coupon promotions based on the products your customers purchased. In the case of a coffee shop, you can offer fans of a particular type of coffee a coupon to try new products with a similar taste.

5. Use Mobile Payment for Customer Loyalty

When a transaction is completed using a mobile payment app, customer data is automatically recorded. This is one of the biggest advantages of this system that every marketer can and should take advantage of. You can run loyalty campaigns, such as loading points to the customer’s account whenever they make a purchase, and offer rewards and discounts to increase customer retention and loyalty.

Amazon rolled out Prime Now to their Prime members earlier this year, which allows customers to purchase items through their app and receive it within a few hours. Aside from making it convenient for their customers to order and receive items they need within the same day, Amazon also offers weekly promotions on discounted items. While consumers can easily buy these same items in-store, the special discounts give them an added incentive to continue using the app to purchase them.

6. Clearly Communicate This Opportunity

Once you’ve enabled a mobile payment option, you need to figure out how to communicate this new form of payment to your customers. Create a campaign to promote this new service to your current and potential customers and explain how easy it is to use it and all of its advantages: speed, safety, and convenience. You can share this information directly in the store, with posters and totems in various parts of the store, and also online, on your website, in an email newsletter, and by posting it on your social channels. Consider sending your customers a mobile discount coupon valid for the first purchase made through mobile payment.

While mobile payment is not new to Uber, a mobile-only ride hailing app, they partner up with major banks to promote their mobile payment services. Here’s a recent promotion from Uber and Chase to new customers offering $30 off a ride for adding a Chase credit or debit card to your Uber account after sign-up.

Mobile helps us in virtually every aspect of our lives, and mobile payment is a further step in this simplification process. If finding a product and comparing prices is getting easier, then the final step should be just as easy: the purchase. Mobile payment will be a trump card for marketers who use it in their future marketing strategies. So, think ahead and prepare yourself and your team to play this card now.

What are your thoughts on implementing mobile payments as part of a consumer marketing strategy? Share them in the comments below.