COVID-19 has shown that for many office workers, remote work is feasible or even preferable to the daily office commute. Even as lockdowns are slowly eased, as many as 75% of employees prefer to work from home out of caution or convenience. This has dramatically accelerated a trend towards remote work that was already underway over the last decade and begs the question, do we need offices?

The answer is, yes, but with a greater focus on flexibility, wellness, and collaboration. As employees increasingly have a choice of where to work, the office must both coexist and compete with the safety of staying home, the comfort of a favorite cafe, or the convenience of a coworking space. The result is much more variability in when and how offices are used along with increased employee expectations of the workplace.

These same trends powered WeWork’s growth over the last decade, and while WeWork may have faltered, the underlying trends continue to create opportunities for property-tech startups.

Millennials now make up over a third of the workplace and overwhelmingly value flexibility in where, when, and how to work. Moreover, top talent has been increasingly clustering in dense urban areas and has been loathe to commute to suburban office parks. Finally, employees have come to expect the same level of technology in their personal and work lives.

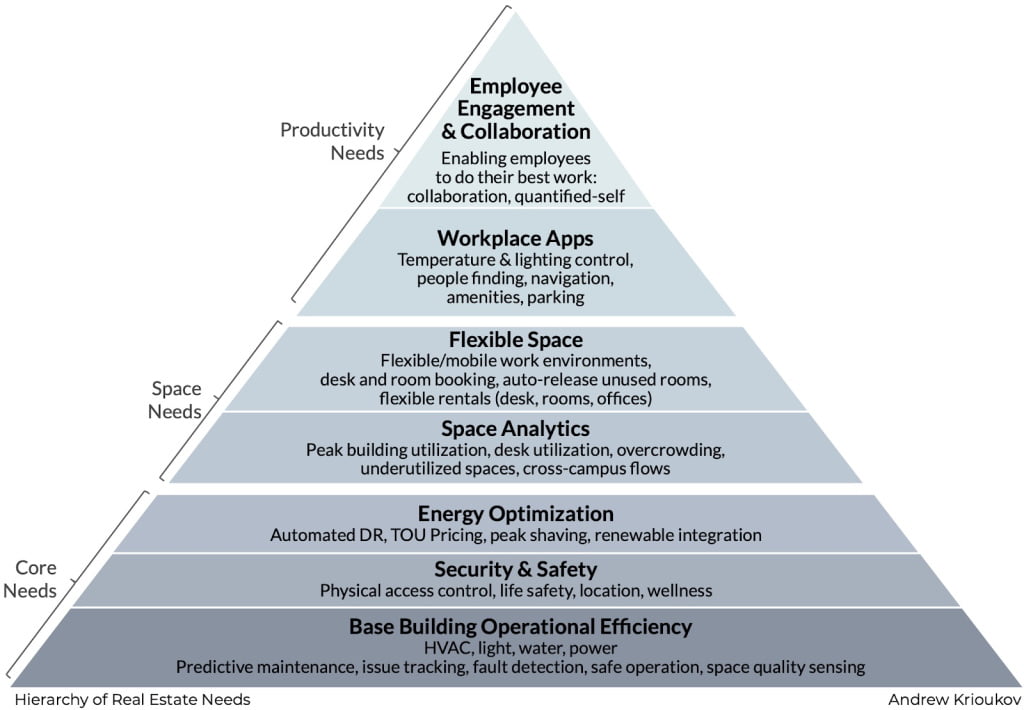

For corporations this poses a complex challenge: how to cost-effectively provide the right kind of office space, when and where it is needed. Solving this problem creates a wealth of opportunity for property-tech startups in three broad areas: 1) core needs, 2) space needs, and 3) productivity needs.

Opportunities

The Hierarchy of Real Estate Needs (above) is a taxonomy of needs and opportunities in property tech inspired by Maslow’s famous hierarchy of needs. The base of the pyramid consists of physiological or core needs applicable to all people in all buildings; the top of the pyramid shows “self-actualization” needs relating to productivity and collaboration that a narrower set of leading customers are currently pursuing. The value of solutions on a per-square-foot basis grows by orders of magnitude as you move up the pyramid because utility bills, rent, and employee salaries are each roughly 10x larger than the former, as JLL describes in the 3-30-300 rule.

Successful business can be built at any point on the pyramid, from high-volume business focused on core needs to high-value business focused on productivity needs or any mix of the above.

Core needs

Nearly all buildings need security, HVAC, and power; however, the way many of these systems operate has been stuck in the 1980s. This creates big opportunities for innovation, and a multitude of new startups have been formed to address these opportunities, including my previous company, Comfy. This is even more true in the time of COVID-19, when proper HVAC operation is critical to reduce the likelihood of virus spread.

Building automation

Automation systems control HVAC, lighting, fire, and security in buildings. Installation and setup of these systems is often very manual, error-prone, and expensive, leaving many smaller buildings underserved. The control logic in automation systems is custom programmed for each building in a process that is slow and frequently results in inefficient or even incorrect code, which is rarely fixed throughout the life of a building. Companies like PassiveLogic are rethinking how building controllers are built, installed, and programmed with an emphasis on ease of installation and automated control.

Once an automation system is installed and operating, a facilities team is tasked with maintaining and servicing any failures. Typical systems have basic alerts with frequent false positives and are often ignored by facilities. In the future, companies will use a mix of rules and AI for predictive maintenance and root-cause analysis to pinpoint issues and proactively order parts or service. Startups working on this problem include Aquicore and KGS Buildings.

Finally, interoperability between systems is poor. While standards like BACnet have existed since the 1990s, they are only used for low-level communication, not application profiles covering common components like thermostats or boilers. There is also a severe lack of metadata describing where components are in a building, how they are interconnected, and how they are configured. BRICK is a leading academic and industry effort in this area and will be a key enabler for future smart buildings.

Security

Security systems control access to offices, elevators, turnstiles, data centers, and other secured spaces. Incumbents in this space have been slow to respond to the convergence of security and IT, especially the growing demand for allowing smartphones to unlock doors. Common pain points include lost keycards, the complexity of adding/removing employees or guests, lack of integration with IT systems, tailgating, and congestion at turnstiles. Companies like Proxy, Openpath, and Latch are disrupting this sector by replacing legacy solutions with cloud-based services. (Disclosure: My firm is an investor in Proxy.)

Energy and grid

Buildings generate nearly 40% of annual global greenhouse gas emissions and therefore are rightfully under increasing pressure to improve efficiency. New York City has recently passed NYC LL97, which will require large buildings to reduce their carbon footprint by over 25% starting in 2024. Cities including Los Angeles, San Francisco, and Seattle are adopting similar rules. Utilities are increasingly charging time-of-use pricing, which makes consuming energy during peak hours much more expensive. All of these forces are pushing owners and operators to invest in measuring, monitoring, and mitigating their energy consumption and to match energy consumption with renewable generation. Startups including Blueprint Power, Gridium, Carbon Lighthouse, and Evolve Energy are capitalizing on these trends.

Space needs

Facing the twin pressures of providing high-quality space in expensive urban centers and supporting employees with flexibility in where they work, companies need new tools to understand how space is used, manage utilization, and provide new locations cost effectively.

Space analytics

In 2018, US offices were utilized at an average rate of 60%, meaning that 40% of the time desks sat empty during the workday, a huge cost for employers. On the other hand, complaints about a lack of meeting rooms or crowded workspaces are frequent.

As offices reopen after COVID-19 shutdowns, we will likely see a mix of new use cases. Some companies will require more office space to further space out employees and reduce potential transmission, while others will move to permanent work-from-home arrangements or a hybrid of home, coworking, and office spaces to minimize commutes and maximize social distance. In every case, the variability of space uses and demands will grow.

Sensors and analytics are a part of the solution. The key challenge is to accurately count people in a space at a low cost with easy installation (running electrical on the ceiling is expensive!) and while preserving privacy. A number of startups are active in this space. Density and Dor offer over-door sensors to count traffic in and out of rooms. Enlighted offers ceiling and under-desk PIR sensors, with or without lighting controls. PointGrab and VergeSense offer camera-based systems to count people. In the future, software solutions will automatically recommend how to design space from the number and size of meeting rooms to assignment of desks and design of agile work areas to meet business goals around safety, productivity, and cost.

Flex space

In response to low utilization and demands for flexibility, companies are increasingly adopting unassigned seating (often called hoteling or hot-desking) and renting coworking spaces. This creates opportunities to solve the biggest problems employees face when working without assigned desks: from finding an open seat to locating colleagues and booking nearby meeting rooms. Software such as Comfy is addressing this pain point as are consulting firms like PLASTARC and Gensler.

Finally, the rise of coworking gives companies the flexibility to have short-term rentals in many locations and dynamically scale up or down their space needs. Industrious, Knotel, and WeWork are some of the leaders in the coworking space. Landlords are also looking to make shared meeting rooms and space rentable with software like Yardi Kube. In the future, there will be a common set of tools and employee apps across all space making the experience in a company’s HQ and remote coworking location feel seamless. COVID-19 will drive demand for this even more.

Productivity needs

Many studies have shown that engaged and inspired employees are twice as productive and lead to improved financial results. The workplace plays a key role in employee engagement and employee productivity including flexibility in work location, office layout, lighting, temperature, and the amount of time it takes to do common tasks like finding colleagues or available meeting rooms or navigating an unfamiliar location.

A number of startups are active in this space. Comfy is focused on making employees more productive in the office. HqO sells to landlords wanting to improve the tenant experience in their buildings. Looking forward, workplace apps will extend to focus on even more aspects of our workday including fostering collaboration, building community and providing “quantified self” feedback on how we work.

The bottom line

While COVID-19 has disrupted the real estate business today, it will largely accelerate trends and create more opportunities for property-tech startups as businesses reopen. The Hierarchy of Real Estate Needs shows many of the opportunity areas from broadly applicable core needs to higher-value productivity needs. Numerous successful companies will emerge throughout this sector.

Andrew Krioukov is a serial entrepreneur, former CEO of Comfy, and currently an EIR at VC fund Union Labs.